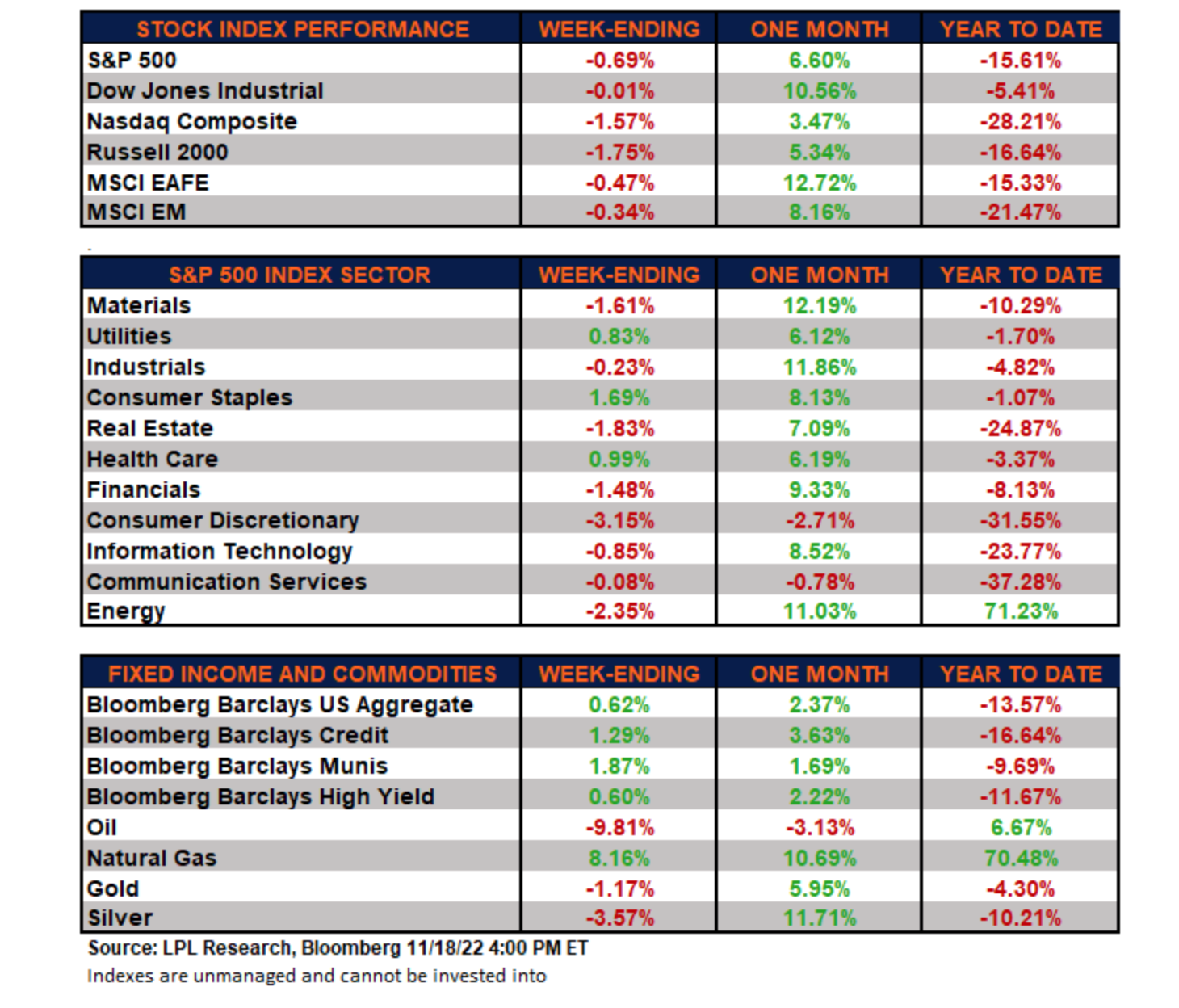

1. YTD Performance…Dow Jones Only Down -5.4%

LPL Research

https://iplresearch.com/2022/11/18/weekly-market-performance-markets-lower-following-last-weeks-solid-showing/

