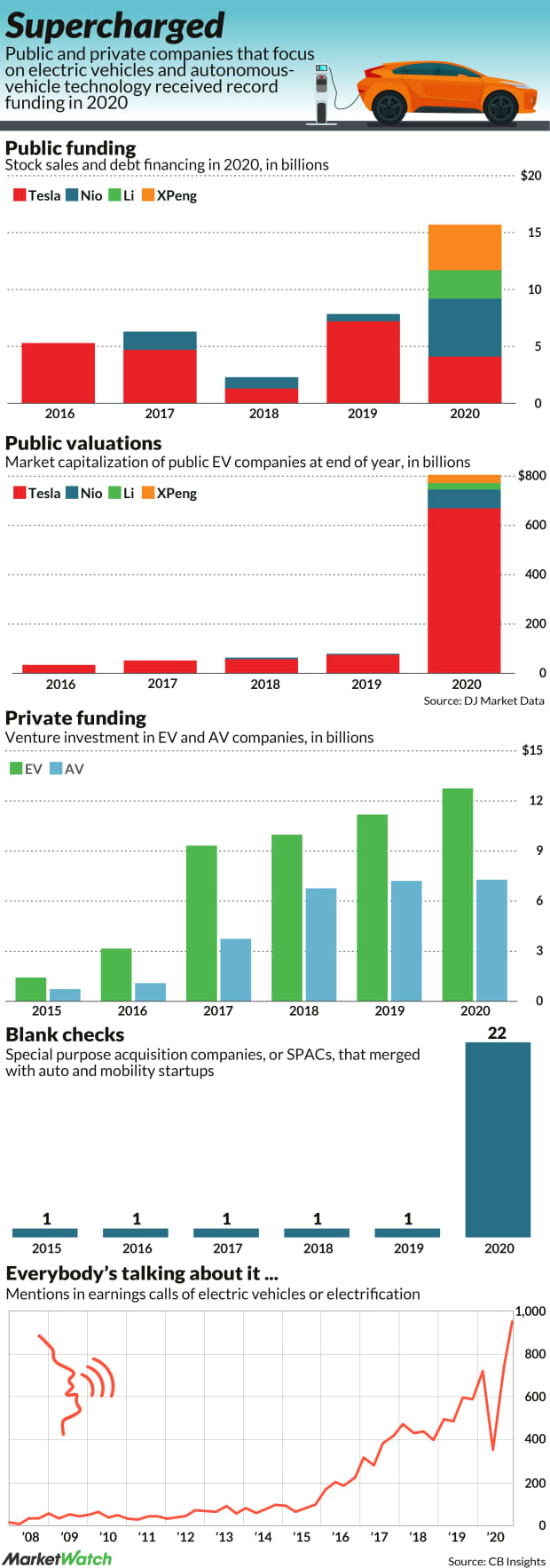

1. In One Chart: The explosion in electric-vehicle funding, valuation and trading

Jeremy C. Owens and Tomi Kilgore

At least $28 billion flowed into public and private electric-vehicle companies, while even more went to autonomous-vehicle tech amid an uprising for blank-check companies

Electric-vehicle stocks suffered a correction early in 2021, but still appear to be popular investment targets that retain much of their shocking 2020 increases in valuation while putting billions in funding to use.

2. SPAC Increases Flying Car Valuation by 23,000% in One Year…Archer Aviation

Bloomberg–The aircraft stands poised, six black propellers turned skyward, gauzy light glinting off its silvery skin. Twin-tailed and blimp-shaped, it might look at home in a galaxy far, far away, in the “Star Wars” universe.

For now, from a business perspective, it’s about as real as a Jedi.

An Archer Aviation prototype aircraft.

The futuristic electric craft — or at least the artist rendering of it on the internet — is the brainchild of a young company called Archer Aviation. Its plan is to build helicopter-type vehicles that can whisk passengers quickly and quietly above Earth-bound traffic for the price of a $50 Uber. “The flight of a lifetime, every day,” its website promises.

A money manager at a brand-name investment firm told me that Archer came to him last year looking for private financing. He passed. In fact, he didn’t even take a meeting. As he pulled up a PowerPoint outlining the proposal, he remembered why: to him, the company looked more like a science project than a business.

