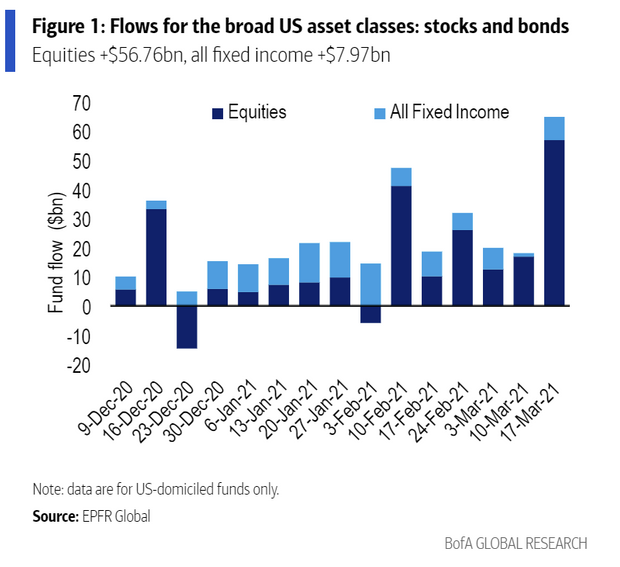

1. Investors were Pouring into Bonds Pre-Election 2020 now Back to Record Stock Inflows….$56B Last Week

Marketwatch-Stock market investors poured a record amount of money into U.S. equity mutual funds and exchange-traded funds in the past week as the Dow Jones Industrial Average topped another milestone and the S&P 500 index also touched a record. BofA Global Research on Friday said U.S. equity inflows hit a weekly record of $56.76 billion in the week ending March 17, up sharply from $16.83 billion a week earlier. The Dow DJIA, 0.14% on March 17 closed above the 33,000 for the first time, while the S&P 500 SPX, 0.49% also finished at an all-time high.

Investors poured record $56.8 billion into stock-market funds as stimulus checks arrived-By William Watts

2. Market Participation Among Under 35 Investors Close to 1999 Highs

Some of you reading this may still picture millennials as being just out of high school. The truth is that the oldest members of this group turn 40 this year. Historically, Americans reach their peak earning years between 45 and 54, so it’s incumbent upon this generation—the largest in the U.S. right now at 72.1 million—to keep the bull market running.

Advisor Perspectives Blog

3. 2-5-10 Year Breakeven Inflation Rates Line Up on Chart

Advisor Perspective Blog

Broken Debt by John Mauldin of Mauldin Economics, 3/19/21 https://www.advisorperspectives.com/commentaries/2021/03/19/broken-debt

4. Lumber Up 188% in 6 Months

The burning question among everyone from home builders to DIYers is: When will lumber prices correct? To answer that question, Fortune reached out to Dustin Jalbert, senior economist at Fastmarkets RISI where he specializes in wood prices.

Jalbert told Fortune a lumber correction will come, the only question is when. If the vaccine rollout is successful, he says, some price relief should come later this year.

“For some mills, this latest wave of COVID-19 from November to January restrained production at a time when mills would have liked to add overtime or shifts to meet unseasonably strong demand,” Jalbert said. “As COVID-19 cases continue to plummet, vaccination roll out over the coming weeks and we achieve some level of herd immunity, I expect mill production to ramp up and distribution delays to start dissipating. Supply should increase in the coming months.”

Jalbert also sees lumber supply increasing this year as new producers, particularly in the South, get into the business. The record prices are hard to resist for producers. That expected ramp-up in production, he says, should continue into 2022 and 2023.

