1. ”Real” Rates Not Near Recession Levels.

Dave Lutz at Jones Trading-“Real rates are staying very accommodative, which tends to go against the recession trade. They averaged +200bp at the time of past curve inversions, vs current negative. One doesn’t tend to have a recession from the starting point of outright negative real rates“ – JPMorgan

2. Platinum and Palladium Big Corrections

Platinum -17% Correction

Palladium -40% Correction

3. Brazil Stock Market +35% Year to Date

EWZ Brazil ETF-20% Move Up in 10 Days…50day thru 200day to upside

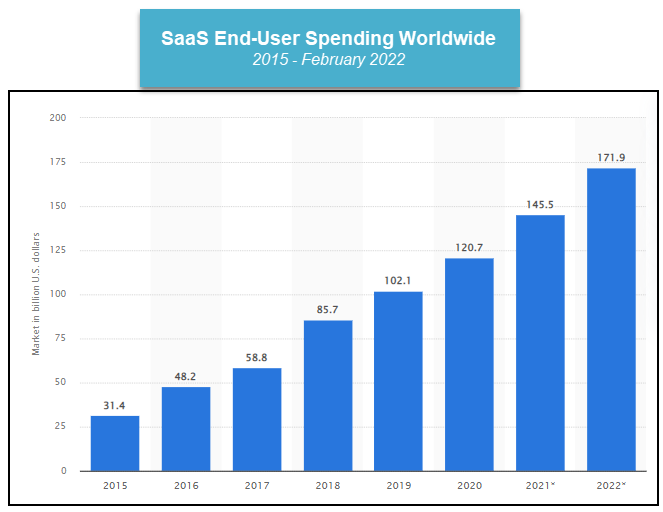

4. Software as Services (SaaS) Worldwide End-User Spending

Many of the fastest-growing companies within the technology sector over the past few years have implemented the Software-as-a-Service (SaaS) software licensing model, which allows users to access the software through a subscription-based internet platform instead of downloading programs. This business model makes software easier to scale, as there are fewer barriers to entry for new customers. The recurring revenue generated by subscription-based services also makes SaaS companies more attractive to potential investors. The past few years have seen a rapid appreciation in the value of many of these companies, with the seemingly endless availability of capital that was partially the result of massive global economic stimulus after the pandemic-induced decline. Many SaaS companies also benefited from the work-from-home investment theme, as internet-based platforms allowed for easier transitions between working environments.

https://www.nasdaq.com/solutions/nasdaq-dorsey-wright

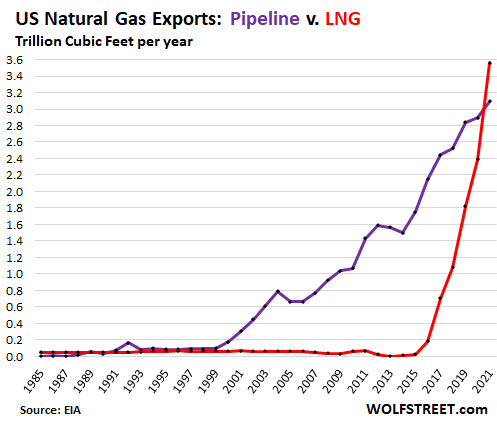

5. Exports Via LNG Exceed Pipeline for First Time in 2021

Exports via LNG (red line) in 2021 exceeded pipeline exports (purple line) for the first time:

US Natural Gas Production and LNG Exports amid Urgent Demand for LNG from Europeby Wolf Richter https://wolfstreet.com/2022/

6. Best Performing Commodity ETFs this Year

Best Performing Commodity ETFs Of The Year (ex. leveraged/inverse)

