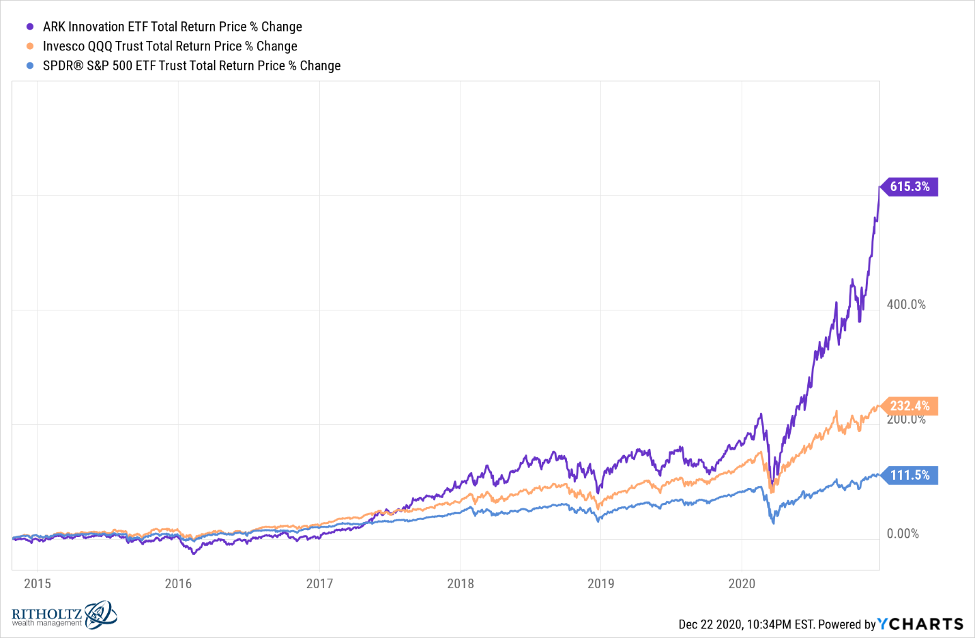

1. ARKK Innovation Fund Officially Down -20% from Highs.

ARKK-closing in on Dec. levels

2.My last quarterly letter mentioned ARK exploding…2020 Year End Letter – Welcome to the Jungle- https://matttopley.com/quarterly-letters/

Hot Managers Explode

Cathie Wood, founder and CEO of ARK Innovation, is brilliant for creating her ETF offerings. But in 2020 they went parabolic – like 1999 technology stock mutual funds. In classic retail investor behavior of chasing the hot funds, ARK innovation ETF saw a 900% increase in new money flows during 2020.

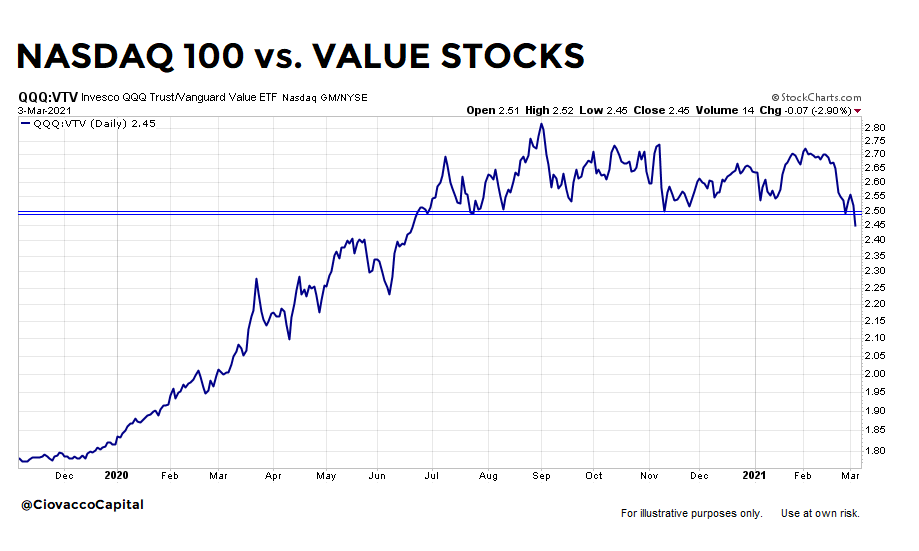

3. Naz 100 vs. Value Stocks (VTV) Interesting Chart Break

Chris Ciovacco, @CiovaccoCapital

Like any breakout or breakdown, the longer it holds, the more relevant it becomes. 48% of QQQ is allocated to tech stocks. TBD. Speaks to odds.

https://twitter.com/CiovaccoCapital/status/1367229239121104901/photo/1

4. IPO ETF Closes Below 50 Day Moving Average.

IPO ETF dropped 4.7% yesterday—below Jan 2021 levels

©1999-2021 StockCharts.com All Rights Reserved

5. What are Millennials Planning to do with Stimulus Checks?

The Stock Market Stands to Win Big in a New Stimulus Program

Spencer Platt/Getty Images

Will the $1.9 trillion federal relief plan making its way through Congress do more to stimulate the U.S. economy—or the stock market?

