1. Tune in to hear Matt Topley discuss “the wildest financial cocktail in history” on the NJFPA Stradley Ronon Food Forum Podcast

2. Quasi-Closed End Bitcoin and Ethereum Funds.

GBTC-Grayscale Bitcoin -50% correction from high to low

ETHE-Grayscale Ethereum -46% correction high to low

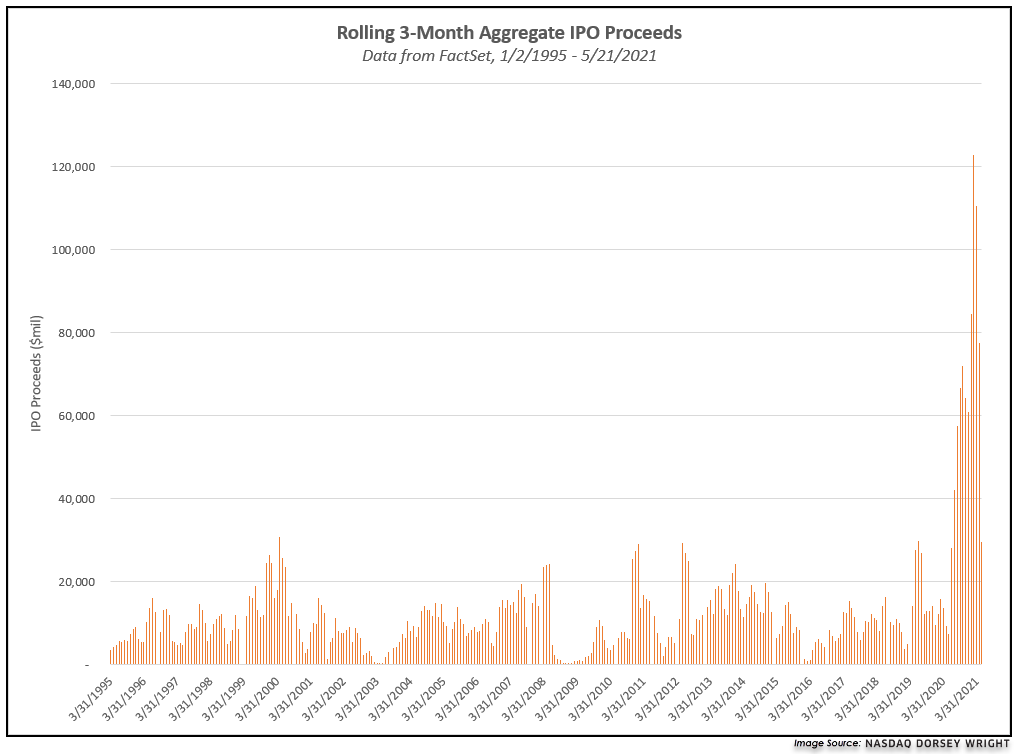

3. Vivid Picture of IPO Explosion….Rolling 3 Month Aggregate IPO Proceeds.

Nasdaq Dorsey Wright www.dorseywright.com

4. U.S. Travel Spending Back to 75% of Pre-Covid.

From Dave Lutz at Jones Trading —After a year of crippling losses, Carnival and Royal Caribbean said late last week that their first post-pandemic cruises will set sail in July, after the United States Centres for Disease Control (CDC) earlier in May gave the green light to allow trips with passengers and crew who received Covid-19 vaccinations. “US travel spending is back to ~75% of pre-COViD even as foreign tourists are back to only 20%” – Barclays

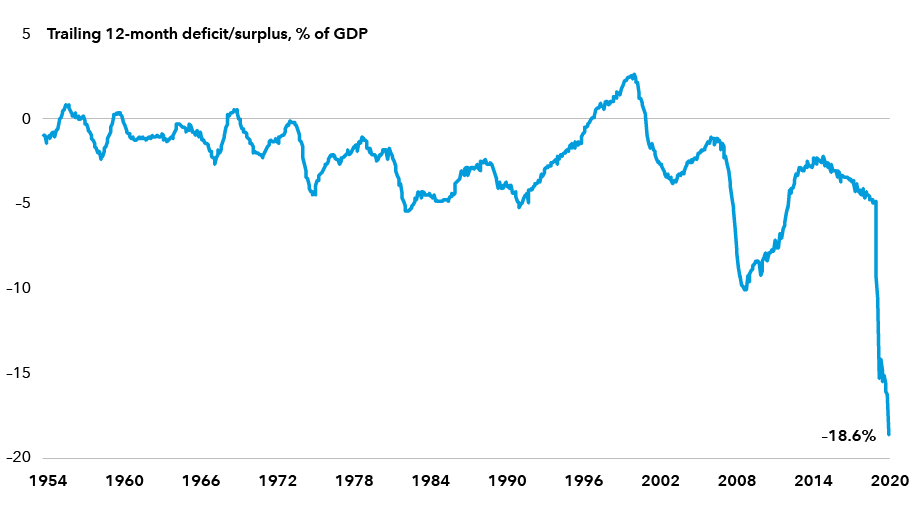

5. 12 Month Deficit as % of GDP Historical.

