1. Covid Hospital Admissions

https://www.advisorperspectives.com/commentaries/2021/02/26/the-great-jobs-reset

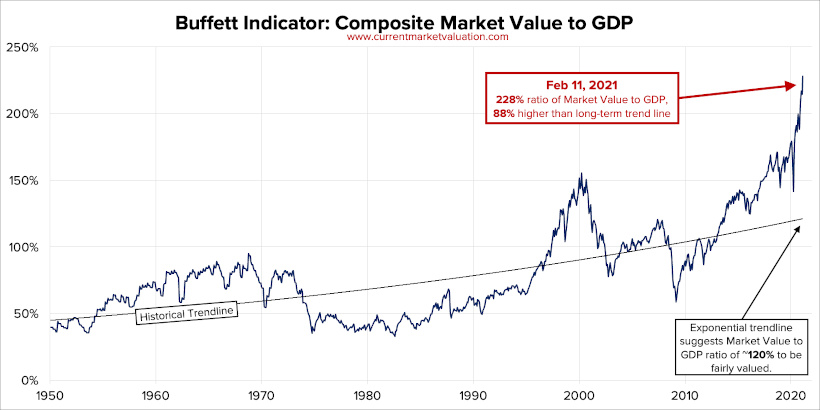

2. A Look at Past Returns When Buffett Indicator Gets this High.

According to Warren Buffett, “if the ratio approaches 200%…you are playing with fire.”

And with the current U.S. ratio sitting at 228%—about 88% higher than historical averages, it certainly looks like things are heating up.

Will History Repeat Itself?

As the popular investing expression goes, the trend is your friend. And historically, the Buffett Indicator has predicted several of America’s most devastating economic downturns.

Here’s a look at some historical moments in the U.S. stock market, and where the Buffett Indicator was valued at the time:

| Date | Event | Buffett Indicator | Value (+/- Trendline) |

| October 1987 | Black Monday | Fairly Valued | -13% |

| March 2000 | Dotcom Bubble | Strongly Overvalued | +71% |

| December 2007 | Pre-Financial Crisis | Fairly Valued | +18% |

| March 2009 | Financial Crisis Bottom | Undervalued | -46% |

| February 2020 | COVID-19 | Overvalued | +49% |

| February 2021 | Today | Strongly Overvalued | +88% |

As the table shows, the ratio spiked during the Dotcom Bubble, and was relatively high in the months leading up to the 2008 financial crisis. But does that mean we should take the ratio’s current spike as a warning for a market crash in the near future? According to some experts, we might not need to sound the alarms just yet.

Why are some investors so confident in the current market? One main factor is low interest rates, which are expected to stay low for the foreseeable future.

When interest rates are low, borrowing money becomes cheaper, and future real earnings are theoretically worth more, which can have a positive impact on the stock market. And low interest rates mean smaller returns for low-risk assets like bonds, which lowers investor demand and ultimately boosts stock prices further. Meaning that, as long as interest rates are at record lows, the Buffett Indicator will likely stay high.

However, history has been known to repeat itself. So, while we might not need to fasten our seatbelts just yet, this historically high ratio is certainly worth paying attention to.

Article by Visual Capitalist

https://www.valuewalk.com/buffett-indicator-all-time-highs/

3. Incomes in U.S. Surging

Booming Incomes Charlie Bilello–Speaking of inflation, incomes in the US saw another surge higher as the 2nd round of stimulus payments take hold.

In an unexpected twist, the pandemic has been an enormous economic boost for the vast majority of households as more than one hundred million Americans who never lost their job have received free money payments. Real incomes are up over 10% in the last year alone.

