1. One-Year Performance Numbers….Exxon Converging on Amazon

In September Amazon was +100% in previous 6 months vs. Exxon Down…….Close Friday 1 year…AMZN +84% vs. Exxon +65%

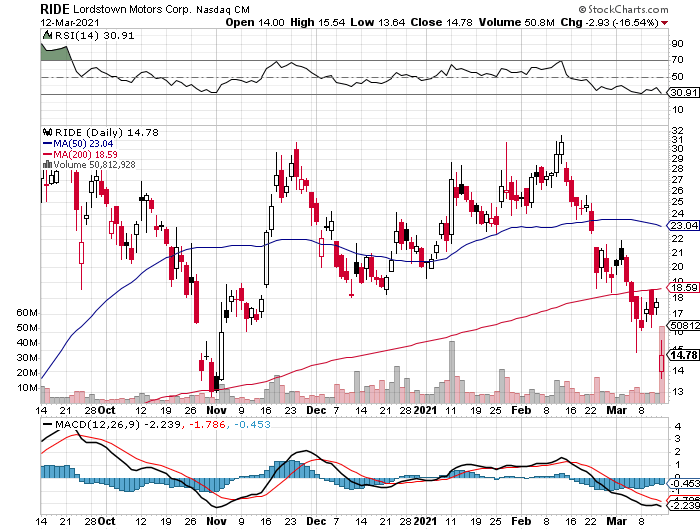

2. Mini-Teslas Under Heavy Pressure More Short Reports

Nikola $70 to $17

Lordstown Motors -41% from High

GM-backed startup Lordstown Motors accused of faking preorders

The short-selling firm that dug into Nikola last year has a new targetBy Sean O’Kane@sokane1 Mar 12, 2021, 12:46pm EST

General Motors-backed EV startup Lordstown Motors has been accused of fabricating some of the 100,000 preorders for its forthcoming Endurance electric pickup and misleading investors, the public, and government regulators about how much progress it’s made in developing the truck.

The accusations come in a new report from short-selling firm Hindenburg Research — the same firm that published a report about hydrogen trucking startup Nikola that led to the founder resigning his position and a major restructuring of that company’s business. Hindenburg says in the report, published Friday, that it has taken an unspecified short position in Lordstown Motors, meaning it stands to make money from the startup’s stock price falling.

The accusations from Hindenburg could also raise questions about General Motors and the due diligence it does on the startups it backs. GM, the biggest automaker in the US, had previously planned to take a big stake in Nikola before Hindenburg’s report came out last year.

LORDSTOWN MOTORS GOT BIG SUPPORT FROM THE TRUMP ADMINISTRATION

GM has backed Lordstown Motors since its inception and has a seat on the startup’s board. It loaned Lordstown Motors $40 million so the startup could buy a plant that GM shuttered in Lordstown, Ohio — a deal praised by then-president Donald Trump that eventually led to a White House photo-op and then-Vice President Mike Pence appearing at the Endurance unveiling event.

GM also invested more money and made other contributions (for a total value of $75 million) to Lordstown Motors as part of its merger with a special purpose acquisition company, or SPAC, which turned the startup into a publicly listed company on the Nasdaq stock exchange and helped it raise nearly $700 million total. (The startup has since said it’s in the “due diligence” phase of obtaining a loan from the Department of Energy (DOE), too.)

“The $75 million investment from General Motors in LMC included certain in kind contributions that have already been provided to Lordstown. These include the plant itself. We have nothing to say about the report,” GM’s director of finance and sales communications James Cain said in an email.

“We will be sharing a full and thorough statement in the coming days, and when we do we will absolutely be refuting the Hindenburg Research report,” Lordstown Motors said in a statement late Friday. The DOE declined to comment.

Lordstown Motors has claimed to have presold 100,000 pickup trucks to date. But Hindenburg accuses Lordstown Motors founder and CEO Steve Burns of paying consultants to preorder the startup’s electric pickup truck — something Burns confirmed to The Wall Street Journal on Friday.

The firm claims multiple big-batch orders for the truck were from companies that either exist mostly on paper or don’t operate vehicle fleets to begin with. One order for 14,000 trucks — which would cost more than $700 million — was placed by a Texas company with just two employees on LinkedIn. Another order for 1,000 Endurances was from a similarly small company, the CEO of which allegedly told Hindenburg he had no plans to buy the trucks.