Lumber prices are up a staggering 188%—when will the wood shortage end?BY LANCE LAMBERT https://fortune.com/2021/03/20/lumber-prices-2021-chart-when-will-wood-shortage-end-price-of-lumber-go-down-home-sales-cost-update-march/

From Abnormal Returns Blog www.abnormalreturns.com

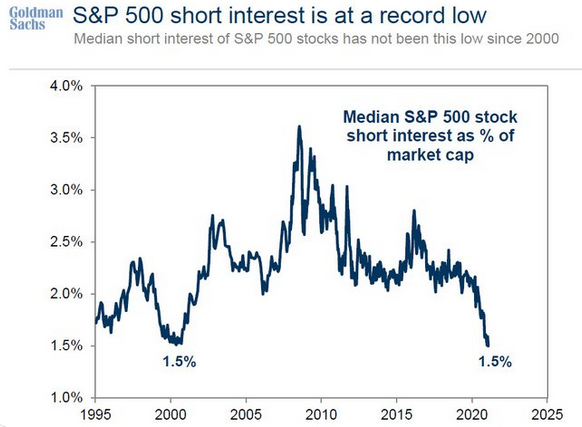

5. S&P Short Interest Hits Internet Bubble Levels…Record Low.

From Dave Lutz at Jones Trading

GS notes S&P Short Interest is at a record low.

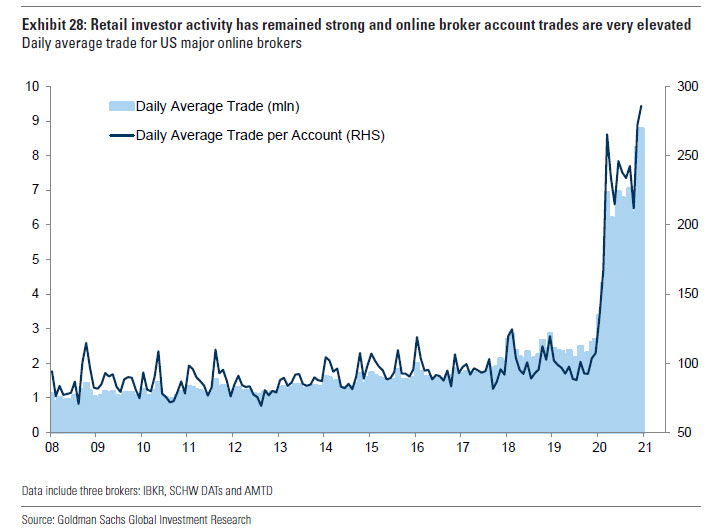

6. Daily Average Trade for U.S. Major Online Brokers.

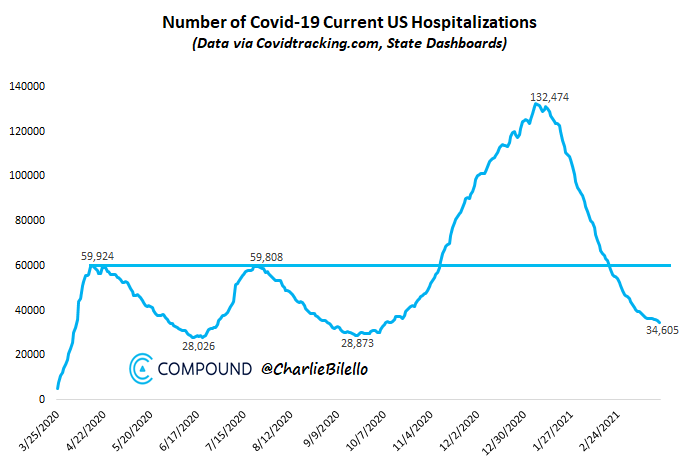

7. Covid-19 hospitalizations in the US were down 5% over the past week, the 68th consecutive day of week-over-week declines. Down 74% from their peak on Jan 6.

Charlie Bilello https://twitter.com/charliebilello

8. Treasury Disbursed $242 Billion In Relief Funds To 90 Million Americans…In Bank Accounts One Week Tomorrow

By PYMNTS

Posted on March 17, 2021

President Joe Biden’s $1.9 trillion American Rescue Plan released its first tranche of pandemic relief, so far distributing an estimated $242 billion in payments to approximately 90 million people.

Payments were largely electronic and directly deposited into people’s bank accounts but the Treasury also mailed about 150,000 paper checks or debit cards totaling around $442 million, according to a Wednesday (March 17) press release from the Treasury Department.