Young millennials—those from 25 to 34 years old—plan to put 50% their anticipated payments from Uncle Sam into the stock market, according to a survey of online investors for Deutsche Bank. Among Gen Z types from 18 to 24, the percentage earmarked for stock investing was a hefty 40%. And for older millennials and Gen Xers from 35 to 54, the portion planned for stocks was only slightly lower at 37%. By contrast, boomers over 55 expect to put only 16% of their money from D.C. into stocks.

Neophyte investors plan to plow the most of their payments into stocks, with those with 12 months or less investing experience expected to invest some 43% in equities, the Deutsche Bank survey further found. The cohorts with between one and two years’ experience and those with three or more years both expected to put 34% of their largess from Uncle Sam into stocks.

Based on the survey, the best-heeled expected to put the most into the market. Those with incomes over $100,000 planned to put 43% of any government payment into stocks, suggesting fewer more-pressing needs for the money. That may be a moot point if the income ceiling to receive payments is lowered to $80,000 for individuals and $160,000 for couples, as agreed to Wednesday by President Joe Biden and the Senate Democratic leadership. That’s down from $100,000 and $200,000, respectively, in the bill passed by the House of Representatives.

The bank’s survey found middle-income cohorts planned slightly less of their expected payment to be plowed into stocks. The figure stood at 36% for those making $50,000-$99,000, while those making $25,000-$49,000 planned to put 37% into equities. Respondents with incomes under $25,000 somewhat surprisingly said they would put 24% of their government money into stocks.

Given that this was a survey of online investors, it wasn’t representative of the entire population. Based on the stimulus payments slated (before those proposed changes by the White House and Senate Democrats), Deutsche Bank strategist Jim Reid estimates that $405 billion in relief payments could mean as much as $150 billion would be earmarked for the stock market. But based on historical assumptions that only about 20% of the recipients actually have trading accounts, that “would still add around $30 billion of firepower—and that’s before any possible boosts to 401k plans outside of trading accounts,” he writes in a client note.

Based on the feedback from a cohort of young millennial traders (one of whom is the offspring of a prominent senior investment strategist), Deutsche Bank’s survey is only part right. The money coming from Washington is definitely going into their trading accounts; but half is planned for cryptocurrencies such as Bitcoin, with the other half planned for equities.

And what this senior source says they’re looking for is BUZZ, which is the ticker symbol of the VanEck Vectors Social Sentiment exchange-traded fund, to be launched Thursday. BUZZ will follow an index based on social media, according to VanEck’s website. Scraping the internet is nothing new for hedge funds and other institutions, but BUZZ provides a marketable concept for individuals to follow it while continuing with venues such as WallStreetBets and Stocktwits

With Uncle Sam set to stake them with $1,400, this crowd could provide some fuel to equities and cryptocurrencies. For some other recipients, pressing needs such as food and rent may have to take precedence over playing the market

6. Afghanistan: The U.S. Wasted Billions On Buildings & Vehicles

BY TYLER DURDEN

THURSDAY, MAR 04, 2021 – 2:45

A report released by The Special Inspector General for Afghanistan Reconstruction (known as SIGAR) has found that the United States wasted billions of dollars on capital assets such as buildings, motor vehicles and aircraft in Afghanistan.

SIGAR conducts audits, inspections and investigations to ensure U.S. taxpayer money invested in reconstruction is spent efficiently and the agency aims to prevent waste, fraud and abuse of funding. The picture is not a good one, as Statista’s Niall McCarthy notes, by the end of 2020, SIGAR reported that the U.S. has appropriated around $143.27 for relief and construction in the war-torn country since 2002 with the cost distributed across four key areas – security ($88.32 billion), governance anddevelopment ($35.95 billion), civilian operations ($14.87 billion) and humanitarian aid ($4.13 billion).

https://www.zerohedge.com/geopolitical/afghanistan-us-wasted-billions-buildings-vehicles

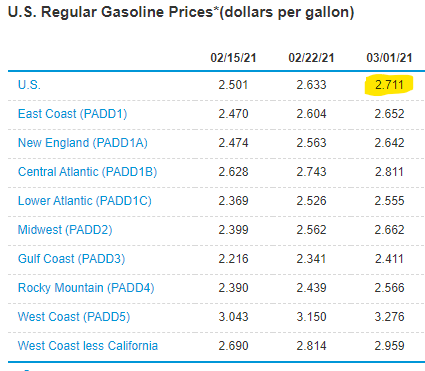

7. U.S. Regular Gasoline Prices Per Gallon

8. There are No Homes for Sale…..325,000 Total Inventory

Mike Simonsen, @mikesimonsen

Available inventory drops again this week. We’re at 325,000 single family homes on the market. No trough in site yet. We’ve just had no signs of normal seasonal patterns this year.

https://twitter.com/mikesimonsen

9. Instacart $14 Billion Valuation?????

Instacart raises $265 million as grocers score big VC deals

Dan Primack, author of Pro Rata

Illustration: Brendan Lynch/Axios

Instacart, a San Francisco-based grocery delivery company, raised $265 million in new funding from existing investors at a $39 billion valuation.

