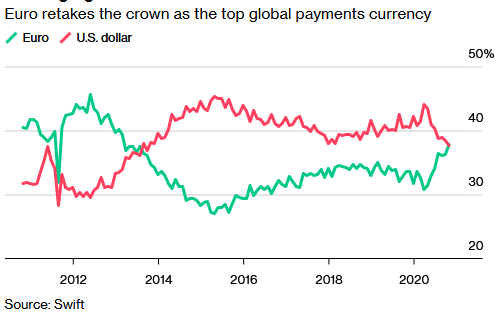

1. Top 10 Has Shown Multiple Charts on Dollar Weakness….Euro Most Common Currency Last Month First Time Since 2013

Dave Lutz at Jones Trading The euro was the most used currency for global payments last month, the first time it has outpaced the dollar since February 2013 – Data from the Society for Worldwide Interbank Financial Telecommunications, which handles cross-border payment messages for more than 11,000 financial institutions in 200 countries,showedthe European Union’s single currency and the greenback were followed by the British pound and the Japanese yen.The Canadian dollar overtook China’s yuan for the fifth spot, Swift said\\

2. More Evidence of Broadening Stock Market Rally.

PIZ Developed International Markets ETF Hits New Highs

3. Natural Gas Reverses Toward Lows….$9 would break all-time lows

4. Global Stock Prices Inverse Correlation with Global Bond Yields…1984-2020

Ned Davis Research

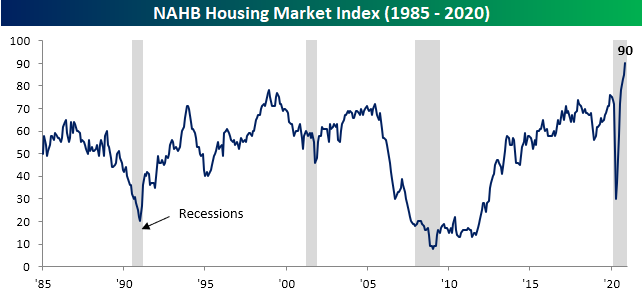

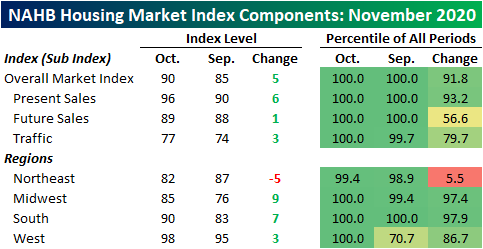

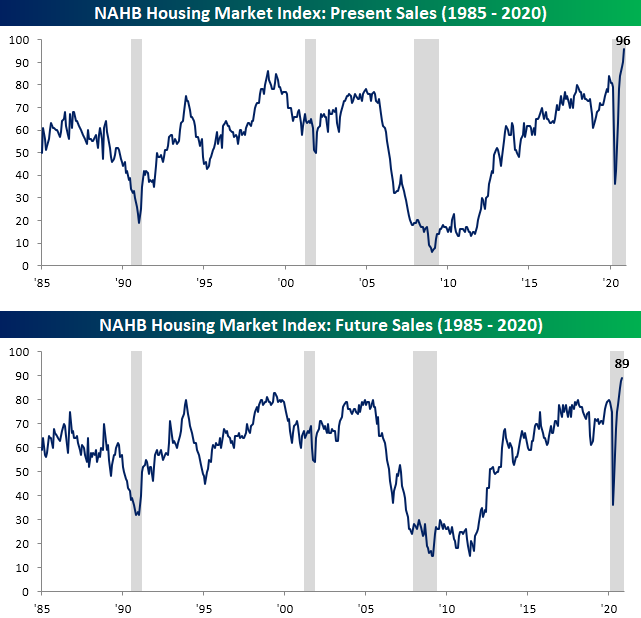

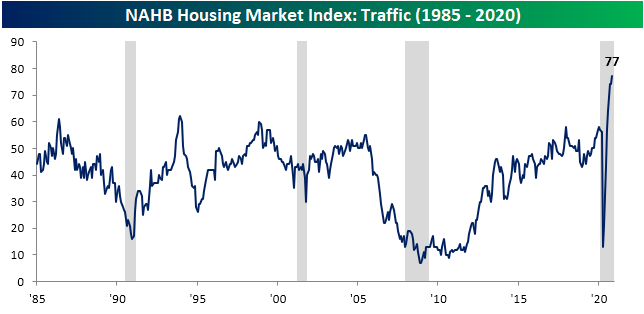

5. Never Been Better for Builders

Tue, Nov 17, 2020-Bespoke Investment Group

It is hard to believe that housing-related indicators could continue to impress, but the NAHB’s reading on homebuilder sentiment released this morning did just that. The headline reading was expected to hold steady at what was a record high of 85. Instead, the index set the record high bar even higher as it rose 5 points to 90.

Not only does the index sit at an all-time high, but the 5-point move this month was in the top 10% of all month over month changes. The same can be said for the index for Present Sales as well as sentiment in the Midwest and the South. Overall, just about every sub-index of the report was higher this month and rising to new record highs. The Northeast was the only holdout as that index fell 5 points, but at 82 it is still at its second-highest level ever. With more records this month, every index has made a new record in at least two of the last three months. The headline index, Present Sales, and Future Sales have done so in back to back to back months.

https://www.bespokepremium.com/interactive/posts/think-big-blog/never-been-better-for-builders

6. Global debt to hit record $277 trillion by year end on pandemic spending splurge: IIF

