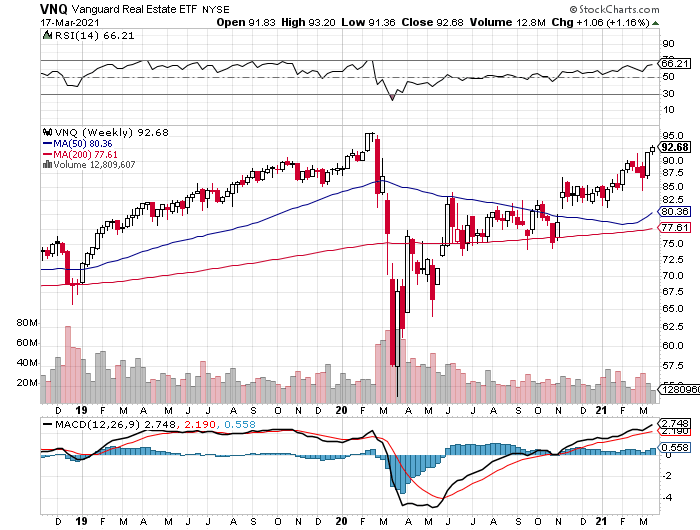

1. Another Chart Approaching Highs …..REIT Indexes Recover

Vanguard REIT ETF just below 2020 Highs.

©1999-2021 StockCharts.com All Rights Reserved

2. Inflation-Bonds, REITS and Stock Far Better Hedges Against Inflation than Gold

Charlie Bilello–This is what that same chart looks like if we include Investment Grade Corporate Bonds, REITs, and Stocks…

Note: Investment Grade Bonds = ICE BofA US Corporate Total Return Index, REITs = FTSE Nareit All REITs Index (Total Return), S&P 500 Index = S&P 500 Total Return Index.

As it turns out, Bonds, REITs, and Stocks have all been far superior hedges against inflation than Gold. And they’ve all done so with lower volatility than Gold.

What’s the Best Hedge Against Inflation?BY CHARLIE BILELLO

HTTPS://COMPOUNDADVISORS.COM/2021/WHATS-THE-BEST-HEDGE-AGAINST-INFLATION

3. Long-Term Bonds 10% Drawdown for 11th Time Since 1994….All Recovered in this Bond Bull Market

For the 11th time since 1994, long-term bonds are in a 10% drawdown.by Michael Batnick

The most interesting thing about this chart is that an all-time high followed all of them. And just eyeballing it, it looks like it didn’t take too long for investors to get their money back.

Bond investors got paid back quickly when interest rates rose because rates were relatively high. At higher levels of income, you’re going to make your money back faster. The other reason investors were quickly made whole is that rising rates were just a temporary climb in a long downward trend.

https://theirrelevantinvestor.com/2021/03/15/aint-so-bad-2/

4. Will the Value Rally Last? The Spread Between Growth and Value Returns in 2020 was Massive

ETF.com Massive Growth Outperformance 2020 Across Market Caps

Why Avoiding Alpha A Good ETF Play

https://www.etf.com/sections/index-investor-corner/why-avoiding-alpha-good-etf-play

5. Google Searches for Inflation Spike.

Jim Reid Deutsche Bank

6. There is no Shortage of Oil

From the Daily Shot Blog-There is no shortage of oil. Spare production capacity within OPEC is close to record levels.

