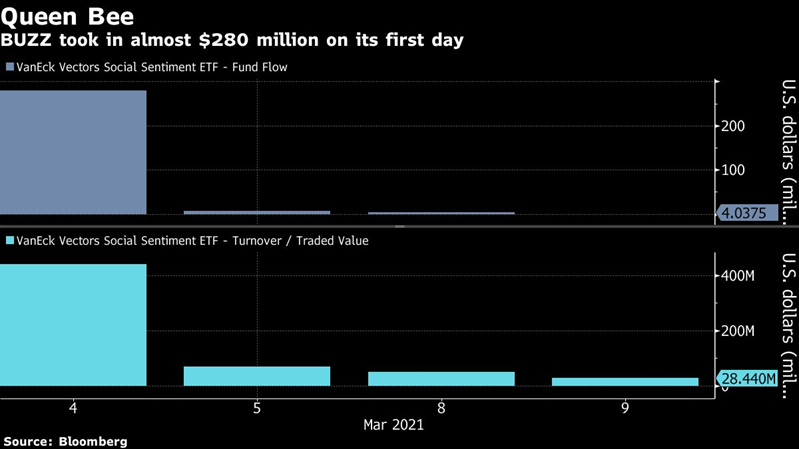

1. BUZZ ETF $280m Inflows Day 1…Holdings List Not Huge Differentiator.

https://etfdb.com/etf/BUZZ/#holdings

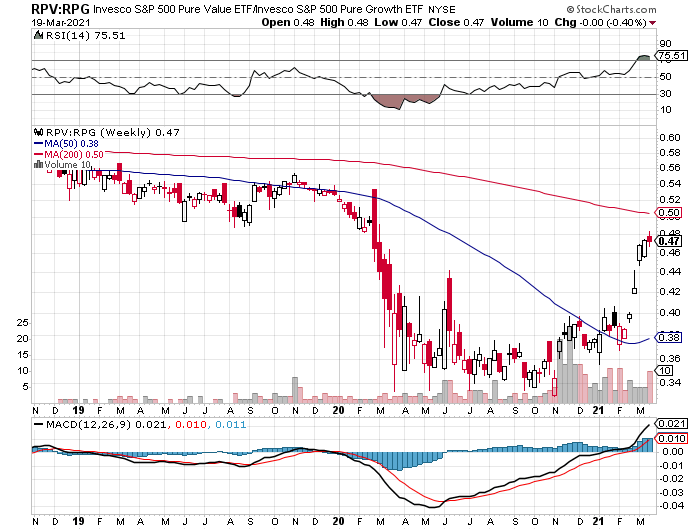

2. RPV Pure Value ETF +23.5% VS. RPG Pure Growth -2.5%

Barrons- Year to date, the Invesco S&P 500 Pure Value ETF (RPV) has gained 23.8%, while the Invesco S&P 500 Pure Growth ETF (RPG) declined 2.5%.

Statistically, there might be more room for value stocks to run. Goldman Sachs calculated that the highest-P/E slice of the S&P 500 was 231% more expensive than the lowest-P/E one at the beginning of this year, the widest gap since 2000.

That premium had recently shrunk to 161%, but the 40-year average is 103%.

This Chart Compares RPV Pure Value to RPG Pure Growth……Big Move Off Bottom but not yet Back to Pre Covid Highs

Jack Hough https://www.barrons.com/articles/9-sensible-stock-picks-for-this-strange-market-51616197878?mod=past_editions

