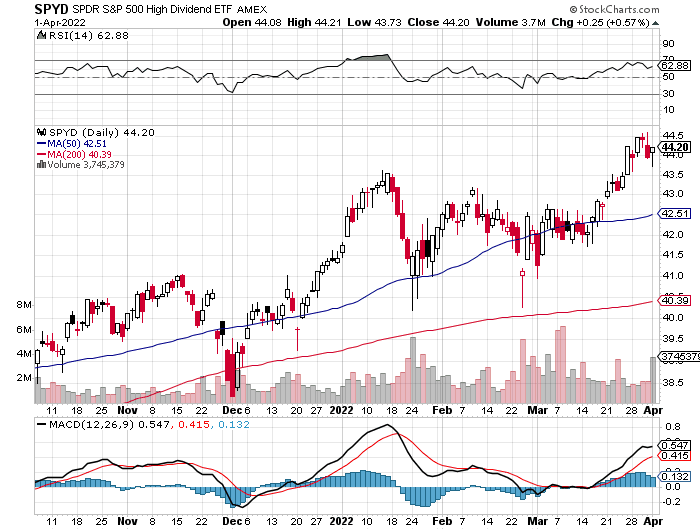

1. High Yield Stock Index Trading at Discount

Barrons-Start with common dividends. Five years ago, the S&P 500 index traded at 18 times forward earnings, and the index’s high-yield stocks went for about the same price. Now, investors can pay 20 times this year’s earnings for the S&P index, or 13 times for its high-yielders. One fund that tracks them is the SPDR Portfolio S&P 500 High Dividend exchange-traded fund (SPYD). It yields 3.8%.

https://www.barrons.com/articles/stocks-yields-51648852945?mod=past_editions

2. Price to Book Valuations Vs. Historical

Top Down Charts Blog-Price to Book Valuations: S&P 500 price to book ratios still at eye watering levels.

Correction barely put a dent in valuations: Upper Quartile of industries are trading at price to book ratios *higher* than that seen during the dot com bubble, and this is despite a (minor) reset. Even the Lower Quartile is at the upper end of the range, and last but not least: the Median is well above that ever seen in recent history.

Source: Chart of the Week – Vertiginous Valuations

3. JP Morgan Valuation Update March 31

4. Lithium Prices +441% in One Year

The February reading for the lithium price index, which is tied to the global weighted average price for lithium carbonate and hydroxide—two primary lithium chemicals—stood at 869.2, up 88% so far this year, and up by a whopping 441% from the same time a year ago, according to data from Benchmark Mineral Intelligence. By Myra P. Saefong

https://www.barrons.com/articles/ev-demand-lithium-prices-51648710901?mod=past_editions

https://tradingeconomics.com/commodity/lithium

5. Intermediete Term Momentum Positive…Nasdaq Had 10% Rally in 10 Trading Sessions

Bloomberg-Last week, 80% of the roughly 2,000 constituents of the NYSE Composite Index — which spans all common stocks listed on the New York Stock Exchange — traded above their 20-day averages. That’s happened 56 times in the last decade, and over the subsequent 100 days after these occurrences, the gauge climbed an average 6%, according to data compiled by Bloomberg.

The technology-heavy Nasdaq 100 index is also flashing some positive signals. In mid-March, it rallied more than 10% over four trading sessions. Four-day gains of at least 10% are rare, occurring 12 times in the last two decades, according to data compiled by Bloomberg. Over the subsequent 100 days, the index returned an average of 8%.

Tech Jump

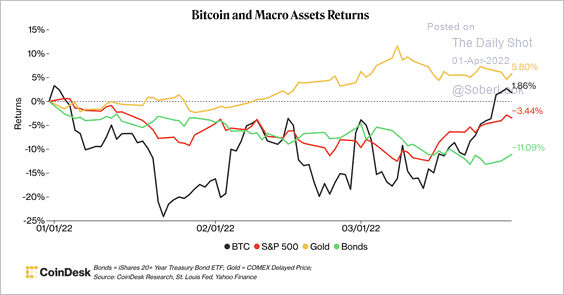

6. Bitcoin Now Outperforming S&P YTD

Cryptocurrency: Bitcoin is outperforming the S&P 500 so far this year but has lagged gold.

Although, altcoins outperformed bitcoin in March, indicating a stronger appetite for risk among crypto traders.

From The Daily Shot Blog https://dailyshotbrief.com/the-daily-shot-brief-april-1st-2022/

7. Rise in Average Monthly Mortgage Payments

NYT- In February, according to the Mortgage Bankers Association, the median monthly payment on a new mortgage application in America jumped more than 8 percent in just one month. That spike points to an entirely new and unpredictable phase in what has been a jaw-dropping housing market.

By Emily Badger and Quoctrung Bui https://www.nytimes.com/2022/03/31/upshot/home-prices-mortgage-rates.html

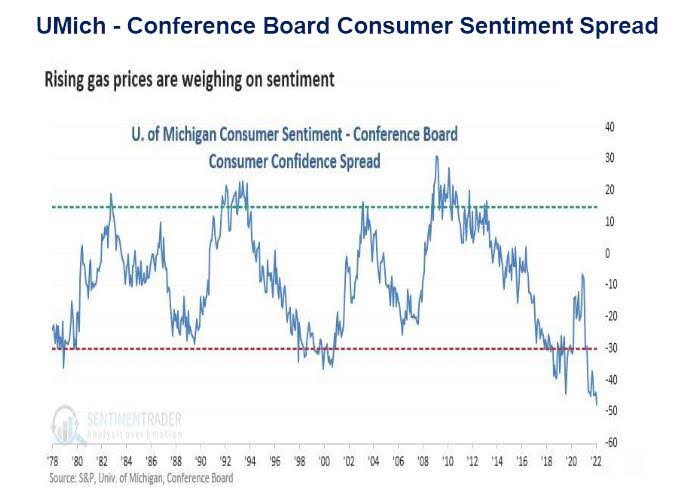

8. Inflation Huge Negative for Consumer Sentiment

Found at Zerohedge

9. U.S. Military Spending vs Other Top Countries

Source: Visual Capitalist

From Barry Ritholtz Blog https://ritholtz.com/2022/04/weekend-reads-510/

10. 10 Lessons from Great Businesses

After publishing over half a million words on some of the world’s most innovative businesses, these are the 10 lessons I come back to again and again. You’ll find tactics from Stripe, FTX, Tiger Global, OpenSea, and other exceptional organizations.

Actionable insights

If you only have a couple of minutes to spare, here are ten lessons from great businesses that investors, operators, and founders should know.

- Be a painfully persistent recruiter (Stripe)

- Maximize deep work time (Levels)

- Obsess over your customer (Coupang)

- Align the incentives (AngelList)

- Think like a nation-state (Terra)

- Invest in soft-power (FTX)

- Preserve optionality (OpenSea)

- Intensify your advantages (Tiger Global)

- Find your counter-positioning (Telegram)

- Proactively reinvent yourself (Many)