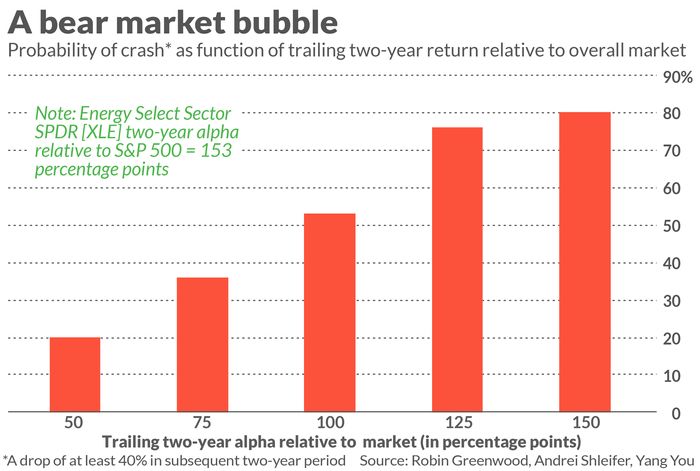

2. Energy Stocks-History of Sectors with 2 Years Outperformance.

Energy stocks -Mark Hulbert Marketwatch

Research shows that when a sector’s trailing two-year return soundly beats the U.S. market average, that sector takes a beating over the next two years

Oil and gas stocks are likely in a market bubble that’s vulnerable to popping.

That’s the conclusion when applying a formula from recent academic research into the predictability of stock market bubbles and subsequent crashes.

The research, which appeared in the Journal of Financial Economics, was conducted by Robin Greenwood and Andrei Shleifer of Harvard University, and Yang You of the University of Hong Kong.

The researchers found that the probability of a market sector crashing — defined as a drop of at least 40% over the subsequent two years — was correlated with its trailing two-year performance relative to the overall market.

The chart above provides the specifics, based on U.S. data back to 1926. Whenever an industry or sector outperformed the broad market by at least 100 basis points (1 percentage point) over a two-year period, there was a 53% chance it would drop by at least 40% over the subsequent two years. When the trailing two-year outperformance was at least 150 basis points (1.5%), those odds grew to 80%.

These findings are why the energy sector is so vulnerable. The Energy Select Sector SPDR XLE, -0.79%, for example, has beaten the S&P 500 SPX, +0.48%over the past two years by 153 percentage points. Assuming the future is like the past, the odds of the energy sector falling by 40% or more in the next two years are 80%.

On several prior occasions, I’ve applied this academic research to various assets, and it’s worked every time. Here’s a brief rundown:

- November 2017: bitcoin BTCUSD, -0.58%. At one point in the two years after that column appeared, this cryptocurrency was down 61%.

- June 2019: bitcoin. At one point in the two years after that column appeared, bitcoin was 60% lower.

- February 2020:Tesla TSLA, -1.63%. At one point in the two years after that column appeared, this stock was 59% lower than where it was trading then.

- February 2021: S&P 500 Technology Hardware Storage & Peripherals Index. At one point over the 21 months subsequent to when that column appeared, this index was down 40%.

- February 2021: bitcoin. At one point in the 21 months subsequent to that column appearing, bitcoin was down 66%.

