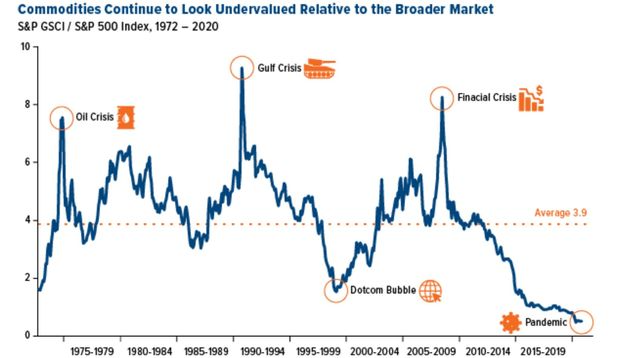

1. Commodities Hit New All-Time Lows Versus S&P 500 Blowing Thru 1999 Bottom

Commodity Index vs. S&P Historical

The next bear market will be the worst in at least 78 years, warns co-founder of Soros’s legendary Quantum FundBy Shawn Langlois

2. Risk On Measure Semiconductor ETF had -9% Correction……Barely a Blip on Longer-Term Chart. $100B in Semiconductor Mergers so far 2020

SMH-Semiconductor ETF

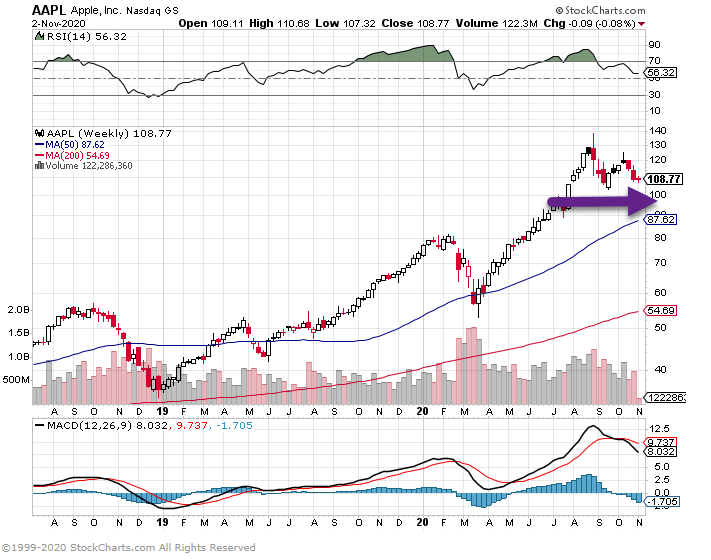

3. Apple High to Low -23% Correction…Barely a Blip on Long-Term Chart.

AAPL Weekly Chart

4. Twitter Market Cap is 5% the Valuation of Facebook.

2 Year Comparison….FB +75% vs. TWTR +15%

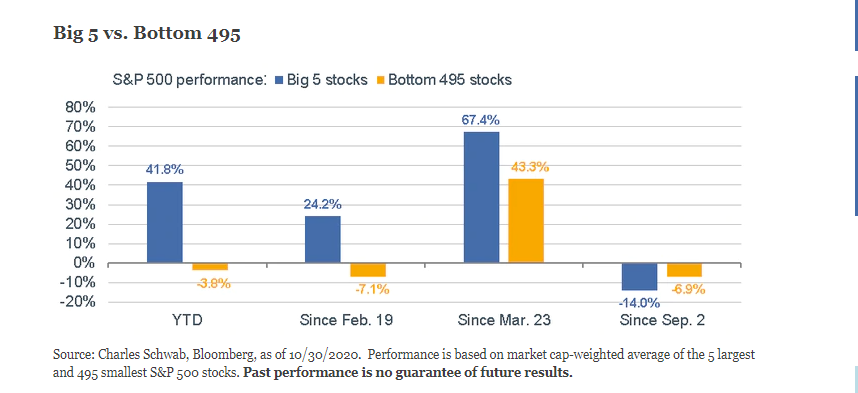

5. Big 5 Stocks vs. Bottom 495

Schwab-Liz Ann Sonders

6. XLI Industrials Taking Leadership Would Be a Tell That Economy Picking Up….Still -10% Behind S&P YTD

S&P +3.5% vs. XLI -7%

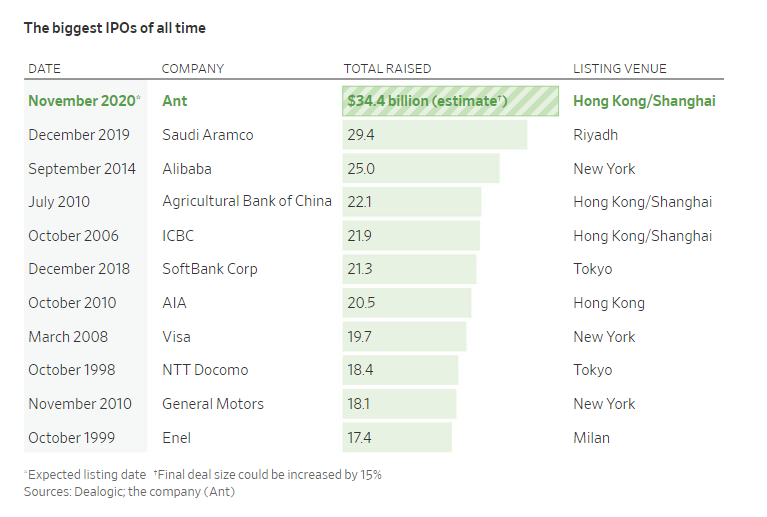

7. Chinese Retail Investors Put in $2.8 Trillion of Orders for ANT IPO

WSJ

To Ant Group Co. ’s set of staggering statistics—a billion users, more than $17 trillion in yearly payment volumes—add one more: trillions of dollars in stock orders from small investors.

Late Thursday, the Chinese financial-technology giant said individual investors in mainland China had placed the equivalent of more than $2.8 trillion of orders for their slice of Ant’s record-breaking initial public offering, in which it is listing simultaneously in Shanghai and Hong Kong.

That sum exceeds the value of all the stocks listed on the exchanges of Germany or Canada. Mom-and-pop investors in Hong Kong have also clamored to buy into this IPO, betting that Ant will soar in value after it goes public next Thursday.

Ant IPO Sets Off $3 Trillion Scramble Among Small Investors–By Joanne Chiuhttps://www.wsj.com/articles/ant-ipo-sets-off-3-trillion-scramble-among-small-investors-11604050204?mod=itp_wsj&ru=yahoo

8. Blackstone CEO Survey

Blackstone conducts regular surveys of CEOs within their portfolio companies, the most recent of which polled 94 executives spanning the globe, in a wide variety of industries. Not surprisingly, the majority expected revenue to fall in 2020, with a median estimate of a minus (10%) growth rate. However, the majority of respondents expected a fairly quick rebound from the pandemic. Over 24% of respondents expected employment to be greater at year end than pre-COVID levels. 60% expected employment to be within 75-100% of pre-covid levels

