1. Highest 4 Month Total in Stock Buybacks 20 Years

BONANZA– Companies are preparing to launch a record wave of share buybacks as executives get comfortable with spending excess cash following a blockbuster earnings season and greater clarity on the trajectory of the world economy. US companies announced $484bn in share buybacks in the first four months of this year, the highest such total in at least two decades, according to Goldman (FT) In what its analysts dubbed a “buyback bonanza”, Goldman projected shares repurchases by US companies would increase 35 per cent this year from 2020.

2. History of 40% 2 Day VIX Surges.

These ‘panic events’ could soon spell relief for stock markets, says top strategist Thomas Lee–By Barbara Kollmeyer

3. Municipal Market Analytics, a net $39 billion have flowed into municipal-bond mutual funds this year (as of 5/6), the most over the same period since 2008.

Muni ETF did not make new highs after record inflows

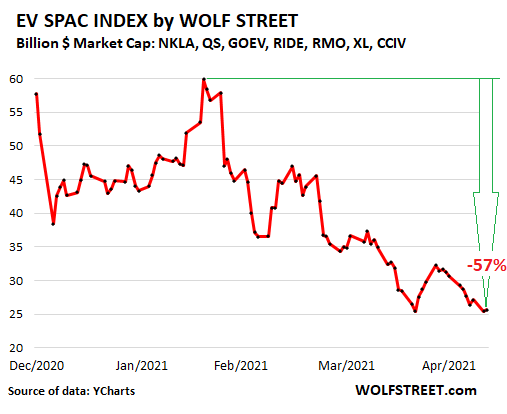

4. EV SPAC Index -57%

Wolf Street -The EV SPAC boom-and-bust is reflected in the WOLF STREET EV SPAC Index, which has collapsed by 57% since its peak on February 17. The index tracks seven EV-related companies that have gone public via a merger with a SPAC: Nikola, QuantumScape (batteries for EVs), Canoo, Lordstown Motors, Romeo Power (batteries for EVs), XL Fleet (EV drive systems for fleets), and Lucid Motors. Since February 17, these seven stocks combined have shed $35 billion in value, which they should have never had in the first place. Easy come, easy go, except when it’s your money (data via YCharts):

The individual stocks in the EV SPAC index have collapsed even more spectacularly as the individual peaks came with different timing:

| Stock | Price | % from high | |

| Nikola | [NKLA] | $11.83 | -87% |

| QuantumScape | [QS] | $29.48 | -78% |

| Canoo | [GOEV] | $7.92 | -68% |

| Lordstown | [RIDE] | $7.76 | -76% |

| Romeo | [RMO] | $7.18 | -82% |

| XL Fleet | [XL] | $6.04 | -83% |

| Lucid Motors | [CCIV] | $18.60 | -71% |

https://wolfstreet.com/2021/05/11/the-most-hyped-corners-of-the-stock-market-come-unglued/

5. Stagflation Scare …CPI UP and Labor Participation Down

ZEROHEDGE BY TYLER DURDEN-Taken together a much weaker-than-expected payroll and much higher-than-expected CPI report suggests more than a whiff of stagflation…

https://www.zerohedge.com/markets/stagflation-surge-sparks-purge-stocks-bonds-bitcoin-bullion

6. 10-Year Breakeven Inflation 20 Year Chart……It will get interesting if we break above this purple line.

https://fred.stlouisfed.org/series/T10YIE

7. Gas Prices Hit $3 Per Gallon for First Time Since 2014

The national average price of gasoline today has surpassed the $3 per gallon mark. This is a milestone not seen since David Letterman still hosted Late Night, Pharrell’s meme-worthy hat was introduced to the world, and Kim and Kanye got hitched.

GasBuddy’s head petroleum analyst prognosticated that gas prices may escalate past the key barrier in GasBuddy’s annual Fuel Outlook Report released in January of this year. While many Americans are pointing fingers, they should be pointing at the same factor GasBuddy mentioned months ago: COVID-19 related recovery is pushing things back to normal and leading to rising gasoline demand.

