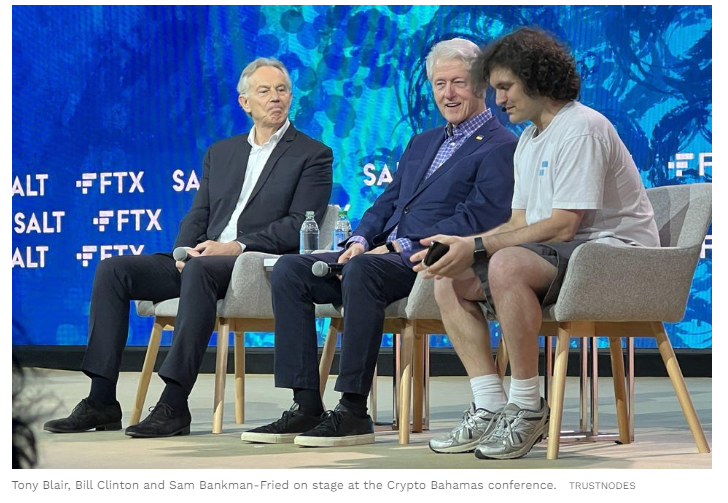

1. Not Sure if These 2 Were the Top Last Week at Crypto Gathering

Royal Flush: Inside Crypto’s Most Exclusive Gathering (forbes.com)

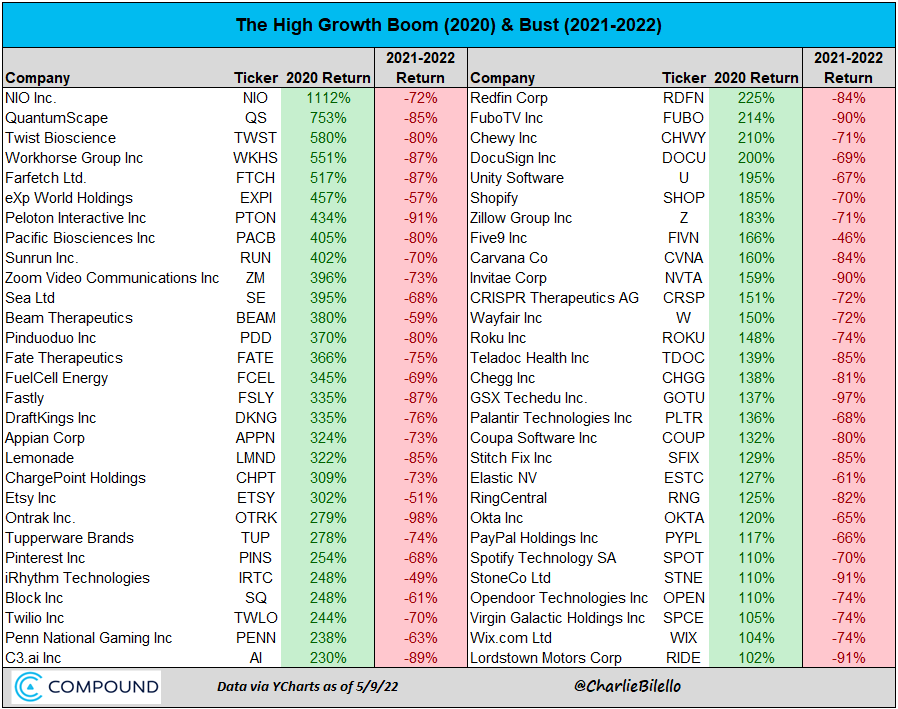

Coinbase Joins the Wipeout Disruptor Stock List -86% from Highs

2. Disruptor Stocks Blow Up List

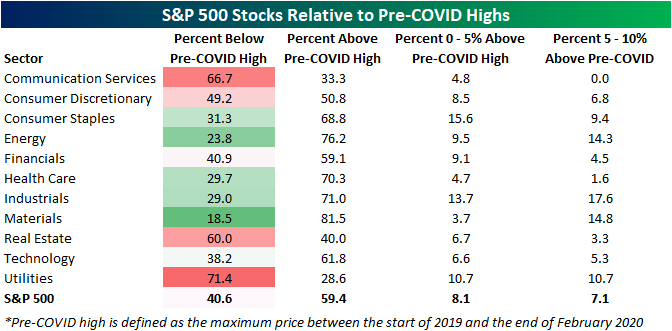

3. Over 40% of S&P 500 Stocks Below Pre-COVID Highs

The world changed dramatically with the onslaught of the COVID pandemic in early 2020. Businesses were forced to digitize, consumers saved at historic rates, the Federal Government and Federal Reserve flooded the economy with cash, new hobbies were picked up faster than a dropped hundred dollar bill, and consumers emerged from the lockdowns financially stronger than ever. Long story short, COVID appeared to permanently alter the ways in which consumers and businesses interact, and companies that stood to benefit from the new way of life saw their stocks surge while the old-economy stalwarts were crushed. That was then.

