1. Goldman Sachs Non-Profit Tech Index -36% from Highs

Holger Zschaepitz https://twitter.com/Schuldensuehner

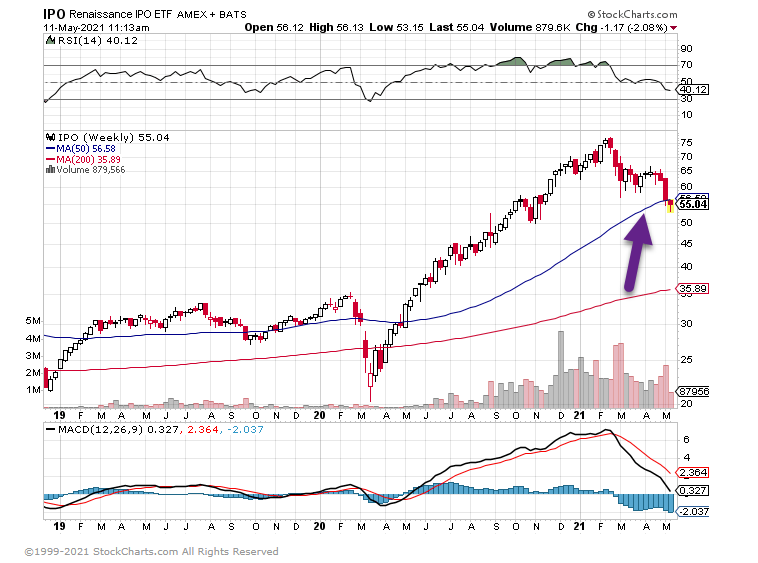

2. IPO ETF -29% from Highs.

IPO ETF breaks thru Dec. 2020 levels

Long-term weekly chart closes below 50 day but still way above pre-covid 2019 levels

3. Chinese Tech Giants -30% from Highs

Chinese tech giants have borne the brunt of the sector’s retreat this month, after regulators expanded an antitrust crackdown and announced steps to rein in the companies’ fast-growing finance units. Meituan’s stock plunged as much as 8.6 per cent in early Tuesday trading, taking the slump over two days to 15 per cent after the Shanghai Consumer Council released criticism late Monday on issues that hurt consumer rights. With talk of tighter regulation from Beijing, Chinese tech heavyweights Baidu, Alibaba, and Tencent, collectively dubbed the BATs, all dropped more than 3%.

4. Semiconductor Stocks -10% Correction from Highs.

No Breakout for Semi ETF.

5. 55% of ARKK Total Lifetime Flows are now Under Water

Eric Balchunas, @EricBalchunas

Roughly 55% of $ARKK‘s total lifetime flows are under water now as they came in after Nov 2020, which is the level its price has fallen to. Also true is the fund is STILL up 78% over past 12mo, $QQQ 44%. Can’t not add that context, sorry. Here’s a quick look at the situation:

6. Decentralized Finance Growth …Smart Contracts Cross $10B Mark.

What is DeFi?-Definition

Short for decentralized finance, DeFi is an umbrella term for peer-to-peer financial services on public blockchains, primarily Ethereum.

DeFi (or “decentralized finance”) is an umbrella term for financial services on public blockchains, primarily Ethereum. With DeFi, you can do most of the things that banks support — earn interest, borrow, lend, buy insurance, trade derivatives, trade assets, and more — but it’s faster and doesn’t require paperwork or a third party. As with crypto generally, DeFi is global, peer-to-peer (meaning directly between two people, not routed through a centralized system), pseudonymous, and open to all.

Contracts Cross 10B

DeFi still is a niche market with relatively low volumes—however, these numbers are growing rapidly. The value of funds that are locked in DeFi-related smart contracts recently crossed 10 billion USD. It is essential to understand that these are not transaction volume or market cap numbers; the value refers to reserves locked in smart contracts for use in various ways that will be explained in the course of this paper. Figure 1 shows the Ether (ETH, the native cryptoasset of Ethereum) and USD values of the assets locked in DeFi applications.

Figure 1

Total Value Locked in DeFi Contracts (USD and ETH)

NOTE: M, million.

SOURCE: DeFi Pulse.

The spectacular growth of these assets alongside some truly innovative protocols suggests that DeFi may become relevant in a much broader context and has sparked interest among policymakers, researchers, and financial institutions. This article is targeted at individuals from these organizations with an economics or legal background and serves as a survey and an introduction to the topic. In particular, it identifies opportunities and risks and should be seen as a foundation for further research.

Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Marketsby Fabian Schär

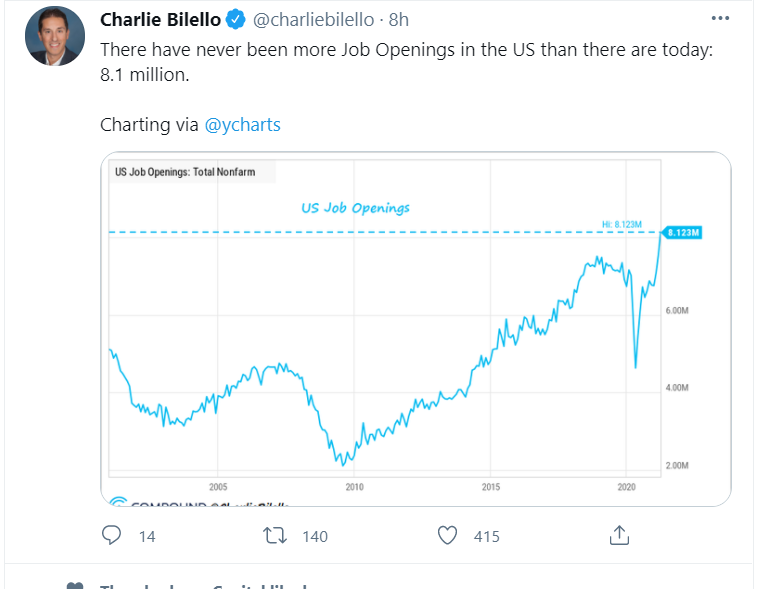

7. The Most Job Openings Ever in the U.S.

8. Pizza Machines Coming Via Robot

Piestro | The Future of Artisanal Pizza

From Morning Brew Morning Brew

9. Global Greenhouse Gas Emissions by Sector

10. Afraid of Change? 6 Ways to Embrace It—

Change doesn’t have to be bad, even if it’s unwelcome

KEY POINTS

- Even as we long for change, we tend to prefer the safety of our routines.

- The negative impact of change tends to be overestimated, and therefore avoided.

- A mindset of growth, careful risk-calculation, and novelty-seeking can help leverage anxiety control, so you can get on with living your life.

We are afraid of change.

Whether it’s facing post-pandemic bak-to-work, an unknown event forced into our calendar, or the simple change of season requiring the perennial change of wardrobe and routine. Most of us don’t like change, and we seldom foresee its good side, even as it appears a prerequisite for almost all that strengthens us in life. Despite its likelihood of portending something positive, in the face of change, we resist. We cling to what we know – even if stuck in our routines – because we are afraid that we won’t like, and worse, can’t handle what is ahead.

Ironically it is resistance, and not the process of change itself, that actually burdens us. Fighting change ignites fear and anxiety, robs us of novelty needed for health, and is exhausting. In the end, most of adjust, even if we kick and scream. If you feel yourself resisting risk and feel afraid of change, here are a few things to keep in mind that can help ease your dread.

1. We overestimate how bad things might be. Thanks perhaps to negativity bias or simply a habit of catastrophizing, we are prone to overestimate future pain which in turn drives up anxiety and resistance. If one listens to every worry and avoids all risk, success will remain out of reach, and anxiety will continue its escalation, having been reinforced by avoidance. The trick is to learn how to work with your anxiety and discover where your anxiety could be holding you back, rather than just protecting you. There are times when anxiety’s message needs to be considered, but then overturned in favor of action. Action is where the relief is, not avoidance.

2. Taking risks and embracing change allows us to grow. To grow and adapt is to stretch outside our comfort zone, that is to say, depart from what’s comfortable. People in business understand that success in any competitive endeavor involves risk – to take advantage of an upside, one has to be willing to invest when others won’t. This means being uncomfortable. Not all discomfort or risk is advisable, of course, and risks need to be considered carefully. Risk taking isn’t about taking any risk, it’s about taking smart risks.

3. Calculating risk allows you to take control. Still not sure what’s a smart risk, and what’s just a bad idea? Try taking anxiety out of the equation by asking yourself, “what would you do if you couldn’t fail?” This should help you rebalance the thinking parts of the decision from the emotional parts. If you are risk averse, and struggle with letting anxiety get the better of you, look to balance facts in calculating a decision.

article continues after advertisement

4. Novelty helps . Ironically it is precisely when we are overstretched that we are primed for change, and ready to be inspired by novelty. Novelty requires energy, but can deliver it too. Curiosity, a different perspective, and intrinsic motivation are all helped by new situations and experiences. These are the things we need when we are stuck and overwhelmed. So if you need a boost of motivation, look to find novelty in the changes ahead.

5. How you fail is more important than if you fail. In business, in relationships, and in life, failing is part of learning, and sometimes delivers the most powerful learning there is. Thanks to evolution, we are primed to notice and learn from our mistakes so as not to make them again. But that shouldn’t mean we set out to avoid them all together, an impossible goal. Instead we should aim to manage how we learn from our mistakes. This is what it means to have a growth mindset, to expect failure and change as part of the creative process.

6. Balanced stretching produces the most growth. We can’t grow if we don’t stretch, but we won’t grow unless we rest. Balancing exertion with rest is the key to managing a growth process effectively, and keeping ourselves strong. This means managing your body and your human resources. Making good nutritional choices, moving your body, and prioritizing sleep are the three most important things you can do to maintain optimal mental and physical health.

Change inherently feels uncomfortable, but that doesn’t mean it is bad. Make the best rational decision you can, channel courage – that is, believe something is more important than your anxiety – and take action. Simply making a decision is an action, and action always feels better than avoidance and risk aversion. That’s not to say this is easy, but it works. If you struggle with change, how might you spark your curiosity for what’s ahead, and allow yourself to lose a bit more sight of the shore?

Looking for more help understanding your anxiety? Visit my website , get the Hack Your Anxiety book , or read more about my wellness and anxiety programs here .

https://www.psychologytoday.com/us/blog/hack-your-anxiety/202105/afraid-change-6-ways-embrace-it

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..