From Tim Hussar-Wharton Hill

9. Leaving New York: High earners in finance and tech explain why they left the ‘world’s greatest city’

PUBLISHED SAT, OCT 31 202010:53 AM EDTUPDATED SUN, NOV 1 20207:58 AM EST

KEY POINTS

· Brenan Hefner is one of thousands of high earners who’ve left New York this year, an exodus that is deepening concerns over a projected $9 billion budget shortfall.

· Data from the U.S. Postal Service, national moving companies and tech start-ups tracking smartphones all show an elevated outflow from New York City this year.

· For those in finance, the simple math of lower tax regimes is hard to ignore. New York state levies 8.8% on wages for high earners, and New York City takes another 3.9%, or nearly 13% combined.

Like many before him, Brenan Hefner arrived in New York 20 years ago in search of a career on Wall Street

His journey will sound familiar to those drawn to the nation’s financial capital. Hefner got a job at an asset management firm in Manhattan, found love and career success, and eventually moved to Pelham, an upscale town in Westchester, to start a family.

He would still be there if it wasn’t for the coronavirus pandemic. When Hefner, co-founder of a research platform called Analyst Hub, sold his house this summer to a couple from London, he wondered if it made sense to look beyond the surrounding neighborhoods for a new home. He ended up moving his family to Dallas last month.

Hefner is one of thousands of high earners who’ve left New York this year, an exodus that is deepening concerns over a projected $9 billion budget shortfall. While the city is no longer the national virus hotspot it was earlier this year, those leaving cite anxiety over the region’s economy and quality of life and a conviction that higher taxes are coming. Last month, business leaders publicly upbraided Mayor Bill De Blasio for “deteriorating conditions in commercial districts and neighborhoods across the five boroughs.”