This is now. As the economy has emerged from COVID, the cost of inputs has skyrocketed, real buying power has diminished, supply chains have become strained, and geopolitical tensions are hot. Not only that, but whereas the rate of fiscal and monetary stimulus was stronger than ever during the pandemic, the headwind from their removal is as intense as it gets.

Given the shifts, a number of stocks that originally surged in the COVID world have been hit hard in the post-Covid environment, and some of the biggest COVID losers during the lockdowns have turned into market leaders. As things currently stand, 40.6% of S&P 500 members are below their pre-COVID highs (closing high price from the start of 2019 through the end of February 2020), even as the index is up 18.0% from its pre-COVID closing high on 2/19/20. Besides the fact that four out of every ten S&P 500 stocks are below their pre-COVID highs, 8.1% of the index members are within 5% of their pre-COVID high and another 7.1% are within 10% of their pre-COVID highs.

At the sector level, three sectors – Communication Services, Real Estate, and Utilities- have more than half of their components trading below their pre-COVID highs. In addition to those three sectors, in both the Consumer Discretionary and Financials sectors, more than 40% of components are below their pre-COVID highs, and another 10% of each sector’s components are within 10% of those former highs. At the other end of the spectrum, the original ‘losers’ from COVID like Energy and Materials have fewer than a quarter of their components trading below their pre-COVID highs. While it seems some days like COVID will never go away, the rallies that a large number of stocks experienced are now nothing more than memories. Click here to view Bespoke’s premium membership options.

https://www.bespokepremium.com/interactive/posts/think-big-blog/over-40-of-sp-500-stocks-below-pre-covid-highs

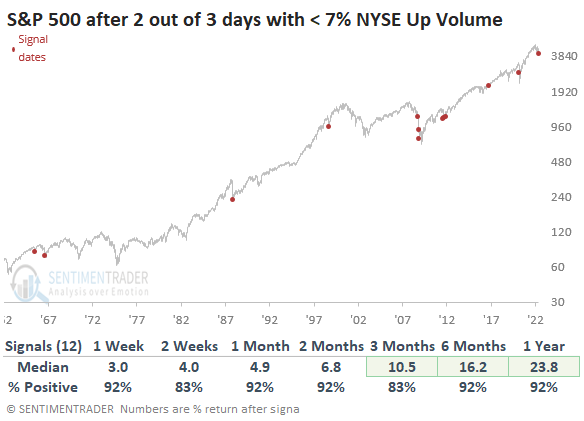

4. History of Heavy Over 93% Down Volume.

@jasongoepfert About the only positive here is that selling has been so bad it might be exhaustive. Over the past 60 years, there have been 12 times (besides today) when 2 out of 3 sessions saw 93% or more of volume focused on falling stocks. 11 of them witnessed a rebound.