NEW YORK (Reuters) – Global debt is expected to soar to a record $277 trillion by the end of the year as governments and companies continue to spend in response to the COVID-19 pandemic, the Institute of International Finance said in a report on Wednesday.

FILE PHOTO: Line workers spot weld parts of the frame on the flex line at Nissan Motor Co’s automobile manufacturing plant in Smyrna, Tennessee, U.S., August 23, 2018. REUTERS/William DeShazer/File Photo

The IIF, whose members include over 400 banks and financial institutions across the globe, said debt ballooned already by $15 trillion this year to $272 trillion through September. Governments – mostly from developed markets – accounted for nearly half of the increase.

Developed markets’ overall debt jumped to 432% of GDP in the third quarter, from a ratio of about 380% at the end of 2019. Emerging market debt-to-GDP hit nearly 250% in the third quarter, with China reaching 335%, and for the year the ratio is expected to reach about 365% of global GDP.

“There is significant uncertainty about how the global economy can deleverage in the future without significant adverse implications for economic activity,” the IIF said in its report.

Total U.S. debt is on track to hit $80 trillion in 2020, the IIF report said, up from $71 trillion in 2019. In the Euro area, debt rose by $1.5 trillion to $53 trillion through September.

Among developing economies, Lebanon, China, Malaysia and Turkey have seen the biggest increases in non-financial sector debt ratios so far this year.

Emerging market governments’ declining revenues have made paying down debt “much more onerous” even amid record low borrowing costs across the globe.

Through the end of next year, some $7 trillion of emerging market bonds and syndicated loans will come due, about 15% of which is denominated in U.S. dollars, IIF said.

Officials from the Group of 20 last month agreed to extend the Debt Service Suspension Initiative (DSSI) freeze on official bilateral debt payments to the first half of 2021 and said they would consider another six-month extension in April.

The global economy is forecast to shrink 4.4% this year and expand 5.2% in 2021 according to estimates from the International Monetary Fund as pandemic-induced lock downs and travel restrictions weigh on economic output.