Capital Group Blog –One alternative economic theory that has received some attention amid the surge in U.S. debt is Modern Monetary Theory. MMT posits that most countries that issue their own currency face no financial constraints. Thus, for many governments — including the U.S. — there is no risk of default. Governments can decide what they need to spend as their first priority, and then address financing through taxation and borrowing. There are limits to debt levels, but those levels are tied to inflation.

As noted by economist and MMT advocate Stephanie Kelton, inflation is evidence that a deficit is too big, while unemployment is evidence of a deficit that is too small. Thus, under MMT, fiscal policy plays a more central role in the management of inflation. Critics note that, among other things, the management of inflation would be more heavily influenced by the political process under MMT. In addition, the Federal Reserve would lose its independence, and the framework that has anchored inflation expectations for arguably the last 30 years would be gone.

See rebound from 2008 then gap down

U.S. government budget deficit widens

Sources: U.S. Treasury Department and Bureau of Economic Analysis. As of March 31, 2021.

Capital Group-4 reasons why U.S. debt may not spin out of control https://www.capitalgroup.com/advisor/insights/articles/four-reasons-us-debt.html

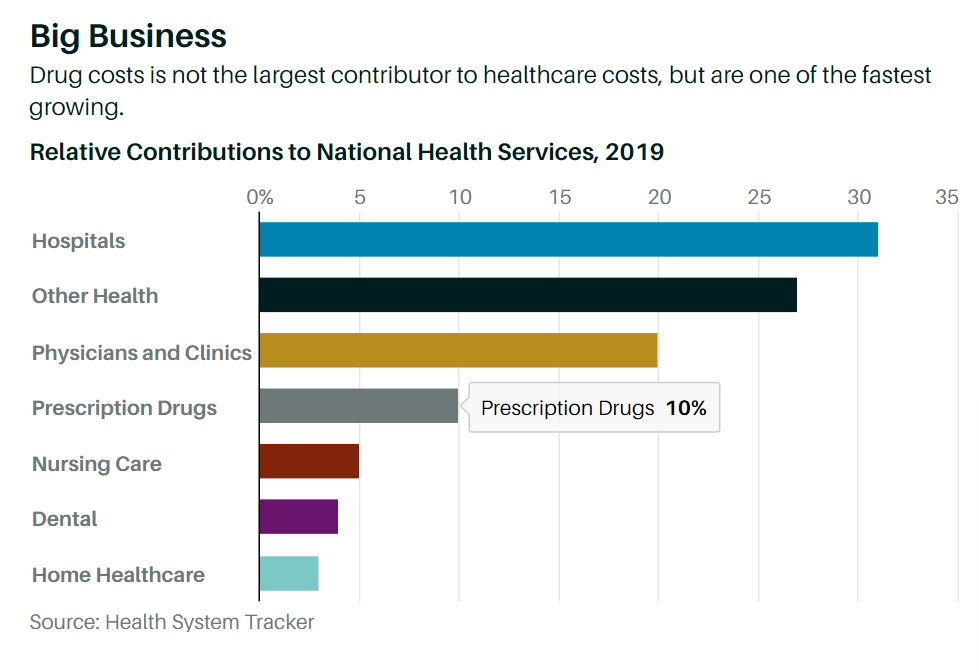

6. Contributions to Health Care Costs by Sub-Sectors

A Pharma Start-Up Takes a Crack at Blockbuster Prices

A Pharma Start-Up Takes a Crack at Blockbuster Drug Prices | Barron’s (barrons.com)

7. The News Organizations with the Most Subscribers.

| The New York Times is reportedly looking to acquire The Athletic, the subscription sports news site. The Athletic has raised more than $139m from investors and has spent aggressively on acquiring sports writing talent since its launch back in 2016, amassing more than 1 million paying subscribers along the way (some of whom are on discounted trial offers). The Athletic has channelled the adage “move fast and break things” in its short life. The company has used data to feedback quickly to writers about what stories are doing well, and have even financially incentivised writers to write articles that bring in as many new Athletic subscribers as possible. The company’s move into the UK, where it paid up to get a number of well-regarded football (soccer) writers onto their team, coupled with aggressive marketing and discounts, was a classic example of The Athletic’s strategy. Paywalls everywhere So far, that strategy has worked. Getting over 1 million paying subscribers for a news product is pretty rarefied air in the world of English speaking news. Only the Washington Post, the Wall Street Journal, Game Informer, the Financial Times and the New York Times itself have broken through that milestone according to data from FIPP. As consumers increasingly get comfortable with paying for news and insight, more publishers are putting content behind a paywall. Stuck between a rock (advertising) and a hard place (convincing readers to get their credit card out), many news publishers are increasingly choosing the latter. |