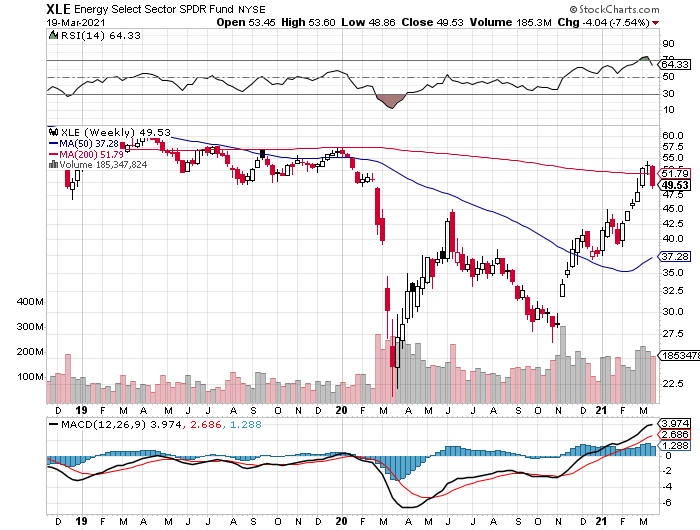

3. 95% of Stocks in Energy Sector Trading Above 200 Day Moving Average

Barrons-In fact, Thursday’s energy-sector selloff, while brutal, might not have been brutal enough to signal a bigger problem, according to Sundial Capital Research’s Dean Christians. It was certainly painful—every stock in the sector finished the day below its 10-day moving average. But 95% of the stocks were still trading above their 200-day moving averages, a sign of longer-term strength. That combination has happened just 12 times since 1980, and when it did, the sector traded higher six months later 82% of the time, with a median gain of 16%. “The group is short-term oversold in an uptrend,” Christians writes.

XLE Energy Sector ETF…Trades right up to 200day on long-term weekly chart then pauses….also back to 2020 levels then pause

The Market Isn’t Fighting the Fed. What That Means for Stocks.

By Ben Levisohn

4. The FED has Failed to Meet its 2% Inflation Objective for Decades

The Big Picture Blog-Barry Ritholtz

https://ritholtz.com/wp-content/uploads/2021/03/Fed-2-infl-tgt.png

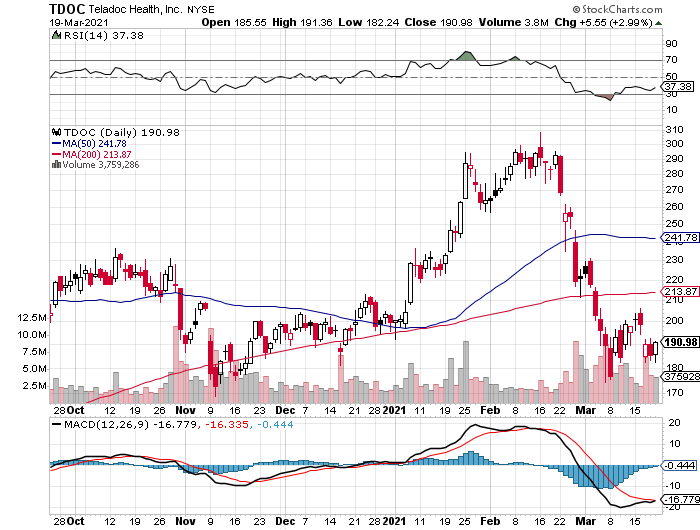

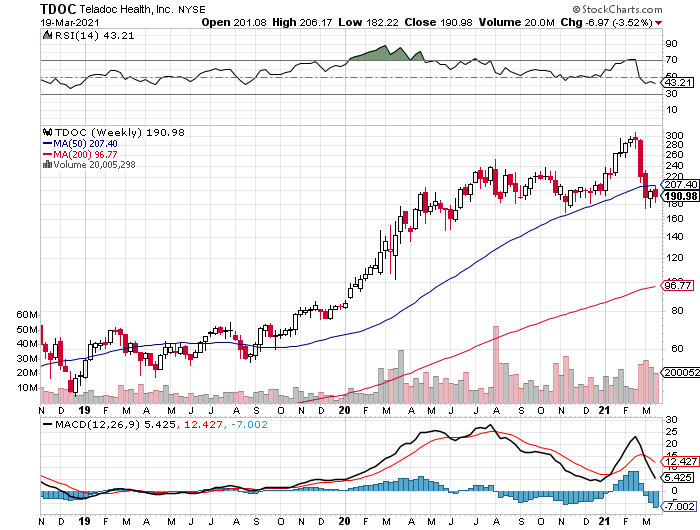

5.Another Name Down -30%+ as Vaccines Distributed….Teladoc Health—Telemedicine Name

TDOC Chart $190 last from $300 High

Longer-Term Chart TDOC was at $80 Pre-Covid

6.The High Costs of the Airline Bailouts-NYT Dealbook

Federal efforts to prop up carriers saved jobs, but taxpayers likely paid big price.

By Andrew Ross Sorkin, Jason Karaian, Michael J. de la Merced, Lauren Hirsch and Ephrat Livni

The federal bailouts sought by C.E.O.s like Doug Parker of American Airlines saved jobs — but at a high cost.Credit…Chip Somodevilla/Getty Images

Socializing losses, privatizing gains

Major U.S. airlines have received more than $50 billion in grants in multiple rounds of taxpayer-funded bailouts during the pandemic. As travel begins to rebound and the stock market cruises to record highs, Andrew asks in his latest column: Was the rescue worth it?

