1.Some Leading Tech ETFs Down YTD and in Correction Territory

SMH-Semiconductor ETF -13% from highs closing in on Dec. 2020 levels

IPO ETF -20% from highs…closing in on Dec. 2020 levels

2.More Tech Leaders

AAPL -15% closing in on Dec. 2020 lows

AMZN -16% from highs…Remember the band I showed earlier in the week..closed right on 50 day moving average….last time below 50 day was March 2020

3.XLE Energy ETF +35% YTD vs. QQQ -1.5%

Energy Crushing Tech 2021

One Year Chart Tech +41% vs. Energy +9%

4.Market Cap of FANGMAN Complex has Dropped $700B from Feb. High

Market cap of #FANGMAN complex (Facebook, Apple, Netflix, Google, Microsoft, Amazon, Nvidia) has dropped $700bn from Feb high, more than the entire market cap of #Italy (which is $665bn). Holger Zschaepitz

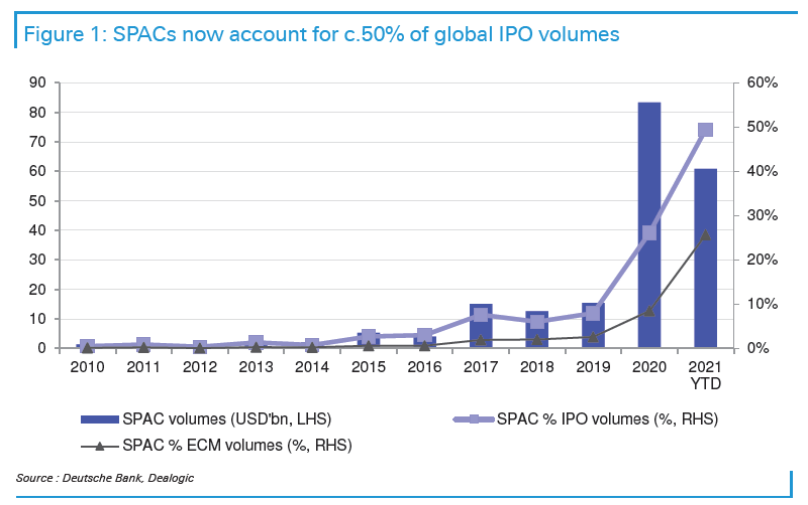

5.SPACS Hit 50% of Global IPO Volume.

Jim Reid Deutsche Bank

6.Tesla Pullback Basically Typical So Far

Bespoke Investment Group-. We also show how Tesla (TSLA) plays into the ARKK ETF. We close out with a review of consumer comfort and manufacturing activity.

©2021 Bespoke Investment Group

7.Charging Stations Scarce in U.S.

WSJ

Found at Barry Ritholtz Big Picture Blog https://ritholtz.com/2021/03/10-thursday-am-reads-328/

8.Seniors are rushing to get back on planes

·Markets Reporter

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Friday, March 5, 2021

Vaccinations are having the biggest impact on airlines.

As we noted on Thursday, investors are fully onboard the re-opening train.

But these trades aren’t only anticipating what might happen when the masses are vaccinated and the economy is fully re-opened — they are also responding to real-time changes in data.

In a note to clients published Thursday, economists at Bank of America Global Research led by Michelle Meyer flagged the massive surge in spending on airlines the firm is seeing from its Bank of America cardholders who are most likely to be vaccinated.

And this chart makes clear that it seems there is one thing people are most inclined to do once they get the vaccine: fly.

Consumers between ages 73-92 have dramatically ramped up their airline spending after COVID vaccines became available, a sign of how quickly consumer habits are liable to change once people feel safe to resume a wide range of activities. (Source: Bank of America Global Research)

“We focus on spending trends amongst traditionalists which are aged 73-92 and are therefore most likely to have received the COVID vaccine,” Bank of America writes. “In particular, spending on airfare surged for traditionalists as compared to other generations — [the chart above] shows the indexed level of average spending by cohort to June 2020; traditionalists spending is now 4X the level in June.”

The firm adds: “We do not see the same [spending] pattern for lodging which may suggest that traditionalists are traveling to see family rather than take vacations. Spending at restaurants and bars increased modestly for this cohort recently relative to other age cohorts but there was little difference in brick & mortar retail spend.”

