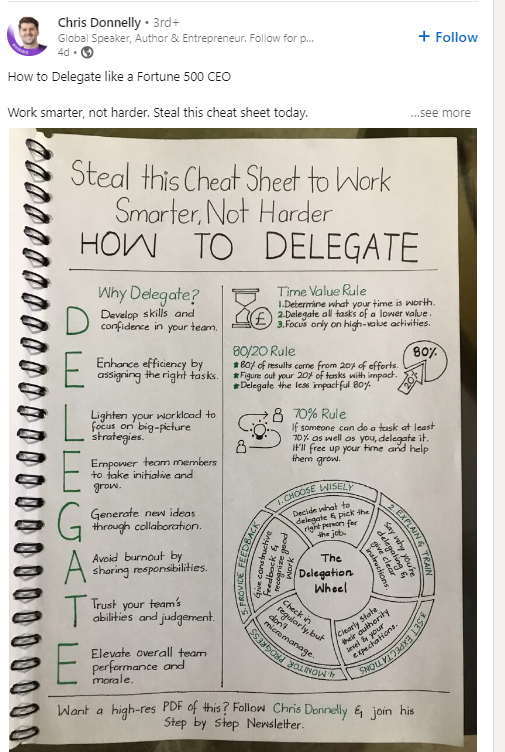

1. Small Speculators in Stock Futures Most Bullish Ever

From Callum Thomas Chart Storm @Callum Thomas (Weekly S&P500 #ChartStorm)

I am not familiar with this indicator but interesting.

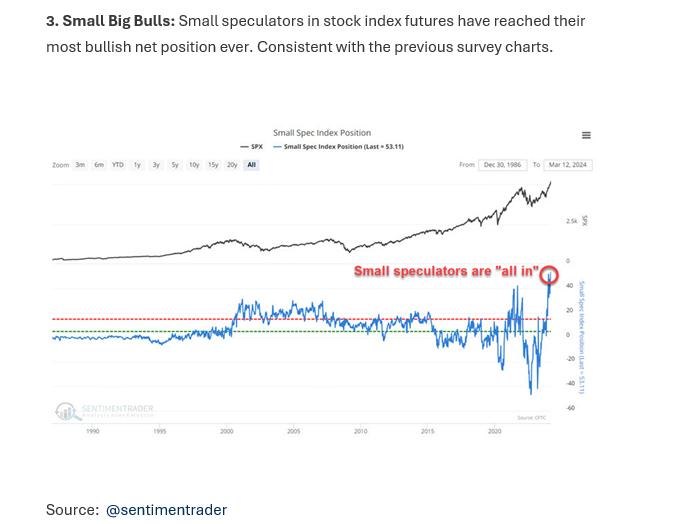

2. Apple App Store Billing Have Doubled in 4 Years

Apple under fire for taking 30% commissions on App store.

https://www.barrons.com/articles/apple-doj-monopoly-lawsuit-stock-trouble-5355d561?mod=past_editions

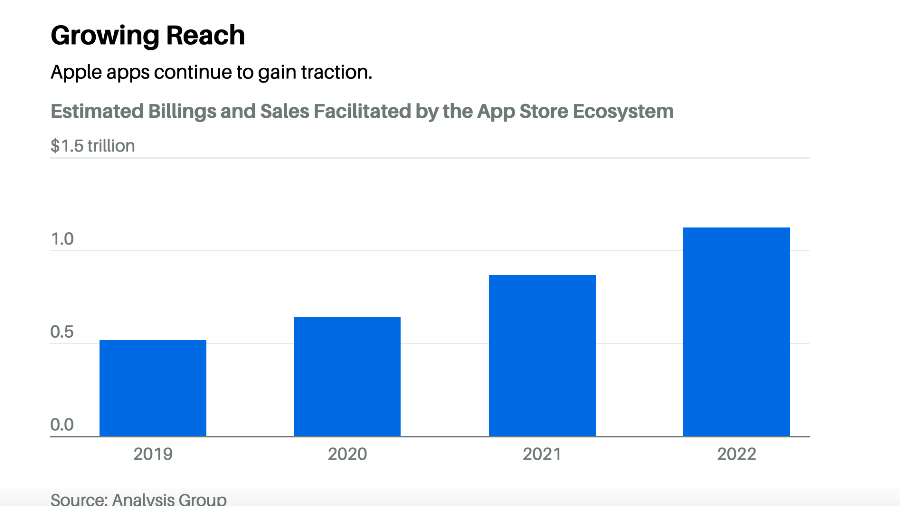

3. Three of the Mag 7 Stocks in Bottom Quartile of S&P 500 Performance 2024

Bloomberg

4. Insider Selling in Technology Stocks Highest in 3 Years

Dave Lutz Jones Trading

The FT reports Peter Thiel, Jeff Bezos and Mark Zuckerberg are leading a parade of corporate insiders who have sold hundreds of millions of dollars of their companies’ shares this quarter, in a signal that recent stock market exuberance could be peaking. As markets hit record highs, the ratio of corporate insider selling to insider buying is at the highest level since the first quarter of 2021, according to Verity LLC, which tracks insider trading disclosures. Stock sales at the beginning of a calendar year are normal, with pent up demand in early 2024 being exacerbated by shareholders avoiding sales last year because of depressed company valuations.