By forcing the mass adoption of remote work and crimping many of the advantages of urban life, the pandemic has turbocharged migration from high cost, high-density places to lower-cost states including Texas, Florida and Nevada. Nearly half of New Yorkers earning more than $100,000 a year said they considered leaving the city recently, with cost of living being the top factor, according to a Manhattan Institute survey.

“The cost of living down here is significantly less,” Hefner said by phone from his new home. “There’s no state income tax. I’m not riding mass transit during the middle of a global pandemic to get to a subway to live in a WeWork or something.”

For Hefner, the pandemic showed that for those in financial services, the gravitational pull of New York still exists, but is far weaker. He says he is about as effective operating his business over Slack and Zoom, and plans on flying to New York monthly for client meetings. His company, founded in 2018, helps star Wall Street analysts leave big banks to form independent research shops.

“I’m just not sure it’s a requirement to be in the city anymore,” Hefner said. “That doesn’t mean that I don’t love the city, I do. It’s an amazing place, but as far as a family of five, I’m not sure if it’s the right place for us at this time.”

‘Everybody’s leaving’

Even within his 19-person start-up, Hefner has company. Caroline Goodson, his director of corporate access and sales, left Manhattan after a homeless encampment popped up outside her apartment building. She also moved to Dallas.

His co-founder Michael Kronenberg, who owns a downtown Manhattan apartment, has spent most of the pandemic outside of New York, renting a succession of houses in places including Scottsdale, Arizona; Vail, Colorado and Sullivan’s Island, South Carolina. For senior finance professionals not chained to a trading floor, moving to lower-tax states has never been more appealing, he said.

“Everybody I know is leaving,” Kronenberg said. “It’s not just New Yorkers. My partners, long-time clients and investors of mine that live in Connecticut or New Jersey, they are used to commuting in to the city. They’re never going to commute in five days a week ever again.”

The coronavirus pandemic has caused the worst global economic crisis in living memory and taken 230,000 American lives so far, with New York City claiming one-tenth that grim figure. Downtown and midtown business districts are still a shadow of their former selves, depriving local businesses and the city of much needed revenue. A record daily case count in the U.S. and surges in Europe have New Yorkers bracing for a tough winter.

But since moving trucks began clogging city streets this summer, New Yorkers have been incensed by the idea that the place De Blasio refers to as the “greatest city in the world” is on the cusp of a multi-year decline. An ex-hedge fund manager’s LinkedIn post that declared “NYC is Dead Forever” prompted a withering response from Jerry Seinfeld.

Many of those who remain say the city is more livable than before, with streets closed off to car traffic and restaurants taking up more outdoor space. Of course, the city has bounced back from every calamity in its history, from the 1918 Spanish flu to the suburban flight of the 1970s, the terror attacks of 9/11 and the 2008 financial crisis.

Falling rents

But it’s hard to deny the signs of pain ahead. Data from the U.S. Postal Service, national moving companies and tech start-ups tracking smartphones all show an elevated outflow from New York City this year. More than 246,000 New Yorkers filed a change-of-address request to zip codes outside the city since March, almost double the year-earlier period, for instance.

That’s reduced demand for Manhattan apartments, where median monthly rents fell 7.8% to $2,990 in the third quarter, part of a city-wide decline not seen since 2010, according to StreetEasy.

To be sure, the New York area’s suburbs have been the primary beneficiary of the exodus: Home sales in Westchester jumped 112% in July, according to appraiser Miller Samuel Inc. Sales in Greenwich, Connecticut just had the strongest quarter in more than a decade.

For those in finance, the simple math of lower tax regimes is hard to ignore. New York state levies 8.8% on wages for high earners, and New York City takes another 3.9%, or nearly 13% combined. Meanwhile, states including Florida, Texas and Nevada don’t tax wages. The more people make, the greater the incentive there is to leave, and the difference could easily mean hundreds of thousands more dollars in after-tax pay.

That’s a trade that some Wall Street titans have already made. Hedge fund billionaire Paul Singer is moving the headquarters of Elliott Management to Florida from midtown Manhattan, Bloomberg reported this month. His move follows that of another billionaire, famed corporate raider Carl Icahn, who made the switch last year to avoid New York taxes.