https://www.etf.com/sections/

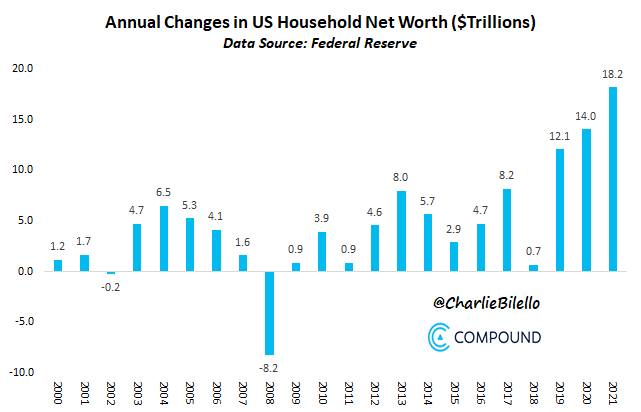

7. $18 Trillion Increase in Household Net Worth 2021

The Free Money Effect-The significant increase in US home prices (Case Shiller National Index up 19%) combined with a roaring stock market (S&P 500 up 29%) lead to an $18.2 trillion increase in US Household Net Worth during 2021. This was the third consecutive year of record highs, an unfathomable outcome when the pandemic first hit in early 2020.

https://twitter.com/charliebilello?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

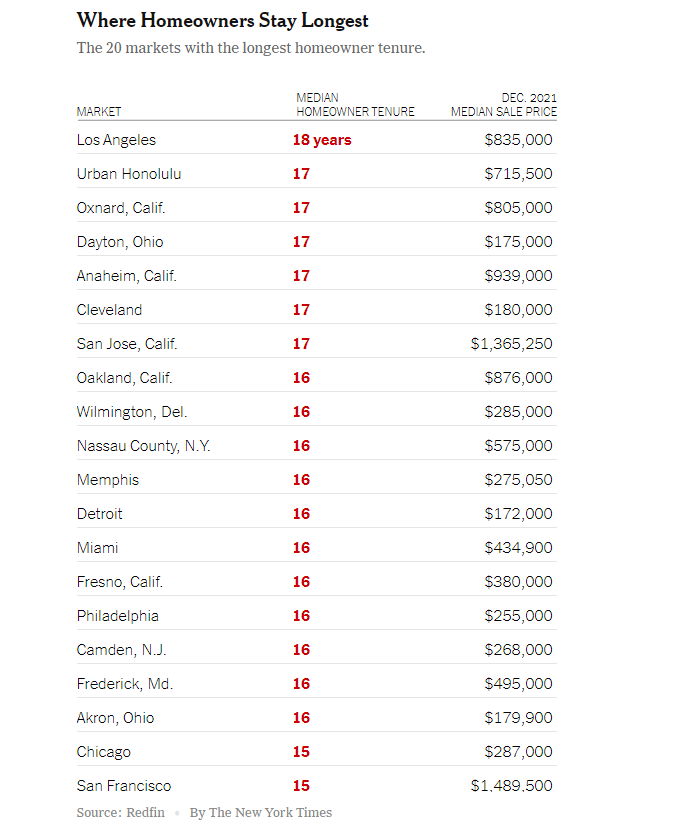

8. Where Do Homeowners Stay in Their Homes the Longest?

Across the nation, people are staying in their homes for less time than they did even a year ago.

With about half the number of homes available on the market as there were two years ago, many frustrated buyers are wondering when more owners will be ready to sell. A new study by Redfin shows that it may be starting to happen — although homeowners are still staying in their homes much longer than they did a decade ago.

The study found that U.S. homeowner tenure dipped a bit in November 2021, when the typical homeowner had spent 13.2 years in their home — down from 13.5 years in November 2020, and the first drop in tenure length since 2012, when the average was 10.1 years. The recent dip may be the result of owners cashing in on high prices, and by the scores of remote workers opting to relocate during the pandemic.

But it’s unclear if the market is really at a turning point. In some areas, homes are being held far longer than the national average. In the Los Angeles market, homes have typically sold every 18 years, the longest homeowner tenure in the country; in fact, seven California locales are among the top 20 in which people stay put longest.

One reason could be a misunderstanding of the state’s Proposition 13. Under the law, property taxes are kept low for homeowners for as long as they stay in the home, and only rise again when they sell it, reflecting its higher value. Fearful their next purchase will come with much higher taxes, a growing population of older Californians has stayed in place, Redfin suggests. But changes to the law now allow those seniors to transfer their lower tax rate to a new home. When this is more widely understood, California homeowner tenure could slide.

Redfin’s study shows that Midwest cities — Chicago, St. Louis and Detroit among them — saw the greatest increases in tenure, while popular destinations like Las Vegas, Atlanta and Tampa, Fla., saw the greatest decreases. This week’s chart, based on the study, shows where people stay put the longest, as well as the local median sale prices.

