1. Comparison Today to Previous Bubbles

Source: LinkedIn

The Big Picture Blog https://ritholtz.com/2021/03/10-wednesday-am-reads-228/

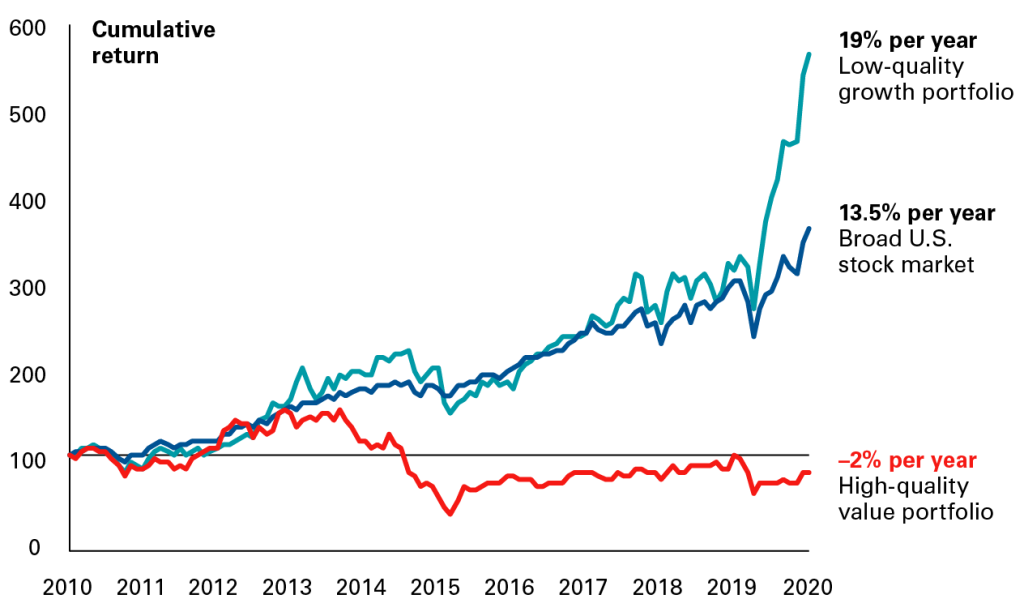

2. Low Quality Growth Stocks Led the Last Decade

Vanguard Blog Low-quality growth stocks—companies with little to no operating profits—have outperformed the broad market by 5.5 percentage points per year over the last decade. Of course, there are reasons why growth stocks may be richly valued compared with the broad market. Growth stocks, by definition, are those anticipated to grow more quickly than the overall market. Their appeal is in their potential. But the more that their share prices rise, the less probable that they can justify those higher prices. A small handful of these “low-quality growth” companies may become the Next Big Thing. But many more may fade into obscurity, as occurred after the dot-com bubble. Commentary by Joseph H. Davis, PhD, Vanguard global chief economist

Low-quality growth has outperformed the broad market

https://investornews.vanguard/asset-bubbles-and-where-to-find-them/

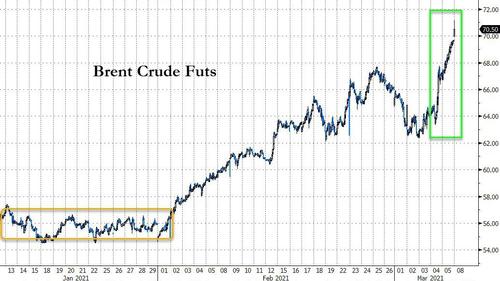

3. Crude Oil Futures Spike Above $70

Just as we warned, US equity markets (massive short squeeze) and oil (Saudi bombing) are exploding higher at the Sunday futures open.

Brent crude futures are above $70…Zerohedge

BY TYLER DURDEN https://www.zerohedge.com/markets/stocks-crude-crypto-explode-higher-asia-opens

4. Returns Since December 31, 2019

Reopening: Markets vs Our Economy-by Adam Jordan of Paul R. Ried Financial Group, 3/5/21

https://www.advisorperspectives.com/commentaries/2021/03/05/reopening-markets-vs-our-economy

5. SPAC ETF -20% Plus

Charlie Bilello

We may be seeing some early signs of that, with a number of the most popular SPACs showing significant declines in recent weeks, with the SPAC ETF ($SPAK) down over 20%.

