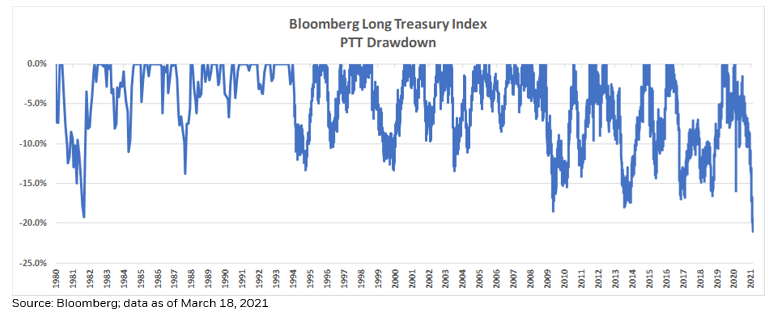

1. Barclays Long Treasury Index Biggest Drawdown in 40 Years

Rick Rieder-Blackrock -Global FIxed Income CIO

We’re in the midst of witnessing #BondMarketHistory, as the peak to trough drawdown for the Barclays Long Treasury Index now exceeds -20% (not including today’s move), its worst #drawdown going back 40 years and meeting what many consider to be a bear #market!

https://twitter.com/RickRieder

2.Another Holy Shit Chart from Michael Batnick Irrelevant Investor…1999 Bubble Burst…Tech was Still Down 56% When Dow Hit New Highs

The bursting of the dot-com bubble was so destructive that by the time the Dow hit new highs in October 2006, the Nasdaq was still 56% below its peak.

https://twitter.com/michaelbatnick

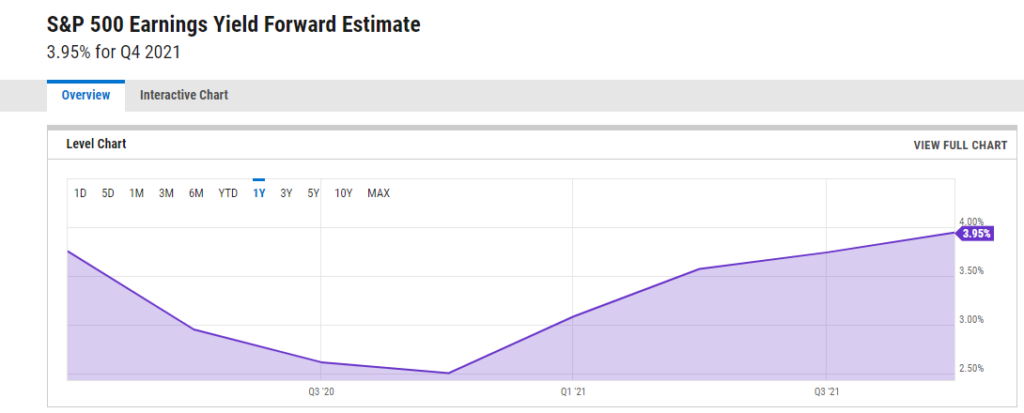

3. Howard Marks 4.5% Earnings Yield on S&P vs. 1.7% 10 Year Treasury

Advisor Perspectives -Howard Marks Comments

In particular, as to item (a) above, we can look at the relationship between today’s 4.5% earnings yield* on the S&P 500 and the yield on the 10-year Treasury note of 1.4%. The implied “equity risk premium” of 310 basis points is very much in line with the average of 300 bp over the last 20 years. Valuations can also be viewed relative to short-term interest rates. The current p/e ratio on the S&P 500 of 22 is slightly below the reading of 24 in March 2000 (the height of the tech bubble), and the fed funds rate is around zero today versus 6.5% back then. Thus, in 2000, the earning yield on the S&P 500 was 4.2%, or 230 basis points below the fed funds rate, while today it’s 450 bp above. In other words, the S&P 500 is much cheaper today relative to short-term rates than it was 21 years ago.