“While this is not a milestone anyone wants to celebrate, it’s a sign that things are slowly returning to normal,” said Patrick De Haan, head of petroleum analysis at GasBuddy. “In this case, rising gas prices are a sign Americans are getting back out into the world — attending baseball games, going to concerts, taking a road trip — basically staying anywhere but at home. This summer may see some blockbuster demand for fuel as well, as Americans find it very challenging to travel internationally, leading many to stay in the confines of U.S. borders, boosting some weeks to potentially record gasoline demand.”

Rest assured that summer gas prices will not be setting records. They will settle down to levels more similar to 2018: the national average briefly rising above $3/gallon but eventually falling back under and remaining in the upper $2 to low $3 per gallon range. Should any major refinery issues develop in the midst of the summer travel season, gas prices could become impacted in a large way, especially if the economy continues to see solid recovery and demand for fuels increases.

If you are looking to stretch your hard earned dollars into more miles, be sure to shop around at the pump with the free GasBuddy app and drive less aggressively. The savings could add up to $477 per year, or roughly $10 per tank.

In addition, sign up for Pay with GasBuddy, a free program that links to your checking account and offers savings of up to 25 cents per gallon. It is accepted at nearly all gas stations, no matter the brand.

8. Copper Another Leg Up on Chart

9. 4 Investing Lessons from David Swensen

Posted May 11, 2021 by Nick Maggiulli

Last week, David Swensen, the famed investment manager and Chief Investment Officer at Yale, died at the age of 67 after a long battle with cancer. Swensen, who was the pioneer behind the “Yale model”, revolutionized how endowments and institutions invest their money by emphasizing asset allocation and taking on more equity risk. His ideas have been used by tens of thousands of institutions to generate higher returns for millions of beneficiaries over the past few decades.

But Swensen’s body of work goes beyond institutional investing. It can be used by individual investors as well. For this reason, below I have summarized four investing lessons we can use from Swensen to improve our investment results.

1. Asset Allocation is Everything

When Swensen talks about investing, he suggests that there are three primary tools that we can use to affect our returns:

- Asset allocation

- Security selection

- Market timing

What asset classes you buy (asset allocation), which securities you buy within those asset classes (security selection), and when you buy them (market timing) are the three main levers that affect your long-run investment performance. Unfortunately, Swensen discovered that only one of these three tools actually mattered for most investors. As he explained during a guest lecture at Yale:

More than 90% of the variability in returns for institutional portfolios had to do with the asset allocation decision.

Swensen goes on to explain that this is true because security selection and market timing are negative sum games. While some investors will win when they select better stocks or time the market correctly, others will lose doing the same thing. So when you take into account the fees/commissions charged for doing so, the result is a negative sum game.

This is why most investors who try to pick stocks or time the market end up underperforming in the long run. While some people will outperform in these areas, most won’t. As a result, Swensen concluded that the primary driver of long-term performance is asset allocation. What assets you own (and in what proportions) are going to be the primary determinant of your investment results, all else equal.

Unfortunately, since we have no idea what future asset returns will look like, we can’t know what will be the optimal asset allocation going forward. Despite this, Swensen does provide some clarity on what kinds of assets you should own.

2. If You Want Growth, Increase Your Equity Exposure

Though future asset returns are unknowable, what we do know is that equities tend to outperform bonds, commodities, and cash in the long run. This is why Swensen recommends an increased exposure to equities for those with longer time horizons (i.e. institutions). And though you aren’t an institution, the logic still applies.

Swensen solves the asset allocation problem I mentioned in the prior section by looking at what would have worked throughout history. His conclusion suggests a larger allocation to equity (and equity like) investments from around the globe. Swensen provides one such allocation as an example in his book Unconventional Success: A Fundamental Approach to Personal Investment:

- 30% U.S. equity

- 15% Foreign developed equity

- 5% Emerging market equity

- 20% U.S. Real Estate (REIT)

- 15% U.S. Treasury Bonds

- 15% U.S. Treasury Inflation-Protected Securities (TIPS)

What you will notice about this allocation is that it is only 30% U.S. stocks and 30% U.S. bonds, with the remaining 40% spread out across international stocks and U.S. real estate.

