1. Big Pharma Cheapest vs. S&P in 20 Years

PPH Big Pharma ETF 13x forward vs. 22x for S&P….This chart compares PPH to SPY

2. YTD Small Cap Value +20% vs. Momentum ETF MTUM flat

Small Cap Value ETF +20% vs. Momentum ETF Flat

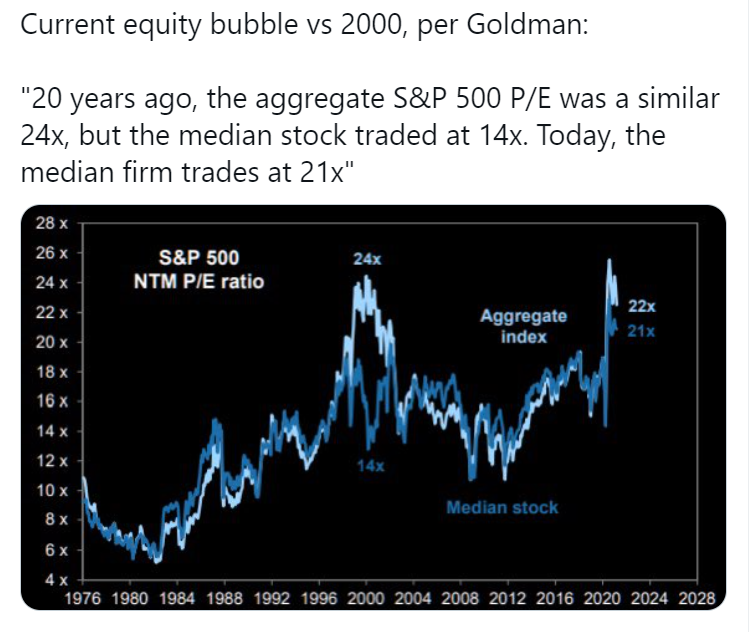

3. 1999 vs. 2020…Median Stock in S&P Trades at 21x Today vs. 14x 1999.

Another example of lower rates being the difference between today and 1999

Twitter-The SPAC King https://twitter.com/JulianKlymochko

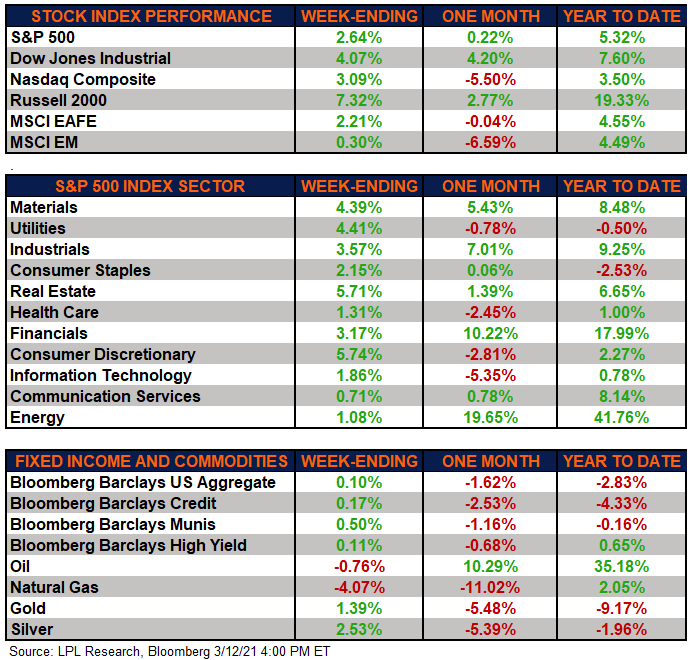

4. Sector Dispersion…Energy +41% and Financials +18% YTD

LPL Research

5. Real 10-year yields are off their lows, but still in negative territory

Inflation-adjusted yields still negative

Schwab

Note: A real interest rate is an interest rate that has been adjusted to remove the effects of inflation.

Source: Bloomberg. U.S. real 10-year yield (H15X10YR Index). Daily data as of 3/5/2021

https://www.advisorperspectives.com/commentaries/2021/03/12/moving-with-bottlenecks

6. Fed Futures Pricing in Rate Hike for December Next Year

The $1.9 trillion stimulus bill President Joe Biden signed into law last week and the rollout of COVID-19 vaccinations stoked a bullish mood, but the focus was gradually turning to the outlook for monetary policy from the Fed this week. “The Federal Reserve is expected to rigidly stick to its easing plans, despite (Fed Chair Jerome) Powell & Co likely becoming significantly more upbeat on the outlook,” said AFS in Amsterdam. Fed fund futures are now pricing in almost a full rate hike by December next year, Bloomers note