Such skepticism aside, Archer Aviation nonetheless has managed to land on the venerable New York Stock Exchange as if it were a Boeing or Airbus. It got there via a SPAC orchestrated by Ken Moelis, another prominent dealmaker, who has started to raise money for three other SPACs.

Archer’s good fortune is a testament to SPACs, also known as blank-check companies. SPACs have a lot of wiggle room in valuing the businesses they buy. Unlike traditional IPOs, where financial results are in focus, SPACs can base entire deals on projections.

When I reached out, a spokeswoman for Archer said it’s been testing an 80%-to-scale prototype at private airfields in California. It hasn’t carried pilots or passengers. The company says it will turn out 500 flying taxis by 2026. United Airlines has promised to buy at least 200, provided a range of conditions are met, to spirit passengers from Hollywood to Los Angeles International Airport. Archer says it’s the only company in its space — that is, electric vertical takeoff and landing aircraft, or eVOTL — that has secured a commercial contract for orders. It also has a major auto manufacturing partner with plans to make electric cars.

That, essentially, is enough for a SPAC.

The math is jaw-dropping. Only last April, a round of seed funding valued Archer at $16 million. Moelis’s deal has placed a higher value on the company: $3.8 billion. In other words, in less than a year, the valuation has jumped 23,650%.

“There are a significant number of SPACs betting on concepts, rather than looking at real and projectable revenues,” Mark Attanasio, co-founder of the $30 billion Crescent Capital Group and principal owner of the Milwaukee Brewers, said of SPACs broadly. Crescent, naturally, has a SPAC too.

‘Hey, Hey, Money Maker’: Inside the $156 Billion SPAC Bubble

3. More Than 2/3 of all U.S. Buyouts were Priced Above 11X EBITA.

Alternatives: More than two-thirds of all US buyout deals were priced above 11x EBITDA (reflecting rich public valuations). High deal multiples are putting added pressure on general partners to produce growth, according to Bain.

Source: Bain & Company

From The Daily Shot https://dailyshotbrief.com/the-daily-shot-brief-march-16th-2021/

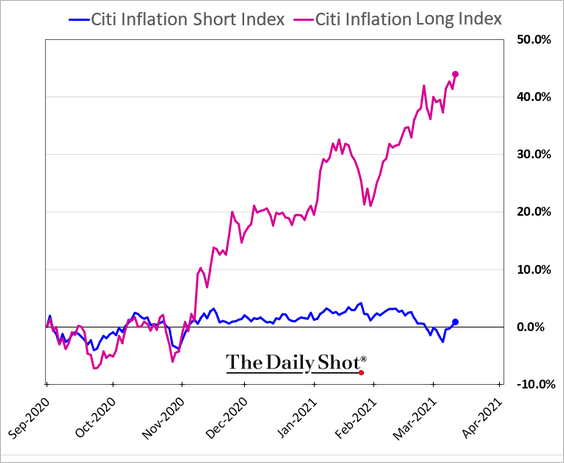

4. Equities: The market is increasingly pricing in higher inflation ahead.

Stocks sensitive to rising prices have outperformed sharply since the vaccine announcement.

Source: The Daily Shot. https://dailyshotbrief.com/the-daily-shot-brief-march-11th-2021/

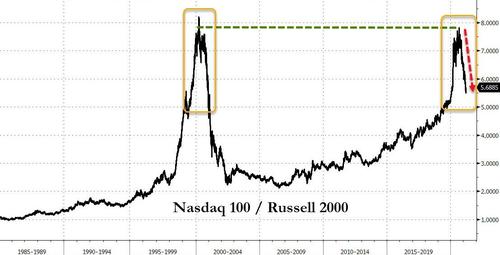

5. Nasdaq 100 vs. Russell 2000 (small cap) Hit 1999-2000 Levels Before Reversal

Zero Hedge Is this the new trend to befriend?