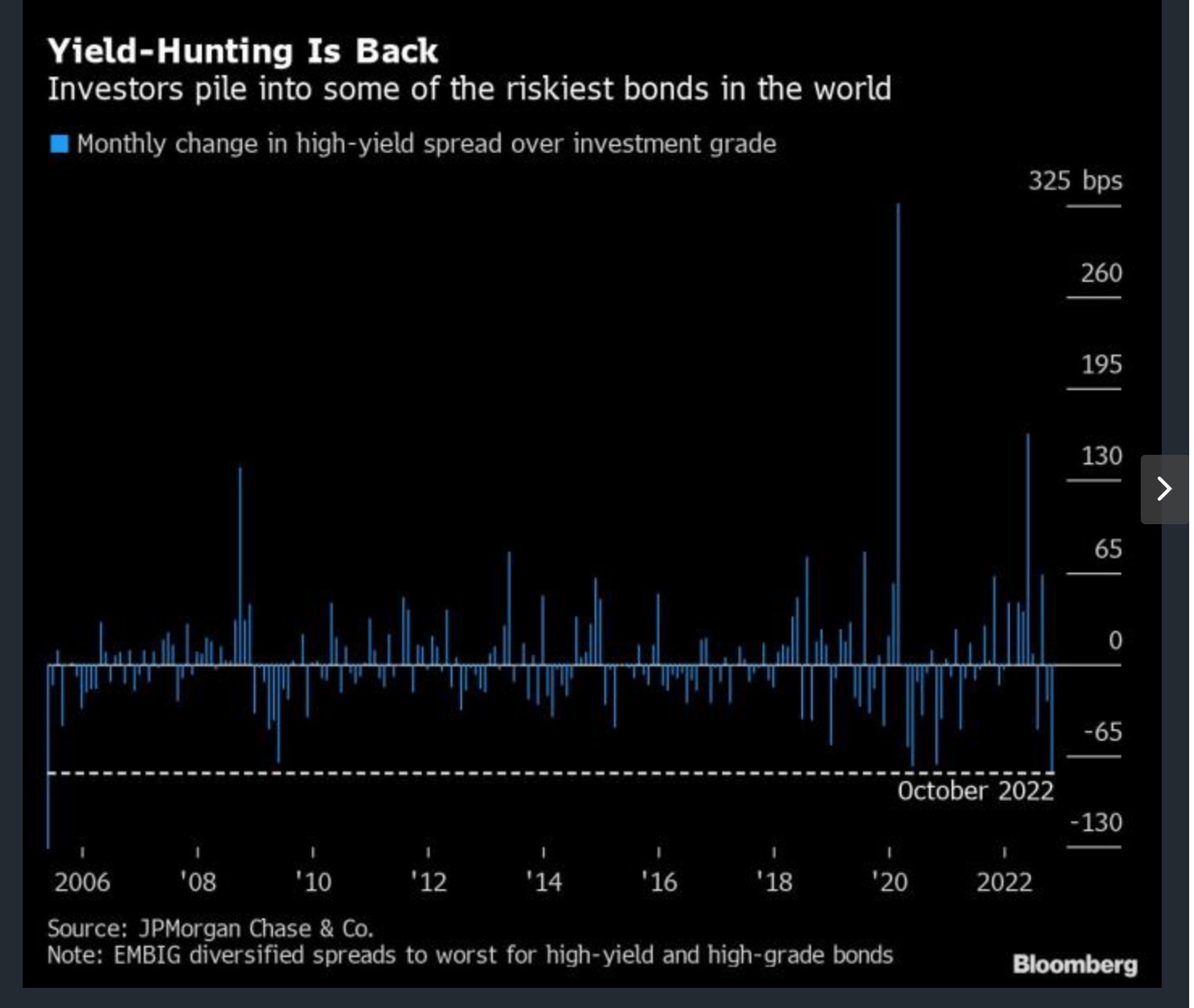

3. High-Yield Party Returns to Emerging Markets Too Cheap to Ignore

Netty Ismail (Bloomberg) — Yield hunting is back in emerging markets with a force not seen for 17 years.

Most Read from Bloomberg

Investors are buying the bonds of some of the world’s poorest nations so fast that the risk premium on them is falling at the quickest pace since June 2005 relative to their investment-grade peers, JPMorgan Chase & Co. data show. And countries that were tottering on the brink of default just months ago — such as Pakistan, Ghana and Ukraine — are leading this high-yield rally.

Before this month, the most brutal selloff since the 2008 financial crisis already had emerging-market money managers talking about how cheap high-yield bonds were and how their underperformance against higher-rated debt was an unsustainable distortion. But the bonds continued to be shunned because of a surge in US yields driven by the Federal Reserve’s aggressive monetary tightening. It’s only now, with the prospect for a slower pace of interest-rate hikes, that investors are returning.

“Cheaper high-yield emerging-market bonds do look more attractive relative to investment grade,” said Ben Luk, a senior multi-asset strategist at State Street Global Markets. The recent rebound in commodity prices, especially oil, could also “generate greater cash flow and lower the chance of any sovereign default in the near term.”

https://finance.yahoo.com/news/high-yield-party-returns-emerging-170000920.html

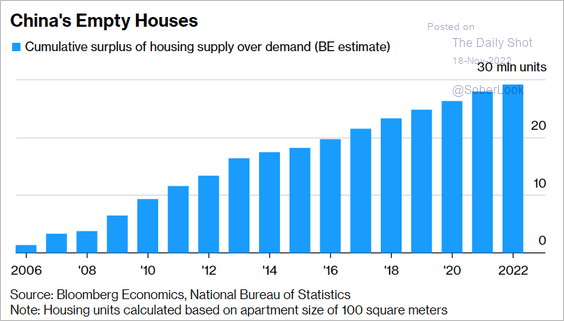

4. Chinese Housing Surplus 30m Units

China: The housing surplus is massive.

