1. Short-Term Overbought

Bespoke Investment Group

Here in the US, it was a broad rally last week as Real Estate was the only sector ETF to finish in the red, and seven of eleven sectors rallied over 1%, including three that were up over 2.5%. Normally, when you have a big gain in the market like last week, you can expect to see Technology at the top of the performance list, and while the 2.25% gain for the sector was pretty much right in line with the S&P 500, it was ‘only’ the fourth best-performing sector on the week. On a YTD basis, Technology ranks as just the fifth best-performing sector, and six other sectors are more extended relative to their 50-day moving average. Technology has been far from a dog lately, but it’s certainly given up some of its leadership position, and it’s understandable with several of the mega-caps now in the crosshairs of US and EU regulators.

Read today’s entire Morning Lineup.

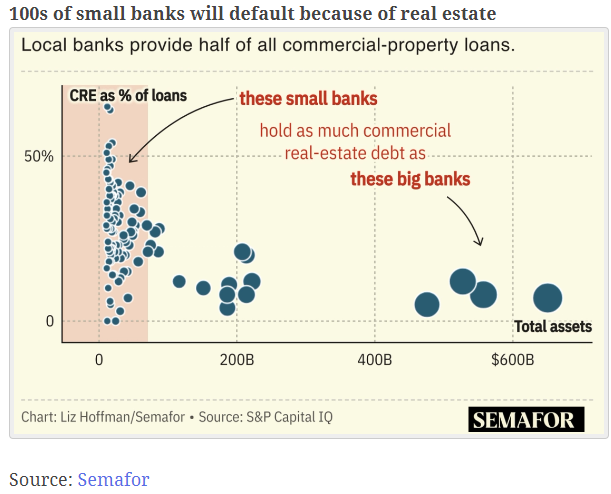

2. Not Sure About Defaults But Chart Tells the Story on Who Owns CRE Debt

From Barry Ritholtz Blog

https://ritholtz.com/2024/03/weekend-reads-606/

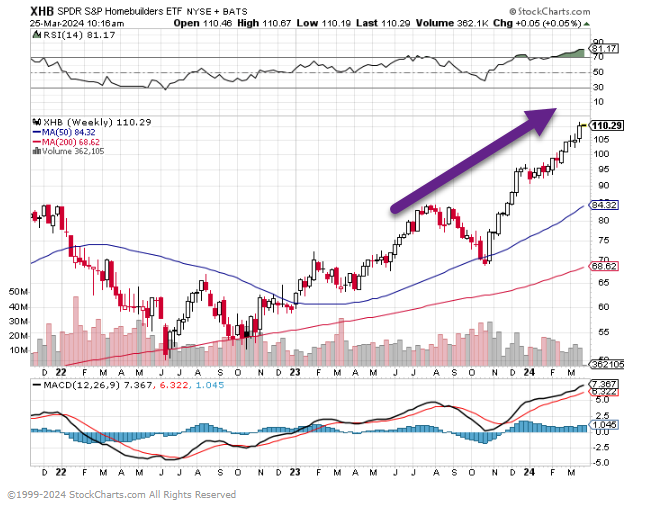

3. Homebuilders Keep on Trucking ..Straight Up