Hindenburg also includes claims in its report that some preorders are nonbinding and require no money upfront, though this is a practice that has been common among startups in the space that try to book orders before getting a vehicle to production.

SOME BIG ORDERS CAME FROM COMPANIES THAT BASICALLY ONLY EXIST ON PAPER

While Burns has stuck to a September 2021 date for getting the startup’s pickup into production, Hindenburg says it spoke to former employees who believe the truck is at least three years away from being ready, including one who allegedly claimed that the startup has not completed cold weather and other testing required by the government. The report also cites a local news report of one of the startup’s prototype trucks catching fire in February as further evidence.

What’s more, Hindenburg discovered a previously unreported lawsuit filed against Lordstown Motors by EV startup Karma Automotive. In it, Karma accuses Lordstown Motors of trying to steal its infotainment system technology after initially trying to buy it.

Lordstown Motors’ relationship to Burns’ previous company, fellow Ohio EV startup Workhorse, is also called into question in the report. Burns founded Lordstown Motors shortly after leaving Workhorse in 2019, thought Hindenburg claims he was fired. Workhorse did not immediately respond to a request for comment.

As it entered into the deal with GM to buy the Lordstown factory, Burns’ new startup struck an agreement with Workhorse to license IP for a pickup truck that his former company was never able to get off the ground. Hindenburg claims that Workhorse was more than happy to unload the pickup truck. This deal has paid off handsomely so far for Workhorse, too, as Lordstown Motors paid $15.8 million for the IP, plus another $4.8 million when the new startup went public. Lordstown Motors also handed Workhorse a 10 percent stake that is now worth some $300 million based on the new startup’s stock price as of the end of 2020.

Hindenburg obviously stands to benefit from any hit to Lordstown Motors’ stock price. The firm’s research into Nikola did lead to that startup performing an internal investigation, which turned up evidence that founder Trevor Milton did in fact make “inaccurate” statements about his company before he ultimately resigned. But Nikola claims the results of the investigation do not line up with Hindenburg’s accusation that that the startup is an “intricate fraud.” Department of Justice and Securities and Exchange Commission investigations into Nikola are currently ongoing.

Update March 12th, 4:00PM ET: Added details about the Lordstown factory being included in the $75 million investment made by GM.

Update March 12th, 5:34PM ET: Added comment from Lordstown Motors.

3. Bitcoin +1000% in One Year

Bloomberg-Bitcoin is up about 1,000% in the past year amid signs of increasing institutional interest as well as speculative demand. Advocates champion the cryptocurrency as a store of value akin to gold that can act as a hedge against inflation and a weaker dollar. Others argue that the rally is a giant stimulus-fueled bubble on track to burst like it did in the 2017-2018 boom-and-bust cycle.

Bitcoin Hits Another Record and Leaves Other Asset Classes TrailingBy Olivia Raimonde

4. 302 IPOs 2021 vs. 35 by this Time 2020…763% Increase

Barrons–So far this year, 302 U.S. initial public offerings have raised $102.3 billion as of March 10, according to Dealogic. That is up 763% from the 35 offerings, valued at $11 billion, for the same period in 2020. For all of 2020, there were 457 IPOs, collecting $167.8 billion. Before that, the high-water mark for IPOs came during the dot-com bubble of 1999 when 547 offerings raised about $108 billion.

Ross Yarrow, managing director U.S. equities at Robert W. Baird, looked at the first-quarter results for companies that went public last year. He found that 81% were unprofitable. He also analyzed companies that went public in 2000, the peak of the dot-com bubble. Roughly 73% were unprofitable one quarter after the IPO.

IPO ETF still -10%+ off highs

©1999-2021 StockCharts.com All Rights Reserved

The Booming IPO Market Shows No Signs of Slowing. What Investors Need to Know.By Luisa Beltran

5. 2021 Move to Value Sees Boom in Old-Fashioned Names…Now Named “Nostalgia Index”

The Nostalgia Index

So far in 2021, investors have gravitated to stocks long seen as old-fashioned.

| Company | Stock Change Year-to-Date |

| ViacomCBS / VIAC | 154.8% |

| Barnes & Noble Education / BNED | 91.2 |

| Gannett / GCI | 68.8 |

| Fossil Group / GCI | 67.4 |

| Pitney Bowes / PBI | 49.8 |

| WW International / WW | 47.1 |

| Deluxe / DLX | 42.4 |

| Cinemark Holdings / CNK | 37.9 |

| H&R Block / HRB | 33.5 |

| Mattel / MAT | 20.2 |

| Average | 61.3 |

Source: Bloomberg

It’s Not Just GameStop. Why These Retro Stocks Are Suddenly Hot.