2020 in Review-by Howard Marks of Oaktree Capital Management, 3/18/21–https://www.advisorperspectives.com/commentaries/2021/03/18/2020-in-review

4. Global Growth Outlooks

https://lplresearch.com/2021/03/18/solid-global-growth-outlook-but-multi-speed/

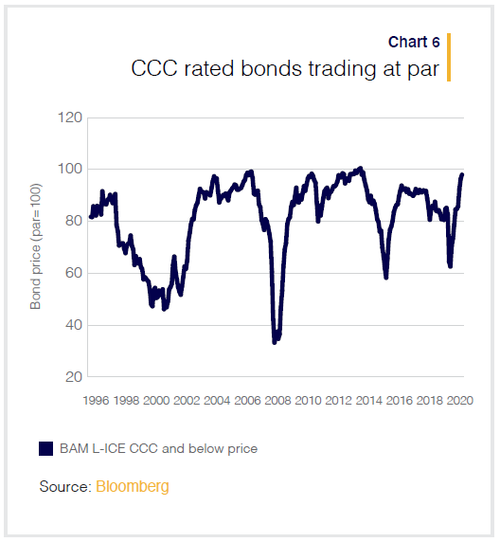

5. CCC Rated Bonds Trade Up to Par

Found at Zerohedge

Dylan Grice: “The Bubble Is Just Beginning”–BY TYLER DURDEN HTTPS://WWW.ZEROHEDGE.COM/MARKETS/DYLAN-GRICE-BUBBLE-JUST-BEGINNING

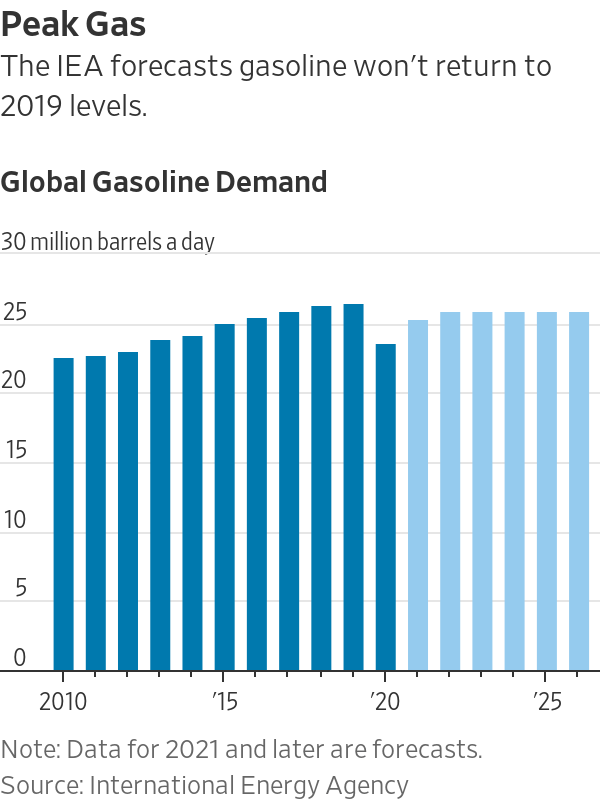

6. Prediction from IEA—2019 was Peak in Gasoline Prices

WSJ By

David Hodari and William Bosto

The world’s thirst for gasoline isn’t likely to return to pre-pandemic levels, the International Energy Agency forecast, calling a peak for the fuel that has powered personal transportation for more than a century.

The Paris-based energy watchdog, in its closely followed five-year forecast, said an accelerating global shift toward electric vehicles, along with increasing fuel efficiency among gasoline-powered fleets, will more than outweigh demand growth from developing countries.

The forecast comes as auto makers have pivoted recently to boost their EV fleets, after years of industry skepticism about whether car buyers would ever embrace fully electric models. General Motors Co. said it would stop selling gas-powered vehicles by 2035. Volvo Cars of Sweden has said it would be all-electric by 2030.

https://www.wsj.com/articles/never-mind-peak-oil-global-forecaster-calls-peak-gasoline-11615988228

https://gasprices.aaa.com/state-gas-price-averages/

7. Canceling student debt would mostly benefit middle- and high-income families, JPMorgan finds-Business Insider

- JPMorgan found student debt cancellation would mostly benefit middle- and high-income families.

- However, income cutoffs would significantly reduce the amount of debt forgiven.

- Any long-term solution for student debt should factor in low-income families’ tuition costs and enrollment.

With student debt in the US totaling approximately $1.7 trillion, there is no question that forgiving that debt would be a welcome relief for many Americans. But whether $10,000 or $50,000 in student debt is cancelled per person, experts found middle- and high-income families would reap most of the benefits.

A new report from JPMorgan Chase examined four different cancellation scenarios: universal cancellation of up to $10,000, cancellation of up to $50,000 for people earning less than $125,000, cancellation of up to $25,000 for people earning less than $75,000 and phasing out at $100,000, and cancellation of up to $50,000 with the same phaseout.