Incomes will see another boost higher soon with the House passing another $1.9 trillion stimulus bill this week. While the Senate could still make changes, free money payments in the latest bill are expected to be highest to date ($1,400 per individual for most Americans – family of 4 receiving $5,600).

https://compoundadvisors.com/2021/6-chart-saturday-2-27-21

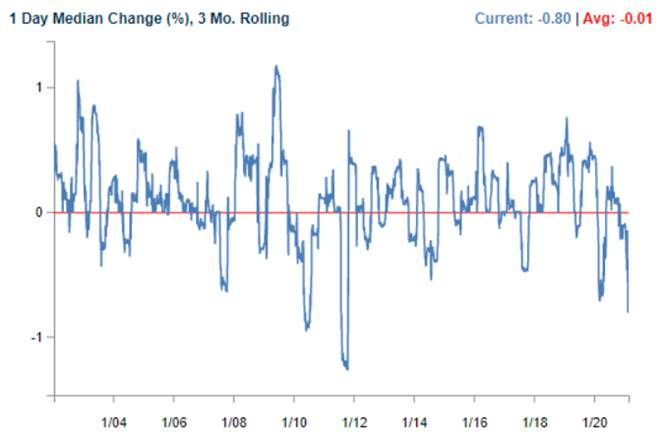

4. Earnings Season-Stocks have Seen Their Worse One-Day Share Reaction Since 2011

As Earnings season winds down, Bespoke notes Over the last three months, stocks reporting earnings have seen their worst one-day share price reactions since late 2011

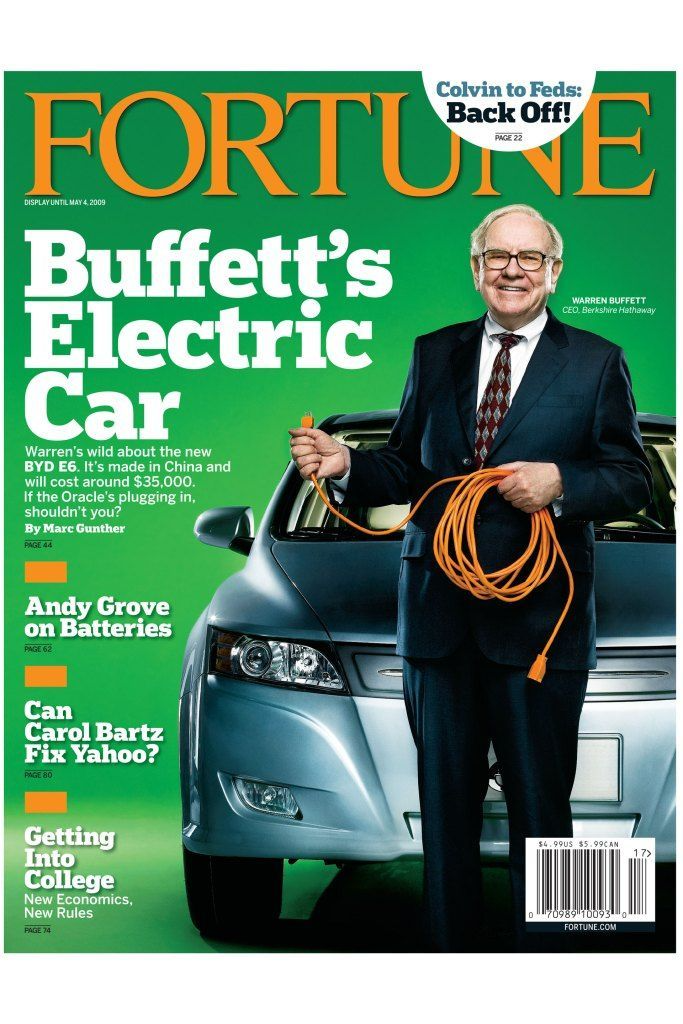

5. Buffett BYD EV Bet from 2009 Now Paying Off.

BYDDF—Chinese Battery Supplier

©1999-2021 StockCharts.com All Rights Reserved

Fortune Cover 2009

The April 27, 2009 cover of Fortune Magazine.