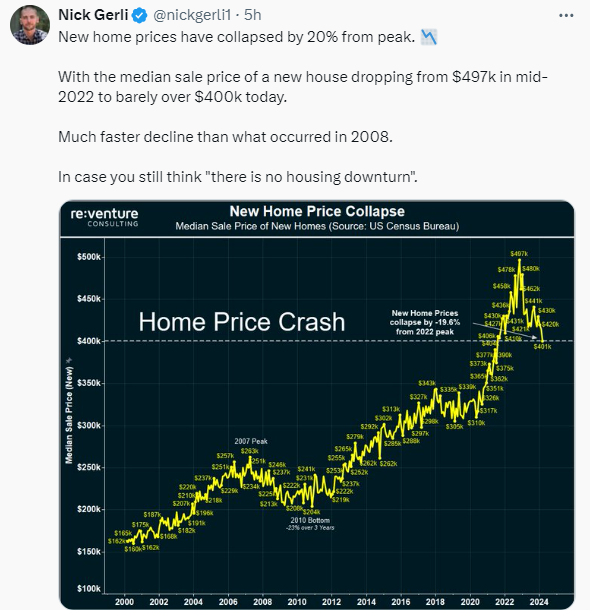

4. This May Be Why Fed is Lowering Rates….Housing and Commercial Real Estate

5. MSTR +675% One-Year

WSJ Jason Zweig

The company said this week that, as of March 18, it held 214,246 bitcoin. At the digital currency’s average price this week of roughly $65,000, MicroStrategy’s trove is worth something close to $14 billion.

Adjusting for debt and options that can be converted to shares, the stock has a total market value of about $33 billion. That’s about twice the value of MicroStrategy’s remaining software business and all its bitcoin holdings combined.

MicroStrategy has funded its bitcoin buying by issuing more than $5 billion in stock and debt. Normally, companies dilute their earnings per share when they issue extra stock. MicroStrategy’s stock offerings, however, have been anti-dilutive. By issuing shares at such a high premium to the value of its bitcoin, and then pouring the proceeds into more bitcoin, which in turn has risen even higher, MicroStrategy has driven up its stock price.

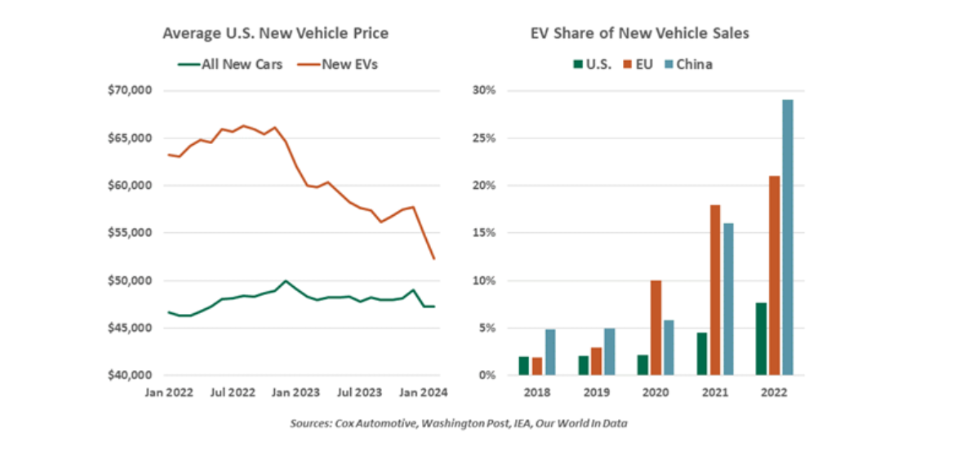

6. EV Car Update

By Ryan Boyle of Northern Trust

https://www.advisorperspectives.com/commentaries/2024/03/26/u-s-ev-sales-need-boost

