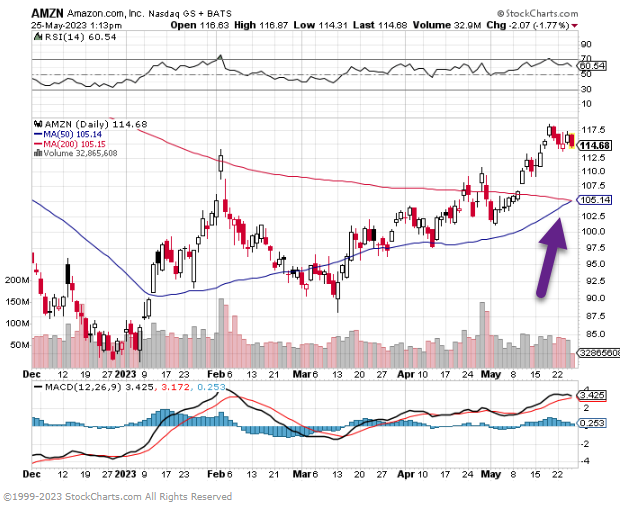

1. Amazon Chart

Yesterday was all NVDA but……AMZN 50day thru 200day bullish to upside.

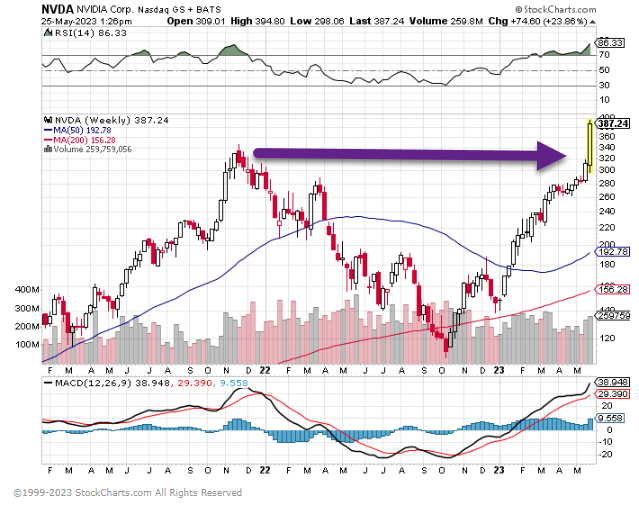

2. NVDA Breakout

Believe it or not yesterday was NVDA break thru of 2022 highs

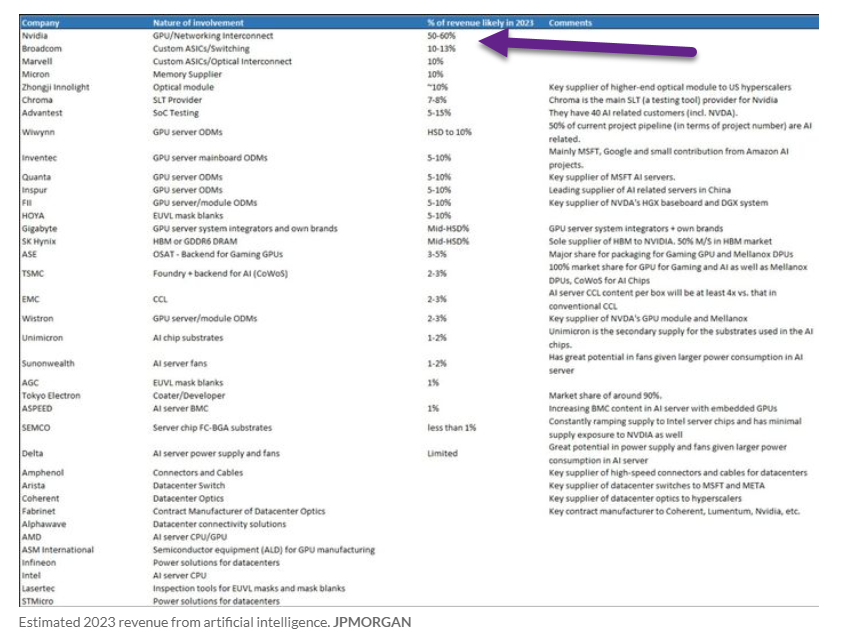

3. NVDA 50-60% of Revenues from AI

Most other companies in 10% Range

4. Next Chart to Watch for Breakout…Semiconductor Index

5. Get Ready for a Flood of Investment Products Around AI

New ETF uses artificial intelligence to time the market

The fourth ETF from upstart Qraft will test the limits of AI by going in and out of the market based on what the data say.

By Jeff Benjamin Can artificial intelligence accurately time the stock market? The developers behind a new ETF from Qraft Technologies believe it can, and that’s the premise of the Qraft AI U.S. Large Cap Dynamic Beta and Income ETF (AIDB).