Why it matters: Big VC deals for grocery delivery aren’t just a North America thing. Within the past 24 hours we learned: Rohik, the Instacart of Eastern Europe, bagged €190 million; Flink, a German grocery deliverer that utilizes “dark stores,” got seeded with $52 million; and Crisp, an Amsterdam-based online grocer focused on fresh produce, added €30 million.

Instacart backers include Andreessen Horowitz, Sequoia Capital, D1 Capital Partners, Fidelity and T. Rowe Price.

The bottom line: This feels like a pre-IPO round, particularly given that Instacart recently added a pair of independent directors. But so did a $200 million injection last fall at a $17.7 billion valuation. And the $325 million deal last summer at a $13.8 billion valuation.

- At the very least, it gives Instacart more firepower as deep-pocketed rivals like DoorDash encroach on grocery and as Instacart expands into areas like alcohol and non-food retail delivery.

Instacart raises $265 million as grocers score big VC deals – Axios

Here’s a recap of what we covered:

Instacart’s 2020 growth

During COVID-19, Instacart quickly adapted to meet consumer needs, and consumers responded by making Instacart an essential part of their daily lives. In the first half of 2020, Instacart saw a 500% increase in order volume and a 35% increase in average basket size.

The Instacart network and operations grew as well:

- 10k+ new stores (40k total stores)

- 150+ new or expanded partners (500+ total retailers)

- 1,500+ new pickup locations

- 15x number of care agents

- 3x number of shoppers (500k+ total shoppers)

Instacart is quickly becoming consumers’ “go-to” delivery service, with growth in traditional grocery categories and beyond. Instacart has continued to partner with new retailers and expand throughout 2020.

Though Instacart’s primary focus is on grocery, they continue to add non-food selections for consumers across the marketplace. New and expanded partnerships include:

- Bed Bath & Beyond

- Staples

- Walmart

- 7Eleven

- Costco

- Sephora

- And dozens of local grocers across the country

Unsurprisingly — especially given the huge growth of online grocery shopping during the pandemic — food continues to grow year-over-year as the most-shopped category on Instacart.

The top 5 food categories by sales volume are:

- Produce

- Dairy & eggs

- Meat & seafood

- Frozen foods

- Beverages

10. Warren Buffett Just Taught an Incredible Lesson in Emotional Intelligence. (Actually, 3 Lessons)

It’s an under-appreciated personal strength. But there it is, laid bare in 7,200 words

BY BILL MURPHY JR.@BILLMURPHYJR

Getty Images

There are three reasons why Warren Buffett’s shareholder letters, the most recent of which dropped Saturday, are among the most-read missives in all of corporate America:

1. First, because of Buffett’s wealth and experience. He could probably gather an audience to read his grocery list.

2. Second, because Berkshire has a well-earned reputation as one of the most successful companies on the planet.

3. Third, and most important for our purposes, because this year’s 7,200-word letter displays one of Buffett’s underappreciated personal strengths: his extraordinarily high emotional intelligence.

I’m especially attuned to this because of my work recently on two free ebooks: Warren Buffett Predicts the Future, and 9 Smart Habits of People With Very High Emotional Intelligence. (You can download both books here, for free.)

It’s striking to look through this year’s letter, which is part of the 2020 Berkshire Hathaway Annual Report, and see so many examples of how Buffett leverages his emotional intelligence to make the letter accessible–and a model for any business leader. Here’s why it works.

1. He uses the second person singular.

Emotionally intelligent people understand that in any conversation, people intuitively gravitate to the parts that are about them. So, while the letter and the annual report are about Berkshire, the individual shareholder wants to know: How does this affect me?

As a result, Buffett writes much of the letter to, “you.” As an example, when Buffett talks about BNSF, the largest freight railroad company in North America, which Berkshire owns outright, he words much of it like this:

“Your railroad carries about 15% of all non-local ton-miles (a ton of freight moved one mile) of goods that move in the United States” … and later: Your railroad is in good hands.”

