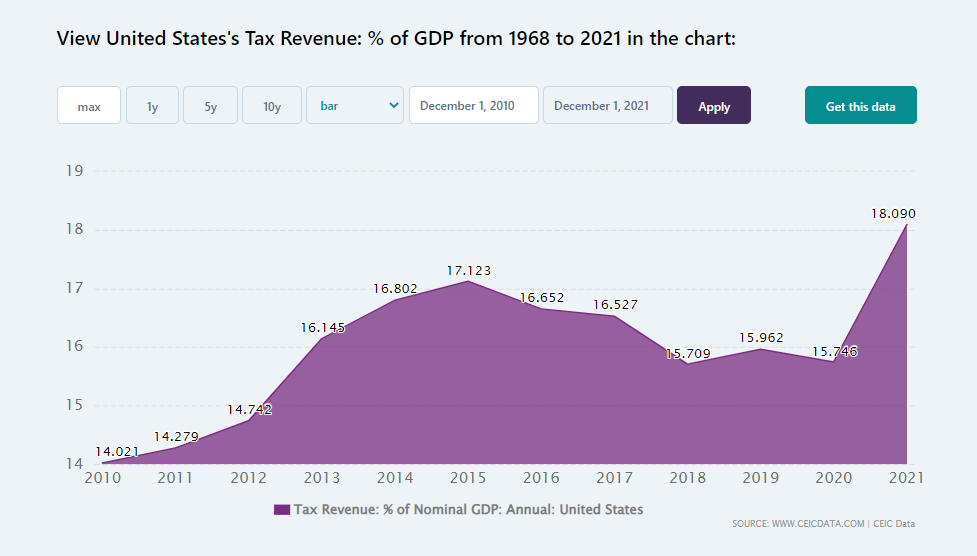

1. Federal Tax Revenue was 19.6% of GDP Last Fiscal Year…Highest on Record

It’s important for investors to recognize that even if the Democrats end up with narrow control of the House, they are unlikely to raise taxes in the next couple of years. Federal tax revenue was 19.6% of GDP in the fiscal year that ended September 30. That’s the highest on record with the exceptions of the peak of the first internet boom in 2000 and World War II.

Brian S. Wesbury – Chief Economist Firsttrust Microsoft Word – w111422 – Democrats Overperform (ftportfolios.com)