From Dave Lutz at Jones Trading

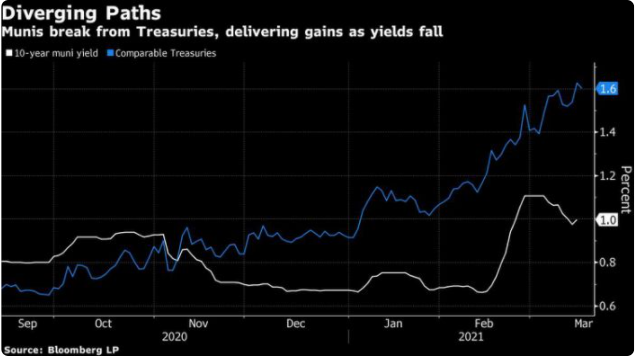

7. Munis Become Refuge From Bond Market Losses With Yields Falling—

Bloomberg Fola Akinnibi

Bloomberg) — America’s municipal bonds are proving to be a haven for fixed-income investors.

Even as speculation about resurgent economic growth drove up yields on corporate bonds and Treasuries this month — saddling investors with losses — tax-exempt debt moved in the opposite direction. Benchmark municipal-bond yields have dropped so far in March, delivering investors a return of 0.72%, according to the Bloomberg Barclays index.

The disconnect is coming as investors plow back into the municipal market following a selloff late last month, with both mutual funds and exchange-traded funds seeing an influx of cash.

https://finance.yahoo.com/news/munis-become-refuge-bond-market-173125206.html

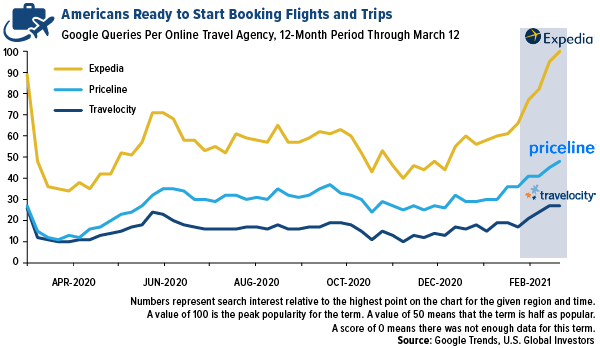

8. Airlines Betting on a Strong Rebound in Summer Bookings -From Advisor Perspectives Blog

This week marks the one-year anniversary of the start of the pandemic, and if Google Trends data is any indication, Americans are ready to travel again. The number of Google queries for online travel agencies Expedia, Priceline and Travelocity hit pandemic highs this week as airlines announced new deals and routes.

This Summer Could Be the Start of a New Roaring Twenties by Frank Holmes of U.S. Global Investors, 3/12/21 https://www.advisorperspectives.com/commentaries/2021/03/12/this-summer-could-be-the-start-of-a-new-roaring-twenties

9. Would Anyone Guess 2 Airline IPOs During Covid? Frontier and Sun Country

With recovery on radar, two U.S. budget airlines plot IPOs

(Reuters) – U.S. low-cost airlines Frontier and Sun Country plan to raise cash through initial public offerings (IPOs) as they prepare for a rebound in pandemic-hit travel.

FILE PHOTO: A Frontier Airlines Airbus A320neo plane departs from O’Hare International Airport in Chicago, Illinois, U.S. November 30, 2018. REUTERS/Kamil Krzaczynski/File Photo

Budget carriers are expected to bounce back quicker than larger rivals from the pandemic thanks to their lower-cost structures and focus on domestic leisure travel.

Frontier Airlines, which withdrew listing plans in July, filed again on Monday, after Apollo Global Management-backed Sun Country Airlines launched an IPO to raise around $200 million, regulatory filings show.

In its IPO filing, Denver, Colorado-based Frontier said that it was “well positioned to take advantage of the anticipated demand recovery as vaccine distribution continues.

Nearly 1.3 million people were screened at U.S. airports on Sunday, Transportation Security Administration data showed, the second-highest day in 2021 but down 40% from pre-COVID levels.

Frontier, which is owned by private equity firm Indigo Partners, is among a few U.S. airlines that have announced plans to resume hiring pilots.

It flies to more than 100 destinations in the United States, Mexico and the Caribbean and operates 100-plus Airbus A320 family aircra

The airline posted a net loss of $225 million for the year ended Dec. 31, 2020, hurt primarily by a sharp decline in demand due to the pandemic.

Citigroup, Barclays, Deutsche Bank Securities, Morgan Stanley and Evercore ISI are the lead underwriters for Frontier’s offering.

Meanwhile, Minnesota-based Sun Country, which first announced its IPO last month, expects to list around 9 million shares of its common stock at $21.00 to $23.00 per share.

