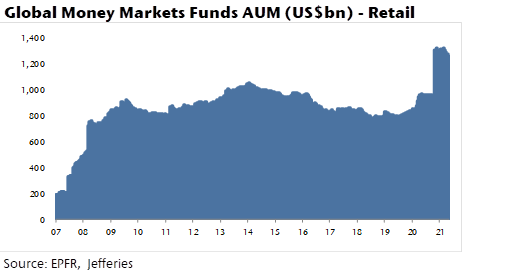

1. Massive Amount of Retail and Institutional Cash Sitting in Money Markets.

Jefferies

Dan Stratemeier

Managing Director

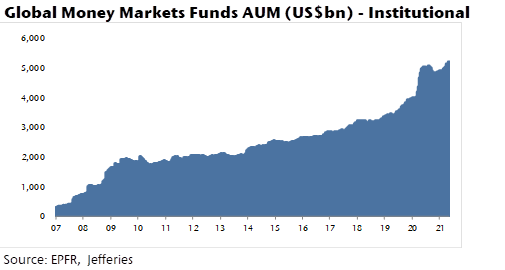

2. Steel Futures $500 to $1600……Plants Running 24/7

NYT–Steel prices are at record highs and demand is surging, as businesses step up production amid an easing of pandemic restrictions. Steel makers have consolidated in the past year, allowing them to exert more control over supply. Tariffs on foreign steel imposed by the Trump administration have kept cheaper imports out. And steel companies are hiring again.

Evidence of the boom can even be found on Wall Street: Nucor, the country’s biggest steel producer, is this year’s top performing stock in the S&P 500, and shares of steel makers are generating some of the best returns in the index.

“We are running 24/7 everywhere,” said Lourenco Goncalves, the chief executive of Cleveland-Cliffs, an Ohio-based steel producer that reported a significant surge in sales during its latest quarter. “Shifts that were not being used, we are using,” Mr. Goncalves said in an interview. “That’s why we’re hiring.”

Soaring Prices Herald Boom Time for Steel Makers-A rebounding economy and Trump-era tariffs have helped drive the price of domestic steel to record highs.– By Matt Phillips

Steel Price Surge Revives U.S. Industry – The New York Times (nytimes.com)