https://www.ceicdata.com/en/indicator/united-states/tax-revenue–of-gdp

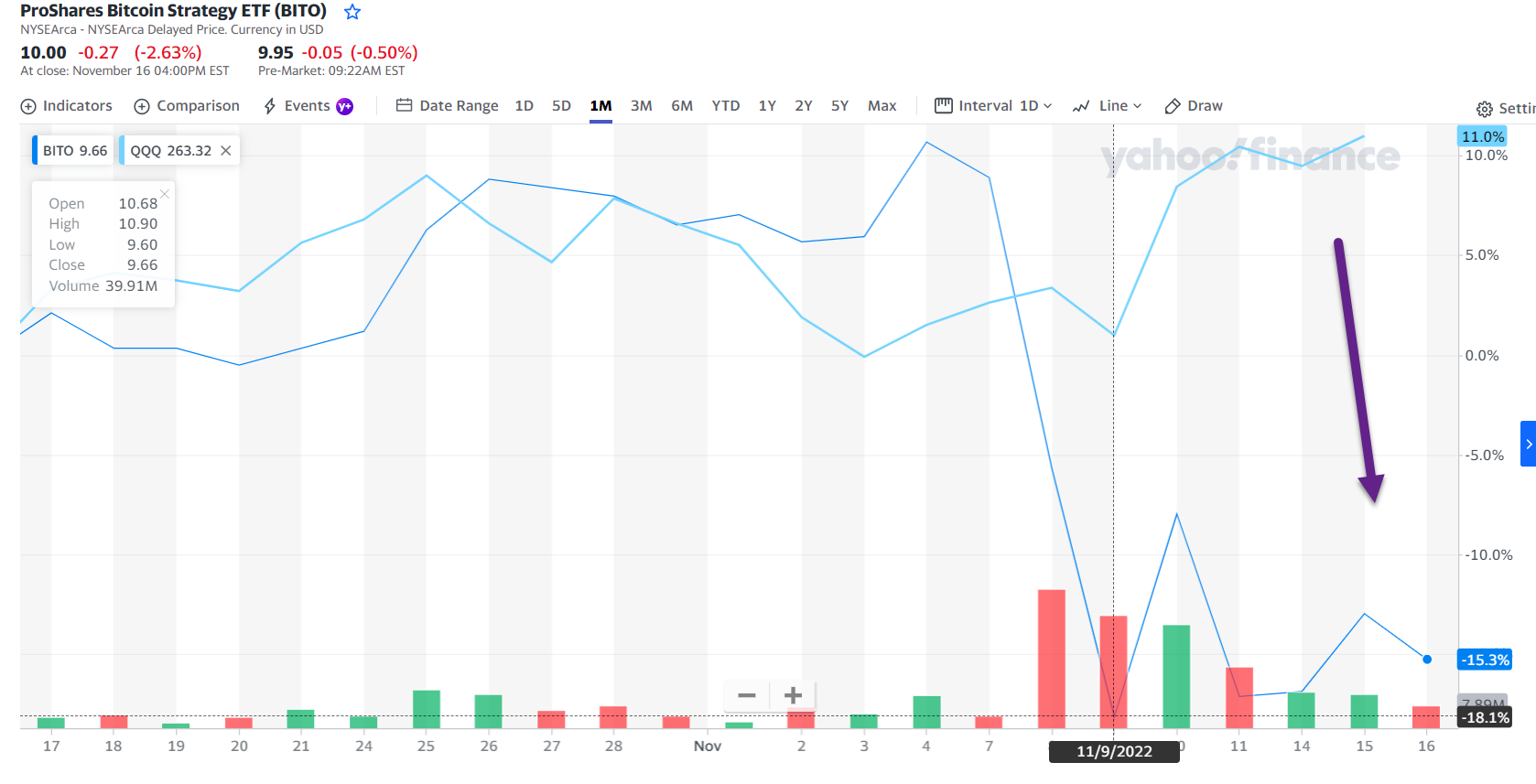

2. Bitcoin Breaks Off from Tech Stocks.

Crypto and Tech Stocks stopped moving together on FTX news….This chart is BITO (bitcoin etf) compared to QQQ…straight down

