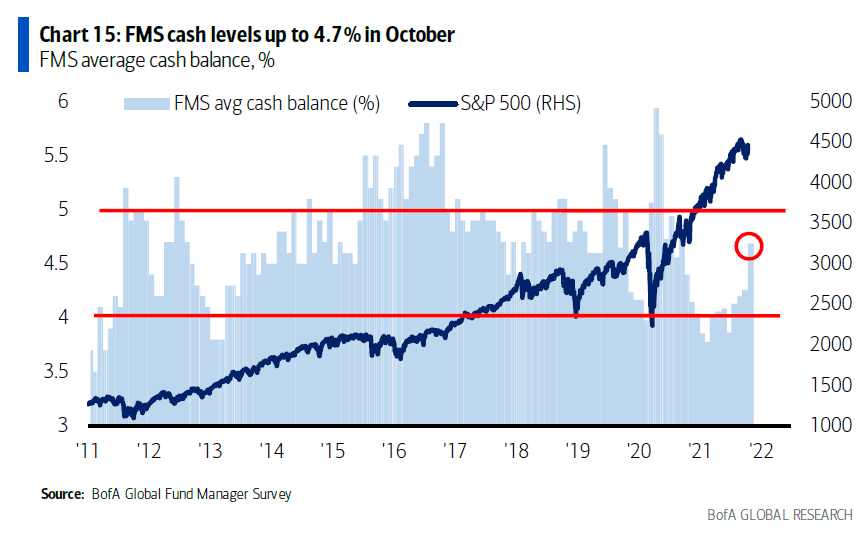

1.Money Managers Have Almost 5% Cash.

LPL Research Blog https://i0.wp.com/lplresearch.com/wp-content/uploads/2021/10/10.20.21-blog-chart-2.png?ssl=1

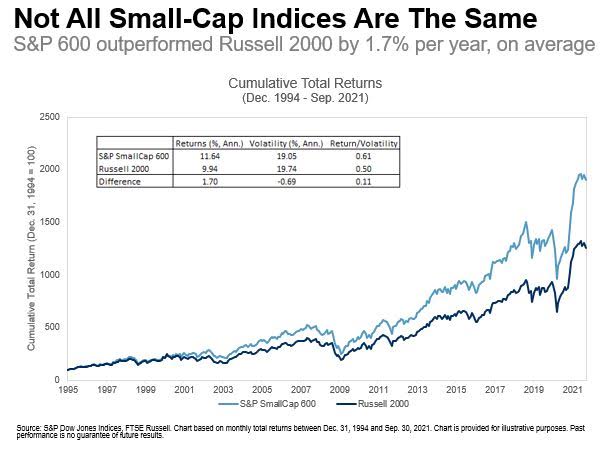

2.S&P 600 Small Cap Outperformance Vs. Peers.

Joseph Carr• 1stDirector at S&P Dow Jones Indices53m • 53 minutes ago

Join us at 11 ET for the S&P DJI Weekly Index Strategy Update. Happy 27th birthday to the S&P SmallCap 600! Hamish Preston, CFA will look at performance, what makes this index different, how it has held up against active, the small cap space, and how it relates to

https://www.linkedin.com/in/joseph-carr-5416907/

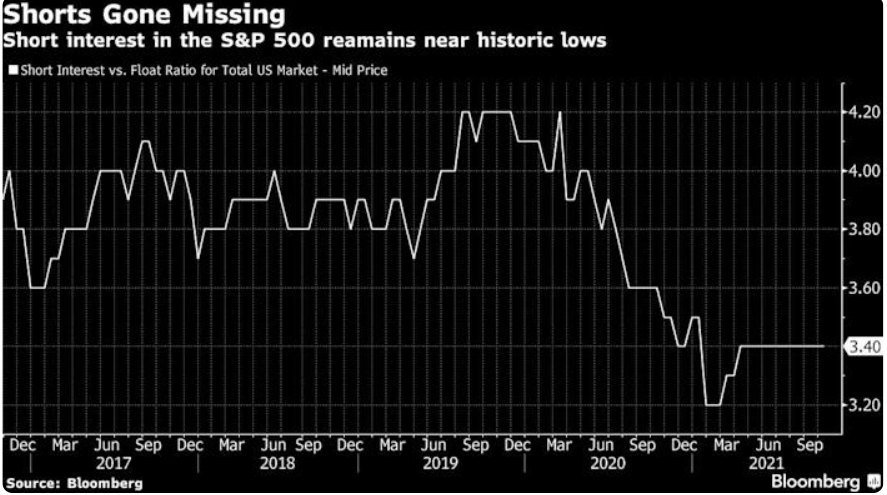

3.Short Interest Hits New Lows.