Source: Longview Economics

The Daily Shot

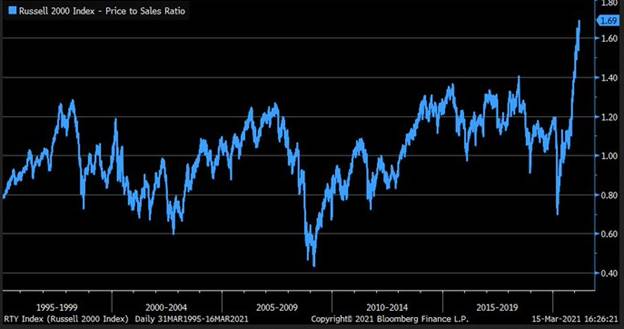

7. Small Cap Russell 2000 Index Price to Sales Ratio Hockey Stick Double Off Lows

From Dave Lutz at Jones Trading. …Price to Sales .65 to 1.65

LizAnn notes the Russell 2000 price/sales ratio has surged to yet another all-time high

8. Net Home Equity Cashed Out vs. 2008 Housing Bubble.

Housing fundamentals say better than 2008 but cash outs rising

Underlying fundamentals are significantly different than what we saw in the early 2000s–Housing Wire

March 15, 2021, 10:34 am By Logan Mohtashami

Share On

https://www.housingwire.com/articles/are-we-seeing-a-cash-out-loan-crisis/

Found at Abnormal Returns blog www.abnormalreturns.com

9. Lordstown Motors faces SEC questions over shortseller report

By Reuters Staff-SEOUL (Reuters) – Lordstown Motors Corp on Wednesday said it received a request for information from the U.S. Securities and Exchange Commission regarding a report by shortseller Hindenburg Research, and the company is cooperating with the SEC inquiry.

The Ohio-based electric pickup-truck startup said on an earnings conference call that its board of directors has formed a special committee to review the matter.

Shares of Lordstown Motors were down 5% in extended trade.

On March 12, Hindenburg Research revealed that it had taken a short position in the electric truckmaker, accusing the company of misleading the public with “fake” orders and claiming that its upcoming truck is three to four years away from production.

The company, which in 2019 acquired a shuttered General Motors Co’s plant in Ohio, reiterated on Wednesday that it remained on track to begin building its Endurance electric pickup truck in September as planned.

Reporting by Hyunjoo Jin; Editing by Leslie Adler and Cynthia Osterman

10. Warren Buffett’s “2 List” Strategy for Focused Attention

James Clear

One of my favorite methods for focusing your attention on what matters and eliminating what doesn’t comes from the famous investor Warren Buffett.

Buffett uses a simple 3-step productivity strategy to help his employees determine their priorities and actions. You may find this method useful for making decisions and getting yourself to commit to doing one thing right away. Here’s how it works…

One day, Buffett asked his personal pilot to go through the 3-step exercise.

STEP 1: Buffett started by asking the pilot, named Mike Flint, to write down his top 25 career goals. So, Flint took some time and wrote them down. (Note: You could also complete this exercise with goals for a shorter timeline. For example, write down the top 25 things you want to accomplish this week.)

STEP 2: Then, Buffett asked Flint to review his list and circle his top 5 goals. Again, Flint took some time, made his way through the list, and eventually decided on his 5 most important goals.

STEP 3: At this point, Flint had two lists. The 5 items he had circled were List A, and the 20 items he had not circled were List B.

Flint confirmed that he would start working on his top 5 goals right away. And that’s when Buffett asked him about the second list, “And what about the ones you didn’t circle?”

Flint replied, “Well, the top 5 are my primary focus, but the other 20 come in a close second. They are still important so I’ll work on those intermittently as I see fit. They are not as urgent, but I still plan to give them a dedicated effort.”

To which Buffett replied, “No. You’ve got it wrong, Mike. Everything you didn’t circle just became your Avoid-At-All-Cost list. No matter what, these things get no attention from you until you’ve succeeded with your top 5.”

I love Buffett’s method because it forces you to make hard decisions and eliminate things that might be good uses of time, but aren’t great uses of time. So often the tasks that derail our focus are ones that we can easily rationalize spending time on.

This is just one way to narrow your focus and eliminate distractions. I’ve covered many other methods before like The Ivy Lee Method and The Eisenhower Box. That said, no matter what method you use and no matter how committed you are, at some point your concentration and focus begin to fade. How can you increase your attention span and remain focused?

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.