Source: @business Read full article

The Daily Shot Blog https://dailyshotbrief.com/

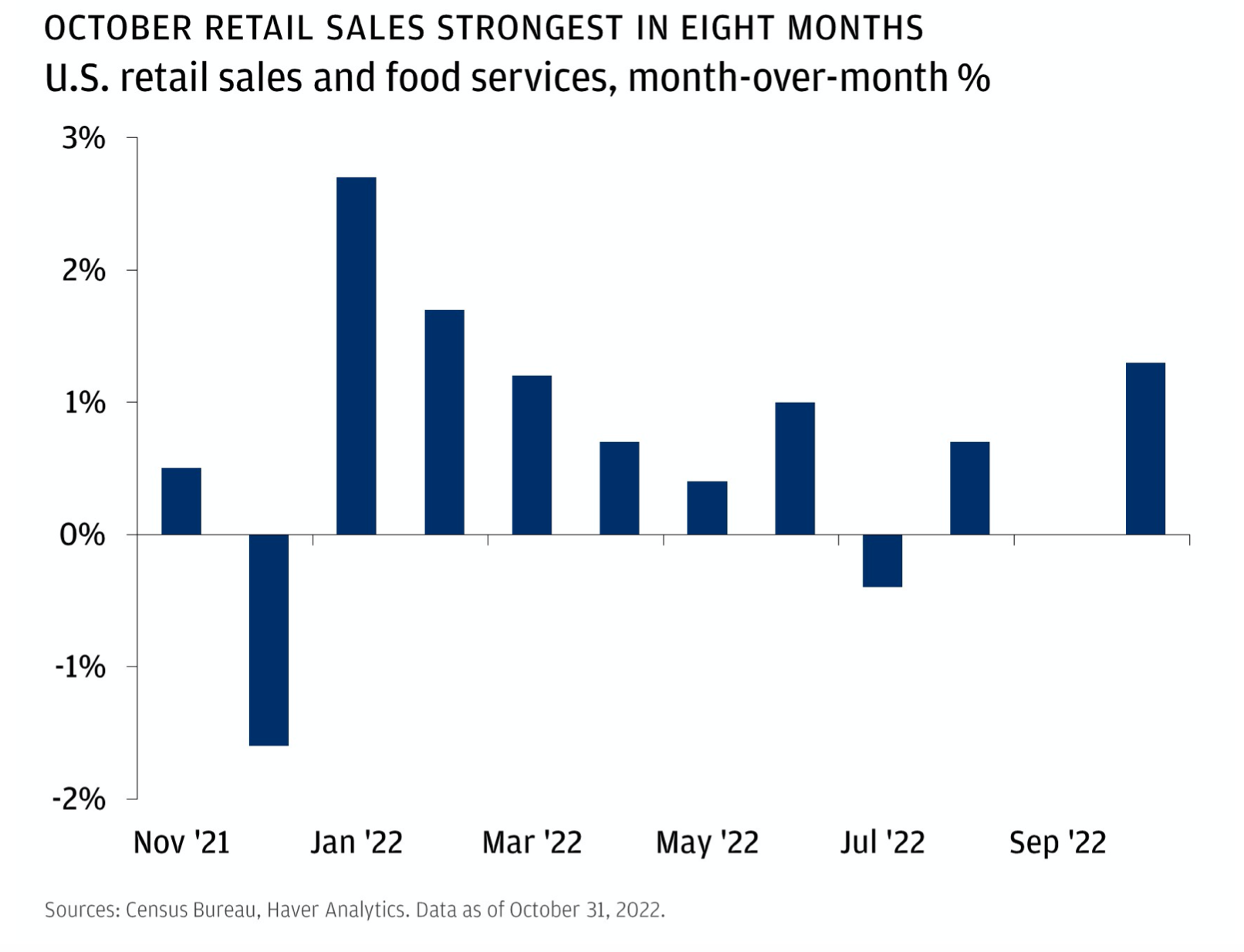

5. Recession? October Retail Sales Strongest in 8 Months

JP Morgan Private Bank

6. LFP Batteries Could Make EV’s More Affordable for the Masses

5 FAST FACTS TO KNOW ABOUT LFP BATTERIES

Sep 30, 2022 by Katherine de Guia, Communications Specialist – New Power

The lithium iron phosphate (LFP) battery is breaking barriers in the electric vehicle (EV) market. It is poised to redefine battery manufacturing and EV sales in North America and Europe. It’s powerful, lightweight, and fast charging…but the LFP is actually nothing new.

1. An LFP is a lithium-ion battery.

The resurgence of the LFP battery and its role in the future of e-mobility leads many to beg the question: Which battery chemistry is best for electric vehicles, lithium iron phosphate or lithium-ion?

Because lithium-ion (Li-Ion) batteries are a rechargeable battery type that most people are likely familiar with, it seems like the logical selection. They’re used in many everyday items, like mobile phones, laptops and electric vehicles driving on the road today. But when discussing the pros and cons of each EV battery, it isn’t a contest between LFP and Li-Ion batteries.

The Li-Ion battery family contains different battery chemistries named after their cathode; LFP is part of that family. And while an LFP is a Li-Ion battery, not all Li-Ions are LFPs. Other lithium-ion batteries include the nickel manganese cobalt oxide (NMC) battery and the lithium nickel cobalt aluminum oxides (NCA) battery. Both are already utilized heavily in electric vehicles.