https://twitter.com/jasongoepfert

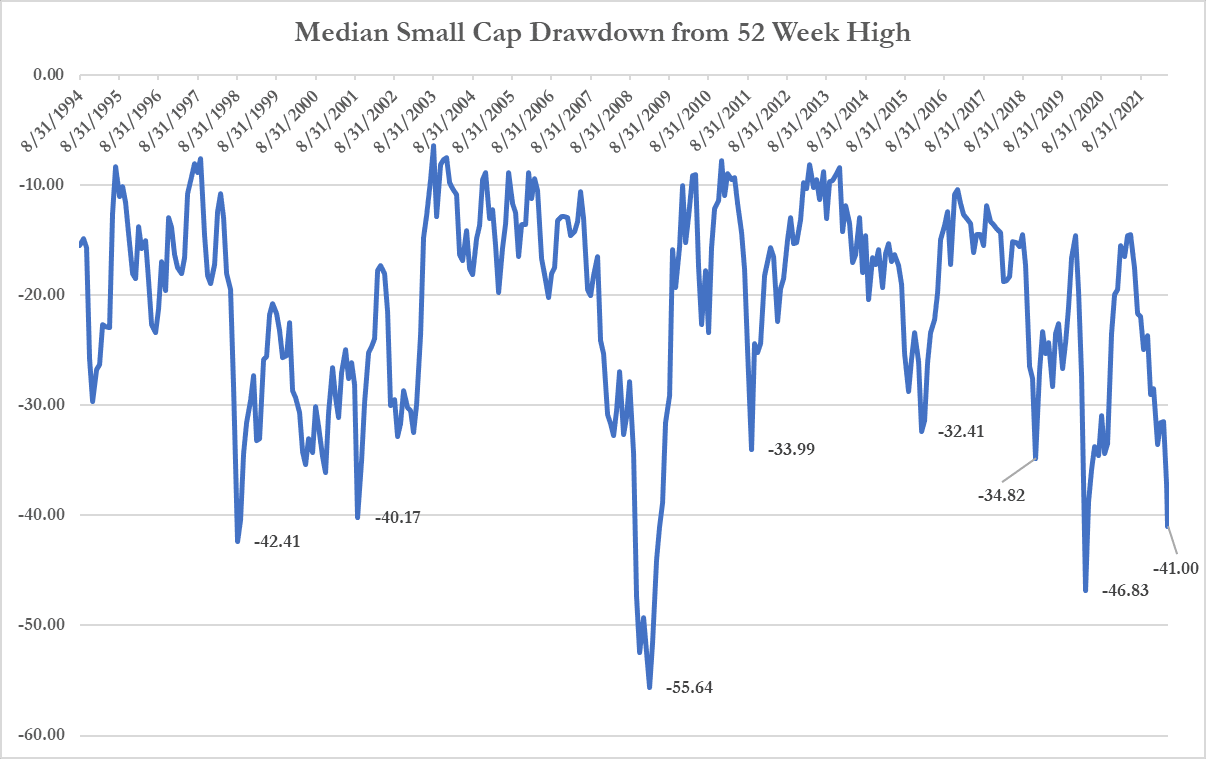

5. Median Small Cap Drawdown on Par with Tech Bubble.

@jonrice80 Fully realize there are many ways to measure sentiment, but we are getting into rare territory for median small cap drawdowns. Median US small cap now down 41% from 52 week high. Now on par with tech bubble, creeping on COVID, still a ways from 08/09

https://twitter.com/jonrice80/status/1523787659289653248/photo/1

6. Biotech -40% YTD

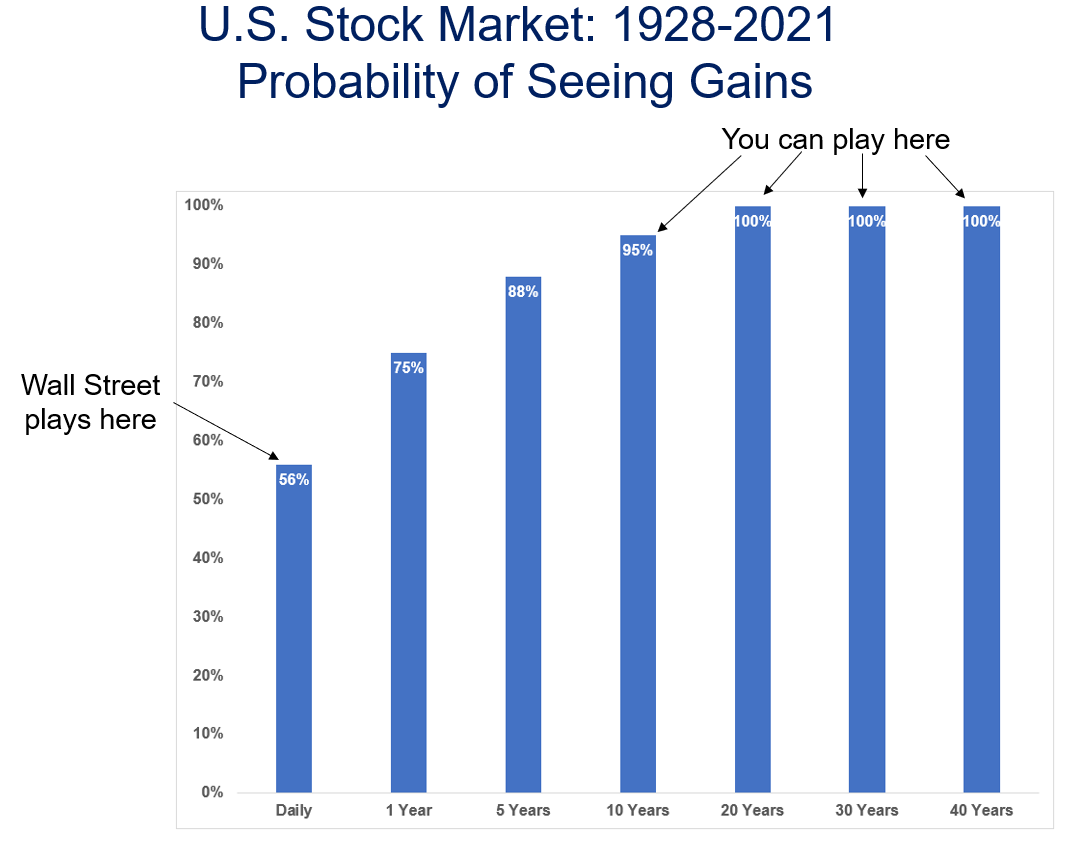

7. A Good Reminder from Ben Carlson Blog

Some Things I’m Not Going to Regret in 20 Years by Ben Carlson https://awealthofcommonsense.