One Month Performance….QQQ +11% vs. Bitcoin -15%

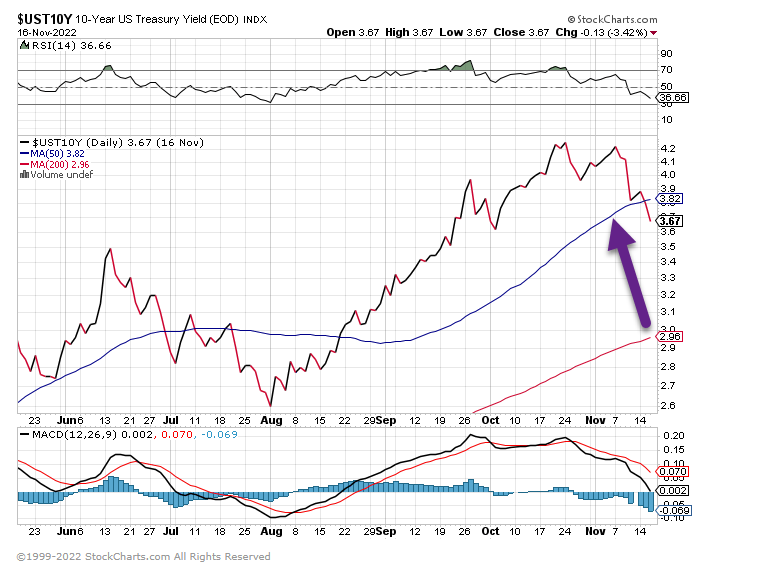

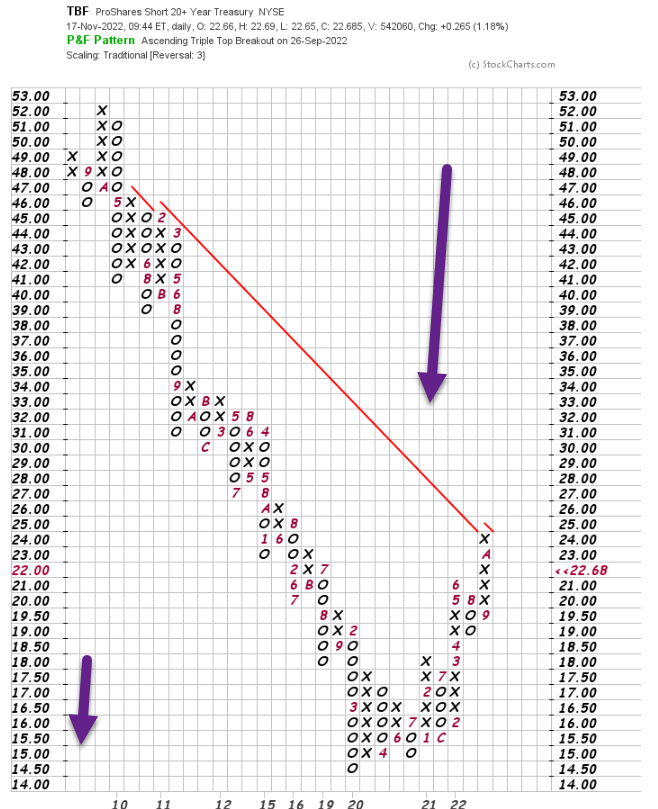

3. Ten Year Treasury Yield Closes Below 50Day Moving Average

Short Treasury Bond ETF is TBF….It Never Broke Above RED Long-Term Downtrend Line Dating Back to 2008 GFC

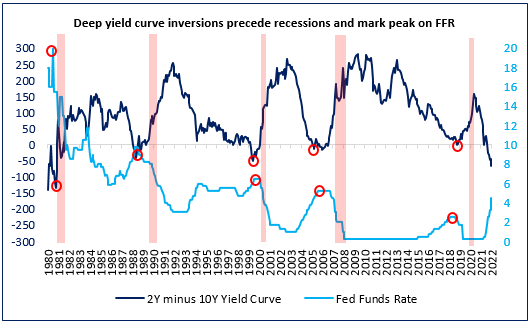

4. Extreme Inversion of Yield Curve Tends to Coincide with Peak Fed Funds Rate

Percy Allison Jefferies LLC The yield curve is extremely inverted (2 year minus 10 year yield is -65bps) implying, based on historical precedent, that the odds of a 2023 recession are high (corroborated by ISM New Orders & Prices Paid/Inventories). A deeply inverted yield curve also tends to coincide with a peak in the Fed Funds Rate. We assume a 50bp hike in December in the chart below.