2. The “F” in LFP stands for iron.

Batteries are typically named after the chemicals used in the cathode, and an LFP battery uses a cathode material made from the inorganic compound lithium iron phosphate, with the formula LiFePO4. The “F” comes from “Fe,” the periodic table of elements chemical symbol for iron. Fe is derived from the Latin word for iron, ferrum. You may also see an LFP referred to as a lithium ferro phosphate battery.

3. LFPs can be charged to 100%.

Keeping an electric vehicle battery healthy is necessary if your EV wants to live a long, happy life. If your EV has an NMC or NCA battery, one of the easiest ways to do so is NOT charging the battery to 100% every today. This prevents accelerated calendar aging, the natural aging of a battery that will occur whether it is in use or not. Charging an NMC or NCA to 100% puts the batteries in an extreme state of charge. Because batteries turn chemical energy into electricity, a battery is inherently unstable when fully charged. Overall, it is considered best practice to avoid a very high and meager charge, with 80% being the standard battery capacity for an optimal lifetime.

However, LFP batteries are an exception to this charging standard. LFPs have 100% of their capacity available, meaning they can be fully charged without causing accelerated battery degradation. This is thanks to the battery’s cathode.

The phosphorus-oxygen bond in the LFP cathode is stronger than the metal-oxygen bond in other cathode materials. This bond hinders the release of oxygen and requires more energy and a higher on-set temperature for thermal runaway. This makes the battery more stable for being stored at full charge.

4. LFPs are a lower-cost option.

Electric vehicles are popular, and the demand for more companies to switch from internal combustion engines to batteries continues to increase. However, even as demand rises, building an EV still costs more than traditional diesel engines due to battery manufacturing.

Manufacturing NMC and NCA batteries require nickel and cobalt, two materials that come at a pretty penny to extract. The cost of buying both materials is expensive already. Still, the increasing nickel shortage and cobalt production being stretched to its limits pose a challenge to manufacturing NMC and NCA batteries and making them affordable for integration into EVs.

LFP batteries, on the other hand, currently bypass supply chain issues and inflated prices because nickel and cobalt aren’t needed for the cathode. An LFP’s cathode is made from earth-abundant materials. Lithium iron phosphate is a crystalline compound that belongs to the olivine mineral family. Because the olivine family is a primary component of the Earth’s upper mantle, LFP is more readily available for extraction at a lower cost.

5. 17% of the global EV market is powered by LFPs.

Lithium iron phosphate batteries first came to light in 1996, so it’s not surprising this battery chemistry is already present in the electric vehicle market. Discovered by John Bannister Goodenough’s research group at the University of Texas, LFP batteries gained recognition for their wide range of benefits. Even with advantageous characteristics, LFPs didn’t experience their first large-scale adoption until 10 years later, when they became the industry favorite for electronics.

LFP technology has improved over the years, and it can now be found in a broader range of applications, from motorcycles and solar devices to electric cars. Seventeen percent of the global EV market is already powered by LFPs, but this battery chemistry is poised to make its next big breakthrough with large-scale adoption in different on-highway applications like electric buses and electric trucks. LFPs are less energy dense, come with lower manufacturing costs and are easier to produce than other Li-Ion and lead-acid battery types.

The warnings of a lithium supply shortage threaten to cut the global EV sales forecast in 2030, but even that hasn’t appeared to slow the momentum of adopting LFP batteries into electric vehicles. LFP battery chemistry remains easier to produce and at a lower cost. Their efficient charging, lower cost of ownership, non-toxicity, long cycle life and excellent safety characteristics make them a crowd favorite for the future of electric transportation.