Emily Graffeo

(Bloomberg) — Bets against the stock market are hard to come by these days, but that’s not necessarily good news to Wells Fargo.

Short interest in the S&P 500 has remained near historic lows for a large portion of 2021 as the U.S. equity benchmark has climbed to new heights. That’s concerning in the longer term, as higher short interest levels tend to help minimize price gapping when the market is faced with unexpected risks or shocks, said a team of strategists including Christopher Harvey in a Thursday note to clients.

“Current levels of SI indicate significant scope for shorting, which we view as a risk,” the strategists said.

On the other hand, the continued trend of low short interest suggests that investors who brushed off fears of shrinking large cap margins prior to the third quarter earnings season have largely been correct. So far, 200 companies in the S&P 500 have beat earnings per share estimates, outpacing the 33 companies that have missed, according to data compiled by Bloomberg.

While the current low levels remain a risk, the strategists also said short interest may pick back up after the earnings season ends and investors begin to focus on the macroeconomic calendar.

“To me it feels more like complacency than euphoria — just the idea that equities are the default asset class of choice. Cash and bonds are so unattractive. That, over time, can lead to a degree of complacency or perhaps inattenton to risk factors,” David Donabedian, chief investment officer of CIBC Private Wealth Management, said by phone.

https://finance.yahoo.com/news/p-500-short-bets-worryingly-145225507.html

4.Amazon Miss…See What Happens to this 18 Month Range.

Amazon sideways range since June 2020

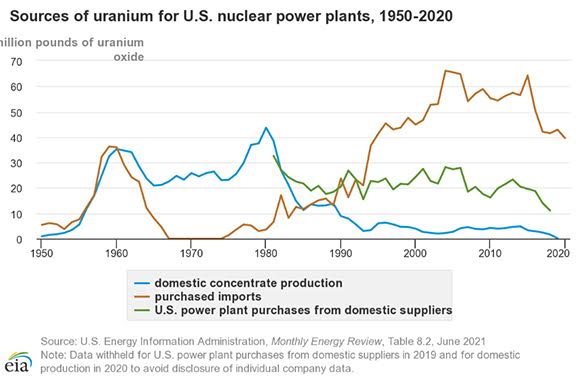

5.U.S.Power Plants Import 90% of their Uranium.

ETF.Com Currently, U.S. power plants import more than 90% of their uranium from foreign sources, including Kazakhstan and Russia, which some feel is a national security risk.

Jessica Ferringer Uranium ETFs Explode https://www.etf.com/sections/features-and-news/uranium-etfs-explode

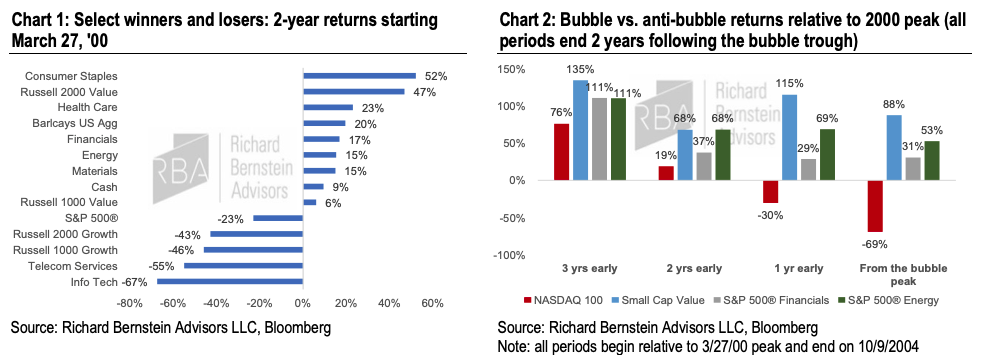

6.Incredible Chart of Undervalued Sector Returns when the Internet Bubble Burst.