In late 2008, Berkshire Hathaway ponied up the aforementioned $232 million for a roughly 10% stake in BYD. As Buffett recalled, Berkshire initially tried to buy 25% of the company, but Wang refused to release more than 10% of BYD’s stock. “This was a man who didn’t want to sell his company,” he told Fortune. “That was a good sign.”

It has proved to be money well spent. As the EV market has exploded in China, BYD has developed into a major player in the world’s largest car market; it sold more than 130,000 battery-powered electric vehicles last year as it competes for market share with rival EV makers like Wuling, NIO, and, of course, Tesla.

As BYD has grown, so has the value of Berkshire Hathaway’s investment. By late 2018, 10 years after cutting that $232 million check, Berkshire’s stake in the company had swollen to roughly $1.6 billion. Since then, that figure has climbed exponentially amid the Chinese EV market’s rapid expansion and a remarkable fourfold increase in BYD’s Hong Kong–traded shares last year: Berkshire Hathaway’s 8.2% stake in the automaker held a market value of $5.9 billion at the end of 2020, per Buffett’s letter to Berkshire shareholders on Saturday.

That means that BYD was Buffett’s eighth-largest holding by market value at the end of last year, and makes it a more valuable investment for the Oracle of Omaha than his stake in that grand old name of American carmaking, [hotlink]General Motors[/hotlink]. (Berkshire’s 3.7% stake in GM was valued at $2.2 billion as of Dec. 31.) Of course, GM is only just accelerating its push into the realm of electric vehicles, whereas BYD has been bracing for an EV-motored future for the past decade and a half—a vision that is now bearing fruit for Buffett, Munger, and their own investors at Berkshire Hathaway.

13 years after investing in an obscure Chinese automaker, Warren Buffett’s BYD bet is paying off big

Rey Mashayekhi

https://finance.yahoo.com/news/13-years-investing-obscure-chinese-153511593.html

6. Tesla’s market share in Europe keeps crumbling, as China reclaims top spot in global EV race

Last Updated: March 2, 2021 at 4:46 a.m. ETFirst Published: March 1, 2021 at 4:03 p.m. ET

By Jack Denton

Volkswagen Group sold the most electric vehicles of any company in the key European market in January 2021

Tesla typically delivers fewer cars to Europe in the first month of each quarter.

(PHOTO BY JOHANNES EISELE/AFP VIA GETTY IMAGES)

Tesla’s share of the critical European battery-electric-vehicle market crumbled in the first month of 2021, and China has taken the top spot from Europe in the EV race, according to new research.

Tesla’s TSLA, -3.47% trajectory in Europe is in decline. There were 1,619 registrations of Tesla’s battery-electric vehicles in 18 key European markets in January, representing 3.5% of all battery-electric vehicles registered that month, according to a report based on public data by automotive analyst Matthias Schmidt. In 2020, the U.S. car maker saw 1,977 vehicles registered in January—more than a 5% market share.

Those 18 markets include the European Union states—minus 13 countries in Central and Eastern Europe—as well as the U.K., Norway, Iceland, and Switzerland.

Schmidt called Tesla’s January performance “consistently low,” noting that the company’s European delivery schedule sees volumes peak at the end of each quarter. However, the analyst noted that Tesla’s 12-month rolling volumes have now fallen behind Hyundai 005380, +0.84% and Kia 000270, +0.88%, which are now the third-most popular EV group in Europe.

Tesla comfortably topped the European EV charts in 2019. It sold more than 109,000 vehicles that year, making up 31% of the region’s battery-electric-vehicle market. But the tide turned in 2020, with Tesla dropping behind both the brands of Volkswagen Group VOW, 1.49% and the alliance between Renault RNO, -0.57%, Nissan 7201, +0.26%, and Mitsubishi 8058, -0.78%.

Last year, Tesla made up just 13% of the European market despite a smaller proportional decline in the number of vehicles it sold—around 10%—from 109,000 in 2019 to nearly 98,000 in 2020.