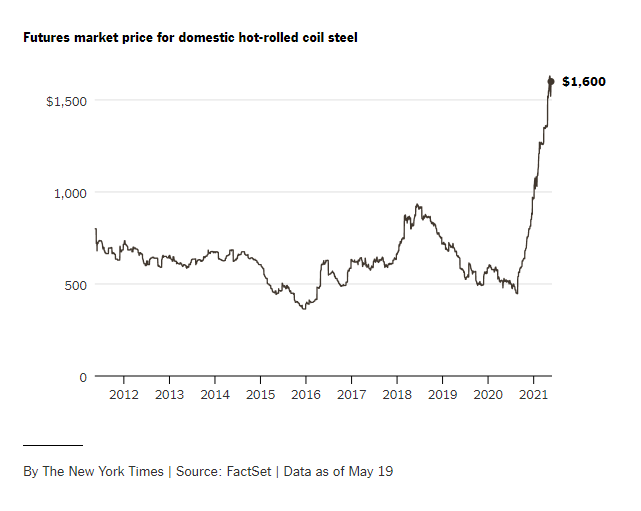

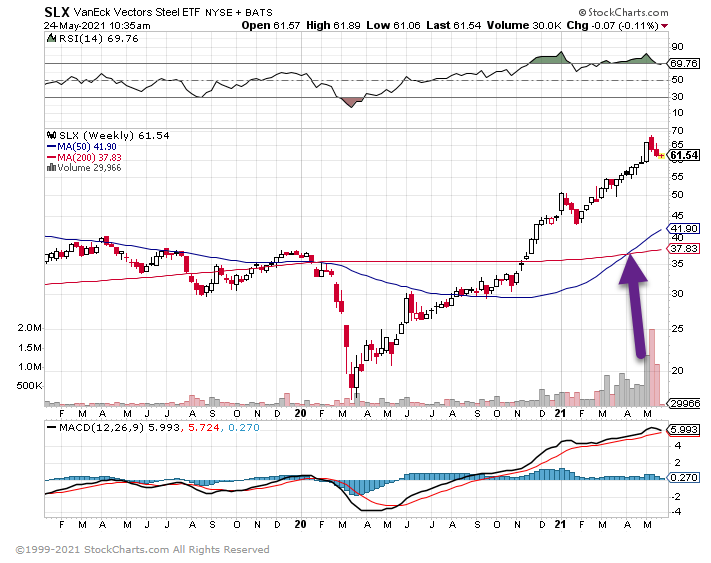

SLX-Steel ETF-50 day thru 200 day to upside on long-term chart

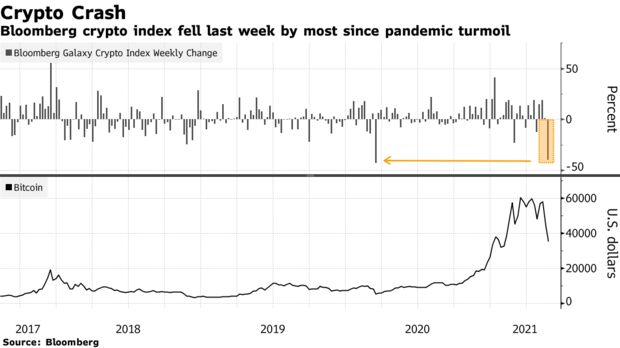

3. The Vast Majority of Bitcoin Investments Under Water Below $36,000

The market value of cryptocurrencies has plunged about $1 trillion from a peak of some $2.6 trillion this month, a slide that stoked questions about possible spillovers from lost wealth and damaged sentiment. Some commentators see more pain ahead for virtual currencies as leveraged positions in tokens like Bitcoin and Ether are closed out and regulators step up oversight.

A mid-week report from blockchain analysis firm Chainalysis showed over half of the $410 billion spent on acquiring current Bitcoin holdings occurred in the past 12 months. About $110 billion of that was spent on buying it at an average cost of less than $36,000 per coin. That means the vast majority of investments aren’t making a profit unless the coin trades at $36,000 or higher.

Crypto Leverage Triggers

For months, the crypto market inflated as traders anticipated Coinbase’s Nasdaq listing and bet on new use cases like nonfungible tokens and decentralized finance. Bitcoin rose steadily from $10,000 to $60,000 between October and April.

“The ride up was relatively smooth,” Lim notes. “What a lot of people forgot is that crypto is prone to these massive drawdowns and liquidations that are due to leverage getting triggered.”

At EQUOS, traders can use leverage of as much as 125 times, though the exchange limits the dollar amount of leveraged bets to $10,000.

“The thing we do want to avoid…is people taking massive bets with leverage they can’t handle,” d’Anethan says. He’s based in Hong Kong and says much of the derivatives trading occurs in Asia, meaning that the wildest moves in crypto can happen when U.S. traders are asleep.

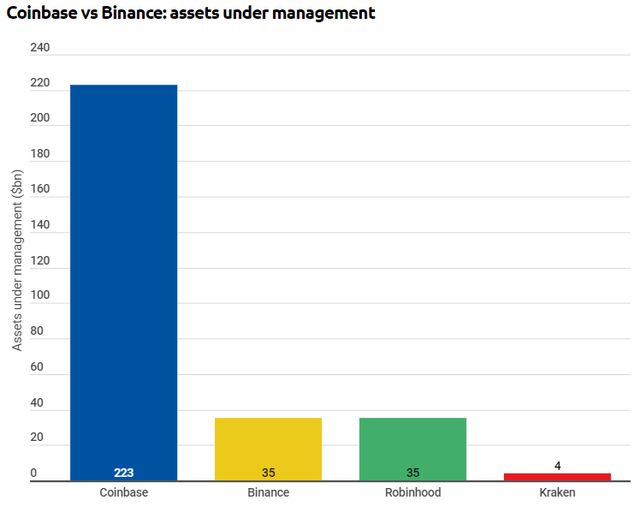

4. Coinbase $220B AUM vs. Robinhood $35B

https://seekingalpha.com/article/4430348-bitcoin-taxes-and-biden

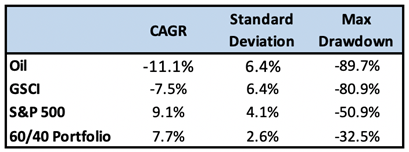

5. 2006-2020 Commodity Bear

| Institutions ended up adding to their asset mix shortly before commodities entered one of the worst periods of underperformance in history. In Figure 4, we show that a hypothetical buy-and-hold commodity investor between 2006 and 2020 would have returned -7.5% compounded annually and endured a maximum drawdown of over 80%. Figure 4: Performance Indicators for Oil and GSCI (2006–2020) |

| Source: Bloomberg, Verdad https://mailchi.mp/verdadcap/the-rise-and-fall-of-commodity-indices |

6. Recycling batteries-An estimated 11 million tons of spent lithium-ion batteries will flood our markets by 2025

Recycling batteries

An estimated 11 million tons of spent lithium-ion batteries will flood our markets by 2025, without systems in place to handle them.