Source: Bloomberg

https://www.zerohedge.com/markets/big-tech-trumps-small-caps-inflation-outlook-hits-13-year-high

6. The Worst S&P 500 Stocks Of 2020 Are Soaring

| Company | Symbol | 2020 % Stock Ch. | % Ch. YTD Stock | Sector | Relative Strength |

| Occidental Petroleum | (OXY) | -58.0% (worst stock of 2020) | 76.9% | Energy | 88 |

| Carnival | (CCL) | -57.4% | 31.4% | Consumer Discretionary | 69 |

| Norwegian Cruise | (NCLH) | -56.5% | 20.8% | Consumer Discretionary | 80 |

| Raytheon Technologies | (RTX) | -52.3% | 9.8% | Industrials | 38 |

| United Airlines | (UAL) | -50.9% | 30.2% | Industrials | 58 |

| Marathon Oil | (MRO) | -50.9% | 82.9% | Energy | 91 |

| ONEOK | (OKE) | -49.3% | 34.4% | Energy | 74 |

| HollyFrontier | (HFC) | -49.0% | 58.8% | Energy | 77 |

| Diamondback Energy | (FANG) | -47.9% | 69.4% | Energy | 91 |

| Schlumberger | (SLB) | -45.7% | 32.9% | Energy | 71 |

Sources: IBD, S&P Global Market Intelligence

Follow Matt Krantz on Twitter @mattkrantz

Warren Buffett’s Panic Sale Of Two Stocks Cost $713 Million https://www.investors.com/etfs-and-funds/sectors/sp500-warren-buffetts-panic-sale-two-stocks-cost-700-million/?src=A00220

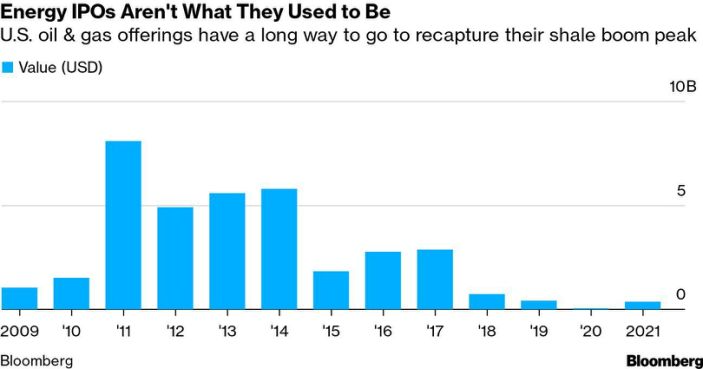

7. First Shale IPO in Almost Half a Decade to Test Wary Investors

Sergio Chapa(Bloomberg) — The first initial public offering for a shale driller in almost half a decade will test investors’ desire for an industry that’s still dusting off from last year’s historic energy-market bust.

Vine Energy Inc., which is backed by private-equity giant The Blackstone Group, plans to sell almost 19 million shares on the New York Stock Exchange as soon as this week. With an initial price range of $16 to $19 per share, the issuance could be valued as high as $357 million.

The natural gas explorer is coming to the market as shale drillers grapple with investor pressure to restrain spending and production growth for the sake of shareholder returns and avoiding new supply gluts.

The seven-year-old company is led by Eric Marsh, the former gas chief at EnCana Corp., which drilled the first exploration well in the Haynesville Shale in Louisiana about 15 years ago, according to Bloomberg Intelligence. EnCana is now known as Ovintiv Inc.

“It will be a great test for appetite in the market for energy companies and underlying valuations,” said Mark Rossano, founder and chief executive officer of C6 Capital Holdings. “Based on how the IPO is received, it could open up additional companies bringing stock or debt to market.”

Vine is the first shale driller to IPO since Jagged Peak Energy Inc. in early 2017. Three years later, Jagged Peak was acquired by Parsley Energy Inc., which has since been taken over by Pioneer Natural Resources Co.