Never Too Early to Sell a Bubbleby Richard Bernstein of Richard Bernstein Advisors, 10/28/21 https://www.advisorperspectives.com/commentaries/2021/10/28/never-too-early-to-sell-a-bubble

7.Here’s how Biden’s Build Back Better framework would tax

Greg Iacurci@GREGIACURCI

KEY POINTS

- President Joe Biden issued a $1.75 trillion social and climate spending plan on Thursday. About $1 trillion would be financed by higher taxes on wealthy Americans.

- The Build Back Better proposal would levy a tax surcharge on Americans who earn more than $10 million, invest in more IRS enforcement and raise taxes for some business owners.

- It’s unclear whether the plan has the full backing of Democrats in the House and Senate.

The White House issued a framework for a $1.75 trillion social and climate spending bill on Thursday — and would finance more than half of it from tax reforms aimed at wealthy Americans.

The plan would raise revenue by levying a tax surcharge on those making more than $10 million a year, raising taxes for some high-income business owners and strengthening IRS tax enforcement, according to the outline.

The framework was the product of several months of negotiations between moderate and progressive Democrats. Together, proposals targeting wealthy taxpayers would raise about $1 trillion of the nearly $2 trillion of total revenue being raised. (The rest would come from new taxes on corporations and stock buybacks, for example.)

President Joe Biden said the legislation was fully paid for and would help reduce the federal budget deficit.

“I don’t want to punish anyone’s success; I’m a capitalist,” President Biden said in a speech Thursday. “All I’m asking is, pay your fair share.”

Biden reiterated that households earning less than $400,000 a year wouldn’t “pay a penny more” in federal taxes and would likely get a tax cut from the proposal, via elements like the enhanced child tax credit, and reduced costs on child care and health care.

The framework omits specifics beyond high-level detail. But it seems to abandon many tax proposals issued last month by the House Ways and Means Committee, even while the overarching policy goal of targeting the wealthy is the same.

For example, the framework doesn’t raise the current top 37% income tax rate or 20% top rate on investment income (with the exception of multimillionaires subject to the proposed surtax). It also wouldn’t impose new required distributions from big retirement accounts or alter rules around estate taxes and trusts, for example.

“It’s far slimmed down,” said Kyle Pomerleau, a senior fellow at the American Enterprise Institute, a right-leaning think tank. “It forgoes a lot of things they’d proposed in the House bill.”

Of course, the proposal needs near-unanimous backing from Democrats in the House and Senate, given their razor-thin majorities, and it’s unclear whether it has the party’s full support.

Here are some of the major provisions in the Build Back Better framework.

Millionaire and billionaire surtax

The plan would impose a new surtax on the top 0.02% of Americans, according to the White House.

There would be a 5% surtax on adjusted gross income of more than $10 million, and an additional 3% (or, a total 8% surtax) on income of more than $25 million.

The surtax is estimated to raise $230 billion over 10 years.

“This is one of the main provisions in here that directly taxes the wealthy,” said Garrett Watson, senior policy analyst at the Tax Foundation.

It would affect a much larger number of people than another tax floated by Senate Democrats earlier this week on the wealth of billionaires. That tax would have affected about 700 people, whereas the millionaire surtax would perhaps affect hundreds of thousands of people, according to Watson’s rough estimate.

Essentially, an 8% surtax would mean the highest earners pay a top 45% federal marginal income tax rate on wages and business income. (They currently pay 37%.)

They’d also pay a top 28% top federal rate on long-term capital gains and dividends, plus the existing 3.8% net investment income tax on high earners. (Taxes on long-term capital gains apply to growth on stocks and other assets sold after one year of ownership. The top tax rate is currently 20%.)

That the tax seems to apply to “adjusted gross income” and not “taxable income” is significant, Watson said.

That’s because the AGI measure reflects income before it’s reduced by charitable contributions and other tax breaks — meaning the surtax would encompass more taxpayers.

IRS enforcement

Democrats’ plan would make investments in IRS enforcement to help close the so-called tax gap.

The top 1% evade more than $160 billion per year in taxes, according to the White House.

Relative to other taxpayers, they get a bigger share of income from opaque sources, such as certain business arrangements that aren’t as readily subject to tax reporting or withholding, according to Watson.

