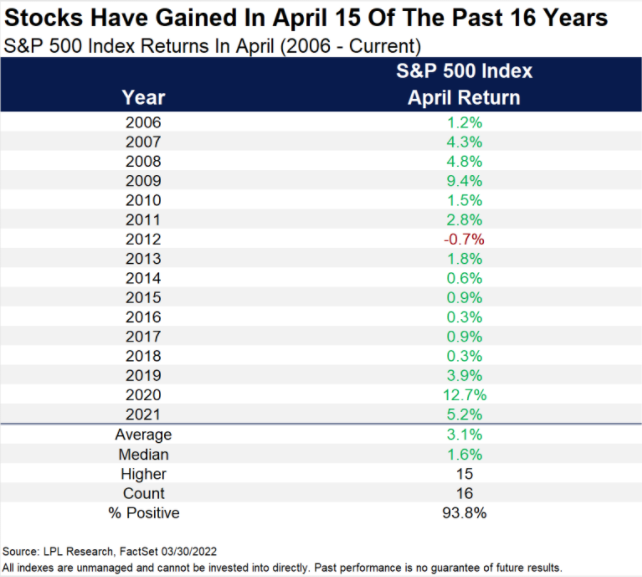

1. Stocks Have Gained in April 15 of Past 16 Years

LPL Research

https://Iplresearch.com/2022/03/30/here-comes-the-best-month-of-the-year/

2. Emerging Markets Closed Below 200day Moving Average on Long-Term Weekly Chart

3. Chief Investment Officer Survey

CNBC

Maggie Fitzgerald@MKMFITZGERALDPatric

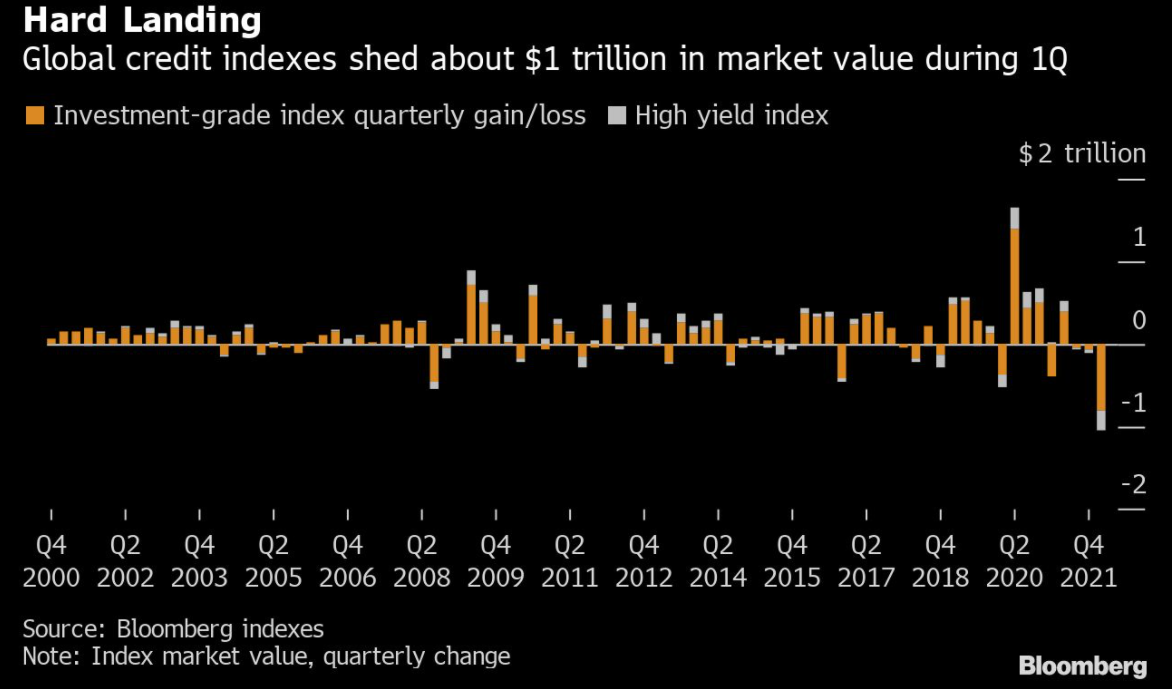

4. Investment Grade Debt Biggest Dollar Decline Ever

Advisor Perspectives-The slump marked the biggest total return loss for high-grade bonds since Lehman Brothers’ collapse, and the worst junk performance since the start of the pandemic. The U.S. investment grade market alone saw about $440 billion in market value erased and is on track for the biggest three-month slump since 1980.

Global Corporate Bonds Lost $1 Trillion, and Risks Are Risingby Tasos Vossos, Hannah Benjamin, Jack Pitcher, 3/30/22 https://www.