Source: Jefferies Trading Desk

Percy Allison Jefferies LLC

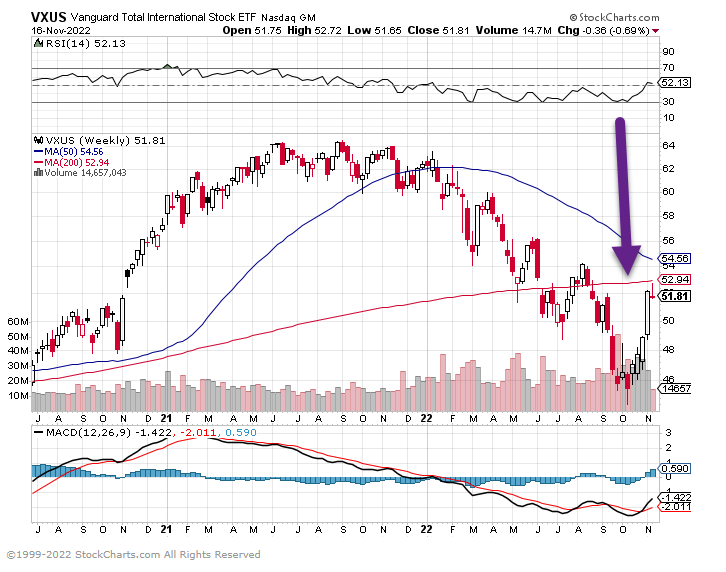

5. Vanguard Total International Stock ETF Rallies Right Back to 200 Day

Vanguard International hits resistance at 200day….interesting 50day never closed below 200day on downside