The IRS would hire enforcement agents trained to pursue wealthy tax evaders, overhaul 1960s-era technology and invest in taxpayer services to help ordinary Americans, according to the White House.

It estimates these measures would raise $400 billion over 10 years — the single-biggest revenue raiser in the proposal.

However, some question how lawmakers arrived at that revenue figure. The Treasury Department estimated last month that an $80 billion IRS investment would generate $320 billion in revenue over a decade.

Business income

There are two provisions in the Build Back Better framework related to business income.

One would apply a 3.8% Medicare surtax to all income from pass-through businesses and another would limit a tax break on business losses for the wealthy.

The reforms would raise $250 billion and $170 billion, respectively, over a decade, according to estimates.

Currently, the owners of most pass-through businesses are subject to a 3.8% self-employment tax or net investment income tax. (Such businesses, like sole proprietorships and partnerships, pass their earnings to owners’ individual tax returns.)

However, some profits (namely, those of S corporations) aren’t subject to the 3.8% net investment income tax, which was created by the Affordable Care Act to fund Medicare expansion. The proposal would close this loophole for wealthy business owners.

The second proposal is also somewhat vague on business losses. But the House tax proposal last month, which contained a similar measure, may offer a clue; it would permanently disallow excess business losses (meaning, net tax deductions that exceed their business income).

This applies to businesses that aren’t structured as a corporation.

This is a developing story. Check back for updates.

https://www.cnbc.com/2021/10/28/heres-how-bidens-build-back-better-framework-would-tax-the-rich.html

8.US Pending Home Sales Unexpectedly Tumble In September

BY TYLER DURDEN

After surging an unexpected 8.1% MoM in August, and on the heels of rebounds in new- and existing-home sales, Pending Home Sales in September were expected to scrape out a modest 0.5% MoM rise, but that was a long way off as Pending Home Sales tumbled 2.3% MoM…

That is the 3rd monthly drop in the last 4 months and leaves pending home sales down over 7% year-over-year.

“Contract transactions slowed a bit in September and are showing signs of a calmer home price trend, as the market is running comfortably ahead of pre-pandemic activity,” said Lawrence Yun, NAR’s chief economist.

“It’s worth noting that there will be less inventory until the end of the year compared to the summer months, which happens nearly every year.

“Rents have been mounting solidly of late, with falling rental vacancy rates,” Yun said.

“This could lead to more renters seeking homeownership in order to avoid the rising inflation,”

Because if you can’t afford to rent, you can afford a million-dollar starter-home?

Signings declined in all four U.S. regions from the prior month, led by a 3.5% drop in the Midwest

“Some potential buyers have momentarily paused their home search with intentions to resume in 2022.”

Pending sales are a forward-looking indicator of closed sales in 1-2 months so this decline suggests trouble ahead for the rebounding sentiment among homebuilders.

https://www.zerohedge.com/personal-finance/us-pending-home-sales-unexpectedly-tumble-september

9.Holiday Sales Set for Record.

Retail trade group: holiday sales could set new record

By ANNE D’INNOCENZIOyesterday

NEW YORK (AP) — The National Retail Federation, the nation’s largest retail trade group, expects that holiday sales gain could shatter last year’s record-breaking season even as a snarled global supply chain slows the flow of goods and results in higher prices for a broad range of items.

The trade group said Wednesday that it predicts that sales for the November and December period will grow between 8.5% and 10.5% to $843.4 billion and $859 billion. Holiday sales increased 8.2% in 2020 compared with the previous year when shoppers, locked down during the early part of the pandemic, splurged on pajamas and home goods, mostly online.

The group expects that online and other non-store sales, which are included in the total, will increase between 11% and 15% to a total of between $218.3 billion and $226.2 billion driven by online purchases.

The numbers exclude automobile dealers, gasoline stations and restaurants billion. Holiday sales have averaged gains of 4.4% over the past five years, according to the group.

The forecast considers a variety of indicators including employment, wages, consumer confidence, disposable income, consumer credit, previous retail sales and weather.

“There is considerable momentum heading into the holiday shopping season,” NRF President and CEO Matthew Shay said. “Consumers are in a very favorable position going into the last few months of the year as income is rising and household balance sheets have never been stronger.”

Shay also noted during a call with the media on Wednesday that the lifting of U.S. restrictions on international visitors from more than 30 countries early next next month should also give a jolt to retailers this holiday season.