Found at Abnormal Returns www.abnormalreturns.com

6. Electric Vehicle Adoption Expecting 28% Annualized Growth

“New developments will potentially make EVs cost competitive not only with new gas-burning cars but with the entire fleet of cars on the road, including used cars,” says Murphy, whose research responsibilities include U.S. automobile and components makers. “That’s about 270 or 280 million vehicles in the U.S. If you take a long-term view, that suggests there could be much stronger growth than the market expects.”

Electric vehicle adoption reaches for higher gear

Source: IEA, Electric vehicle stock in the EV30@30 scenario, 2018–2030; IEA Paris. Data for 2020–2030 are forecasts provided by the IEA.

Beyond Tesla: Electric cars shift into the fast lane

https://www.capitalgroup.com/advisor/insights/articles/electric-cars-shift-fast-lane.html

7..Bond Index AGG Bearish Chart

- AGG-Bond Index 50day thru 200day to downside

8. Amazon Air thrives as other airlines struggle under weight of pandemic

Joann Muller, author of Navigate

Photo: Nicolas Economou/NurPhoto via Getty Images

While most airlines are reeling from the effects of the pandemic, Amazon is on track to double the size of its aircraft fleet by June, a DePaul University analysis found.

Why it matters: Exploding demand for next-day delivery is fueling rapid growth of Amazon Air, the online retailer’s air cargo business.

- Some analysts expect Amazon Air could soon expand into third-party delivery, challenging leading shippers FedEx and UPS, as I reported last year.

Reality check: With 85 planes, Amazon Air is still tiny compared to FedEx’s fleet of 679 planes, and UPS’ 572 aircraft, notes CNBC.

- Amazon leases most of its planes, but in January it purchased 11 used Boeing 767-300 jets from Delta and WestJet.

- Amazon Air now regularly makes an average of 140 flights daily, and could grow to more than 160 by June 2021, according to DePaul’s Chaddick Institute for Metropolitan Development.

- The company plans to open a $1.5 billion air hub at Cincinnati Northern Kentucky International Airport later this year.

- https://www.axios.com/amazon-air-plane-pandemic-4d4328d9-daad-4790-929f-f06615b2d9e0.htm

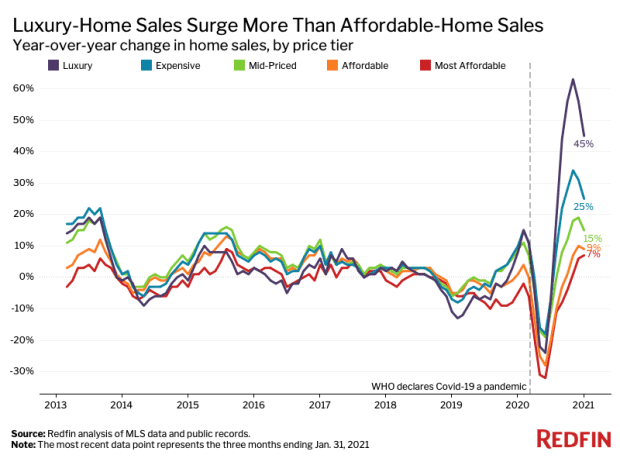

9. Luxury-Home Sales Hockey Stick Up

Housing is a luxury? Here’s what the K-shaped recovery means for real estate By Andrea Riquier

10. Fewer Desks, More Green: What Amazon’s HQ2 Says About the Future of Office Design

The plans for the $2.5 billion campus in Arlington, Virginia, offer a glimpse into the post-Covid workplace.

Amazon’s new headquarters is part of a larger trend to rethink office space as more community-focused culture center than a space where your desk is. Courtesy company

The future of office design is all about collaborative spaces and community. Just ask Amazon. Its new HQ2 designs focus on what you miss most when you’re remote: people.