8. Weed is not Recession/Inflation Proof? MJ Weed ETF Breaks Thru Covid Lows.

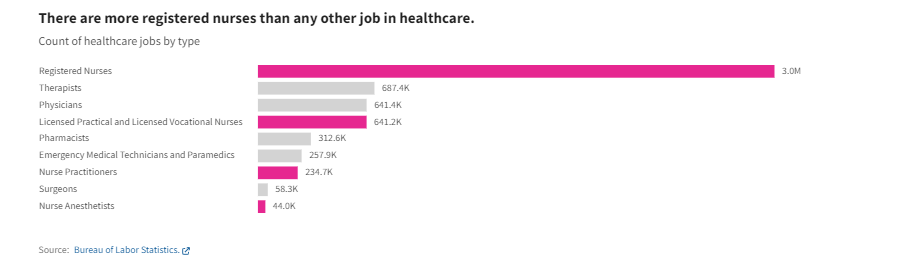

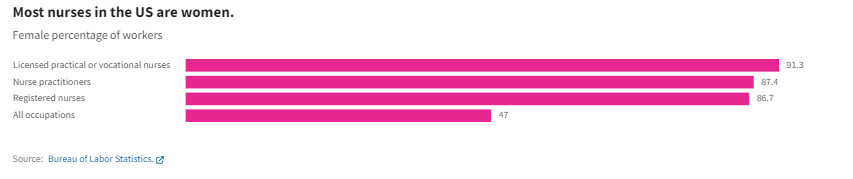

9. Facts on Nurses…

USA Facts Blog

https://usafacts.org/articles/who-are-the-nations-nurses/

10. Mark Cuban Says These are the Dumbest Things Entrepreneurs Do

Whatever you do, don’t do the first thing on this list. Or the second. Definitely not the third.

By Jason Fell July 23, 2019

By nature, entrepreneurs are intelligent, passionate, ambitious people. But all of those smarts and drive don’t always mean every business owner makes all the right decisions all of the time. Hopefully the blunders that are made aren’t big enough that the business fails.

We reached out to tech billionaire Mark Cuban to find out the things that entrepreneurs do that absolutely drive him bonkers. As a longtime investor on ABC’s hit TV show Shark Tank, Cuban has encountered his fair share of entrepreneurs who’ve made some serious missteps.

Whether you’re looking for investment money or quietly growing your business, Cuban says to avoid making the following mistakes at all costs.

For businesses in Ohio, there’s a team working behind the scenes to help you find success.

Not understanding business basics.

One thing that drives Cuban crazy is when entrepreneurs lack the basics. A prime example, he says, is when entrepreneurs “don’t know the difference between a product and a feature.” Before an entrepreneur begins looking for investment money, starts producing a product, even before research and development, they need to have this fundamental understanding.

In other words, if a competitor sells only blue shirts, and your shirts are blue and red, you’ve merely created a feature. Products or services solve problems and people want to purchase them. Features are characteristics that add value to products.

Related: Mark Cuban Shares the Best Advice He Ever Got

Successful companies are founded on products—not features, Cuban says.

Thinking competition equals validation.

Creating something from nothing is no easy feat. Convincing people that you’re providing a valuable service and to buy your products sometimes requires a lot more. Cuban says it’s a big mistake to think that a big competitor moving into your market validates your business.

What it does—or should do—is make smart entrepreneurs extremely uneasy. “It means you are in deep trouble unless you can out-innovate and outsell them,” Cuban says.

Pegging your success on one ‘star’ employee.

As the old saying goes: Don’t put all your eggs in one basket. The same goes for hiring and team building.

Too often, business owners believe that “their next hire will solve their biggest problem,” Cuban says. Hiring the best marketer in the industry doesn’t mean you’ll magically figure out how to sell your stuff and everyone will live happily ever after, he says.

If your star employee leaves or fails, then so does everyone else. Growing a successful business requires all hands on deck, meaning everyone on the team needs to be pulling their weight—together.