“We believe the application of AI in actively managed funds transcends the limitations of the human mind, allowing for potentially better risk management and investment decision making,” said Marcus Kim, Qraft founder and chief executive.

“This is an especially relevant potential benefit for investors in times of market distress when emotions and biases are heightened,” Kim said. “We’ve introduced AIDB to extend these benefits to investors seeking dynamic equity exposure amid global market volatility by anchoring this fund’s strategy to our time-tested AI risk prediction model.”

The ETF, which starts trading Wednesday, joins three other AI-enabled Qraft funds. The difference between those funds and the latest launch is the ability to move in and out of the market in varying degrees based on what the AI data is forecasting.

Francis Geeseok Oh, CEO of Qraft’s Asia-Pacific business unit, said the AI program, which considers more than 70 macro and market data sets, correctly predicted the market downturn in March 2020 leading into the Covid pandemic, as well as the downturn following the market peak in November 2021.

“We’re using AI to predict downside risk,” he said.

The ETF, which has an expense ratio of 70 basis points, has a potential range from being fully invested in a large-cap stock index all the way to being 100% in cash.

The current outlook, according to Oh, “doesn’t see much downside risk so it is suggesting participating 100%, despite the debt ceiling debate.”

The idea of using AI to time the market will likely appeal to some investors and at least be closely watched by financial advisors, said Todd Rosenbluth, head of research at VettaFi.

“Advisors are increasingly looking to tap into artificial intelligence to support investment needs,” he said. “This new ETF taps into the technology to support asset allocation decisions, shifting from equities to cash.”

Rosenbluth pointed out that Qraft’s largest ETF, the $10.7 million Qraft AI-Enhanced Large Cap Equity Momentum (AMOM), is up 9.1% this year. That is much stronger performance than the higher-profile $9.2 billion iShares MSCI USA Momentum Factor ETF (MYUM), which is down 3.9% over the same period.

Eric Balchunas, ETF analyst at Bloomberg Intelligence, described AI as “a huge trend,” but still a long way from being able to generate positive investment returns all the time.

“We’re pretty bullish overall on AI but the challenge is it’s an evolution of smart beta, which is an evolution of active management,and in that way, it faces the same hurdles as human managers,” he said.

Balchunas cited as an example the $107 million AI Powered Equity ETF (AIEQ), an actively managed fund powered by IBM Watson. Not only is the fund up just 3% this year, but its annual turnover rate hovers around 1,700%. That turnover rate compares to 3% for the Vanguard Total Market ETF (VTI).

The new Qraft ETF is shooting for a turnover rate of between 100% and 200%, according to Oh.

“If a computer has machine learning, maybe it will teach itself to trade less,” Balchunas said. “But the more you trade, it just becomes another cost you have to overcome.”

The other challenge Balchunas sees with the new Qraft ETF is the fact it’s offering active management in the large-cap equity space.

“Most advisers are dead set on passive when it comes to large-cap stocks, and it will be really tough to dislodge passive management,” he said.

Nate Geraci, president of The ETF Store, views the AI influence on investing as the latest shiny object for the asset management industry to chase.

“I’m expecting a wave of AI-related ETFs to hit the market as issuers seek to capitalize on what’s clearly a hot topic right now,” he said. “I would equate this to the slew of crypto-related ETFs that launched over the past several years. The use of artificial intelligence in the investment process carries some cachet and investors will begin seeing this term pop up everywhere.”

However, Geraci added, “the jury is still out on whether investors will actually benefit from the growing use of AI by asset managers. AI-powered ETFs sound great in theory, but the proof will be in the performance.”

https://www.investmentnews.com/new-etf-uses-artificial-intelligence-to-time-the-market-237946

Found at Abnormal Returns blog www.abnormalreturns.com

6. Defensive Consumer Staples…A Big Reverse Smile.

Defensive sector Staples heading back to 2023 lows

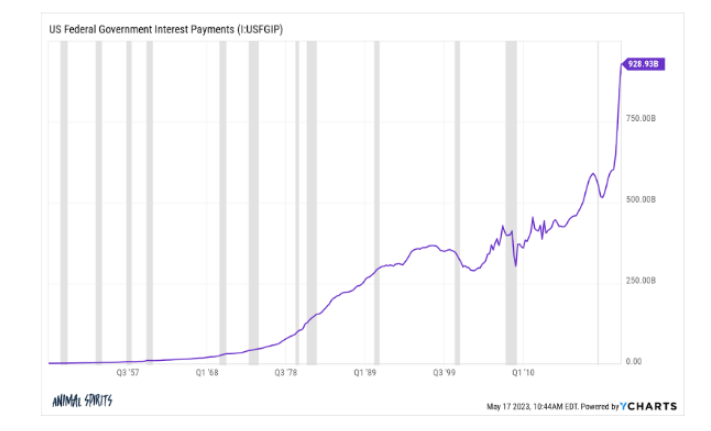

7. Long-Term Chart of Federal Government Interest Payments….Up to 1980’s it was close to zero.

Huge move after 2008 and again post-Covid.