As of Wednesday, everyone in the first batch using direct deposit will now be able to see the money deposited into their bank accounts. The Treasury will continue to release money in tranches over the next several weeks.

“The first batch of payments primarily went to eligible taxpayers who provided direct deposit information on their 2019 or 2020 returns, including people who don’t typically file a return but who successfully used the Non-Filers tool on IRS.gov last year,” according to the press release.

Over 35 million people used the “Get My Payment” tool on IRS.gov as of this past weekend. The tool is updated as soon as new information becomes available.

The stimulus payments are intended to help people struggling due to the economic difficulties caused by the COVID-19 pandemic. The first relief payment was $1,200 to individuals and the second was $600. This latest payment will give most individuals $1,400, including children.

March and April of this year will be a significant time for the U.S. economy, which has taken a pandemic-fueled hit as people locked down and all but essential businesses closed. With everyone largely staying home, people began squirreling money away, contributing to $2.9 trillion in savings worldwide. If people start spending and use the new relief payment for goods and services, that would help the economy recover faster.

Retail investors are expected to use 37 percent of their $1,400 in relief money for the stock market. There is some fear that people might decide to save the money, as they did in previous stimulus rounds. Economists indicated that another surge in stimulus savings would stunt economic growth.

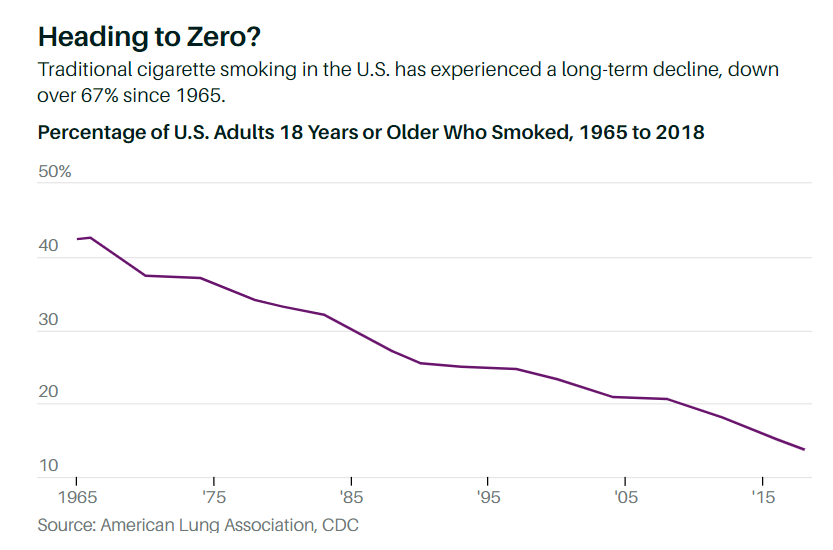

9. Smoking Down 67% Since 1965

Barrons

How the Big Tobacco Giants Can Survive the Last Smoker–Teresa Rivas

10. This 2-Minute Video Is a Master Class in How to Deliver a Motivational Speech

Because method without motivation only gets you so far. And motivation without method gets you nowhere.

Damien Hardwick, coach of the Richmond Tigers of the Australian Football League. Courtesy Amazon

I’m not a fan of “Go get ’em, you’ve got this, you can do it!” motivational speeches. No matter how powerful or stirring in the moment, rah-rah speeches may help me picture myself at the top of the mountain, arms raised in triumph.

But the effect is fleeting, especially if I’m struggling. Telling me I can do something doesn’t really help when recent evidence suggests otherwise.

Just as method needs motivation, motivation needs method.

Sure, I need to get fired up. But I also need to know how to use that energy. And, more important, I need to believe in, and trust, how I will use that energy.

Hold that thought.

If you’re not familiar — and I feel sure you’re not — Damien Hardwick is the coach of the Richmond Tigers of the Australian Football League, easily the coolest sport you’ve never heard of.

At halftime of the 2020 Grand Final (think Super Bowl), Geelong led Richmond by 15 points, a scoreline that flattered the Tigers. Geelong had largely dominated the game.

What did Hardwick say to his team?