5. Yield Curve Inversions and SPX Returns

Posted on March 30, 2022 by Rob Hanna

There has been a lot of talk recently about yield curve inversions and whether that means a recession is on the way, and how soon? And if there is a recession, will there also be a bear market? I decided to forget about economic forecast and just look at how the SPX did after a curve inversion. I looked at both the 2yr/10yr and the 3mo/10yr combinations. For the study I used Norgate Data, and looked back as far as my database went, which was 1976 for the 2yr rate and 1981 for the 3mo. Results can be found below.

Note that 21 trading days is approximately 1 month. So 42 days is two months, 126 days is 6 months, 252 days is a year…you get it.

Not many instances to build out a case here. Some good and some bad numbers. More bullish than bearish. Overall, the initial inversion does not seem to be a great timing signal. Academics can argue and tv talking heads can blather about potential consequences, but traders should probably look to better timing devices to make their market judgements. I don’t see myself factoring this into any trading decisions.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

https://quantifiableedges.com/

6. Two Week Short Squeeze?

Zerohedge

https://www.zerohedge.com/markets/bonds-bullion-black-gold-bid-putin-sparks-stock-skid

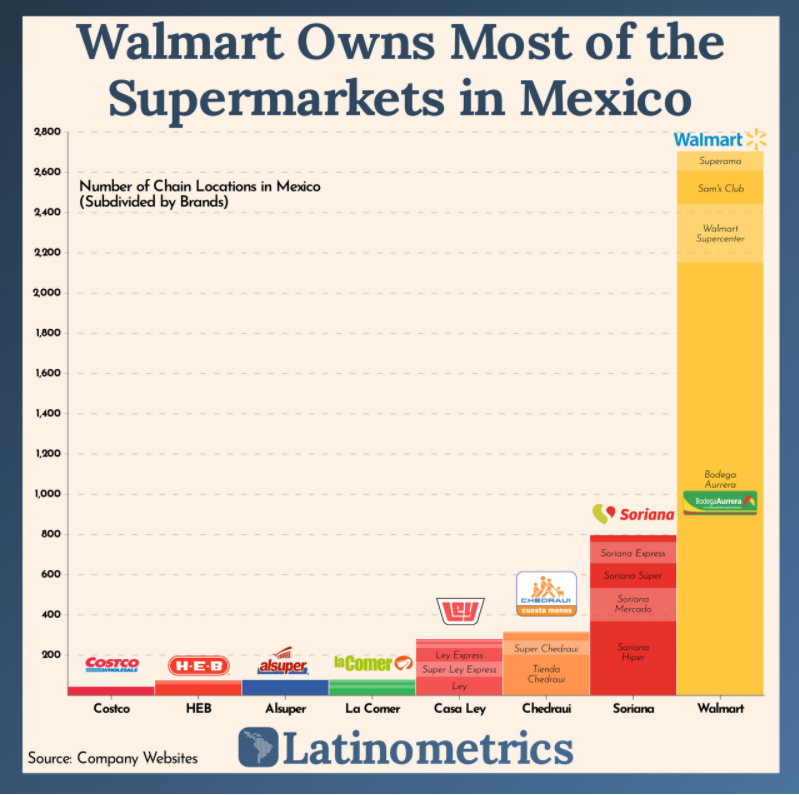

7. Walmart Owns Most of Supermarkets in Mexico

VisualCapitalist-Mexico’s Relationship with Walmart-When it comes to supermarkets in Mexico, no single company comes close to matching the reach of Walmart. Also the world’s largest company by revenue, Walmart has over 2,700 stores in the country, including chains it owns such as Sam’s Club and Bodega Aurrera. The latter is both the largest supermarket within the Walmart category, and also the most popular in Mexico.

https://www.visualcapitalist.com/cp/walmart-owns-most-of-the-supermarkets-in-mexico/

8. Fertilizer Prices Huge Rally but Only Back to Pre-Covid Levels

Barrons

How Putin’s War Made These 3 Fertilizer Producers Hot Stocks-By Craig Mellow https://www.barrons.com/

