1. Momentum Re-Balance to Value—MTUM ETF Re-Bal–Tech weighting -23% vs. Financials +31%

Momentum Re-Balance (MTUM ETF) –This is sector rotation strategy.

Nice look at the massive sector changes coming in the $MTUM rebalance this month, big move into value stocks. Financials is the new Tech via

2. Market/Sectors YTD Performance

3. U.S. Inflation Surprises Strongest on Record.

Jim Reid -DB

Positive US data surprises seem to be normalising due to a combination of analysts catching up with the prior stronger pace of growth, and also due to some evidence that the rate of change of US growth is peaking out.

However as our equity strategist Parag Thatte points out in his excellent latest positioning piece (link here), US inflation data surprises are at their highest in the 20-year history of the series with the last 10 data points almost “off the chart”. Note that inflation surprises during the GFC were sharply negative and didn’t positively overshoot after. During the pandemic we didn’t undershoot and are now overshooting massively.

While it is easy to blame transitory factors, these were surely all known about before the last several data prints and could have been factored into forecasts. That they weren’t suggests that the transitory forces are more powerful than economists imagined or that there is more widespread inflation than they previously believed.

These ‘surprise’ indices always mean revert so we expect this inflation one to as well. However the fact that we’re seeing an overwhelming positive beat on US inflation surprises in recent times must surely reduce the confidence to some degree of those expecting it to be transitory.

For the latest DB chart book on US, Euro and UK inflation (out last night) please see here.

4. XOP Oil and Gas Exploration ETF ……Still 65% Below Highs from 10 Years Ago.

https://www.barchart.com/etfs-funds/quotes/XOP/interactive-chart

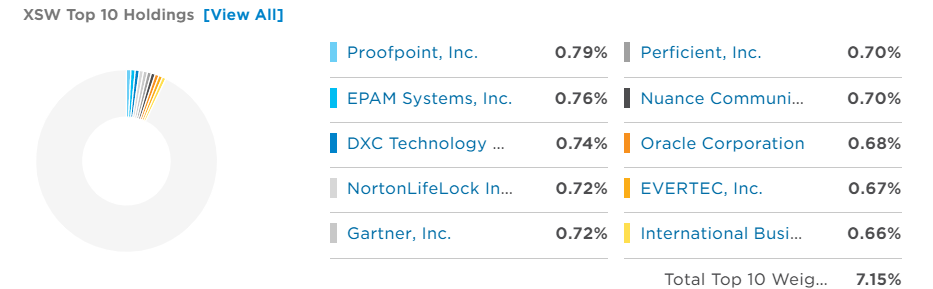

5. Software ETF Never Made It Back to Early 2021 Highs.

XSW-Corrected 15% from highs

Small weightings nothing over 1%

https://www.etf.com/XSW#overview

6. Consumer Discretionary Sector Not Acting Like the Roaring 20’s are Starting.

Chart shows Consumer Discretionary ETF (XLY) vs. S&P

This ratio is back down to its lowest level in more than a year as the consumer discretionary sector trails the S&P 500 by more than 6% year-to-date. Discretionary spending should thrive in the 2nd half of the year, but disappointing retail sales, while not surprising given the post-stimulus lag, prevent this group from gaining.

Consumer Discretionary (XLY) – Deep Underperformance

Lead/Lag Report https://www.leadlagreport.com/

7. House Price to Rent Ratio Higher than 2007

Tadas Viskanta

@abnormalreturns

https://twitter.com/abnormalreturns

8. “S&P 500 is 70% less labor intensive than it was in the 80s” – BofA

SAM RO Managing Editor of

9. Quick Refresher on Bear Markets.

10 Things You Should Know About Bear Markets-Hartford Know About Bear Markets

Even elite athletes need rest days to stay healthy. Sometimes financial markets need to reset from record-setting performance, too. Here’s what you need to know about bear, or down, markets.

| 1. | Watch for 20%: Market cycles are measured from peak to trough, so a stock index officially reaches bear territory when the closing price drops at least 20% from its most recent high (whereas a correction is a drop of 10%-19.9%). A new bull market begins when the closing price gains 20% from its low. |

| 2. | Stocks lose 36% on average in a bear market.1 By contrast, stocks gain 112% on average during a bull market. |

| 3. | Bear markets are normal. There have been 26 bear markets in the S&P 500 Index since 1928. However, there have also been 27 bull markets—and stocks have risen significantly over the long term. |

| 4. | Bear markets tend to be short-lived. The average length of a bear market is 289 days, or about 9.6 months. That’s significantly shorter than the average length of a bull market, which is 973 days or 2.7 years. |

| 5. | Every 3.6 years: That’s the long-term average frequency between bear markets. Though many consider the bull market that ended in 2020 to be the longest on record, the bull that ran from December 1987 until the dot-com crash in March 2000 is technically the longest (a drop of 19.9% in 1990 nearly derailed that bull, but just missed the bear threshold). |

| 6. | Bear markets have been less frequent since World War II. Between 1928 and 1945 there were 12 bear markets, or one about every 1.4 years. Since 1945, there have been 14—one about every 5.4 years. |

| 7. | More than half (56%) of the S&P 500 Index’s strongest days in the last 20 years occurred during a bear market. Another 32% of the market’s best days took place in the first two months of a bull market—before it was clear a bull market had begun.2 In other words, the best way to weather a downturn could be to stay invested since it’s difficult to time the market’s recovery. |

| 8. | A bear market doesn’t necessarily indicate an economic recession. There have been 26 bear markets since 1929, but only 15 recessions during that time.3 Bear markets often go hand in hand with a slowing economy, but a declining market doesn’t necessarily mean a recession is looming. |

| 9. | Assuming a 50-year investment horizon, you can expect to live through about 14 bear markets, give or take. Although it can be difficult to watch your portfolio dip with the market, it’s important to keep in mind that downturns have always been a temporary part of the process. |

| 10. | Bear markets can be painful, but overall, markets are positive a majority of the time. Of the last 91 years of market history, bear markets have comprised only about 20.6 of those years. Put another way, stocks have been on the rise 78% of the time. |