8. New study shows how to boost muscle regeneration and rebuild tissue

Salk research reveals clues about molecular changes underlying muscle loss tied to aging

LA JOLLA—One of the many effects of aging is loss of muscle mass, which contributes to disability in older people. To counter this loss, scientists at the Salk Institute are studying ways to accelerate the regeneration of muscle tissue, using a combination of molecular compounds that are commonly used in stem-cell research.

In a study published on May 25, 2021, in Nature Communications, the investigators showed that using these compounds increased the regeneration of muscle cells in mice by activating the precursors of muscle cells, called myogenic progenitors. Although more work is needed before this approach can be applied in humans, the research provides insight into the underlying mechanisms related to muscle regeneration and growth and could one day help athletes as well as aging adults regenerate tissue more effectively.

“Loss of these progenitors has been connected to age-related muscle degeneration,” says Salk Professor Juan Carlos Izpisua Belmonte, the paper’s senior author. “Our study uncovers specific factors that are able to accelerate muscle regeneration, as well as revealing the mechanism by which this occurred.”

Induction of Yamanaka factors (OKSM) in muscle fibers increases the number of myogenic progenitors. Top, control; bottom, treatment. Red-pink color is Pax7, a muscle stem-cell marker. Blue indicates muscle nuclei.

The compounds used in the study are often called Yamanaka factors after the Japanese scientist who discovered them. Yamanaka factors are a combination of proteins (called transcription factors) that control how DNA is copied for translation into other proteins. In lab research, they are used to convert specialized cells, like skin cells, into more stem-cell-like cells that are pluripotent, which means they have the ability to become many different types of cells.

“Our laboratory previously showed that these factors can rejuvenate cells and promote tissue regeneration in live animals,” says first author Chao Wang, a postdoctoral fellow in the Izpisua Belmonte lab. “But how this happens was not previously known.”

Muscle regeneration is mediated by muscle stem cells, also called satellite cells. Satellite cells are located in a niche between a layer of connective tissue (basal lamina) and muscle fibers (myofibers). In this study, the team used two different mouse models to pinpoint the muscle stem-cell-specific or niche-specific changes following addition of Yamanaka factors. They focused on younger mice to study the effects of the factors independent of age.

In the myofiber-specific model, they found that adding the Yamanaka factors accelerated muscle regeneration in mice by reducing the levels of a protein called Wnt4 in the niche, which in turn activated the satellite cells. By contrast, in the satellite-cell-specific model, Yamanaka factors did not activate satellite cells and did not improve muscle regeneration, suggesting that Wnt4 plays a vital role in muscle regeneration.

According to Izpisua Belmonte, who holds the Roger Guillemin Chair, the observations from this study could eventually lead to new treatments by targeting Wnt4.

“Our laboratory has recently developed novel gene-editing technologies that could be used to accelerate muscle recovery after injury and improve muscle function,” he says. “We could potentially use this technology to either directly reduce Wnt4 levels in skeletal muscle or to block the communication between Wnt4 and muscle stem cells.”

The investigators are also studying other ways to rejuvenate cells, including using mRNA and genetic engineering. These techniques could eventually lead to new approaches to boost tissue and organ regeneration.

Other authors included: Ruben Rabadan Ros, Paloma Martinez Redondo, Zaijun Ma, Lei Shi, Yuan Xue, Isabel Guillen-Guillen, Ling Huang, Tomoaki Hishida, Hsin-Kai Liao, Concepcion Rodriguez Esteban, and Pradeep Reddy of Salk; Estrella Nuñez Delicado of Universidad Católica San Antonio de Murcia in Spain; and Pedro Guillen Garcia of Clinica CEMTRO in Spain.

The work was funded by NIH-NCI CCSG: P30 014195, the Helmsley Trust, Fundacion Ramon Areces, Asociación de Futbolistas Españoles (AFE), Fundacion Pedro Guillen, Universidad Católica San Antonio de Murcia (UCAM), the Moxie Foundation and CIRM (GC1R-06673-B).