According to Schmidt, who publishes the European Electric Car Report, it was the introduction of emissions targets, and the specter of massive fines, that accelerated the European car makers’ battle against Tesla for dominance.

More broadly in January, China raced past Europe to reclaim its crown as the world’s largest market for electric vehicles. There were 179,000 battery-electric and plug-in hybrid electric vehicles registered in China in January, compared with 110,000 in Europe.

The boost in China comes after a standout year for Europe. There were 1.33 million electric-vehicle registrations in Europe in 2020, topping 1.25 million in China, amid a pedal-to-the-metal push to increase EV adoption from European governments and supercharged demand from consumers.

China is home to a strong domestic electric-vehicle sector, including manufacturers Nio NIO, -12.92%, Xpeng XPEV, -10.97%, and BYD 1211, +0.75%.

Schmidt’s report shows that Volkswagen Group, which manufactures VW, Audi, Skoda, Seat, and Porsche, remains the most popular battery-electric vehicle group in Europe, with more than 22% of the market share after 10,193 of its vehicles were registered.

Plus: Audi is betting on the luxury market in a new electric-vehicle venture with China’s oldest car maker

It is closely followed by Stellantis STLA, 1.10%, a group formed earlier this year through the merger of PSA—which included Peugeot and Citroën—and Fiat Chrysler. Stellantis sold 9,005 vehicles.

Behind Stellantis is Hyundai and Kia, increasingly popular in Europe, which had 7,087 registrations. That puts the Korean group ahead of the Renault-Nissan-Mitsubishi Alliance, with 6,018 registrations, though Renault’s Zoe remained the most popular battery-electric vehicle in Europe in January.

Then comes Mercedes-owner Daimler DAI, 2.49%, BMW BMW, 0.64%, and Volvo VOLV.B, 0.59%, all with registrations ahead of Tesla in the first month of the year.

Germany remained the single largest market within Europe for electric vehicles. The 16,315 battery-electric vehicles registered in the country in January were more than the totals of the next-two largest markets, France and the U.K., combined.

7.Average Inflation by Spending Category

From Michael Batnick Twitter

https://twitter.com/michaelbatnick/status/1366876514327945220/photo/1

8. Canada Second Highest Debt to GDP

9. 30-39 Year Old Millennials Leading Demographic….Good for Housing.

This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group last decade (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group peaked in 2018 / 2019 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak around 2023.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over this decade.

This demographics is now positive for home buying, and this is a key reason I’ve expected single family housing starts to increase this decade.

https://www.calculatedriskblog.com/2021/03/demographics-renting-vs-owning.html

10. These 2 Guys Have a Vision for the Post-Covid Workplace: Barbecue, Bike Rides, and Fiber-Optic Cable

This posh co-working space in New York’s Hudson Valley wants to redefine work-life balance. Is this the future of work?

Workspace booths in the Hudson, New York, Barnfox. Courtesy company

You’d think a co-working space opened a month before a global pandemic would be a sure failure. But for co-founders Frederick Pikovsky and Tim Tedesco, the pandemic didn’t halt their business. It instead helped solidify their vision for the future of work: remote co-working outside city centers that redefines work-life balance.

“You can get out of the city, get out into nature, do outdoorsy stuff, and enjoy small-town living without missing a beat when it comes to work,” says Pikovsky.

The two partners met on the Facebook housing-search group Gypsy Housing in 2017 and bonded over a shared passion for the outdoors and escaping the city. They set out to build a co-working space that would support a lifestyle that embraced nature and community.

They called it Barnfox and opened their first location in February 2020 in Hudson, New York, a popular weekend destination with a Manhattan-bound train line, a variety of cafés and restaurants, and a growing residential population. Soon after, they added a second location in Kingston, New York.