The plan for the $2.5 billion complex in Arlington, Virginia, features a spiral double-helix glass tower with two lushly landscaped pedestrian paths. There are also 2.5 acres of open public space that include a dog run, stores, daycare facilities, and restaurants. The designs can yield a wealth of ideas for businesses rethinking their own workplace for the post-Covid world.

“Design gives us the opportunity to transform and reshape the workplace into a healthier and more purposeful experience,” says Robert Mankin, partner of NBBJ, the global architecture firm behind the plan, which was unveiled earlier this month. The complex, known as Amazon’s second headquarters, includes three 22-story office buildings.

The goal is to bring people together in a flexible office space to foster the sharing of ideas, says John Schoettler, Amazon’s vice president of global real estate and facilities. “Opening buildings and spaces for the entire neighborhood to benefit from and enjoy are a key piece of our inclusive and creative development,” he says.

Article continues after sponsored content

TRANSFORMING WORKPLACESSPONSORED CONTENT

How Leadership has Changed during COVID-19

Paths stretching across the campus allow for easy walking or biking access. Note the dog run.COURTESY COMPANY

In the post-Covid future, many organizations will adopt a hybrid workforce model: Heads-down work will take place offsite, instead of in the office. More employees will work from home and come into the office for meetings, mentorship, connection, and learning from peers. To help make that happen, companies will want to offer more interactive spaces and social connection points to foster cultural connections, says Mankin.

Gone are the rows of desks and quiet, library-like open-office plans. Instead, the office is designed to foster interaction, focus on nature, and welcome the community. HQ2 is designed with these ideas in mind, says Mankin, whose firm also counts Microsoft, Google, and Samsung as clients. “It could have been an easy direction for Amazon to build an isolated campus, but that’s not what we’re doing here,” he says. “It’s actually a campus that allows the public to move freely through.”

HQ2 will have an emphasis on nature, as green space can help boost employees’ creativity and reduce their stress.COURTESY COMPANY

Given the pandemic’s disruption to the workplace, now is a great time to rethink how your company uses its office and to create a plan to make a hybrid workforce work for you.

“This is a moment in time that will probably accelerate many things that we have been either thinking about or wishing for,” says Carlos Martínez, principal at San Francisco-based architecture firm Gensler, which has designed for such companies as Etsy, Adidas, and Facebook.

Want to incorporate the future of office design into your own workplace? Consider the following three tips.

1. Encourage gathering.

Collaborative spaces are more than just desks placed together or a meeting room with well-stocked cupboards. An office layout should encourage spontaneous interactions among staff. You don’t need a big budget to do so.

Think about putting comfortable seating near your kitchen or coffee station, so you can sit down to chat when you run into a co-worker. Or, create an open space where employees are in view, not cornered off by cubicle walls. Just as Amazon’s HQ2 designs include retail space and outdoor-gathering spots, you can try opening up your lobby or a furnished outdoor area to the public, so that your community extends beyond your own employee head count.

2. Incorporate nature.

Maximize natural lighting whenever possible by removing furniture that may obstruct windows. Add plants and greenery, which can reduce stress. Help employees get outside, where creativity is often sparked, by adding paths and bike parking, so employees can walk or ride through the surrounding neighborhood on their way to work.

3. Design for flexibility.

Technology is changing workspaces rapidly, even year by year, so it’s important to be flexible. Don’t think that you can sign a 10-year lease and design a space that fits your needs for an entire decade.

Find a lease that can offer a shorter time commitment in case your needs change, Martínez says. Then make sure that what you build or purchase is absolutely essential. Whatever you create should support the behavior of your employees and your company’s values.

Consider the storied tech companies starting in the founder’s garage. “A garage as a psychology of space is one of the most adaptable spaces that exist,” Martínez says. “Garages are blank boxes that allow you to modify things very quickly. You should create a space that gives you some of those elements.”

In other words, let your office be your story, a collaborative space to project your culture and your aspirations. Everything else? That can get done at home.

Correction: An earlier version misstated NBBJ’s headquarters. The firm doesn’t consider one city as its headquarters and its partners are located globally.

https://www.inc.com/anna-meyer/amazon-hq2-office-design-collaboration-space.html

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.