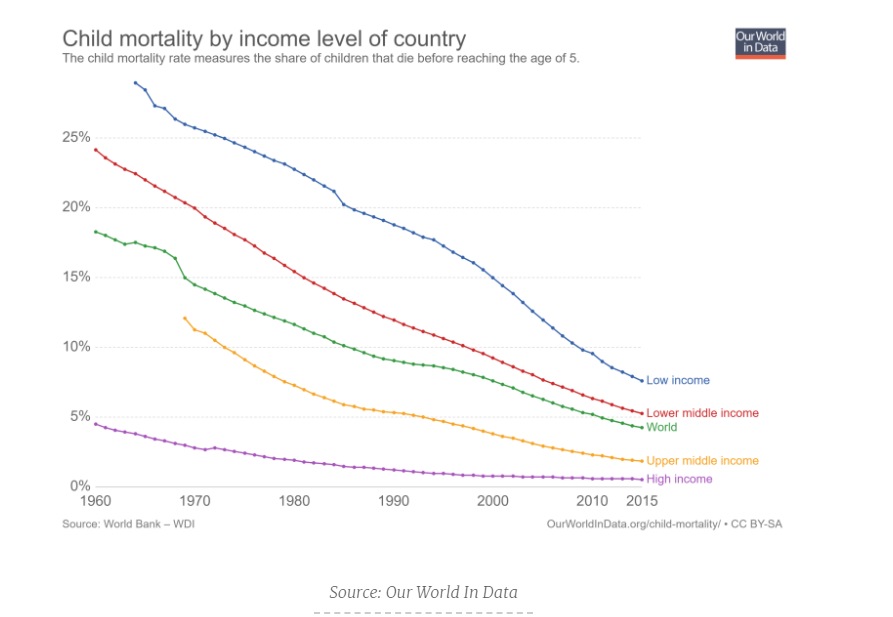

9. Global Child Mortality Rate Drop

Introduction to Effective Altruism

Introduction to Effective Altruism

Introduction to Effective Altruism – Effective Altruism

10. 7 Absolutely Certain Ways to Grow as a Leader

You can change your future, by changing your habits today.

Are you interested in growing as a leader, or just in getting ahead? In my job as a leadership coach, I see lots of people who want to advance. But my work is much easier–and the odds of moving ahead are much better–when the person I’m coaching wants to be coached and is focused on their own growth instead of an outcome they can’t fully control.

Here are seven opportunities to grow as a leader, the more closely you follow them, the better your chances of success.

1. Identify your motivation.

How you feel about yourself starts with how motivated you are. It takes self-motivation to remove the obstacles that keep you from developing and growing–and ultimately all motivation is self-motivation. Before you can grow as a leader, you must know the “why” behind your drive. Once you do, you will know the way.

2. Unmask your flaws.

To conquer your flaws, you must first accept them. Once you know your weaknesses, no one else can use them against you, and you’re better prepared to grow as a leader. Everyone has flaws, but when you understand your own you can embrace all of who you are.

3. Learn from your failures.

Growing as a leader means developing the ability and willingness to have your failures shape you. Failure is instructive–it allows you as a leader to learn. We all fall down, but failure means we refuse to get back up and deal with our issues.

4. Appreciate feedback.

No one likes hearing that they’ve done something wrong, but try to view all feedback as a gift, an opportunity to develop. The best leaders realize feedback helps them improve so they can do better. We all need people in our lives who can give us feedback; seek it with sincerity and receive it with grace.

5. Listen to those with more experience.

Listen to the experienced people in your life–not because they’re always right, but because they have a better understanding of being wrong. To grow in wisdom you need to pay attention to those who have experience. They can teach you to listen when you want to speak, to stop and think when you want to react, to keep trying when you want to quit. And each of those little steps will help you grow into a great leader.

6. Refuse to settle for mediocrity.

Don’t allow your fears to limit you to mediocrity. If you want to pursue excellence, it takes hard work. If you want to go beyond what’s expected, you have to evolve and grow to advance and make progress. The best leaders–the ones who really want to grow–never settle for mediocrity. They understand that good enough is not good enough.

7. Invest in yourself.

If you’re truly interested in growth, create an environment in which you can invest in yourself so you can be at your best. Make time to read; surround yourself with clever people and experts. Investing in yourself pays high dividends, because when you feel good about yourself you are more motivated to work hard and succeed and grow.

At the end of the day, you’ll take one of two paths as a leader: either you’ll step forward into growth or backward into safety. The choice is yours.

Inc. helps entrepreneurs change the world. Get the advice you need to start, grow, and lead your business today. Subscribe here for unlimited access.

APR 12, 2018

The opinions expressed here by Inc.com columnists are their own, not th

https://www.inc.com/lolly-daskal/7-opportunities-you-have-every-day-to-grow-as-a-leader.html

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..