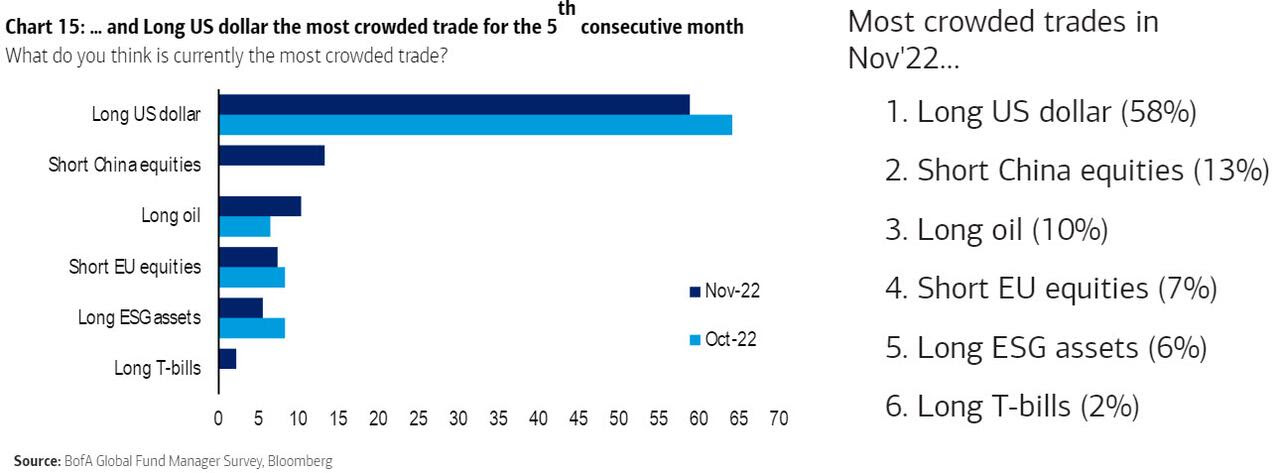

6. Most Crowded Trades….Long Dollar by Far the Largest

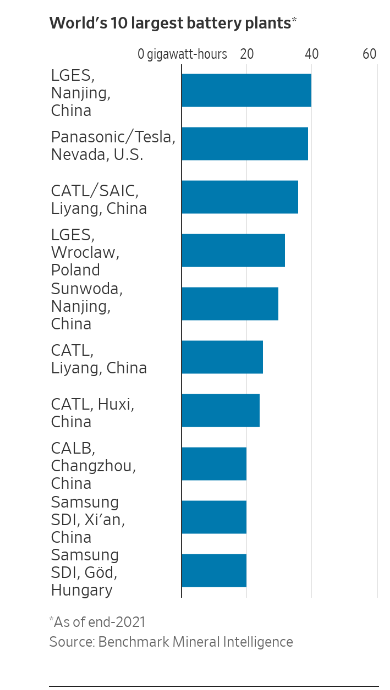

7. The U.S. Needs Battery Plants….8 of 10 Largest Battery Plants in China

WSJ By Stephen Wilmot

Koch Teams With Startup to Build Giant Battery Factory in Georgia – WSJ

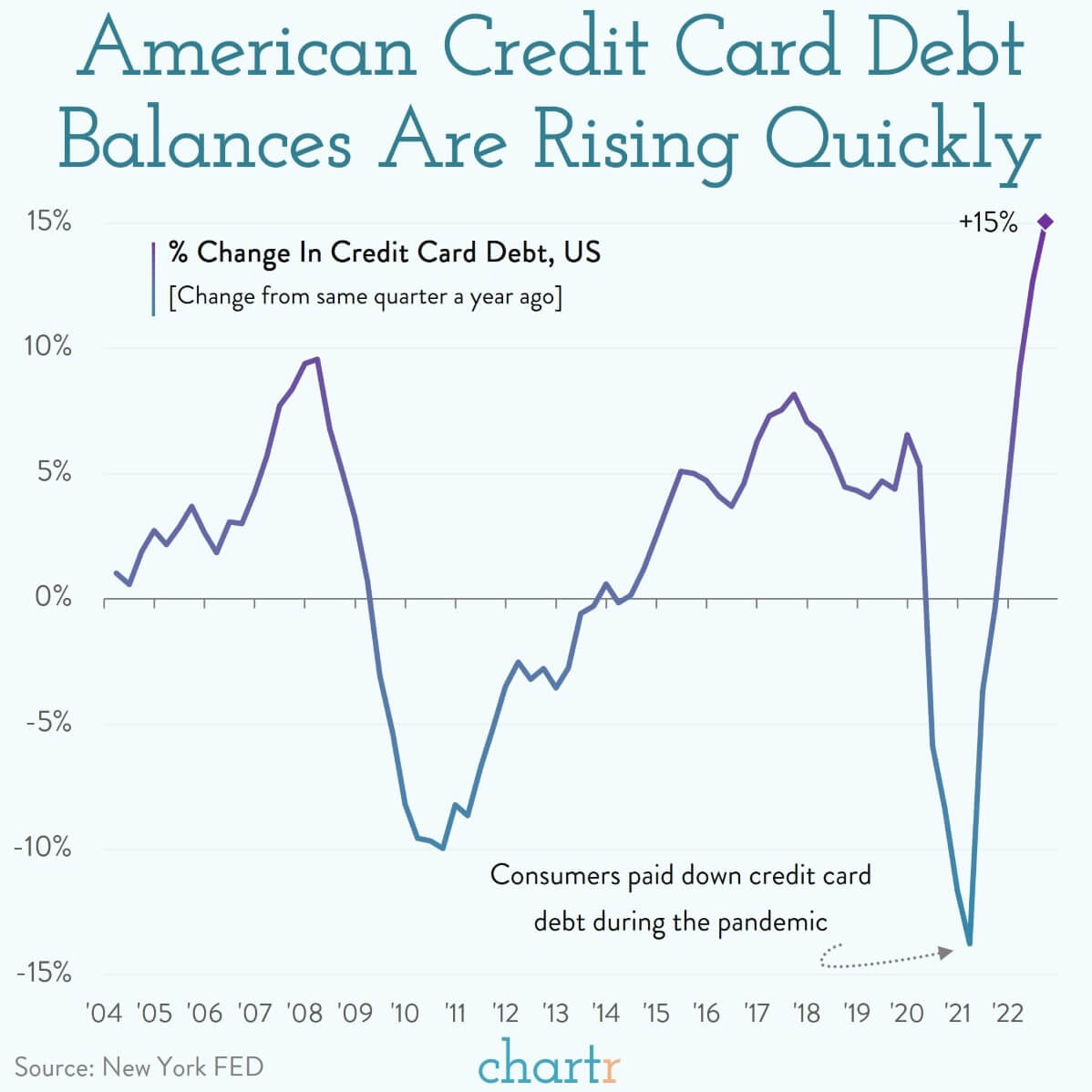

8. American Credit Card Balances Reversed Quickly from Covid Lows

American household debt has hit a new high, with the collective tab rising $351bn in the latest quarter, taking the total owed by households to more than $16.5 trillion. There’s not many comparisons to give that number context, but its roughly 5x the size of the UK economy, or just shy of 7x what Apple is worth.