https://www.cummins.com/news/

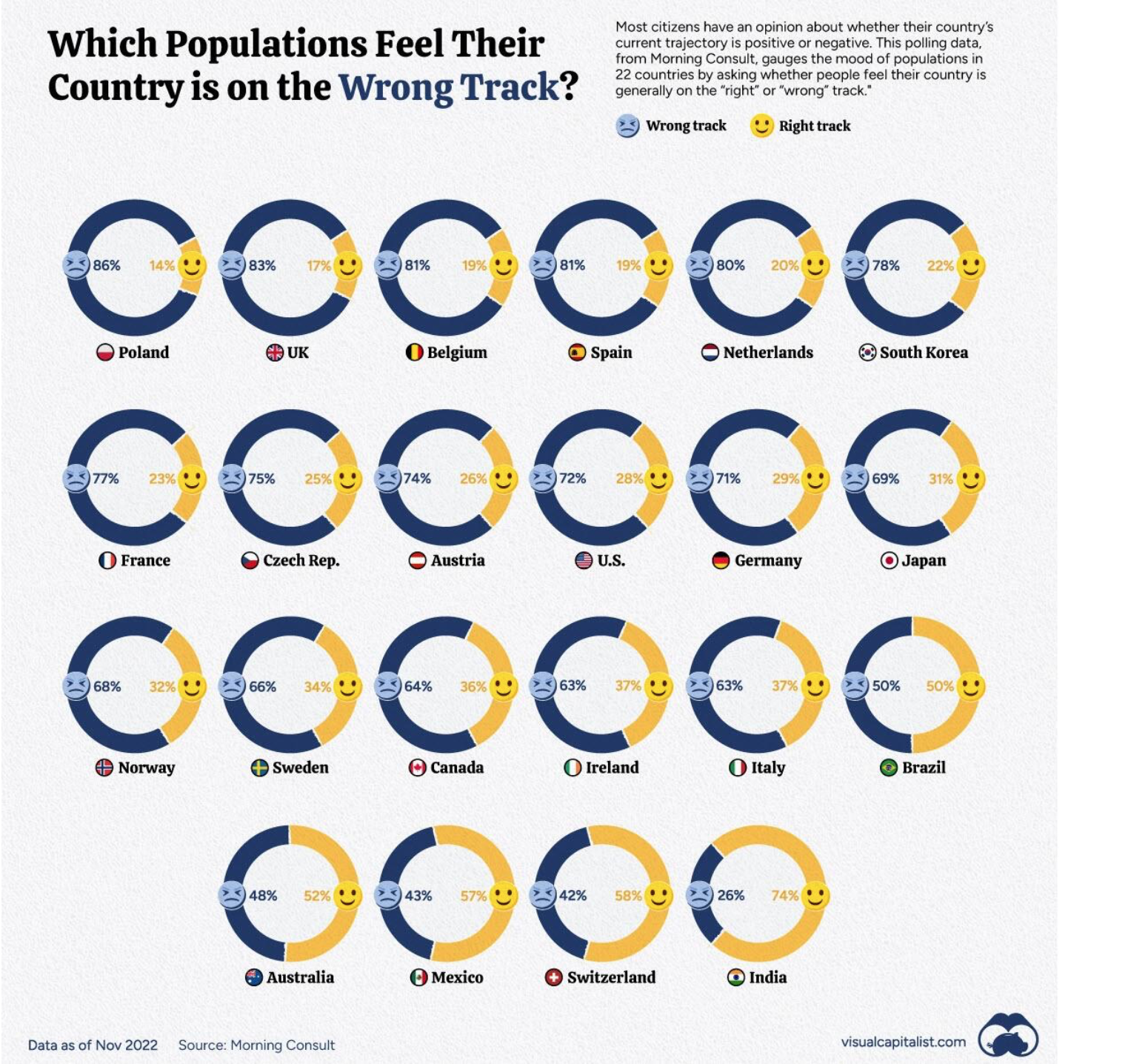

7. This Doesn’t Read Well for the West and NATO

https://www.visualcapitalist.com/which-populations-feel-their-country-is-on-the-wrong-track/