Barnfox co-founders Frederick Pikovsky (left) and Tim Tedesco (right).COURTESY COMPANY

“It’s ‘cabin in the woods’ meets ‘lounge space of a Manhattan hotel lobby,’ with some mid-century modern flair in there,” says Tedesco, who had run a small furniture-design company. He designs the Barnfox spaces and builds much of their interiors himself.

The partners see Barnfox as the new model for co-working: a flexible space with popular amenities outside of a city center. They’re betting that in the new remote-work era, professionals will try to strike a balance of work and pleasure–and, if not move out of the city, certainly escape it more often.

The idea is for members to feel like they’re in nature, while still having all the comforts of a co-working space that you’d find in a city, like fiber-optic internet, snacks, cold-brew coffee, and kombucha on tap. Full membership is $325 per month or $2,500 for the year. It includes a lounge and bar, conference rooms, phone booths, printing services, and lower local hotel rates. While a person has to apply to become a member, most everyone is accepted, and the applications are more to “get a feel for who’s joining,” says Pikovsky, who had launched the Brooklyn co-working space Dumbo Startup Lab, which he left in 2013. (It closed two years later.)

Members are invited to workshops and events, such as weekly bike rides, barbecues, and other casual get-togethers. Most have taken place outside because of Covid precautions. In more outdoor-friendly months, it’s like “an adult summer club,” says Pikovsky. Barnfox plans to apply for liquor licenses after the pandemic subsides, maybe in the next year, he says.

Barnfox has attracted more than 100 members, most locals or New York City residents living in their second homes during Covid, according to the partners. The original concept was to cater to New Yorkers with summer homes or vacationers looking for a workspace away from the city. What the co-founders didn’t expect was an influx of city dwellers relocating for good because of the pandemic.

The build-out cost a combined total of $400,000 for both the 1,500-square-foot Hudson location and the 3,200-square-foot Kingston location.The first location became profitable within four months. While they have bootstrapped, Pikovsky says, they’re looking for funding. Their first investment may come from a group of three Barnfox members.

The common area of the Barnfox in Kingston, New York.COURTESY COMPANY

Kianga Daverington, managing partner and chief investment officer at Acre of America; clean energy investor Nathaniel Doyno; and impact investor Christopher Lindstrom came together to form a $50 million opportunity fund to help create new high-paying jobs in the Hudson Valley and support the area’s residents and businesses.

“Without Barnfox, and especially during a pandemic, we may never have so quickly been able to put together a team and a plan that’s going to have the right kind of impact in this region,” says Daverington, whose investment firm focuses on distributed-ledger technology for rural communities. The fund is still being set up, and discussions with Barnfox are under way.

To be sure, other co-working companies have struggled through the pandemic. Most notably, the U.S. business of co-working startup Knotel filed for Chapter 11 bankruptcy protection in January as new leasing and renewals dwindled. The once-high-flying WeWork is reported to be losing money, saddled with heavy lease commitments, although it is expected to go public through a special-purpose acquisition company.

Even so, as more employers embrace remote options for their post-pandemic workforces, the Barnfox team is looking to expand. A third, 2,500-square-foot location is scheduled to open in June in Livingston Manor, a small town in the Catskill Mountains. It’s also eyeing a fourth location, its biggest, at up to 6,500 square feet, in Beacon, New York. Eventually, the co-founders say, they plan to open more locations in rural and weekend destinations across the U.S. They’re targeting places within two hours from such city hubs as Los Angeles, San Francisco, Austin, and Denver, and particularly in opportunity zones, which are economically distressed areas designated to spur investment and jobs through tax advantages.

“Eventually, I’d like people to use our spaces anywhere around the world. We want to exist in destinations that people visit, and sometimes stay, whether that’s a weekend sort of destination or quick getaway,” says Pikovsky. The time just may be ripe for nimble and strategic startups offering flexible remote workplaces to thrive.

https://www.inc.com/brit-morse/barnfox-frederick-pikovsky-tim-tedesco-coworking.html

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.