The report found that income cutoffs would significantly reduce the total amount of debt forgiven and make a cancellation effort less regressive.

“This relative regressivity is driven by the fact that higher-income households carry larger debts, often from professional or graduate degrees,” the report said. “Conversely, more aggressive income targeting does not necessarily result in a greater share of forgiveness going to borrowers in a debt trap or facing long repayment horizons.”

Here are the main findings of the report:

- A $10,000 cancellation would forgive 27% of the total outstanding debt, a $50,000 cancellation with the income limit would forgive 50% of the debt, a $25,000 cancellation with a phase out would forgive 28% of the debt, and a $50,000 cancellation with a phase out would forgive 39% of the debt;

- A disproportionate amount of debt forgiveness would go to middle- and higher income families since they tend to hold more student debt;

- A greater share of forgiveness goes to borrowers in a debt trap or under long-term repayment plans when the cancellation ceiling is higher;

- And the distribution of cancellation benefits by race is fairly unchanged under the scenarios, meaning the scenarios may not be effective at closing the racial wealth gap.

The report also noted that if people believe more debt will be cancelled in the future, they might change their behaviors by taking out more debt or repaying it slower than anticipated. An income cutoff for debt forgiveness could also reduce people’s incentives to work, whereas a one-time cancellation could avoid those problems.

Progressive lawmakers have been unrelenting in calling for President Joe Biden to cancel up to $50,000 in student loan debt. While Biden has said he would consider cancelling $10,000 in debt, lawmakers like Sen. Elizabeth Warren of Massachusetts and Senate Majority Leader Chuck Schumer have repeatedly argued that if the president can legally cancel $10,000 in debt, there’s no reason he cannot cancel $50,000.

“If it’s OK legally to do a small amount, it’s OK legally to do a larger amount,” Schumer said during a press call on Monday.

During a CNN town hall on February 16, Biden said he would support a higher amount of debt cancellation through legislation, but Schumer said executive action remained “far and away, the quickest, best, and easiest” method. White House Press Secretary Jen Psaki said during a press briefing on February 17 that the Justice Department would review Biden’s ability to cancel student debt through executive action.

But despite the calls to cancel $50,000 in student loan debt, even the “most generous” cancellation scenario would not solve the bigger problems that drive the high debt levels in the country.

“Any economic forces that contributed to the current stock of student debt today, such as increasing tuition costs and increasing enrollment among low-income families, will continue to push tomorrow’s students to accumulate debt,” the report said. “Any long-term solution to relieving students is incomplete without addressing these underlying forces.”

8. 80% of Millennials and Gen Z Eventually Want to be Home Owners.

9. The first 3D-printed housing community in the US is being built in the California desert

By David Williams, CNN

Updated 7:38 AM ET, Thu March 18, 2021

Developers plan to build 15 3D-printed houses in Rancho Mirage, California.

(CNN)Developers in Southern California are building what they say will be the first 3D-printed zero net energy neighborhood in the United States.

Palari Group said it plans to build 15 eco-friendly 3D-printed homes on a five-acre parcel of land in Rancho Mirage, an upscale community in the Coachella Valley, near Palm Springs.

The 1,450 square foot, single-story homes will be made from a stone composite material that is strong, fire resistant, water resistant and termite proof, Palari Group founder and CEO Basil Starr told CNN.

The homes will be made of modular panels that are printed out by their partner Mighty Buildings at a facility in Oakland and are assembled at the building site “kind of like Lego blocks,” Starr said.

Starr said his company, which is focused on sustainable building techniques, turned to 3D printing because it is less wasteful.

“In wood frame construction there’s a significant waste that is generated for the home that’s being built, it’s about two tons of waste that goes into landfills,” Starr said. “And with 3D printing, it’s a revolutionary way of building that completely eliminates that unnecessary waste.”

Bathrooms, cabinets and other interior materials that can’t be 3D printed are sustainably sourced.

The three-bedroom, two-bathroom homes will come with a deck and a swimming pool and will have a starting price of $595,000. Buyers will be able to add a smaller, two-bedroom, one-bath secondary residence on the property for another $255,000.

All energy needs will be supplied by solar power, and owners will have the option to install other options like the Tesla Powerwall, fire pits, cabanas and outdoor showers.