This matters if we are to address climate change. We must use existing battery resources as best as possible, to avoid pollution from toxic waste and secure a strong supply of raw materials at low environmental cost.

To recycle a battery, it currently costs $1.20 per kilogram. But the value of raw material reclaimed is only a third of that. Recycling lithium costs five times as much as extracting virgin material. Hence, only 5 percent of lithium-ion batteries are recycled in Europe.

However, recycling could be worthwhile. Consider that in 2015, lithium-ion batteries consumed metals and minerals worth $2 billion. The price of cobalt rose by more than 80 percent over the past 12 months, and cobalt demand is estimated to double by 2020, to 200,000 tons per year. Demand for lithium is expected to quadruple by 2025, to 780,000 tons.

Moreover, lithium is a valuable raw material. To reclaim one ton, 28 tons of batteries have to be recycled. But to extract one ton of virgin lithium from Chile, 1,250 tons of earth must be dug up.

Overall, recycling is promising. But it is currently obstructed by several barriers, including the limited scale of batteries available for recycling; lack of battery standards to simplify recycling; an insufficient policy and incentive scheme to incentivize collection; and limited clarity about liability.

https://www.greenbiz.com/article/how-batteries-could-charge-fight-against-climate-change

7. 20 Largest Companies by Market Cap 2021 vs. 1989…5 of 6 Largest American…..7 of 10 Largest American

Brooklyn Blog

So, like many of you, I watched the BRK annual meeting (replay) as usual. It was nice to have Ajit and Greg join Buffett and Munger on the stage. Buffett and Munger both looked great, and it was good to see that duo in action again.

There were a few interesting things this time. This is by no means a summary of the meeting or anything close to it; I will just talk about things that stood out to me or things that I thought about. I know I’ve said that before and then sort of ran through the various topics that came up. But in this post, really, I don’t mention most topics that came up.

Opening Statement

The first interesting thing was Buffett’s comments before the Q&A started. He showed a couple of interesting tables. The first one is the top market cap companies of the world as of March 31, 2021. Here is the list:

He pointed out that the top 5 out of 6 companies are U.S. companies. People who think the U.S. is on the decline should take note of this. The U.S. has a system that works etc. He said that in 1790, we had 3.9 million people in the U.S., 600K of whom were slaves. Ireland had a larger population, Russia had 5x more people, Ukraine had 2x more people etc… And yet, here we are in 2021 with 5 of the top 6 companies around the world U.S. based.

And then he talked about indexing and how pros are often wrong. He asked, of the top 20 largest companies on the 2021 list, how many will still be there 30 years from now. Then he showed us the list of top global companies in 1989 and pointed out that none of them are on the list today.

Here is the 1989 list:

This is kind of scary because at the time, there were all these books out there, like Japan as Number One and many others that basically said that Japan has the industrial / political structure, hard-working, obedient and highly educated work force and many other traits that make them an inevitable force that will take over the world. Well, that didn’t quite work out.

http://brooklyninvestor.blogspot.com/

Found at Abnormal Returns Blog www.abnormalreturns.com

8. More Than 750 Million Worldwide Would Migrate If They Could-Gallup

BY NELI ESIPOVA, ANITA PUGLIESE AND JULIE RAY

GALLUP–In 13 countries, at least half of the adult population would like to move to another country if they had the chance. These countries represent nearly every region of the world — except for Northern America and Asia — and most of them were going through or are still going through some sort of upheaval. Sierra Leone and Liberia, for example, were still in the grips of an Ebola outbreak when Gallup surveyed residents in those countries.

Countries Where at Least Half of Adults Would Like to Move

| Desire to migrate | |

| % | |

| Sierra Leone | 71 |

| Liberia | 66 |

| Haiti | 63 |

| Albania | 60 |

| El Salvador | 52 |

| Congo (Kinshasa) | 50 |

| Ghana | 49 |

| Dominican Republic | 49 |

| Nigeria | 48 |

| Armenia | 47 |

| Honduras | 47 |

| Syria | 46 |

| Kosovo | 46 |

| GALLUP WORLD POLL, 2015-2017 |

U.S. Still Top Desired Destination for Potential Migrants

The countries where potential migrants say they would like to move — if they could — have generally been the same for the past 10 years. In fact, roughly 18 countries attract two-thirds of all potential migrants worldwide.