Reporting by Rodrigo Campos, Editing by Karin Strohecker and Toby Chopra

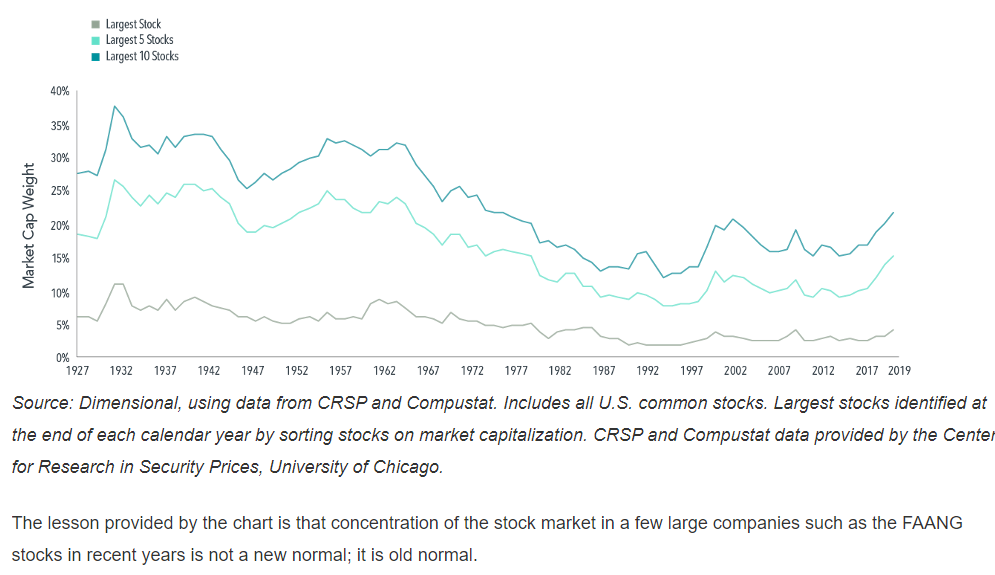

7. Concentration of Stock Market in a Few Large Stocks not Unusual…FAANG.

Larry Swedroe Is the market top-heavy?

While investors may think the current “top-heavy” concentration of the S&P 500 is unusual, as you can see in the following chart from Dimensional, that is not the case. In fact, from 1927 through the mid-1960s, the top 10 stocks made up more than 25% of the market cap of the index.

Summary

One of my favorite expressions is that there is nothing new in investing, only the investment history you don’t know. While the types of business that make up the largest stocks change over time, we have “been there and done that” with both concentration and dramatic outperformance of stocks that go on to become one of the 10 largest. We also have seen what happens once they become one of the 10 largest; they tend to underperform the market over the succeeding five- and 10-year periods. This seems logical, as investors would likely view them as great companies and, as such, safe investments – unless you believe that risk and expected return are unrelated, safe investments must have lower expected returns.

The evidence, as presented annually in the S&P Active Versus Passive Scorecard, demonstrates that it is the extreme difficulty of systematically predicting which companies will outperform the stock market that makes active management a loser’s game – a game in which the odds of winning are so low that it’s not prudent to play. This insight also highlights the importance of having a broadly diversified equity portfolio that provides exposure to a vast array of companies and sectors.

As to the future performance of the FAANG stocks, Professor French noted: “The past decade of extraordinary realized returns tells us little about the FAANG stocks’ future expected returns. And unfortunately, this is a general result. For most investments and most investment horizons – a month, a year, five years, even 10 years – the realized return is driven far more by the unexpected return than the expected return.”

Larry Swedroe is the chief research officer for Buckingham Wealth Partners.

https://www.advisorperspectives.com/articles/2020/11/16/is-the-market-top-heavy

8. A Little Biased but Interview with Cliff Asness.

Billionaire Cliff Asness pegs AQR rebound on ‘largest opportunity ever’ in value stocks

Asness said he’s sticking to his value investing strategy despite many funds’ slumping performance this year

Cliff Asness – Misha Friedman/Getty Images – Tom Teodorczuk

AQR Capital Management’s outspoken co-founder Cliff Asness says the systematic quantitative investing giant is seeking to profit from the “largest opportunity ever” in value investing in order to end its recent underwhelming performance.