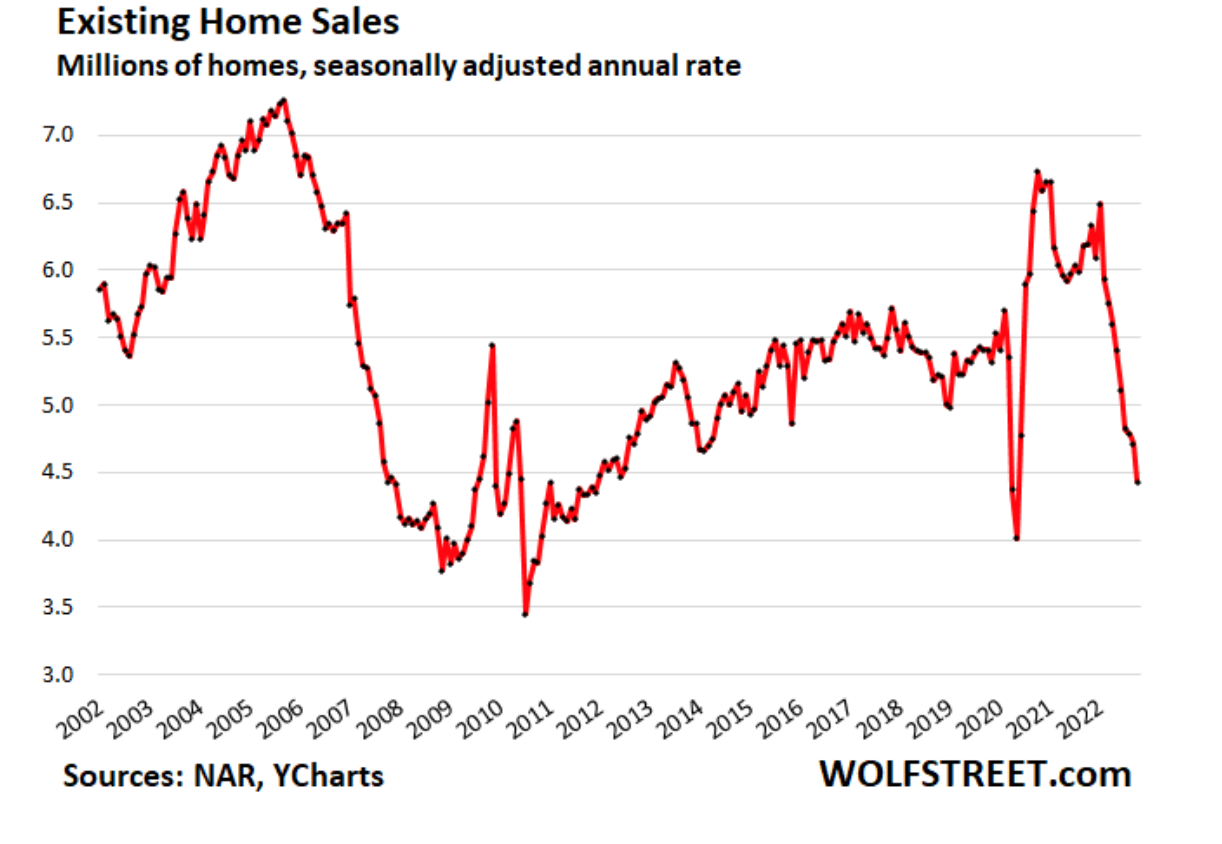

8. Existing Homes Sales Approaching Covid Lows

Wolf Street

https://wolfstreet.com/2022/11/18/home-sales-plungee-investors-pull-back-too-princes-drop-8-4-in-4-months-active-listings-price-cuts-rise-further/

9. Masayoshi Son owes SoftBank $4.7bn as side deals go sour

Portfolio losses ratcheted up Japanese billionaire’s deficit to about $2.8bn from his Vision Fund 2 interest alone

Investors have raised concerns that Masayoshi Son’s mix of personal and company interests are a corporate governance risk. Reuters

Bloomberg

Masayoshi Son is now personally on the hook for about $4.7 billion on side deals he set up at SoftBank Group to boost his compensation, after mounting losses in the company’s tech portfolio wiped out the value of his interest in the second Vision Fund.

Over the years, the Japanese billionaire’s controversial personal stakes in SoftBank’s investments drew fire from investors, who pointed to the mix of personal and company interests as a corporate governance concern.

Mr Son, who owns a more than 30 per cent stake in SoftBank, has denied there was a conflict of interest and said it was remuneration for his investment expertise, in lieu of investment fees.

The move has backfired, enveloping Mr Son’s personal finances in the downside of the world’s biggest tech investor’s bets. He was down more than $4 billion on his side deals through to the June quarter, Bloomberg reported earlier.

Mr Son last week said he was stepping away from leading earnings calls, to focus on preparing chip designer Arm for a public listing — an event that would give SoftBank fuel to again pursue new investments. SoftBank will bide its time in a tech winter and pay down its debt, he and his lieutenants said.

SoftBank’s Vision Fund arm posted a $7.2 billion quarterly loss last week, driven by the declining value of portfolio companies such as SenseTime, DoorDash and GoTo. The company has been selling assets to raise cash and shore up its balance sheet, posting gains from selling a chunk of its stake in Alibaba.

“We need to go full-on defence,” SoftBank chief financial officer Yoshimitsu Goto said. “SoftBank is pessimistic on the outlook. We do not yet see the light.”

The 65-year-old Mr Son holds 17.25 per cent of a vehicle set up under SoftBank’s Vision Fund 2 for its unlisted holdings, as well as 17.25 per cent of a unit within its Latin America fund, which also invests in start-ups. He has a 33 per cent stake in SB Northstar, a vehicle set up at the company to trade stocks and derivatives.

Portfolio losses ratcheted up Mr Son’s deficit to about $2.8 billion from his Vision Fund 2 interest, and $252 million at the Latam fund, according to disclosures for the September quarter. His remaining deficit at SB Northstar was 233.6 billion yen ($1.6 billion).

The amount Mr Son owes SoftBank from his interests in Vision Fund 2 and the Latam fund rose about $750 million in the last quarter.

Mr Son’s interests in Vision Fund 2 and the Latam fund were structured so the billionaire didn’t pay cash up front for his 17.25 per cent stakes. He is obligated to pay 3 per cent on the “unpaid equity acquisition amount” until repayment, interest that has been wrapped into his liabilities.