All of which sounds like great news for airlines. The market, of course, has anticipated some of the specific trends that will play out as the economy re-opens with air travel being one of them. And while airline stocks were caught up in Thursday’s sell-off, shares of major U.S. airlines like United (UAL), American (AAL), and Delta (DAL) are just a few percentage points off their 52-week highs.

Bank of America’s report, then, serves as confirmation of what investors have expected from consumer behavior as the economy re-opens. And whether Millennials start hopping on planes with the enthusiasm of their grandparents once their turn to get a vaccine is up remains to be seen.

One imagines that this cohort might change its behavior to a slightly more muted degree given the elevated risk COVID infections pose to the elderly. Then again, if there is a place consumers tend to draw the line on which risks they are willing to take during the pandemic, air travel is a popular one.

The big takeaway from this data, however, is that as we move into the second quarter things will move quickly. The rapid ramp in airline spending BofA sees in its data won’t be the only economic activity chart that soars up and to the right. And this chart may serve as a harbinger of how fast behaviors change once people are vaccinated and give themselves the all clear.

By Myles Udland, reporter and anchor for Yahoo Finance Live. Follow him at @MylesUdland

9.Mortgage Rate Trends …30 Year Back Above 3%

Len Kiefer-Freddie Mac

10.Relationships the Key to Resilience-

HBR.ORG

Are your relationships broad and deep enough to help support you when you hit setbacks? Here’s an exercise to help you think that through.

Step 1: Identify your top resilience needs.

Below are eight common relational sources of resilience, the same ones we noted above. Our research shows that these sources are not universally or equally important to everyone. For example, some people value laughter, while others prefer empathy. In short, our resilience needs are personal and are shaped by our unique history, personality, and professional/personal context. But collectively, the relationships we develop are a toolbox that we can turn to in our most difficult times, which we can rely upon to help us navigate day-to-day life challenges.

Using the framework below, identify the top three sources of resilience that you would most like to strengthen in your life. Make a note of those that are most important for you to work on developing.

Step 2: Plan how to expand your network.

Reflecting on the top three resilience needs you indicated, place the names of people or groups that you could invest in to further cultivate sources of resilience. Connections that yield resilience can be intentionally cultivated in two ways. First, we can broaden existing relationships by, for example, exploring non-work interests with a teammate or strengthening mutually beneficial relationships with influential work colleagues that help us push back. Second, we can initiate engagement with new groups or people to cultivate important elements of resilience — for example spiritual groups that remind us of our purpose, or affinity groups that allow us to laugh. Broadening our network helps us develop dimensionality in our lives — a rich variety of relationships and connections that help us grow, that can provide perspective on our struggles, and that can offer us a stronger sense of purpose.

These groups may come from any and all walks of life — athletic pursuits, spiritual associations, nonprofit board work, community organizing groups around social, environmental, or political issues, etc. Engaging in nonwork groups (particularly board work, social action, and community organizing groups) helps us develop resilience in our work life as well. Exposure to a diverse group of people allows us to learn different ways of managing, leading, and handling crises, and helps us develop different relational skills such as negotiating with various stakeholders. It also helps us cultivate empathy and perspective that we carry back into our work, among other benefits. In summary, meaningful investment in non-work relationships broadens the toolkit one can rely upon to manage setbacks when they arise.

One critical insight from our interviews is that relying on your network in times of transition matters a great deal. When people told us stories of significant transitions — moves, job losses, role expansions, or family changes — they tended to separate into one of two groups. One group tended to lean into the transition and relied on existing relationships to work through the ambiguity and anxiety they were experiencing. This group also used the transition to reach out to one or two new groups such as a working parents group, a newcomers group, or a work-based coaching circle. In contrast, the second group operated with a mindset that they just needed to absorb the transition and closed in on their circle. They felt overwhelmed and said they would lean into activities when they had time in the future. Over the ensuing 18 months, this group became a smaller version of themselves and often drifted away from the connections that had been so important to their lives.

Covid has created a significant transition for us all. The importance of building and maintaining your connections has never been clearer. For most of us, the challenges and setbacks we are experiencing in work and life during this pandemic have been relentless. But you’re not alone in this battle. You can build resilience. Start by understanding the critical importance of growing, maintaining, and tapping a diverse network to help you ride out the storm.

***

Support and funding for the research behind this article was received from the Innovation Resource Center for Human Resources.

The Secret to Building Resilience-by Rob Cross,Karen Dillon, and Danna Greenberg https://hbr.org/2021/01/the-secret-to-building-resilience

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.