Value investors, who seek to profit from buying neglected stocks in companies trading at a discount, have struggled in recent years, with the performance difficulties extending into 2020. Hedge Fund Research’s Fundamental Value index is down 12.7% this year to the end of April.

But in a webinar interview with Frank J. Fabozzi,Visiting Professor of Finance at New York University’s Stern School of Business, Asness passionately defended the value investing style. Asness said he thought “we are in some kind of large bubble within stocks … it has been excruciating to get here, I will not downplay it, but we’ve thrown everything we can at it and it looks like the largest opportunity ever in value, not a strategy that is broken going forward.”

Value investing, he added, comprised “a fairly giant bubble. Unless we ever find something — it’s not going to come from returns — but something of a story that really makes sense and is supported by the data why things are different now, we will be sticking with this like grim death, and like we have several other times in the past, we will win.”

Asness acknowledged AQR has suffered in 2020. Many of its 41 mutual funds are down this year across equities, fixed income and multi-asset classes. AQR funds with negative performance in 2020 until May 27, according to data on the firm’s website, include AQR Long-Short Equity Fund (down 16.25% YTD), AQR Multi-Strategy Alternative Fund (down 26.7%), AQR Risk-Balanced Commodities Strategy Fund (down 24.3%) and AQR Multi-Asset Fund (down 8.5% YTD). Every one of its 19 equity funds is down in 2020.

“It’s been a real tough two years,” Asness said. “Defensive investing, trend following have actually been OK, particularly during the Covid crisis. But broadly speaking, multi-factor quant has had a very tough period. I think that sets it up for a very good period going forward.”

Connecticut-based AQR was founded in 1998 by Cliff Asness, David Kabiller, John Liew and Robert Krail, who all had worked for Goldman Sachs. Its recent performance struggles are notable since the company has experienced strong growth and performance in most years.

Asness said AQR’s performance woes partly stemmed from its track record, suggesting that investor expectations set the bar high.

Last week, Asness engaged in a public spat with Black Swan author Nassim Nicholas Taleb over the merits of tail-risk hedging strategies.

In the webinar, Asness also vociferously denied AQR was a hedge fund. “It never has been,” he said. “It’s one of my pet peeves. In particular journalists do this. I think 22 years ago when we started this, they would do it because it sounded sexier back then. Now I think it just sounds more evil just because the world has changed and what these words tend to invoke in people.

“It’s never been true. We run some hedge products and we run a lot of traditional beat-the-benchmark, no leverage, no shorting, very low fee, nothing like a hedge fund. Our business is roughly split between the two … I do think hedge funds is not an accurate summary…[but] I’ve given up any real hope of getting the world to change that.”

To contact the author of this story with feedback or news, email Tom Teodorczuk

9. Gold Heading Back to July Levels?

GLDDfrom highs

10. Bill Gates Just Predicted the Pandemic Will Change the World in These 7 Dramatic Ways

Life after Covid-19 will look a lot different than life before Covid-19, according to the Microsoft founder and philanthropist.

BY JESSICA STILLMAN, CONTRIBUTOR, INC.COM@ENTRYLEVELREBEL

Bill Gates and Rashida Jones. Courtesy GatesNotes

Five years ago Bill Gates got up on the TED stage and basically predicted the current pandemic and America’s shambolic response. Thanks to that talk, he’s now regarded as one of the most prophetic voices out there on the threat of new diseases. That means when he offers his opinion on what life after Covid-19 will look like, we should all sit up and take notice.

Which is what the Microsoft founder-turned-philanthropist just did on the first episode of his new podcast. Together with actor Rashida Jones, Gates talked to fellow infectious disease heavyweight Anthony Fauci about progress toward a vaccine, the measures we should all be taking now, and his vision of life after Covid. Here are Gates’s top predictions.

1. Remote meetings will be normalized.

Before the pandemic you would probably worry a client might feel slighted if you opted to meet with them virtually rather than in person, but after Covid the calculus of when to go and when to Zoom will be very different, according to Gates.