Credit or debit?Though mortgages are still by far the biggest source of debt, the collective credit card balance was the category that grew fastest on a relative basis. All told, household credit card debt grew 15% year-on-year, the largest annual jump for more than 20 years. A group of Federal Reserve researchers, hardly known for their sensationalist exaggeration, said that the increase “towers over the last 18 years of data”.

With over 500 million accounts open in the US, credit cards are a staple of consumer spending — more than 190 million Americans have at least one account, and 13% reported having five or more cards.

The concern for the economy is that consumers will find themselves owing more, at a higher interest rate, and may struggle to make payments. The good news is that, per The New York Fed, delinquency rates so far have only risen very modestly — and in a historical context remain low — suggesting that people are making payments on time.

9. Interesting International Home Ownership Data

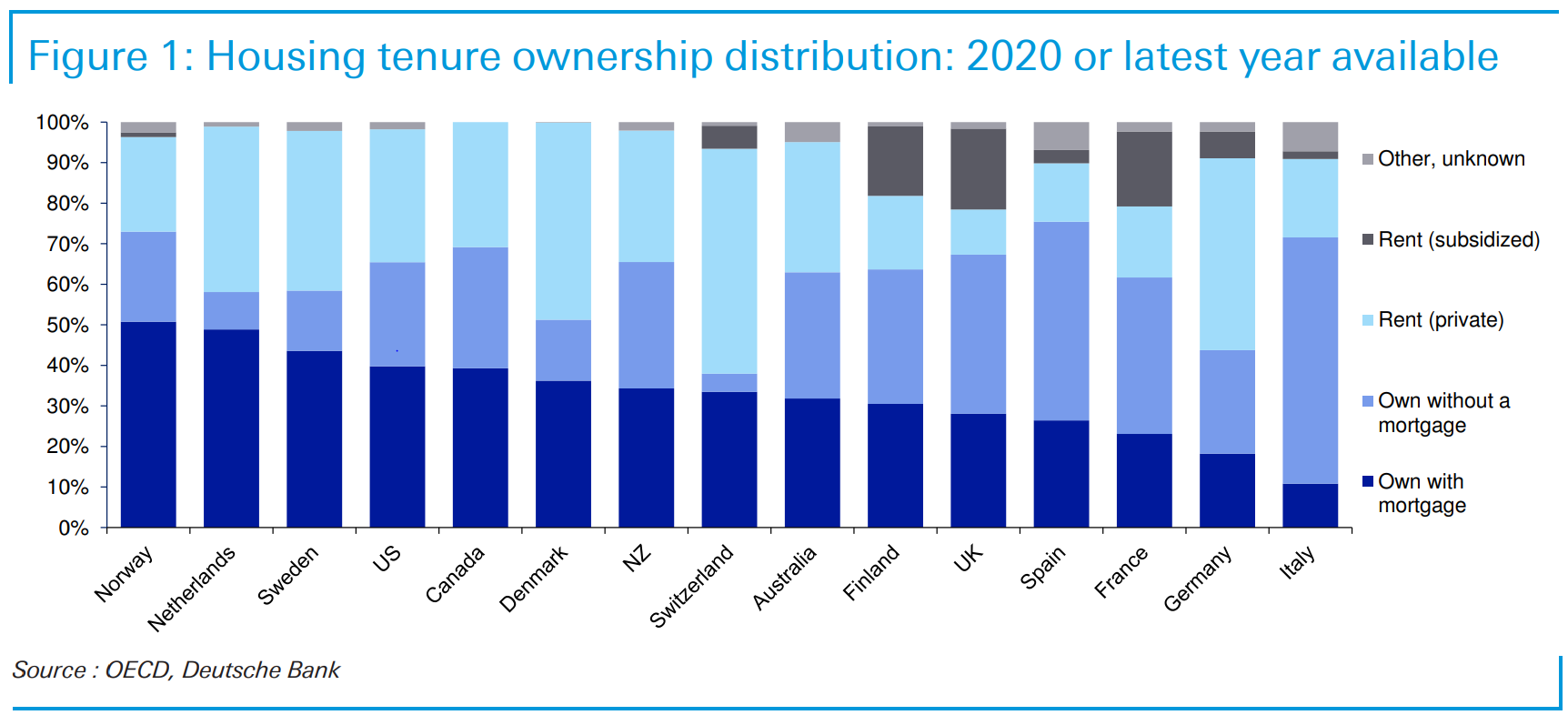

Jim Reid Deutsche Bank Adrian Cox and Galina Pozdnyakova in my team have just produced a report on global housing as part of my team’s 101 series aimed at simplifying big important topics for generalists. Today’s CoTD shows the proportion of homes by ownership status for a selection of countries. There are some interesting extremes in the data. Italy has a very low ownership by mortgage with only 10.8% owned with a mortgage and 60.8% of housing stock owned outright without one. This hints at a more traditional multi-generational family ownership structure. Spain is not too dissimilar. English speaking and Nordic countries are much more likely to have mortgages as the highest form of home ownership. Germany and

The report shows that the hottest markets in recent years are in countries with the highest household debt ratios to GDP hinting at leverage fuelled gains. It also shows the maturity split of mortgages issued in recent times. For example virtually all Finnish and Norwegian mortgages issued in the last year or so have been variable with a fixed rate of no more than 12 months but virtually all new US mortgages have been long-term fixed.

Every market is different so it’s impossible to put a one-size fits all valuation framework on global housing but this report will hopefully give you some basic facts to understand the major differences. The table on p.19 puts it all together and shows which markets might be most at risk going forward. See here for the full report.

10. 5 Reasons Fear Can Make You Better