Gas Play

Vine posted a loss of $252 million last year on revenue of $379 million. The company plans to use the proceeds to pay down some of its nearly $1.2 billion in debt and for general purposes as it expands in the Haynesville region, according to a filing with the U.S. Securities and Exchange Commission.

https://finance.yahoo.com/news/first-shale-ipo-almost-half-100003138.html

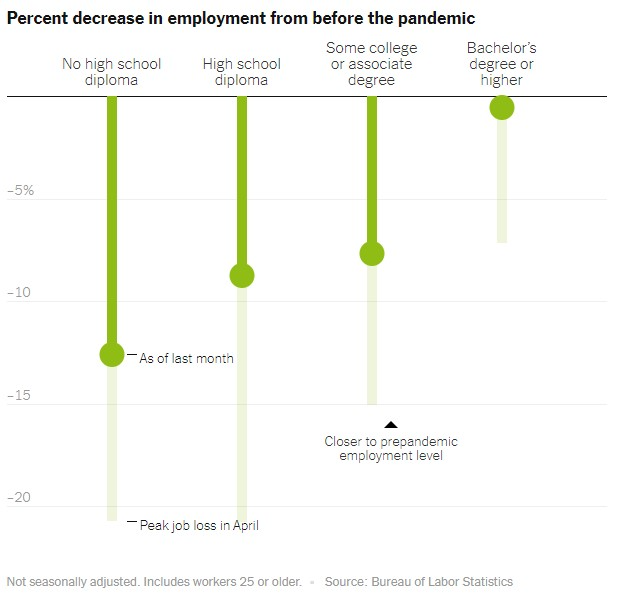

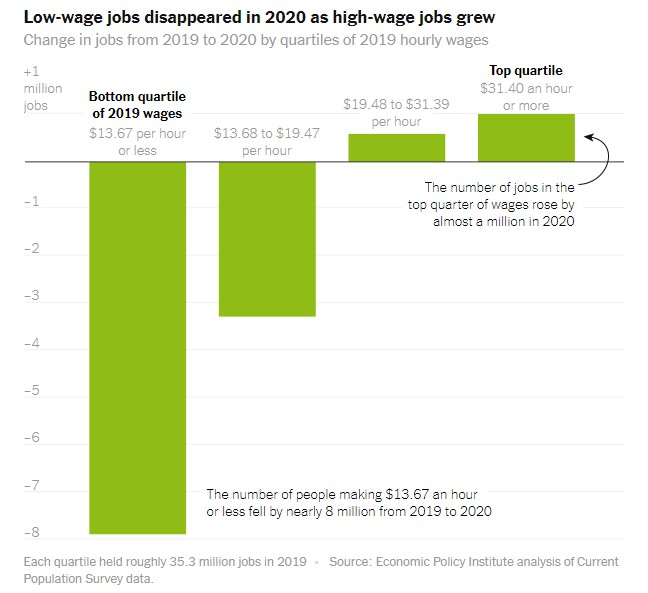

8. Employment Picture During Pandemic

Just look at these charts from The New York Times on the employment picture during the pandemic:

And here is the change in jobs segmented by wages:

The Most Important Investment Factor of the 21st Centuryby Ben Carlson

https://awealthofcommonsense.com/2021/03/the-most-important-investment-factor-of-the-21st-century/

Found at Crossing Wall Street https://www.crossingwallstreet.com

9. Google’s Nest Adds Sleep Tracking in New Health Tech Foray

Nico Grant

Tue, March 16, 2021, 9:00 AM·2 min read

(Bloomberg) — Google’s Nest unit is expanding into health technology with a feature that tracks sleep patterns, offering a potential new revenue stream but also raising privacy concerns.

The company unveiled the second-generation model of its Nest Hub smart display in a blog post Tuesday, and this time it comes with a function called Sleep Sensing that monitors the breathing and movement of a person sleeping next to the screen — without a camera or needing to wear a device in bed.

The system also detects disturbances such as coughing and snoring, along with light and temperature changes using the Nest Hub’s built-in microphones and ambient light and temperature sensors. Over time, it learns the user’s sleep patterns and gives personalized recommendations.

Ashton Udall, a senior product manager at Google Nest, said Sleep Sensing will be available as a free preview until next year. That suggests the company may begin charging for the service in the future.

Nest was a pioneer in so-called smart home technology through its internet-connected thermostat. Google acquired the company for $3.2 billion in 2014. Since then, Nest struggled with some new product launches, lost its founders and dealt with recurring privacy questions.