The average owner-occupied home value in Rancho Mirage is $825,738, according to the city’s website.

Palari Group said it plans to break ground in September and complete the project by Spring 2021.

Starr said that once construction begins, the company will be able to move more quickly than with traditional construction.

Mighty Buildings, he said, can print the panels for the houses at the same time they build roads, foundations and install utilities at the site.

Potential buyers have already put down $1,000 refundable deposits to get a spot on the reservations list, Starr said. Palari Group is looking at building additional developments in Rancho Mirage and possibly other parts of California.

Rancho Mirage isn’t the only 3D-printed home project making news.

Last month, a company called SQ4D Inc. listed a 3D-printed house in Riverhead, New York, on Zillow with an asking price of $299,999.

Developers in Austin are building four houses that use 3D printing and traditional construction techniques.

Austin-based construction technology company ICON is working with Kansas City developer 3Strands to build four 3D printed homes in East Austin that are scheduled to be move-in ready by in June or July.

10. The 5 Non-Negotiable Disciplines of a High Achiever

By Patrick Allmond | May 2, 2016 | 0

1. The Discipline of Believing

Most of us think about doing great things. The difference between the average person and the high achiever is a commitment to belief—because possessing the unqualified belief that you are capable of doing something is the first step to achieving it.

I like the way Will Smith put it: “There’s a redemptive power that making a choice has. Decide what you’re going to be, who you are going to be and then how you are going to do it. From that point on, the universe is going to get out of your way.”

When you commit, really commit to a choice, then everything else will fall into place to make it happen for you. Your decisions will be guided by your mindset.

2. The Discipline of Eliminating Interruptions

The world around you is structured to interrupt you. If you already struggle with focus, you are fighting a losing battle from the moment you wake. If you are normally a focused person but don’t control your environment, your day will become a series of interruptions. To combat this, you need to turn off everything that could attract your attention. Everything.

My phone never makes an audible noise, I keep it face down most of the time so I can’t see the screen light up, and when I install new applications, I disable notifications. And that is exactly the way I want it. I lived a great life before text messages, and life will go on if I miss one now.

Learn to be comfortable with silence and focus. The quality of your work will drastically increase and you will be more productive, and the depth of your thinking will increase because you will have long periods to dedicate to your thoughts.

3. The Discipline of Time Management

Some might say time management is a myth because we have no control over time—it marches on with or without you. I don’t buy into that. But you should consider the limited amount of time you have to get things done. I know when you are sitting at a desk staring at a project all day, the eight hours ahead of you can feel like 100.

Most people build their lives around getting everything else done before getting to the fun stuff. I’m going to propose something crazy to you: Start with the fun stuff. Schedule them on a recurring basis and work the mundane around it.

Related: 5 Qualities of People Who Use Time Wisely

I lay out my high priority items as recurring weekly appointments. The appointments are with nobody but me, and nobody will know if I miss them. My exercise time is scheduled three days a week at 6 p.m. Because health is a priority to me, I’ve made these nonnegotiable in my mind. When that time of the day hits, I stop everything, change and go to the gym. Any work or other tasks will be there when I return.

Start doing the same on your calendar. It could be writing a book, spending time with a loved one, practicing piano or learning a new programming language. Nobody is going to knock on your door and push you to do it. It has to come from you. Be stingy with your time. Protect it.

4. The Discipline of Being Healthy

If your body is not capable of handling your goals, you will become physically and mentally exhausted.

To keep yourself healthy and ready to achieve your goals, you need to allocate regular, recurring time in your calendar to take care of your body—like I do with my gym time. Ideally this should be multiple times a week and it should be nonnegotiable. Exercise, done correctly, trains your muscles, heart and lungs to withstand larger levels of stress. So if your body is used to the stress from regular exercise, it will have an easier time managing the stress in other areas of your life.

The better you are at managing your stress and energy, the better you will be at accomplishing the goals you have set for yourself.

5. The Discipline of Ignorance

Ignorance is the epitome of focusing. You can’t possibly know everything, and you don’t need to. Once you are willing to live with not knowing everything, the things you choose to pay attention to will get more of your attention and you will produce better results.

If you want to achieve a higher level of skill at any venture in life, use this list to help you get started on your journey of being disciplined.

Related: 4 Straightforward Steps to Success

Photo by titovailona/Twenty20

https://www.success.com/the-5-non-negotiable-disciplines-of-a-high-achiever/

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.