Although the image of U.S. leadership took a beating between 2016 and 2017, the U.S. continues to be the most desired destination country for potential migrants, as it has since Gallup started tracking these patterns a decade ago.

One in five potential migrants (21%) — or about 158 million adults worldwide — name the U.S. as their desired future residence. Canada, Germany, France, Australia and the United Kingdom each appeal to more than 30 million adults.

Top Desired Destinations for Potential Migrants

To which country would you like to move?

| 2010-2012 | 2015-2017 | Estimated number of adults | |

| % | % | (in millions) | |

| United States | 22 | 21 | 158 |

| Canada | 6 | 6 | 47 |

| Germany | 4 | 6 | 42 |

| France | 5 | 5 | 36 |

| Australia | 4 | 5 | 36 |

| United Kingdom | 7 | 4 | 34 |

| Saudi Arabia | 5 | 3 | 24 |

| Spain | 4 | 3 | 21 |

| Japan | 2 | 2 | 17 |

| Italy | 3 | 2 | 15 |

| Switzerland | 2 | 2 | 14 |

| United Arab Emirates | 2 | 2 | 12 |

| Singapore | 1 | 1 | 11 |

| Sweden | 1 | 1 | 9 |

| China | 1 | 1 | 9 |

| New Zealand | 1 | 1 | 9 |

| Russia | 1 | 1 | 8 |

| Netherlands | 1 | 1 | 7 |

| South Africa | 1 | 1 | 7 |

| Brazil | 1 | 1 | 6 |

| South Korea | 1 | 1 | 6 |

| Turkey | * | 1 | 6 |

| *Less than 0.5% | |||

| GALLUP WORLD POLL, 2015-2017 |

More Than 750 Million Worldwide Would Migrate If They Could (gallup.com)

9. History of Home Prices in Brooklyn……During Interview Mayoral Candidates Price Guesses Off by 80-90%

Earlier this month, it happened again when several New York City mayoral candidates responded to a question posed by The New York Times editorial board: Do you know the median sales price for a home in Brooklyn?

Many were way off the mark.

Shaun Donovan, housing secretary under President Barack Obama and housing commissioner under Mayor Michael R. Bloomberg, guessed $100,000. Ray McGuire, a former Citigroup executive and an investment banker, put it at $80,000 to $100,000.

These answers would have been closer to reality back when Mr. Bush was still serving as vice president under Ronald Reagan in the 1980s. In fact, the median Brooklyn sale price was already triple those estimates in 2003, or about $300,000. Since then it has tripled again to $900,000, even after a post-recession dip between 2009 and 2012. (Among the candidates who answered the Times’s question, only Andrew Yang guessed correctly. Kathryn Garcia, a former sanitation commissioner, came close at $800,000, as did Scott M. Stringer, the city comptroller, who guessed $1 million.)

A Lesson in Brooklyn Home Prices-Here’s a much-needed cheat sheet for New York City’s mayoral candidates.By Michael Kolomatsky

https://www.nytimes.com/2021/05/20/realestate/a-lesson-in-brooklyn-home-prices.html

10. There are two types of talent: natural and chosen – Farnum Street

Tiny Thought

There are two types of talent: natural and chosen.

Natural talent needs no explanation. Some people are just born better at certain things than others. While natural talent may win in the short term, it rarely wins in the long term. A lot of people who are naturally talented don’t develop work at getting better.

Eventually, naturally talented people are passed by people who choose talent.

How can you choose talent?

When you focus all of your energy in one direction for an uncommonly long period of time, you develop talent.

Timeless Insight

“It is easier to keep adding exceptions and justifications to a belief than to admit that a challenger has a better explanation.”

— Zeynep Tufekci

Knowledge Project

Tyler Cowen on preparing for the future:

“I think the future belongs to people who are what I call meta-rational. That is, people who realize their own limitations. So not all the skills that you think are so valuable actually will matter in the future. Don’t just feel good about yourself, but think critically, what am I actually good at that will complement emerging sectors and emerging technologies. The world of the future, even the present will be a world of algorithms. … People who think they can beat the algorithms will make a lot more mistakes. … So know when you should defer. It’s easier than ever before to get advice from other people, including on podcasts, right? Or, you know, go to Yelp. When can you trust the advice of others? Having good judgment there is becoming more important than just being the smartest person or having the highest IQ.”

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..