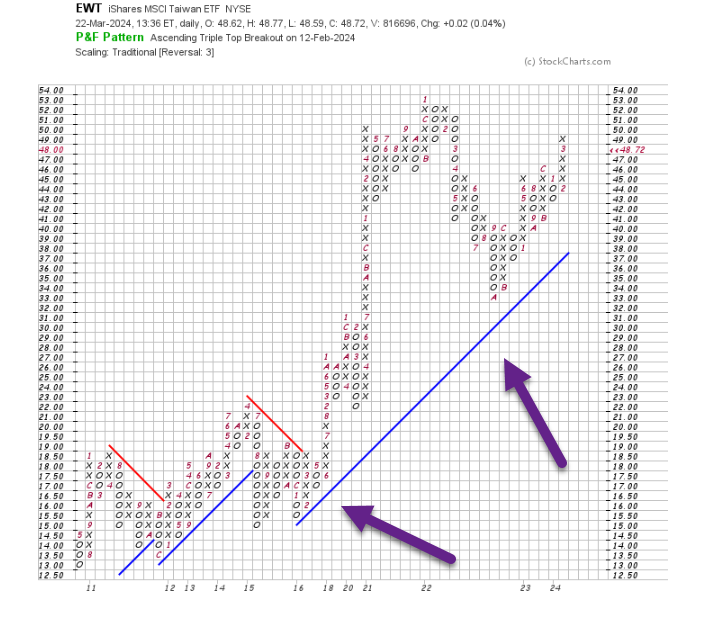

5. China Takeover Hanging Over Taiwan Markets But Rallying Toward Previous Highs

Taiwan ETF held blue trendline going back to 2015

6. Chinese Gold Imports Surge

Gold making new highs

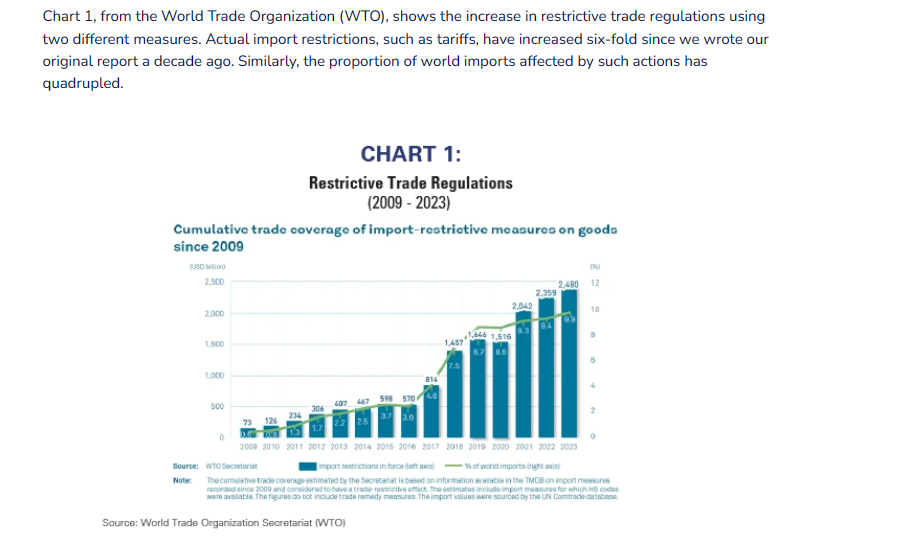

7. The Growth of Restrictive Trade Regulations

RBA Advisors

US Industrial Renaissance: It’s a matter of national security (rbadvisors.com)