There is no deadline for repayment and the value of Mr Son’s positions could improve in the future, and for SB Northstar, Mr Son has already deposited some cash and other assets. The founder would pay his share of any “unfunded repayment obligations” at the end of the fund’s life, which runs for 12 years with a two-year extension.

Mr Son has deposited 8.9 million of his own shares as collateral for Vision Fund 2, and another 2.2 million shares as collateral for the Latam fund, the company said in its disclosures. The stock will be released only once the receivables are settled.

Mr Son’s net worth stood at $12.7 billion after Thursday’s close of trading, after adjusting for his deficit from his interests in Vision Fund 2 and Latam fund, according to Bloomberg Billionaires Index.

10. Harvard Study Reveals the 1 Thing That Makes Humans Happy. Why Are You Doing the Complete Opposite?

Is modern life making you miserable (and alone)? Science says so.

BY NICK HOBSON, CHIEF BEHAVIORAL SCIENTIST, APEX SCORING SOLUTIONS, BAD SCIENCES AT POTENTIAL PROJECT@NICKMHOBSON

Money can’t buy happiness.

Well, that’s not entirely true. Having some money helps. But it’s certainly not the biggest contributor to our happiness and well-being. So what is?

Before the big reveal, there are two things to consider.

First, for some of us, we were dealt a good genetic hand. We are predisposed to being happier in life. Our temperamental “wiring” makes us less neurotic, more emotionally stable, and nicer people to be around.

Second, for some of us, we ended up in the right place at the right time (or the wrong place at the wrong time). German philosopher Martin Heidegger calls this “thrownness“, or Geworfen. This is the idea that our experience in life, from birth to death, is arbitrarily determined by where we’re thrown into the world. Born into a specific family in a particular culture or religion at a given moment in human history is a matter of pure dumb luck.

These two things, genetics and Geworfen, are outside our control. And they matter. But what matters just as much, perhaps more, is something that’s within our control: relationships. And even for those of us with less-than-ideal genes, thrown into a less than ideal environment, human connection is the trump card. So why are we forgetting to play it?

No man or woman is an island

The Harvard Study of Adult Development, the longest-running study on happiness, has followed 724 men since they were teenagers in 1938, with participants coming from a range of socioeconomic backgrounds. The Harvard team has collected a wealth of data over the 74 years, collating all kinds of personal, psychological, and health indicators and outcomes, and asking their families about their mental and emotional health every two years.

“Personal connection creates mental and emotional stimulation,” says project director, Dr. Robert Waldinger, “and those things are automatic mood boosters, while isolation is a mood buster.”

Humans are an intensely social species. It’s literally a matter of life and death. In our ancestral past, if we suddenly became isolated and pushed out by the tribe, it would have meant our inevitable death. So, the behaviors responsible for ensuring social connection — and therefore success in life — would have had a strong selective pressure. They still do.

The genes of modern Homo sapiens still drive our social behaviors in service of connecting, building, and relating to our fellow humans.

Unfortunately, we’re not living that reality.

Modernity is getting in the way of our genes

Technology, and modern life more generally, “gets written down as the progress of man”, to quote my favorite folk singer, John Prine. But consider the unintended consequence of this futuristic world we live in: We are spending more time alone than we have in all of human history. And it’s making us terribly unhappy.

I hope the irony isn’t lost on you. We carry near infinite knowledge on a machine that fits in our front pocket, we fly into space, we enter into alternative realities … but we do all this with an increasing frown and furrowed brow. We’ve never been more advanced. We’ve never been more miserable.

Then (together) versus now (alone)

It’s estimated that early humans in hunter-gather societies would have spent the majority of their time with one another. They would have done basically everything together at every waking point — working, preparing food, eating. Even leisure time and moments of ritual celebration would have been a group experience.

Contrast this with modern humans. Nearly a third of people in so-called developed Western countries live alone. These people are truly alone for about 8-10 hours of the day, every day. For people who live with others, it’s about 5-7 hours every day. Take a look at this graph. As people get older, they spend nearly half their waking time alone.

Imagine for a second we could simulate the same graph but include in it the data from the remaining time period humans have existed. It would look drastically different. Apples and oranges.

We need to look to the future and be intentional about the societies and cultures we want to build. We need to facilitate the natural urge to connect, belong, and socialize. Our technologies, city infrastructures, governmental and corporate organizations, and the way we do business should always take into account the fact that we humans can survive only by connecting with each other. Our “metrics for success” should capture that. Otherwise, we’ll end up with an incredibly advanced society — with little happiness and humanity left.