When he talks about Berkshire’s decision to repurchase its own stock, he frames it like this:

“That action increased your ownership in all of Berkshire’s businesses by 5.2% without requiring you to so much as touch your wallet.”

When he discusses a couple of strategic moves that led to Berkshire owning even more of Apple, he says:

“[Y]ou now indirectly own a full 10% more of Apple’s assets and future earnings than you did in July 2018.”

For that matter, when he talks up the talents and accomplishments of the leaders of some of Berkshire’s companies, he writes:

“When you next fly over Knoxville or Omaha, tip your hat to the Claytons, Haslams and Blumkins …”

The letters and the annual report are about Berkshire Hathaway’s past and future, sure.

But by writing these sections the way Buffett does, he implies that it’s really about his audience. That’s pure emotional intelligence.

2. He displays self-conscious humility.

Buffett does not merely admit errors. He trumpets them sometimes–with humility or humor.

I’ve written separately about how this year’s letter is arguably a narrative description of the long-term ramifications of a single error Buffett made in the 1960s (and that he admits he didn’t finally rectify until about 1985).

But there’s something even more analytical and stark–frankly, the lead of most of the other coverage about it. That’s the big mistake Buffett acknowledges he made.

It has to do with an “ugly $11 billion write-down” that Berkshire was forced to accept. Buffett pulls no punches on himself for this one, calling it:

“almost entirely the quantification of a mistake I made in 2016. That year, Berkshire purchased Precision Castparts (“PCC”), and I paid too much for the company. No one misled me in any way – I was simply too optimistic.”

Of course, Berkshire is a publicly traded company, so you’d never want to paint an artificially rosy picture, or get caught explaining away problems unconvincingly. Better to take it on the chin and move on.

Yet, my sense is that Buffett also understands that at his stage in life, and with the “Oracle of Omaha” moniker, the paradox of humbly rushing to accept blame is that it improves his reputation.

It takes an acute sense of emotional intelligence to realize that. Yet, it’s what this is all about: understanding how you’ll be perceived by the audience, versus how you’d like to perceive yourself.

3. He praises everybody.

Go through the letter, and I don’t think there is a single person whom Buffett mentions by name who does not receive lavish praise in some format.

Literally every name is adorned with complimentary adjectives, with the possible exceptions of the humility and self-deprecating humor with which Buffett talks about himself or Charlie Munger.

· For example, Jack Ringwalt isn’t just described as the founder of National Indemnity in 1940; Buffett describes him as “honest, shrewd, likeable and a bit quirky.”

· Within the company, Ajit Jain and Greg Abel aren’t just vice-chairmen, they’re “invaluable vice-chairmen.”

· Debbie Bosanek isn’t just Buffett’s assistant, she’s his “incredible assistant who joined Berkshire 47 years ago at age 17.”

· Even when he discusses overpaying for PCC — the $11 billion mistake — he describes the company’s CEO, Mark Donegan as: “a passionate manager who consistently pours the same energy into the business that he did before we purchased it,” and says Berkshire is, “lucky to have him running things.”

There’s no reason to mention anyone by name in a letter like this unless he or she is worthy of praise. But, it’s worth noting the cumulative, positive effect on the reader of seeing the praise he lavishes on everyone else.

This habit is easy to copy. When you’re addressing a group, your default position should be to praise the people you mention.

You’re not Hemingway (who famously disdained adjectives). You’re a business leader–and emotionally intelligent leaders know how and why this works.

Good advice

There are other examples of Buffett’s emotional intelligence within the letter, but overall, it’s about the tone and accessibility, and how the whole thing stitches together. So, let’s conclude this by sharing some of the best advice Buffett says he ever got — something that’s squarely in the same realm.

It comes from Thomas Murphy, who was chairman and CEO of Capital Cities/ABC and who still serves on Berkshire’s board. As Buffett recounts:

“He said, ‘Warren, you can always tell someone to go to hell tomorrow.’ It was such an easy way of putting it. You haven’t missed the opportunity. Just forget about it for a day. If you feel the same way tomorrow, tell them — but don’t spout off in a moment of anger.”

An easy way to put it, and a colorful way to articulate one of the key tenets of emotional intelligence. Think before you act, and try not to let emotional reactions overcome your decision-making.

I suppose it shouldn’t be surprising to realize that Buffett manifests it in other ways people probably never notice. He’s a savvy investor and business leader, of course, but these annual letters demonstrate how his personal emotional intelligence is yet another powerful asset in his portfolio. They’re worth studying and imitating in your business.

(Quick reminder, you can download the free ebooks, both the one about Buffett and the one about emotional intelligence, here.)

Inc. helps entrepreneurs change the world. Get the advice you need to start, grow, and lead your business today. Subscribe here for unlimited access.

FEB 28, 2021

Like this column? Sign up to subscribe to email alerts and you’ll never miss a post.

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.