“Just like World War II brought women into the workforce and a lot of that stayed, this idea of, ‘Do I need to go there physically?’ We’re now allowed to ask that,” he says. That will be true of work meetings, but also of other previously in-person interactions.

“The idea of learning or having a doctor’s appointment or a sales call where it’s just screen-based with something like Zoom or Microsoft Teams will change dramatically,” Gates predicts.

2. Software will have improved dramatically.

Not only will the idea of meeting at a distance seem more natural, but Gates also predicts the tools to do so will soon be wildly better than what we’re struggling with now.

“The software was kind of clunky when this all started, but now people are using it so much people will be surprised by how quickly we’ll innovate with the software,” he predicts.

3. Companies may share an office on rotation.

If we’re doing more at a distance, that means we’ll need to go into the office less, and that will have significant knock-on effects. The first of these will be felt in how companies make real estate decisions.

“I think people will go to the office less. You could even share offices with a company that has its employees coming in on different days than your employees are coming in,” Gates suggests.

4. We’ll choose to live in different places.

The knock-on effects of more remote work won’t end there. They’ll also reshape our communities, Gates believes. Downtowns will be less important, bedroom communities will be more important (and we may even rethink the design of our homes).

“In the cities that are very successful, just take Seattle and San Francisco … even for the person who’s well-paid, they’re spending an insane amount of their money on their rent,” he points out. Without the anchor of an office you have to visit every day, staying in such expensive places becomes less appealing, and a bigger house in a smaller community with less traffic much more so.

5. You’ll socialize less at work, and more in your community.

Gates also notes one final knock-on effect of these shifts in the way we work–the way we socialize will change too. You may spend less of your social energies at work, he predicts, and more with your loved ones in your local community.

“I think … the amount of social contact you get from your work may go down, and so your desire to get more social contact in your community with your friends at night, you know, that might go up because, particularly, if we’re doing a lot of remote work, then our desire to socialize, our energy to socialize after we stop working, will be quite a bit greater. You could shift the balance there somewhat,” Gates tells Jones.

6. Things won’t go totally back to normal for a long time.

If that last prediction sounds appealing, the next one, which Gates delivers in partnership with top infectious disease expert (and Gates’s longtime friend) Fauci, is less cheerful. Even after a vaccine largely eliminates Covid from the U.S., things won’t go totally back to normal until the whole world beats the disease.

“There’s a phase where we’re going to have the numbers be super low in the United States, but it’ll still be out in other parts of the world, so you could get a resurgence. I think a lot of people will remain quite conservative in their behavior, particularly if they associate with older people whose risk of being very sick is quite high,” he says

Truly normality will return when not just the U.S. has the pandemic under control, but the rest of the world does as well.

7. The next pandemic won’t be nearly as bad.

If you’re bummed to hear it’s unlikely you’ll be attending concerts with tens of thousands of fellow fans next summer, Gates has one last positive prediction to cheer you up. While this pandemic has been a nightmare, he’s hopeful the next time a killer pathogen emerges, the world will do a lot better at containing it.

“The main reason it’ll have less destructive impact is we will have practiced. We would’ve done disease games like war games, and almost every country will respond like South Korea or Australia did where you’re very quickly testing people and quarantining people, and our tools for testing will be way better. We won’t be this stupid the second time around,” he concludes.

Take all this together and an optimistic picture emerges of a future of more efficient work, tighter communities, and greater disease preparedness. But in the meantime we still all have a lot to get through. Check out the complete conversation between Gates, Fauci, and Jones for advice on how we can all pull together to weather the hard months to come.

Inc. helps entrepreneurs change the world. Get the advice you need to start, grow, and lead your business today. Subscribe here for unlimited access.

NOV 18, 2020

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

https://www.inc.com/jessica-stillman/bill-gates-anthony-fauci-pandemic-changes.html?cid=sf01003

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.