The good news: The bailouts probably saved as many as 75,000 jobs and kept the airlines from declaring bankruptcy.

The bad news:Taxpayers probably overpaid, with the original grant of $25 billion implying that each job cost the equivalent of more than $300,000. (That price grew with subsequent bailouts.)

The biggest beneficiaries were airline shareholders. That includes the carriers’ executives, who have been paid in stock for years. Propped up by taxpayers, airline stocks are up nearly 200 percent from their pandemic trough, and have largely recovered their losses.

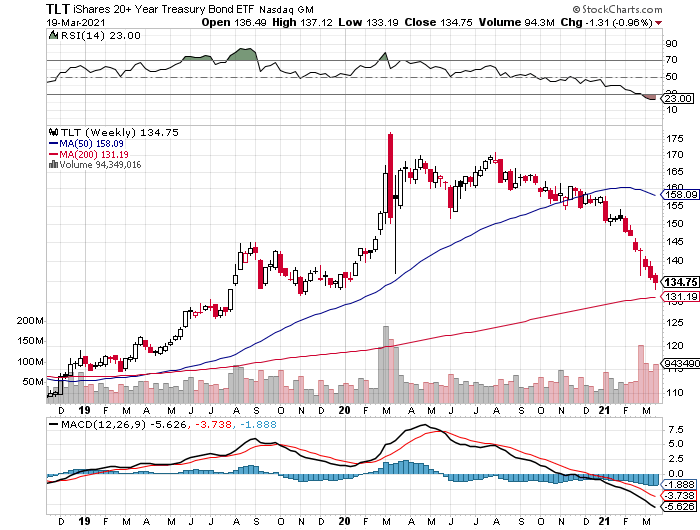

7. TLT 20 Year Treasury ETF -15% in 2021….Watch 200 day moving average for support.

TLT—trades down to 2019 levels…breaks below 2020 lows

8. Median Home Price Over $300,000 for First Time Ever

9. Roughly 4 in 5 Manhattan Office Workers Will Not Return Full-Time, Survey Says

The Partnership for New York City said major Manhattan employers expect less than half of their employees to be back to the office by September

Published March 15, 2021 • Updated on March 15, 2021 at 1:56 pm

Manhattan’s largest employers are starting to plan for the post-COVID future of work, and it seems most of them are giving up on the traditional way of doing things.

Just 22 percent of the island’s large employers will require all workers to return to the office full-time when they do eventually go back, according to a Partnership for New York City survey.

Some 66 percent said they would adopt a hybrid model of days in the office and days at home, another 9 percent said they would not require workers to return to the office at all, and 4 percent said it would ultimately be role-dependent.

Whatever model they choose, employers don’t seem to be in much of a rush either. Survey respondents said they expect just 45 percent of Manhattan’s roughly 1 million office workers to be back to the office by this September.

The nonprofit organization conducted its survey in late February and early March. It was the fourth such poll the group has done in the last year.

Copyright NBC New York

10. Weekend Thoughts from Farnam Street

EXPLORE YOUR CURIOSITY

1. “[I]f someone’s much better than you at something, they probably try much harder. You probably underestimate how much harder they try. I’m not saying that talent isn’t a meaningful differentiator, because it certainly is, but I think people generally underestimate how effort needs to be poured into talent in order to develop it. So much of getting good at anything is just pure labor: figuring out how to try and then offering up the hours.”

— Effort

2. “The biggest change in my professional maturity came when I became Actually Responsible for things. … I gained a lot of appreciation for people who make things, and lost a lot of tolerance for people who only pontificate. I found myself especially frustrated with my past self, whose default was to complain and/or comment, then wonder why things didn’t magically get better.”

3. “I have long been very interested in standard thinking errors.”

— The Revised Psychology of Human Misjudgment, by Charlie Munger

A QUOTE TO THINK ABOUT

“Most people never pick up the phone. Most people never call and ask. And that’s what separates sometimes the people who do things from those who just dream about them. You gotta act. You gotta be willing to fail. You gotta be willing to crash and burn. With people on the phone or starting a company, if you’re afraid you’ll fail, you won’t get very far.”

— Steve Jobs

TINY THOUGHT

If you worked as hard at doing difficult things as you did avoiding them, you’d become unstoppable.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.