NRF’s rosy forecast is similar to other predictions, which call for holiday sales to increase by at least 7%, according to Deloitte, MastercardSpending Pulse and KPMG.

Still, NRF executives acknowledged on the call that there are plenty of headwinds facing consumers who are dealing with the ripple effects of a clogged supply chain that has meant higher prices, less generous discounts and shortages of items.

For example, online prices are up 3% heading into the holidays; in contrast, that number, on average, has been down 5% in past years, according to the Adobe Digital Economy Index, which tracks more than one trillion visits to U.S. retail sites. Adobe predicts that discounts will be in the 5% to 25% range across categories this season, compared to a historical average of 10% to 30%.

Just like last year, shoppers are shopping early for the holiday season for fear of not getting what they want. But Shay said that retailers are doing a good job in making sure inventory is on the shelves though there will be some gaps in some categories. Still, he has seen shoppers learn to adjust by switching to other brands and items if they can’t find their top choice. That happened in the early days of the pandemic when customers were looking for alternative consumer packaged brands when they couldn’t find their top choice.

“Consumer will not be deterred,” said Shay. ”They will be out shopping for the holidays, and they won’t go home empty-handed.”

Follow Anne D’Innocenzio: http://twitter.com/ADInnocenzio

10.A Stoic Response to Power

A Stoic Response, Wisdom, and More

“To recognize the malice, cunning, and hypocrisy that power produces, and the peculiar ruthlessness often shown by people from ‘good families.’” Marcus Aurelius

At a young age, Marcus Aurelius is chosen to one day ‘assume the purple’—to become emperor—by Hadrian. Perhaps Hadrian saw something in him, perhaps since he lacked a son of his own, he thought he might be able to cultivate the traits needed to successfully rule the Roman empire.

Hadrian set in line a succession plan that involved Hadrian adopting the elderly Antoninus Pius who in turn adopted Marcus Aurelius. All the while, Marcus studied philosophy—he read and thought about what it meant to be a good person.

In 161 AD, after the death of Antoninus, Marcus becomes emperor. We’re told that absolute power corrupts absolutely. Well, Marcus was given that power. And what did he with it? What was the first thing he did upon ascending the throne?

He appointed his step-brother Lucius Verus co-emperor. Marcus Aurelius was given unlimited, executive power and the first thing he did was share it with someone he was not even technically related to. In fact, he essentially refused in front of the Senate to be made emperor unless Lucius would also rule with him. Marcus simply did it because he thought it was fair. Because it was the right thing to do.

That’s magnanimity. That’s what biographer Robert Caro, who has deeply studied some of the most powerful people in history, means when he says that power doesn’t corrupt, it reveals.

Marcus’s magnanimity didn’t stop there. Throughout his reign the power he held never seemed to go to his head—neither did the stress or burden. He rarely rose to excess or anger, and never to hatred or bitterness. What’s more impressive about his composure is all the challenges and obstacles Marcus faced during this period: Nearly constant war, a horrific plague, possible infidelity, an attempt at the throne by one of his closest allies, repeated and arduous travel across the empire—from Asia Minor to Syria, Egypt, Greece, and Austria—a rapidly depleting treasury, Lucius turning out to be an incompetent and greedy step-brother as co-emperor, and on and on and on. Despite all this, he adhered to philosophy as a guide.

It would be Machiavelli who would consider Marcus as one of the “Five Good Emperors” and say this about the respect he had earned through his virtuous rule: “Titus, Nerva, Trajan, Hadrian, Antoninus, and Marcus had no need of praetorian cohorts, or of countless legions to guard them, but were defended by their own good lives, the good-will of their subjects, and the attachment of the senate.”

Part of the reason Marcus was able to do this was practicing Stoicism and reminding himself of the important tenets of the philosophy. He was actively working to not let power go to his head. In his writings, we see him speak over and over again about the other emperors who had come before him and who would come after him. How many people even remember their names, he said? He reminded himself that his military successes paled in comparison to Alexander the Great’s. He reminded himself that all of Rome, which was his kingdom, was just a tiny piece of the earth—that it looked pathetic if you flew up in the clouds and looked down upon it. All of this was designed to escape what he called “imperialization”—the stain of power and popularity.