Where Homeowners Stay Longest

Source: Redfin

By The New York Times

For weekly email updates on residential real estate news, sign up here. Follow us on Twitter: @nytrealestate.

A version of this article appears in print on March 27, 2022, Se

https://www.nytimes.com/2022/03/24/realestate/where-do-homeowners-stay-in-their-homes-the-longest.html

9. PPP Fraud…Estimates Between $70-80B

The Biggest Fraud in American History-NBC News By Ken Dilanian and Laura Strickler

They bought Lamborghinis, Ferraris and Ben

And Teslas, of course. Lots of Teslas.

Many who participated in what prosecutors are calling the largest fraud in U.S. history — the theft of hundreds of billions of dollars in taxpayer money intended to help those harmed by the coronavirus pandemic — couldn’t resist purchasing luxury automobiles. Also mansions, private jet flights and swanky vacations.

They came into their riches by participating in what experts say is the theft of as much as $80 billion — or about 10 percent — of the $800 billion handed out in a Covid relief plan known as the Paycheck Protection Program, or PPP. That’s on top of the $90 billion to $400 billion believed to have been stolen from the $900 billion Covid unemployment relief program — at least half taken by international fraudsters — as NBC News reported last year. And another $80 billion potentially pilfered from a separate Covid disaster relief program.

The prevalence of Covid relief fraud has been known for some time, but the enormous scope and its disturbing implications are only now becoming clear.

said Mustafa Qadiri, 38, of Irvine, Calif., used money from the Paycheck Protection Program to buy three cars that cost six figures apiece, including this 2011 Ferrari 458 Italia.U.S. Attorney’s Office, Los Angeles

Even if the highest estimates are inflated, the total fraud in all Covid relief funds amounts to a mind-boggling sum of taxpayer money that could rival the $579 billion in federal funds included in President Joe Biden’s massive 10-year infrastructure spending plan, according to prosecutors, government watchdogs and private experts who are trying to plug the leaks.

“Nothing like this has ever happened before,” said Matthew Schneider, a former U.S. attorney from Michigan who is now with Honigman LLP. “It is the biggest fraud in a generation.”

Most of the losses are considered unrecoverable, but there is still a chance to stanch the bleeding, because federal officials say $600 billion is still waiting to go out the door. The Biden administration imposed new verification rules last year that administration officials say appear to have made a difference in curbing fraud. But they acknowledge that programs in 2020 sacrificed security for speed, needlessly.

Justice Department Inspector General Michael Horowitz, who oversees Covid relief spending, told “NBC Nightly News” anchor Lester Holt in an exclusive interview that Covid relief programs were structured in ways that made them ripe for plunder.

“The Small Business Administration, in sending that money out, basically said to people, ‘Apply and sign and tell us that you’re really entitled to the money,’” said Horowitz, the chair of the Pandemic Response Accountability Committee. “And, of course, for fraudsters, that’s an invitation. … What didn’t happen was even minimal checks to make sure that the money was getting to the right people at the right time.”

The criminal methodology varied depending on the program. The epic swindle of Covid unemployment relief has been carried out by individual criminals or organized crime groups using stolen identities to claim jobless benefits from state workforce agencies disbursing federal funds. Each identity could be worth up to $30,000 in benefits, Horowitz said.

The looting of the Paycheck Protection Program worked differently — and it could be far more lucrative. The program authorized banks and other financial institutions to make government-backed loans to businesses, loans that were to be forgiven if the companies spent the money on business expenses. Nearly 10 million such loans have already been forgiven. Many of the loans-turned-grants were for millions of dollars, public records show.

Experts say millions of borrowers inflated their numbers of employees or created companies out of whole cloth. For much of 2020, lenders did little to verify the applications, prosecutors and experts say, in part because Congress required the Small Business Administration, or SBA, which ran the program, to issue explicit guidance that in the interest of getting the money out fast, lenders “will be held harmless for borrowers’ failure to comply with program criteria.” The Government Accountability Office warned of fraud risk, but the program continued under that rule.

“The government spent approximately $800 billion and provided 21 million loans to individuals,” said Haywood Talcove, the CEO for government at LexisNexis Risk Solutions, which works with the government to verify identities.