By Patti Johnson | August 27, 2013 | 0 The fear of not being good enough, smart enough or successful enough can be debilitating. In my last blog, I talked about why it’s so helpful to know your “go-to” fears so you can learn to anticipate and manage them.

In certain situations, fear can also be expected. It is, for example, a normal part of starting any change. In fact, I have been studying people who made the decision to start a change. Many of them had some fears, but those fears didn’t stop them from acting. One new business owner told me that she was afraid at times, but she wanted to reach her goal so badly that she just accepted the fear and kept going. We often think of fear in a negative way, but fear can be a very positive force, one to signal that you are changing and growing. It can:

- Be a sign that you are doing something that’s important to you

- Indicate that you are learning something very new

- Confirm that you are outside of your comfort zone

- Give you creative energy and ideas

- Cause you to act on something that you know is important

Ask anyone who has begun major changes in their work or life, and there is always some fear and discomfort. That is part of it. When I started my business, my fear of failure was absolutely a motivator and I did my best to use it to my benefit—at least most days. The reality is that if it were easy, you would have already done it. Progress is more likely to happen once you begin managing and using your fear to your advantage.

There is also a different kind of fear—the fear of being successful. Recently, a friend said to me, “I’ve realized that I’m not afraid of failure. I’m afraid of success.” We begin to wonder, what if the new business takes off? What if I get the new job? What if I get the book contract? Can I do it? Our own self-doubt can trip us up not only in our ability to get there, but in wondering what happens if we do.

I am reminded of one of my favorite quotes of all time from Marianne Williamson: “Our deepest fear is not that we are inadequate. Our deepest fear is that we are powerful beyond measure. It is our light, not our darkness, that most frightens us. We ask ourselves, ‘Who am I to be brilliant, gorgeous, talented, fabulous?’ Actually, who are you not to be?” Even fear of success can get in our way.

Accept that the fear factor is a natural part of starting down a new path. Know and accept your “go-to” fears so you are ready for them when they appear. Find the positives of fear and don’t aim to go around or avoid it. If you accept and embrace some of your fear, it can work for you—and it just might be a sign that you are ready to start a change that has been waiting for you.

Report Ad

This article was published in August 2013 and has been updated. Photo by Dragon Images/Shutterstock

https://www.success.com/five-