Watch this two-minute clip:

Now let’s look at why it was so effective.

He Sets the Stage

“We’re in a street fight,” Hardwick says. “That’s the reality of an AFL Grand Final.”

The two best teams in the competition, playing for the championship. Tough. Physical. All-out. Hardwick doesn’t downplay the difficulty of the situation.

But not an unfamiliar one. Richmond has played in three of the past four Grand Finals.

“We’ve been in this situation before,” he says. “We know exactly what it’s like.”

Heads nod. The players do know exactly what it’s like.

Then he references Richmond’s process: their strategies, tactics, and overall system. (Richmond plays a running, swarming, physical brand of football that relies, much like the New England Patriots during their heyday, on players understanding their roles and, as Bill Belichick would say, their willingness to “Do your job.”)

“It is all about believing in our process,” Hardwick says. “Our process has kept us in good shape through the course of this game, and the course of the year thus far. We just have to continue to believe in it.”

Especially if they follow it.

He Explains How

Hardwick starts with a positive. “Defensively, our setup behind our attack, our pressure has been very good,” Hardwick says.

“Our system, though, has been average.” Small breakdowns have hurt the team offensively. Yet instead of going into detail, Hardwick keeps it simple and digestible by focusing on two key adjustments.

“First of all, our ability to set the ground up. Our forwards? We’re too far away. So we’re going to get up the ground (field),” he says.

“But we also have to realize: What is the strength of our mids (midfield players) and backs?” he asks. “Running, carry, work rate. We have to support the attack.”

Heads nod. That is their strength. On average, Richmond players run faster and longer than most teams. They stay structured defensively, yet they also push players forward to overload the other team’s defense. (It’s a hard system to play — but like most hard things, it works.)

“So we’ve got all the answers,” Hardwick says.

Having the answers creates confidence. Knowing what has gone wrong makes the score explainable; Geelong may be winning, but Richmond isn’t playing to its potential. Richmond doesn’t need to “play better.”

The team just needs to get back to what has made them so successful. “Are we asking you to do something we haven’t done for the vast majority of the year?” Hardwick asks. “No. All we have to do is reset, and believe that the more we get the ball into space, the more it favors us.”

Simple tweaks. Simple adjustments. A simple “how.” Most important, one the players believe in, because that system, that process, has consistently produced results.

Method in place, now it’s time for a little inspiration.

He Explains Why

Hardwick tells everyone to grab a jumper; that’s their signal to stand close together. (Holding another player’s jersey creates an even stronger physical — and therefore emotional — bond.)

Then he brings it home:

We’ve been through a helluva journey. However we decide what our story wants to be is on the Richmond Football Club. It’s on every single individual in this huddle. Have we played the very best we (ever) have? No. We have a long way to improve.

But the reality is, it’s our story to write. What story you want it to be is determined by the man in that jumper. And the man in that jumper beside you. It all comes down to us.

We are playing a good side. There is no doubt about that. But you’re a great side. So you get to dictate what this story looks like this second half.

We understand who we are. But, more importantly, we understand what we can do: hard, tough, Richmond-style footy. Leave nothing in the tank. You’re playing the biggest game of the year. Let’s go!

Go back to the video and look at the players’ faces. They’re engaged. They’re focused.

They’re willing and open, because the focus wasn’t on what they might have done wrong; the focus was on he knows — and they believe, because of past results — they could do better.

They trust their coach. They trust one another. They trust the how.

They believe.

And, possibly most important, they understand they embrace playing for one another … yet also for themselves.

“Writing your own story” is a consistent theme at Richmond. Your “story” is what you want to achieve. What you want to become, in service to a larger goal, yet also personal — because the best team goals are also personal goals.

Especially when one of your personal goals is to see the people around you succeed. (Which Richmond does, winning the Grand Final by 31 points.)

The next time you seek to motivate people, follow the same blueprint. Set the stage. Build confidence by describing a practical, effective “how.” Then layer in a little motivation and inspiration.

Because method without inspiration only gets you so far.

And inspiration without method gets you nowhere.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.