“My concern isn’t that they’re leaving, it’s that they’re taking their businesses with them,” said Mark Klein, a New York-based tax attorney and chairman of Hodgson Russ. The flight of business owners is worrying for those remaining in the city, he said.

Still, it has kept him busy. Klein says he has ten times more clients now than pre-pandemic, helping advise people who make more than $800,000 a year move to low-tax states, often bringing their businesses along. Besides hedge funds, Klein said that a spectrum of professional services operators are leaving, including public relations and accounting firms.

“I’ve never been as inundated with people leaving New York and Connecticut, any of these high-tax states, in my 40 years of doing this,” he said. “Once Covid hit, with the recognition that people can work from any location, the floodgates opened.”

The stakes are higher in an election year, with many in finance convinced that higher taxes are coming if Joe Biden wins and Democrats take the Senate. Within Goldman Sachs, multiple traders have told me they are voting for Biden “against their own financial interests” because of his stated plan to raise taxes on those earning more than $400,000 – an easy threshold to exceed on Wall Street.

And to a person, high-earners I spoke with said that the $10,000 cap on state and local tax deductions from President Trump’s 2018 overhaul hurt them personally and believe that local governments are going to seek more money from them in coming years.

Leavers aren’t limited to hedge fund traders and portfolio managers; New York is also home to a growing ecosystem of fintech firms.

Paraag Sarva bought a weekend home in Bucks County, Pennsylvania last year, he figured he’d probably rent it out most of the time. But months into the pandemic, after it became clear that full-time, in-person schooling in New York was unlikely for his small children, he made it his permanent residence.

His new neighborhood, studded with horse farms and multi-acre estates, is vastly different from his old home by the expressway in Brooklyn. Two other families from New York have moved in recently, he said, and they have brought their businesses.

His start-up, Rhino, which replaces renters’ security deposits with a small recurring fee, is still based in Manhattan. But Sarva rarely returns; he has managed the firm’s explosive growth from afar. During the summer, the company doubled its employee count to 90 and raised $14 million in additional capital.

While schooling and quality of life were the main drivers of his move, the lifelong New Yorker wasn’t going to “leave money on the table.” His taxes are 10% lower in Pennsylvania, he figures.

“Once we made the decision, we did consult our tax and legal advisors on what exactly that would mean,” Sarva said. “I am officially a Pennsylvania resident. I voted here, registered my car here, have a Pennsylvania driver’s license. I’ve moved out of my former home and have no intention of returning.”

‘Less boring’

In some finance circles, even people who may not have permanently uprooted their families like Hefner or Sarva are pushing for a tax break. They are typically city dwellers who moved full time to their second homes once the pandemic struck.

“There are a bunch of people I know trying to get out of the NYC tax, they’re living in the Hamptons, Westchester, Connecticut or New Jersey,” said a managing director at a major global investment bank. Another colleague who worked mostly in New York moved her residence to Delaware, he said. He declined to be identified speaking frankly about taxes.

The executive owns condos in Manhattan and houses in Sag Harbor, but has spent most of the pandemic in New Jersey. After a three-hour meeting with his tax consultant, he plans on filing taxes as a Jersey resident to avoid New York’s 3.9% city tax. He and his friends are risking an audit, which can happen three years after he files his 2020 taxes.

In the meantime, he’s worried that his expensive Manhattan properties will lose as much as 40% in value in the coming years.

“Nobody’s gonna feel sorry for me,” he said. “The good news is, maybe the city will get less boring.”

10. 5 Deadly Reasons Why Daylight Saving Time Is Bad for You

The shift disrupts circadian rhythm and raises the risk of stroke and depression

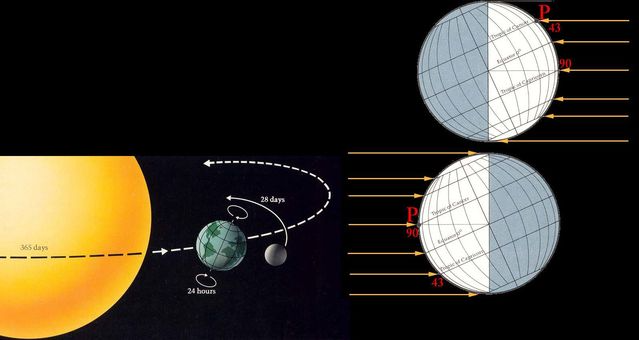

Solar Drumbeat. Life evolved on a rotating planet.