More importantly, though this portfolio only has half the allocation to U.S. stocks as a 60/40 U.S. stock/bond portfolio, it still has returned 8.6% per year over the last decade. While this isn’t as good as the 10.1% annual return of a 60/40 portfolio over the same time period, it’s impressive nonetheless.

Swensen’s argument for more equities (and other risk assets) in your portfolio heavily influenced my thinking on how individual investors should build wealth. This is why I have emphasized income-producing assets as the core building block of your portfolio. And while owning these assets can be riskier in the short run, as Swensen has pointed out, in the long run it’s one of the best ways to build wealth.

3. Diversification Works…in the Long Run

As global asset prices declined during the financial crisis of 2008, Swensen’s approach to investing was under attack. How could anyone hold so many volatile assets that could all fall at the same time? What was the point of diversification if it didn’t save you when you needed it most?

Swensen fought back against these criticisms by arguing that diversification across risk assets wasn’t meant to save you during these short periods of instability, but over the long-term. The example he provides is of the Japanese investor who had most or all of their net worth in Japanese equities in the late 1980s. This investor would have seen an over 50% decline in their holdings over the next few decades. However, if they had owned non-Japanese equities as well, they would have had a very different result.

It’s easy to forget this point when the S&P 500 has outperformed most other asset classes over the past decade. However, we only need to look to the 2000-2010 period to find a time when this wasn’t the case. Swensen’s reminder that diversification is good for us, even though it can fail in the short run, is one that many investors should take to heart.

4. Our Time Horizon Can Be Shorter Than We Think

Of all the lessons I learned from Swensen’s life, one of them is in stark contrast to his teachings. Though Swensen taught us to invest as if we would live forever, unfortunately, his own life was cut short. For a man of his wealth, status, and education level to die at 67 is a grim reminder that the future is promised to no one. Swensen’s belief that we should invest for the long run is a good one, but it doesn’t work forever. Sadly, our time horizon can be much shorter than we think.

If you want to learn more about Swensen’s approach to investing, I highly recommend this excellent talk he gave at Yale and his books Pioneering Portfolio Management and Unconventional Success. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

https://ofdollarsanddata.com/4-investing-lessons-from-david-swensen/

Found at Crossing Wall Street Blog https://www.crossingwallstreet.com/

10. What Are The Best Stoic Quotes On Happiness?

The Daily Stoic Blog

“Everyone gets one life. Yours is almost used up, and instead of treating yourself with respect, you have entrusted your own happiness to the souls of others.” — Marcus Aurelius

“Other people’s wills are as independent of mine as their breath and bodies. We may exist for the sake of one another, but our will rules its own domain. Otherwise the harm they do would cause harm to me. Which is not what God intended —for my happiness to rest with someone else.” — Marcus Aurelius

“The Stoic also can carry his goods unimpaired through cities that have been burned to ashes; for he is self-sufficient. Such are the bounds which he sets to his own happiness.” — Seneca

“It is clear to you, I am sure, Lucilius, that no man can live a happy life, or even a supportable life, without the study of wisdom.” — Seneca

“We have reached the heights if we know what it is that we find joy in and if we have not placed our happiness in the control of externals.” — Seneca

“Do the one thing that can render you really happy: cast aside and trample under foot all the things that glitter outwardly and are held out to you [by the various sects which professed to teach how happiness is to be obtained] by another or as obtainable from another; look toward the true good, and rejoice only in that which comes from your own store.”

“The things which we actually need are free for all, or else cheap; nature craves only bread and water. No one is poor according to this standard; when a man has limited his desires within these bounds, he can challenge the happiness of Jove himself.”

“Make yourself happy through your own efforts; you can do this, if once you comprehend that whatever is blended with virtue is good, and that whatever is joined to vice is bad.” — Seneca

“If there is anything that can make life happy, it is good on its own merits; for it cannot degenerate into evil. 7. Where, then, lies the mistake, since all men crave the happy life? It is that they regard the means for producing happiness as happiness itself, and, while seeking happiness, they are really fleeing from it.” — Seneca

https://dailystoic.com/how-to-be-happy/#stoic-happiness-quotes

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..