7. Lithium ETF $80 to $40

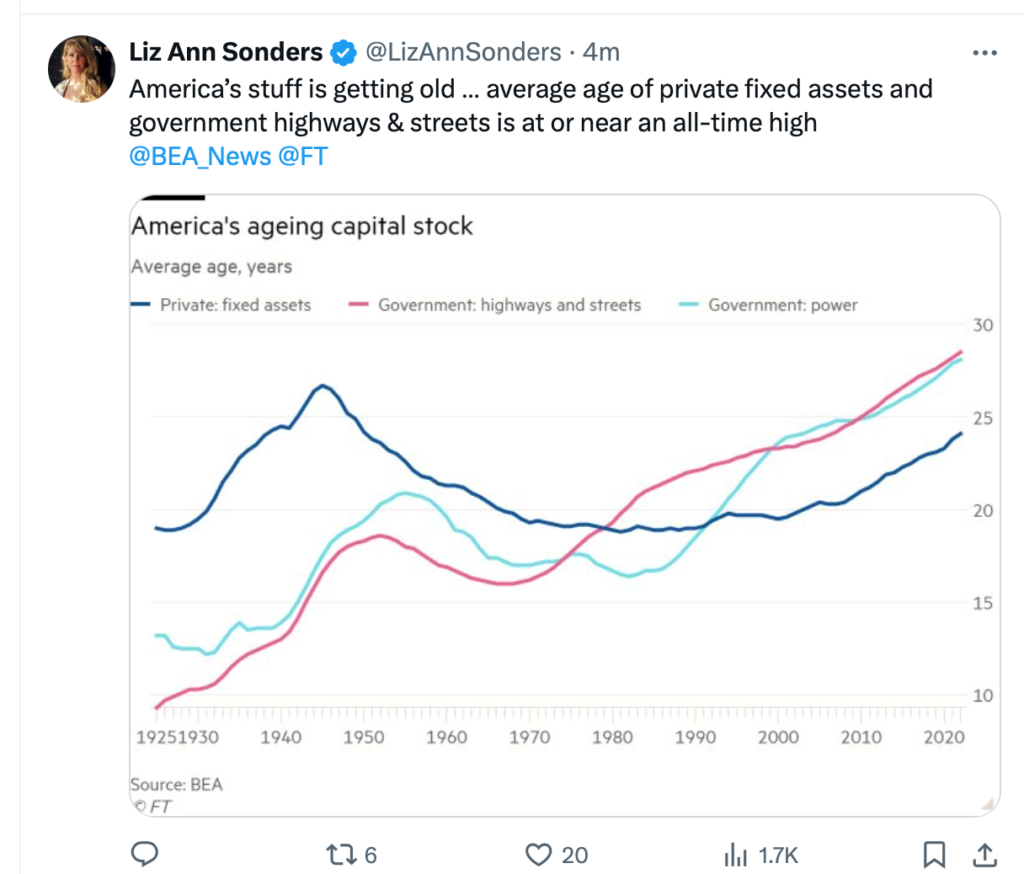

8. Government Highways and Streets are Old

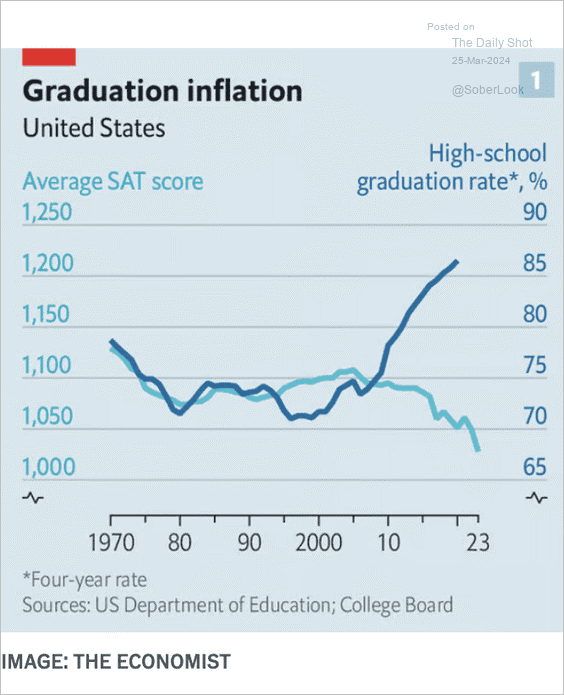

9. Everybody Passes in America

The Daily Shot Blog Food for Thought: Trends in US high school graduation rates and SAT scores over time:

Source: The Economist

10. Common Causes of Bad Decisions

Farnam Street Blog

1. Not asking, “and then what?”

2. Blindness to large trends (blind spots)

3. Assumptions based on small sample sizes

4. Conforming to expectations/authority/group

5. Wanting the world to work the way we want rather than the way it does.”

https://fs.blog/