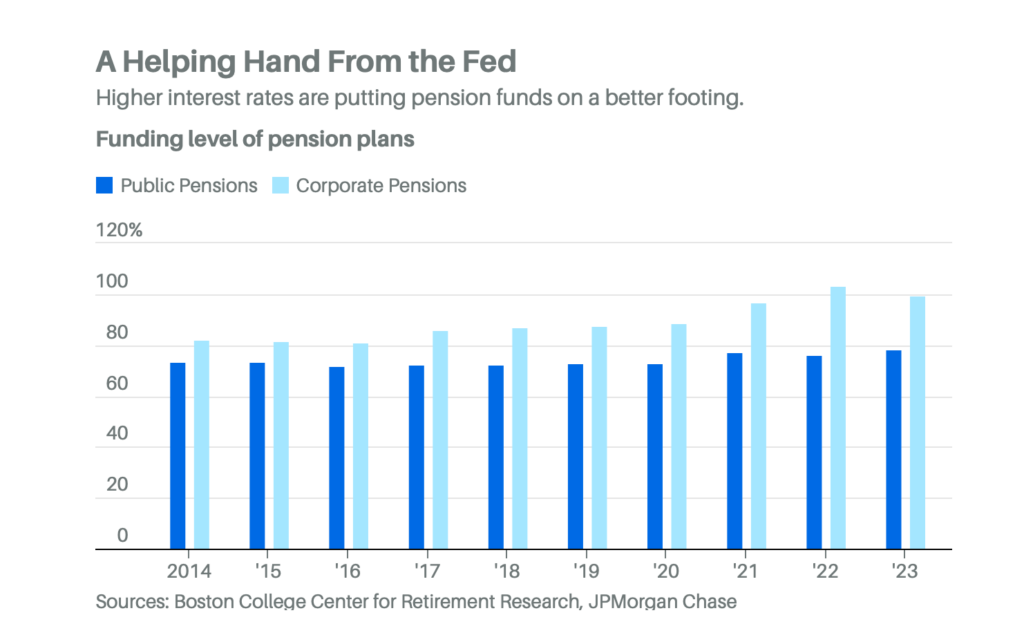

8. Bonds Helping Pensions Funds Get Back to Fully Funded

Barrons By Allan Sloan

Ten years ago, in 2014, JPMorgan Chase, which gathers statistics filed by the country’s 100 biggest corporate pension funds, showed them to be 82% funded. As of the end of last year, they were up to 99.5%—essentially fully funded. (We’ll discuss the drop from 2022 to 2023 in a bit.)

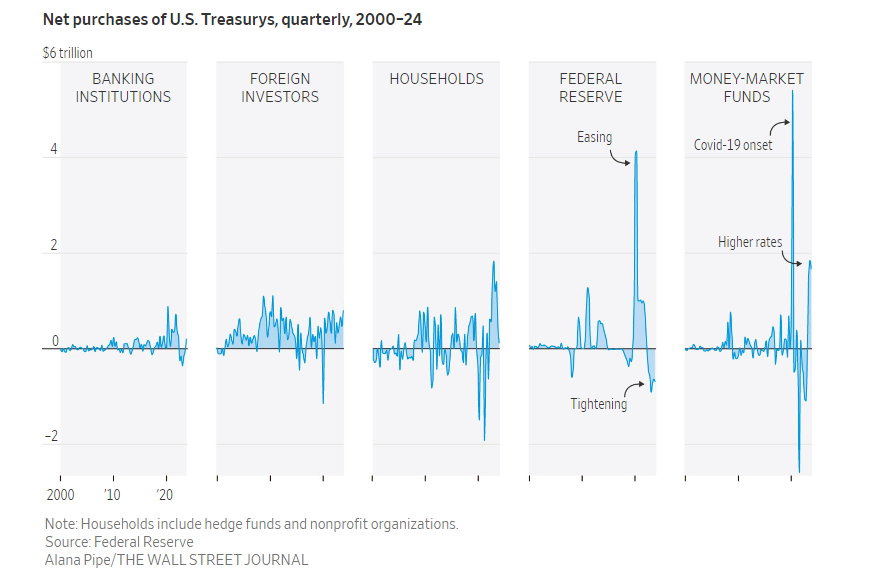

9. Who is Buying Treasuries?

WSJ By Eric Wallerstein

https://www.wsj.com/finance/the-27-trillion-treasury-market-is-only-getting-bigger-a9a9d170

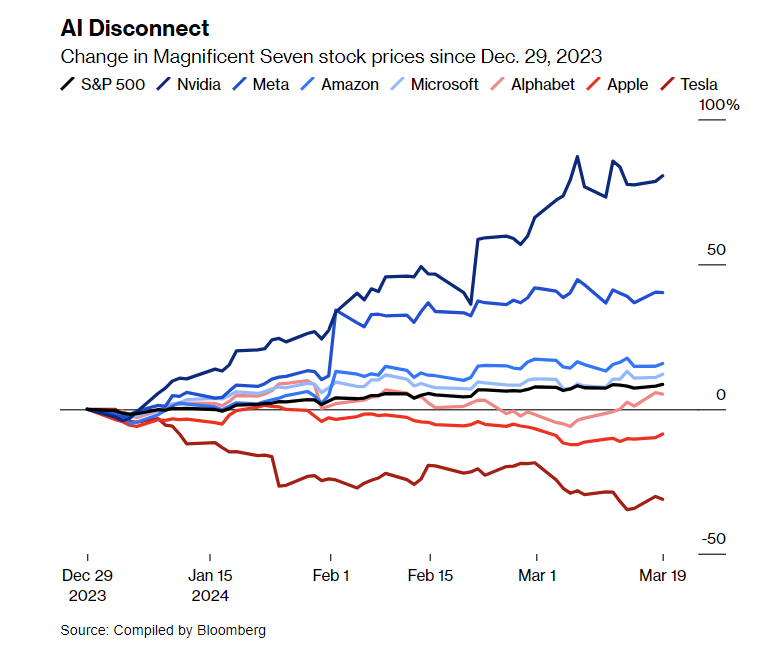

10. How to Delegate