On Tuesday, the internet giant addressed the privacy implications of Nest’s new sleep-sensing feature. The system relies on a low-energy radar technology called Soli to do the tracking, but it can be disabled.

Audio of users’ snores and coughs will be processed on the Nest Hub device rather than being sent to Google’s servers. There’s even a hardware switch that physically disables the microphone. Users can also review and delete their sleep data at any time, and Google stressed that the information isn’t used for personalized ads.

Google, Amazon.com Inc. and Apple Inc. have developed smart displays and speakers to expand their platforms further into consumers’ homes and lives.

https://finance.yahoo.com/news/google-nest-adds-sleep-tracking-130000660.html

10. Why It’s Great to Have a Stubborn Child

BY DONNA GORMAN

DECEMBER 1, 2015 11:23 AM EST

Years ago, in preschool, a teacher sent my youngest child, Ainsley, to sit by herself until she was ready to talk about something she’d done wrong. She sat through circle time. She sat through snack time. She sat through recess and story time and music. It wasn’t until lunchtime that she finally decided to talk. The teacher was surprised by her determination. Me? Not so much.

Her grandmother, a former school principal, sought to reassure me: “You want a strong-willed child. Those are the ones who don’t follow their friends into trouble in high school.” That didn’t make me feel better when I faced off against this fiery little creature, who had strong opinions on everything from clothing to bedtime to whether carrot sticks should ever be on the same plate as apple slices.

New research, though, shows that grandma was right. A recently completed study, which tracked students from their late primary years until well into adulthood, found that kids who frequently break the rules or otherwise defy their parents often go on to become educational over-achievers and high-earning adults.

Children between the ages of 8 and 12 years old were evaluated for non-cognitive personality traits like academic conscientiousness, entitlement and defiance. Forty years later, researchers checked back to see how they turned out; rule breaking and defiance of parental authority turned out to be the best non-cognitive predictor of high income as an adult.

My little girl is going to be rich!

The study doesn’t explain why there is such a strong correlation between rule-breaking youngsters and high income in mid-life. The authors postulate that such children might be more competitive in the classroom, leading to better grades. They might be more demanding as adults; when locked in salary negotiations, they may be the ones who demand more. They may be more willing to fight for their own financial interests, even at the risk of annoying friends and colleagues. The authors can’t rule out a more negative reason— these young rule breakers might be doing something unethical as adults to increase their grown-up salaries.

So how do you know if your child is strong-willed?

Strong-willed kids have strong gut reactions that they’ll battle for even when it’s illogical, say professional therapists. They go after what they want at any cost.

Was grandma right, then? Is it good to have a strong-willed child?

Therapists say it’s true that strong willed kids are more willing to do what’s right, rather than what their friends are doing. If parents can motivate them and turn their drive to doing well at school or a real purpose, these kids can make motivated leaders who will do the right thing even if they have to do it solo.

This all sounds great to me. Who wouldn’t want their child to turn into a motivated leader who can afford to buy mom a beach house? But how do you get from here to there? How do you avoid spending the high school years battling with a child who is determined to win at all costs?

The same way you deal with any conflict situation: keep the lines of communication open. Listen to them. Ask them to explain their view. As they talk out what they think hey may catch their lack of logic. You may even find they win you over. And if they make a compelling case, negotiate.

You can even concede a few points, letting them try, say, staying out late, as long as certain conditions are met. And if they’re not, let them set some consequences in advance.

It’s hard to negotiate with a 5-foot-tall lawyer-to-be! Sometimes I want to put my foot down and fall back on the old “I’m the mom and I say so argument.” It may be that I’m a bit strong-willed myself.

But the next time my young negotiator comes at me with a plan for a later bedtime or a new iPad, I’ll take a deep breath and listen. If the study’s authors are correct, she will reap the benefits of this innate persistence as an adult. Every parent wants his or her child to grow into a successful adult, and this research shows my determined girl is on the right path. It’s just that sometimes adulthood seems a very long way off, indeed.

https://time.com/4130665/why-its-great-to-have-a-stubborn-child/?xid=time_socialflow_twitter

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.