No one is sure exactly how much was stolen. An academic paper released last year estimated at least $76 billion in potential fraud, and the authors said that was conservative.

The SBA’s inspector general has identified $78.1 billion in potentially fraudulent Economic Injury Disaster Loans, another Covid relief program for businesses. The Secret Service has its own estimate: $100 billion.

‘Biggest fraud in a generation’: The looting of the Covid relief program known as PPP (nbcnews.com)

10. The Psychology of Jury Selection

How jurors are vetted by psychologists. Lori Kinsella J.D., PsyD.

The study of forensic psychology involves the application of clinical specialties, research and experimentation in psychology to the legal arena. (1).

One of the most observable and public intersections of law and psychology is in jury selection and jury consulting. Lawyers hire private jury consulting firms to help them examine potential jurors for trials in both criminal and civil matters. Jury consultants are usually psychologists and sociologists who specialize in interviewing, examining and analyzing potential jurors to determine how a jury is likely to react to parties and their claims.

Psychological Examinations of Jurors

The psychological examination of a jury pool, a process called voir dire, is often done by the lawyers and judge in most cases. In some cases, jury consultants are hired by lawyers in high profile or complex litigation. The basic purpose of voir dire is to determine if any particular potential juror has biases which may prejudice his or her decisions as a juror. The questions for the jurors are designed to reveal if a juror would be fair and impartial. The jurors may be personally interviewed or they may be asked to complete juror questionnaires which are analyzed by psychologists (jury consultants) who assign ratings to inform the lawyers on which potential jurors are likely to be fair and which are not. The questions can examine a juror’s potential racial or religious bias, personal experiences, socio-economic status, personal history and outlook and many other factors.

In both civil and criminal cases, attorneys on both sides of the docket probe prospective jurors. Will that juror be more likely to align with one side of the case? Are they bias, prejudice, emotional, religious, liberal or conservative? Even body language and television viewing habits of jurors translates into more data to be factored in the jury selection process to weed out the ‘wrong’ type of juror.

Digital Investigations of Jurors

According to the American Bar Association lawyers and jury consultants now have a digital treasure trove of private information about any potential juror because 74 percent of all Americans have social networking profiles and Twitter processes over half a billion tweets per day (2). Social networking sites like Facebook have become a part of jury selection in the digital age. Lawyers can learn almost anything about jurors including their taste in movies, music, politics, education, hobbies and likes and dislikes. This type of digital inquiry has not been prohibited by law as of the date of this writing. However, the in depth digital investigation of potential jurors may eventually be prohibited as an invasion of privacy. For now, all potential jurors can be subjected to digital investigations.

Jurors Favor Attractive Defendants

A study investigating the biases of juries in criminal cases concluded that the attractiveness of a defendant can play a role in jury decisions on convictions and sentence recommendations. In this study (3), the jurors who participated were divided into two categories. Those who process information through their emotional filters and personal experiences and those who process information through objective and rational-based filters. The jurors who emotionally processed information were found to give lighter sentences to physically attractive defendants and harsher sentences and convictions to unattractive defendants. The study supports the conclusion that among the research participants, juror bias against unattractive defendants resulted in harsher conviction and sentencing outcomes.

Conclusion

The psychology of jury selection is complex because it involves the investigation of a potential juror’s mind and how they process information, their biases, personal experiences and histories, digital thumbprint, age, race, and many other factors. Finding a fair and impartial juror without prejudice is difficult. It involves the probing of minds and hearts. We are all entitled to be judged in a courtroom by a jury of our peers. This means it would be patently unfair to impanel a jury of all one race and gender to judge a defendant of a different race and gender. There are inherent biases presumed in such a case. Even when a jury is composed of a diverse group of men and women, the unseen psychological prejudices they may harbor, such as being bias against an unattractive defendant, are difficult to assess.

Our legal system relies on the good faith and genuine belief of jurors to be fair and impartial as well as the jury selection process to weed out bias and prejudice. In the end, lawyers on both sides of any case are entitled to examine a jury pool and weed out undesirables, this process works overall, with the help of expert psychologists who are skilled in assessment and analysis of a fair and impartial mind. The confluence of psychology and the law in the jury selection process has proven benefits to eliminate unfair bias and implement fair and impartial jury verdicts.

https://www.psychologytoday.