The U.S. airline industry is also preparing for the arrival this year of newcomer Breeze Airways, a start-up by David Neeleman, the entrepreneur behind JetBlue Airways, Canada’s WestJet and Azul Brazilian Airlines.

Reporting by Sohini Podder in Bengaluru and Tracy Rucinski in Chicago; Editing by Uttaresh.V and Alexander Smith

Our Standards: The Thomson Reuters Trust Principles.

10. If You’re Searching for Purpose, Ask Yourself These 5 Questions

By Steve Knox | March 2, 2017 | 0

We are all searching for a purpose, a career and a life that really matter. So if you feel stuck, trapped or hopeless—if you want more—ask yourself these five questions to get your life back on track:

Related: How to Find Your Purpose

1. Why am I here?

Seriously. Right now, whatever coffee shop, classroom, cubicle or conference room you might be sitting in, why are you here?

- What brought me to this moment?

- What strengths, personality, creativity and talent do I have at my disposal?

- Without placing blame or making some sort of rationalization, what the heck am I doing with my life today?

Who you are becoming far outweighs who you are. If what you are doing today is not making you a better human being or the world a better place, you are probably on the wrong path.

I often have my coaching clients write a letter to their future self. If you invest the time to describe in vivid detail the type of person you would like to be a year from now, three years from now or even 30 years from now, then you will be giving yourself an unbelievable gift: the gift of hope.

With a compelling picture of the future, you have a target to aim for.

2. What is my story?

Stories are powerful, regardless of whether they are true. They give you a narrative to live by and life lessons to pass on, that shape and inform the person you are becoming.

One of the reasons you might be experiencing unrest and frustration in life today is that you might not have a better story shaping your life. You need a heroic narrative. A story that calls out your best and highest self. A narrative that demands you bring your full attention, strength and personality to the task at hand, creating a life of significance and substance.

This requires that you acknowledge the good and the bad of your story up to this point. A big part of this is learning how to let go of past guilt and regret, and to start living your life with conviction.

You cannot change your past, but you can create a better future. Make a conscious decision today to stop defining yourself by what you are not. Today is a new day with new opportunities, so start living a better story.

Be accountable to your future self. Live with a deeper sense of responsibility with the amazing talents, genius and strengths you have been given.

3. Who do I need?

You will never reach your full potential without the help of others. Whom you spend time with determines the person you become. Investing in the right relationships and surrounding yourself with the right people is crucial to your success.

It sounds a bit harsh, but there are some necessary endings that you need to embrace—friends who are not really friends, people who suck the life out of you.

- Who in my life is holding me back from becoming my best self?

- Who do I need to ask for help?

- Do I have any honest voices (mentors, coaches or heroes) in my life?

You are built for relationships. You have a calling in your life and a role to play within your team, family and community. Define whom you are fighting for and who is fighting for you.

Grab three friends or mentors in your life and ask them what they think is holding you back in life and how they see you overcoming it. Take notes, do not get defensive and thank them for being in your life.

4. What is at stake?

- What upsets me about the world today?

- What frustrates me?

- What problem do I want to solve?

These are clues to your calling. Windows into your soul. Why? What frustrates you reveals what you care about most. The only way to live life with passion is to discover, name and fight for what matters most to you.

Without something at stake—a cause, person or compelling future—you will merely keep surviving and never experience success, let alone significance. Deep down you know what matters most to you. Who matters most to you.

Procrastination literally means to waste the sacred. Every time you make an excuse, place blame or get distracted from going to work on your life, you move toward an apathetic and happenstance existence.

So stop.

5. How can I help?

The first law of thermodynamics states that energy can be transformed from one form to another, but cannot be created or destroyed.

In layman’s terms, your life can impact and influence others in meaningful ways. Even small ways. A smile, a hug, a thank you, a high-five, eye contact, an email or kind word. All energy transferring in the form of hope from you to another. How beautiful is that?

But you have to start. Commit to serve someone else in some small way. Give more than you take. Listen more than you talk. Write an email or letter of encouragement to someone who has helped you. Get your focus off yourself and onto others.

I guarantee you will surprise yourself with how good it feels to fight for something that matters. For someone who needs your help. If you make a conscious choice to practice empathy, compassion or generosity, then that single choice creates a ripple effect in the lives of others.

You might even spark something in them that causes them to do something for someone else.

Imagine that.

These five questions matter, because you matter. Your life is not your own. The world needs you to discover what makes you come alive and for you to use that in service to a cause bigger than yourself.

Related: Answer 6 Questions to Reveal Your Life Purpose

https://www.success.com/if-youre-searching-for-purpose-ask-yourself-these-5-questions/

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.