Bear Markets Have Been Common

S&P 500 Index declines of 20% or more, 1929–2020

| Start and End Date | % Price Decline | Length in Days |

| 9/7/1929–11/13/1929 | -44.67 | 67 |

| 4/10/1930–12/16/1930 | -44.29 | 250 |

| 2/24/1931–6/2/1931 | -32.86 | 98 |

| 6/27/1931–10/5/1931 | -43.10 | 100 |

| 11/9/1931–6/1/1932 | -61.81 | 205 |

| 9/7/1932–2/27/1933 | -40.60 | 173 |

| 7/18/1933–10/21/1933 | -29.75 | 95 |

| 2/6/1934–3/14/1935 | -31.81 | 401 |

| 3/6/1937–3/31/1938 | -54.50 | 390 |

| 11/9/1938–4/8/1939 | -26.18 | 150 |

| 10/25/1939–6/10/1940 | -31.95 | 229 |

| 11/9/1940–4/28/1942 | -34.47 | 535 |

| 5/29/1946–5/17/1947 | -28.78 | 353 |

| 6/15/1948–6/13/1949 | -20.57 | 363 |

| 8/2/1956–10/22/1957 | -21.63 | 446 |

| 12/12/1961–6/26/1962 | -27.97 | 196 |

| 2/9/1966–10/7/1966 | -22.18 | 240 |

| 11/29/1968–5/26/1970 | -36.06 | 543 |

| 1/11/1973–10/3/1974 | -48.20 | 630 |

| 11/28/1980–8/12/1982 | -27.11 | 622 |

| 8/25/1987–12/4/1987 | -33.51 | 101 |

| 3/24/2000–9/21/2001 | -36.77 | 546 |

| 1/4/2002–10/9/2002 | -33.75 | 278 |

| 10/9/2007–11/20/2008 | -51.93 | 408 |

| 1/6/2009–3/9/2009 | -27.62 | 62 |

| 2/19/2020–3/23/2020 | -33.92 | 33 |

| Average | -35.62 | 289 |

Past performance does not guarantee future results. Investors cannot directly invest in an index. As of 8/31/20. Source: Ned Davis Research, 9/20.

10. When Your Colleague is a Fault-Finder

Amy Cooper Hakim Ph.D.–Working With Difficult People

When Your Colleague is a Fault-Finder Try these five tips to ease tension at work.

Critical colleagues are treasured gems when they help you develop better insight and discover new possibilities. But some peers don’t listen supportively or bother to cushion their comments. They may have nothing against you personally, but they complain in general. Others react resentfully if they think you’re criticizing them.

Usually, fault-finding peers want you to admit that you made a bad judgment call. You may not agree and, without sugarcoating, that’s a difficult pill to swallow. As a result, feelings are hurt on both sides, team morale is seriously injured, and productivity is sidetracked.

For your own protection, stand up for yourself. But do try to maintain a friendly stance with your critics before they attempt to damage your other relationships—such as with your boss, for instance.

Strategy

When being attacked, your first goal is to minimize damage, and the second is to try to convert your enemy into what I like to dub a “friendly.” We do not need to be friends with the people with whom we work. But we do need to maintain a friendly relationship so that we can get our work done and leave work at work when the day is over.

1. Do a quick review. Race over the facts leading up to this point. Did you inadvertently trigger the trouble? Have you assumed colleague support without bothering to check?

2. Don’t play their “I’ve got-a-secret” game. Refuse to promise to keep confidential your peer’s gossip or rumor. Get the issue on the table so that you can deal with it.

3. Dissolve the tension by talking. You can’t let cutting remarks fester. Politely confront your colleague. Then, examine the system that allowed the problem to arise. Discuss options. If a colleague unfairly criticized you at a staff meeting, meet later in private to hash it out.

4. Touch base regularly with potential troublemakers. Keep your peers informed about your projects. Involve them by coordinating appropriate segments. Before they squawk to the boss about you, listen to, understand, and be cooperative about their complaints. Suggest joint presentations with the modifications you agree on. And give them starring roles.

5. Insist on respect for yourself and your peers. Simply refuse to continue a conversation unless everyone is civil.

Tactical Talk

You: “Julie, I heard you were concerned with {x}. We’ve always worked well together. I’m sure you have some good ideas for straightening this out.”

Or: “I can understand why you are upset, Julie. Why don’t we figure out the best approach and go together to the boss? You tell him what we agreed on, and I’ll back you up.”

Or: “I really don’t want to argue about this. I’ll come back when we can talk calmly.”

Tip: When you are attacked by a colleague, confront your coworker and resolve the matter. Early consulting and coordinating with them on a regular basis usually takes the sting out of their bite.

Copyright © 2020 Amy Cooper Hakim

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..