From Irrelevant Investor Blog https://theirrelevantinvestor.com/

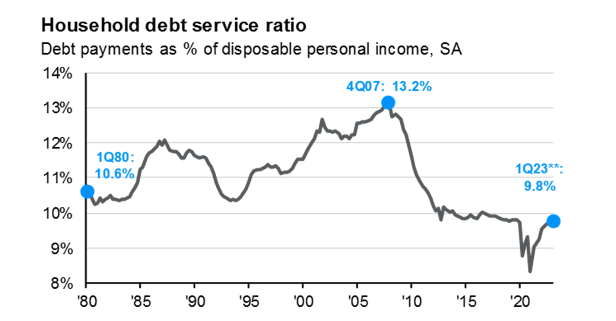

8. Household Debt Service Ratio Still Low After Rate Hikes.

Everyone is working with low rate mortgages locked in.

https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

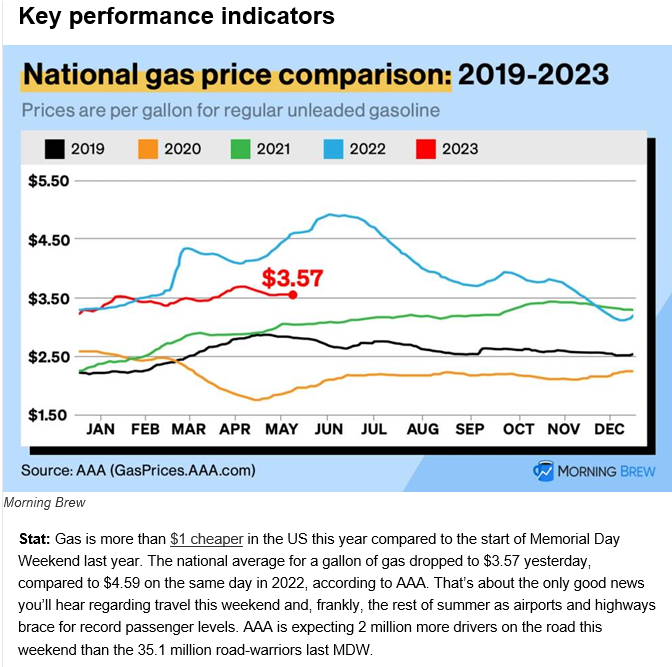

9. Start of Driving Season Compared to Last 5 Years

Morning brew blog

https://www.morningbrew.com/daily

10. You are – What you think about (Recession, Economy, Stock Market)

May 25

You are – What you think about (Recession, Economy, Stock Market)

I’ve been asked by many readers and some clients for my thoughts on the economy and recession.

As I am typing this, I’m thinking about how much ink I should be spilling on writing about the recession and how much time we, as investors, should be allocating to thinking and worrying about it.

Firstly, our ability to predict it is very limited – the economy is a complex system and thus incredibly difficult to forecast. Don’t believe me? The Federal Reserve employs a few hundred PhDs who stare at economic data 24/7 and they have yet to get it right, even once.

Secondly, recessions are not a death sentence to the economy but a natural, transitory phase.

This brings me to the third and most important observation: Time is the currency of life, and attention is how we choose to allocate this currency. As an investor, I can spend most of my day fidgeting, spending my time trying to predict the unpredictable and invest as if, at some point (I don’t know when), our portfolio will encounter a recession. Yes, earnings of some businesses will temporarily decline and then come back. Their stock prices may decline as well. But the value of the businesses, if we have done our analysis right, will not really change much. Recession – a temporary decline of cash flows – is a tiny blip in the stream of discounted cash flows.

There are three versions of ourselves: what people think of us, what we think of ourselves, and who we actually are. There is a saying, “Don’t tell me what you care about, show me how you spend your time.” We are at peace when who we think we are and who we actually are largely overlap. We are even more at peace if the two overlap in the version we’d like to be. We cannot really control what others think of us. The only thing we can do is to behave according to our values; but again, we should not tie our happiness to something we cannot control.

If you want to discover who you truly are, look at how you spend your time. If you are telling everyone and yourself, “I am a long-term investor,” but your daily attention is preoccupied with predicting and trying to avoid the next recession, then something has to change.

By the way, the above applies to many parts of our lives.