We can confidently conclude that it worked. As Matthew Arnold, the essayist, remarked in 1863, in Marcus we find a man who held the highest and most powerful station in the world—and the universal verdict of the people around him was that he proved himself worthy of it.

“But the great record for the outward life of a man who has left such a record of his lofty inward aspirations as that which Marcus Aurelius has left, is the clear consenting voice of all his contemporaries,—high and low, friend and enemy, pagan and Christian,—in praise of his sincerity, justice, and goodness. The world’s charity does not err on the side of excess, and here was a man occupying the most conspicuous station in the world, and professing the highest possible standard of conduct;—yet the world was obliged to declare that he walked worthily of his profession.”

Seneca’s fate, another prominent Stoic figure, eventually one of the most influential power brokers in the empire, was different. Like Marcus, he almost ascended through luck to the highest position in Rome. It would be a conspiracy’s plans—at the height of Seneca’s career—to murder the then-Emperor Nero and have Seneca take the throne, “being a man who seemed to be marked out for supreme power by the good qualities for which he was so famous.” But unlike Marcus, one can argue that Seneca was almost corrupted by power after becoming Nero’s tutor years earlier, a ruthless tyrant by most historical standards, and remaining by his side for years, amassing vast amounts of wealth and power in the process.

As the Roman proverb went, Amici vitia si feras, facias tua. If you put up with the crimes of a friend, you make them your own.

Seneca of course was deeply familiar with power’s corrupting effect, observing of Caligula, that “Nature produced him as an experiment, to show what absolute vice could accomplish when paired with absolute power.” He would eventually write to Nero, in the years after he became Emperor, how one should act when in a position to wield power. He would tell him that “great power is glorious and admirable only when it is beneficent; since to be powerful only for mischief is the power of a pestilence.” Seneca would also say that “cruel punishments do a king no honour: for who doubts that he is able to inflict them? But, on the other hand, it does him great honour to restrain his powers, to save many from the wrath of others, and sacrifice no one to his own.”

It was a letter that urged self-restraint, mercy and compassion and the beneficial exercise of power. Using a popular rhetorical device from the time, Seneca would write as if he was Nero, writing how a ruler, and particularly one with unlimited power, should behave,

“In this position of enormous power I am not tempted to punish men unjustly by anger, by youthful impulse, by the recklessness and insolence of men, which often overcomes the patience even of the best regulated minds, not even that terrible vanity, so common among great sovereigns, of displaying my power by inspiring terror.”

As Seneca’s biographer James Romm would observe, Seneca’s message was to show why power needs to be restrained. As Romm would say, the point was that “kindness from rulers wins adoration from subjects and results in a long, secure reign; severity breeds fear, and from fear springs conspiracy.”

And it would be Romm who would pose the timeless question in regards to Seneca’s life: “How could this sage, who constantly exhorted his readers toward virtue and reason, have served as the right-hand man of a despot notorious for madness, repression and family murder?”

We can never know. Seneca might as easily have told himself that he was the only one who could’ve controlled Nero. Without him, it might have been much worse. Or the answer is vastly simpler—he coveted to be close to power and wield influence as most of us would do given the chance. It may simply be that power corrupted Seneca and rendered all his Stoic training moot.

This tension between Stoicism and power seems to have always been there. Thrasea, a Stoic peer of Seneca’s would conspire against Nero rather than collaborate with him. Cato opposed Julius Caesar, and refusing to live under his rule, committed suicide. Musonius Rufus would be exiled by Vespasian and only returning to Rome after the emperor’s death. Epictetus has also observed power firsthand—as a slave, his own leg was broken by his master, was banished to Greece by Domitian, and his advice would be sought by Hadrian, the emperor who early on saw the potential in Marcus Aurelius.

And what we saw in Marcus was the true Stoic response to power—proving yourself worthy of it. He was a ruler that was universally acknowledged. Upon Marcus’s death, the renowned historian Cassius Dio would describe how things would turn for the worse: “My history now descends from a kingdom of gold to a kingdom of iron and rust, as affairs did for the Romans at that time.”

So for all the brilliance of Marcus, we can also look at Seneca as kind of a cautionary tale, a tragic figure that allows us to debate both the morality of his choices and the efficacy of what he claimed to believe. And through this complicated pairing of opposites, we have a set of important guideposts to orient ourselves against and be wary of.