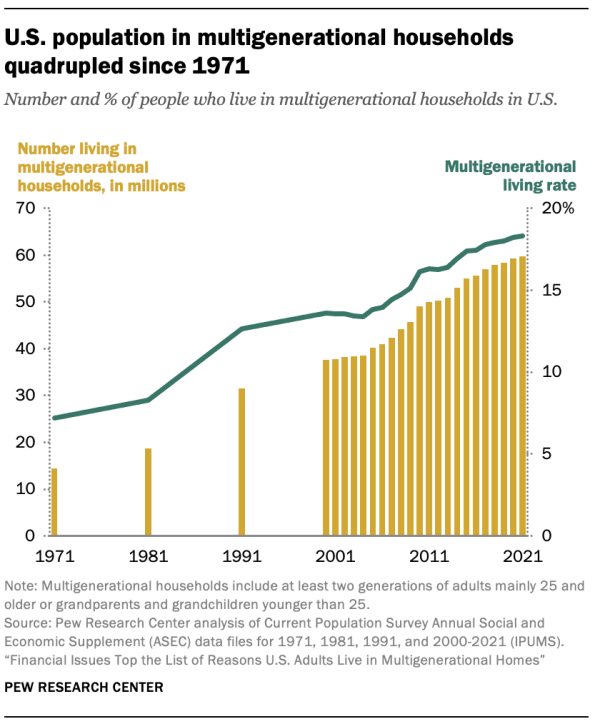

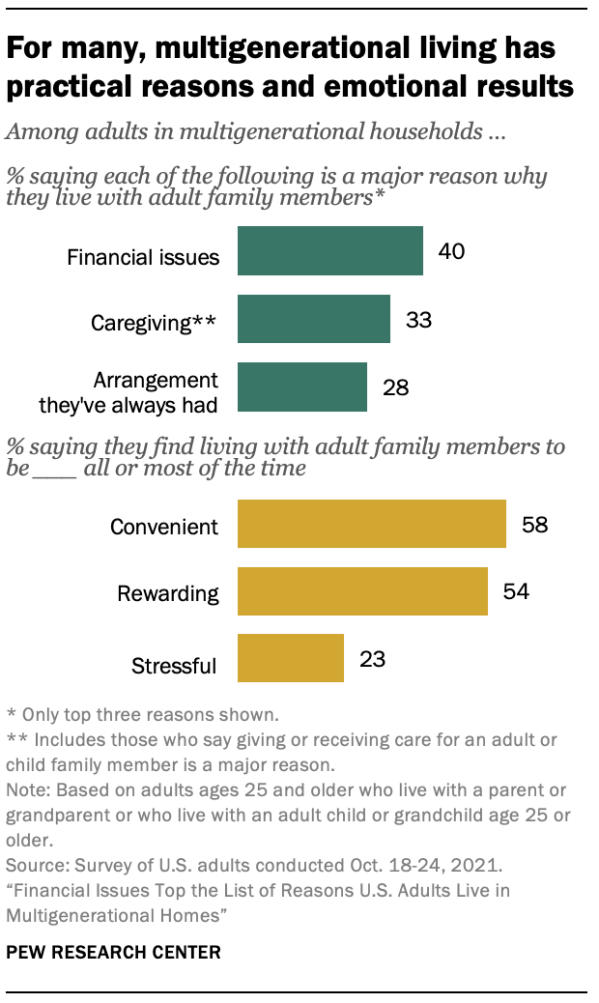

9. U.S. population in multigenerational households quadrupled since 1971

Pew Research

For many, multigenerational living has practical reasons and emotional results

U.S. population in multigenerational households quadrupled since 1971 | Pew Research Center

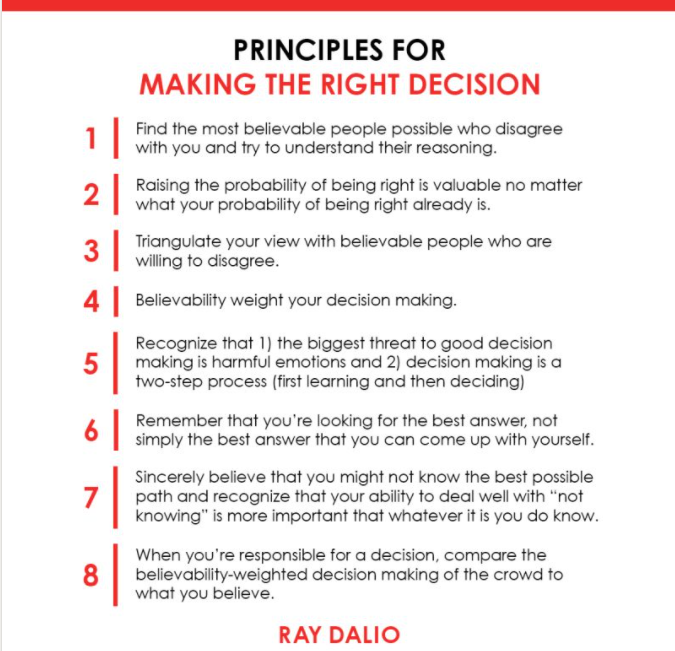

10. Principles For Making the Right Decision

https://www.linkedin.com/in/raydalio/