Every cell in your body has an internal circadian clock. These clocks regulate everything from body temperature and hormone levels to blood pressure, baseline metabolism, and alertness. All of them beat to the rhythm of a master timekeeper (zeitgeber) located in the mid brainstem. Our bodily timekeeper synchronizes itself each day to the natural cycles of sunrise and sunset. Why? Because life evolved on a rotating planet that has a light–dark cycle of 24 hours.

Circadian = “About a Day”

Politicians who meddle with this natural cycle inflict unintended health problems by forcing us to go against our natural circadian rhythm. The word “circadian” comes from the Latin circa dies, meaning “approximately one day.” Isolated volunteers kept in constant illumination fall into a natural rest–wake period of 25.5 hours, which is the brain’s inherent rhythm. Sunlight exposure resets the brain’s circadian clock every day to the familiar 24–hour cycle of sleep and wakeful activity.

Jet lag happens because circadian rhythms adapt sluggishly to time zone changes. When you travel across time zones, the body’s circadian clock adjusts in a day or two to the new cycle of local light-and-dark. But in the case of daylight saving time (DST), clock time changes while the dark-light cycle doesn’t. The result is a discrepancy between your biological clock and the social clock, with a number of untoward consequences.

Standard Time More in Sync with the Sun

Standard time comports closely to the sun’s natural time, whereas DST essentially puts us in another time zone without changing the day-night cycle. The misalignment asks the circadian clock to change our physiological rhythms and do things at times that are not biologically in step. As a result, many people suffer when we change the clock backward or forwards.

Writing in JAMA Neurology, Professor Ann Malow at Vanderbilt University calls switching between standard and daylight saving time “bad for the brain. Going back and forth is disruptive and makes no sense.” Switching time isn’t like flying from Washington DC to Los Angeles. “It’s more like a permanent thing where for the next eight months you’re an hour off and suffer for it” [1].

The American Academy of Sleep Medicine found that 55 percent of American adults feel drained and inefficient during the week or more after switching to DST. Their advisory raises concern because your body knows what time it’s supposed to be, and when governments change it your health can suffer (download the pdf here).

The Dark Arctic Circle

You may wonder how people living in the arctic circle reset their circadian clocks when the local seasonal cycles of light and dark are at odds with the basic rhythm of human biology. Contrary to common belief, the arctic is not in constant darkness for half the year and constant sun during the other half. The Inuit settlement of Mittimatalik (73° N) is about as far north as all but a few people live routinely. Its winter period, when the sun is always below the horizon, lasts only 70 days.

But even then there are a few hours of twilight each day to break the monotony of darkness. Murmansk and Tromsø each have even less time without some daily sun while Shetland, at 6° below the Arctic Circle, is never without a bit of noon sun even in mid-winter. So inhabitants south of 73° N have some sunlight or at least bright twilight each day in the winter [2].

The question then is how much light per day does it take to maintain circadian rhythms? Not much: Even only a few minutes of moonlight will do, and it is impressive that people adapt so well to living there [3]. A few minutes of a bright twilight can also suffice, and during the darkest few weeks around mid-winter people can maintain their rhythm without an external zeitgeber. The Inuit maintain a work/sleep cycle without a corresponding light/dark cycle to guide them [4].

A strongly held belief of Shetlanders is that moonlight should never fall on the face of a sleeping person. Being unused to unexpected periods of light during the long winter nights, they may have come to notice the unsettling effect such light had when it shined at sensitive times during the circadian cycle.

Tips to survive Daylight Saving Time:

· Moving into or out of DST has adverse effects on sleep, wakefulness, mood, and optimal health for 5 to 7 days. Cardiac and stroke risks may last longer.

· These effects are most noticeable in individuals who enter the change with insufficient sleep to begin with.

· The American Academy of Sleep Medicine advises getting at least 7 hours per night for 2–3 days before and after the switch–over (see aasm.org & sleepeducation.org).

· Go outside early on Sunday and expose yourself to morning sunlight to help your jangled internal clock.

article continues after advertisement

Send comments to the sites below, to join Dr. Cytowic’s low-frequency newsletter, or to ask for a free copy of “Your Brain on Screens.”

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.