By Alex Eule

6. Microcap ETFs +130% Off Lows

FDM-First Trust Microcap ETF

©1999-2021 StockCharts.com All Rights Reserved

IWC-Ishares Microcap

©1999-2021 StockCharts.com All Rights Reserved

7. Rare Earth Metal ETF …$25 to $90 One Year.

REMX-Van Eck Rare Earth ETF

©1999-2021 StockCharts.com All Rights Reserved

REMX Fund Description

REMX tracks an index of global companies that mine, refine, or recycle rare earth and strategic metals.

REMX Top 10 Countries

- Australia25.38%

- Hong Kong13.83%

- United States11.05%

- Canada6.48%

- France3.79%

- Netherlands3.71%

- Japan2.53%

- Germany0.00%

- Spain0.00%

REMX Top 10 Sectors

- Specialty Mining & Metals49.90%

- Precious Metals & Minerals20.42%

- Commodity Chemicals9.88%

- Integrated Mining8.45%

- Agricultural Chemicals4.33%

- Specialty Chemicals4.04%

- Semiconductors2.97%

REMX Top 10 Holdings [View All]

- Shenghe Resources Holding Co., Ltd. Class A9.82%

- China Northern Rare Earth (Group) High-Tech Co., Ltd. Class A8.71%

- China Molybdenum Co., Ltd. Class A7.83%

- Zhejiang Huayou Cobalt Co. Ltd. Class A7.44%

- Lynas Rare Earths Limited7.02%

- Xiamen Tungsten Co. Ltd. Class A5.87%

- Pilbara Minerals Limited5.04%

- Ganfeng Lithium Co., Ltd. Class H4.93%

- Lithium Americas Corp.4.81%

- Eramet SA4.80%

Total Top 10 Weighting 66.28%

https://www.etf.com/REMX#overview

8. Consumer Net Worth Hit $130 Trillion….+23% Since 2018. Recession?

9. Consumers Flush but Federal Government Debt $27.9 Trillion Latest Number

Wolf Street

10. 10 Things to Teach Your Child About Money

We need money and use money every day, but it seems nobody every receives an adequate education about how to earn, save, give, spend, and invest money. Most people regret not having learnt more about money earlier in their lives. The majority of adults wish they were more knowledgeable about personal finances, and only 57 percent of Americans are considered financially literate. When is the right time to talk to your child about money? Now and always.

1. The First Rule. Spend less than you make. This simple rule will save you so much stress and suffering. Live moderately. Control your expenses. Live below your means, all wise men and women do.

2. Become a Saver. Save 10% of everything you ever earn. If you do you will be financially independent one day, and that is a beautiful thing. Start today. Save 10% of every dollar that comes your way from chores, birthday gifts, etc. Nobody ever regretted developing the habit of saving.

3. Buying. Before you buy anything, reflect on how hard you had to work to earn the money you are about to spend. Don’t confuse wants with needs. The person who needs the least has the most.

4. Invest. Invest first in yourself. The number one way wealthy people invested in themselves long before they were wealthy is by reading books. 86% of the wealthy love reading versus 26% of the poor. If you want to be financially independent someday become a reader. Commit yourself to learning more about money, personal finances, and the wisdom of wealth every year for the rest of your life. Learn how to put your money to work, so that your savings work for you even when you are sleeping.

5. Debt is a form of slavery. It is one of the major forms of stress in many people’s lives. Debt doesn’t solve problems, it creates them. You cannot borrow your way to happiness, wealth, or success.

6. Compound Interest. Learn about the power of compound interest. If you save $5 a day every day of your life to the age of 65 and invest it at a compounding rate of 9%, you will have over seven million dollars.

7. The Best Things. The best things in life really are free. It’s true. Never lose sight of it. Here are a handful of examples: true love, Sundays, laughter, friendship, work you love doing, nature, hugs and kisses, waking up to a new day, feeling healthy, rain, watching the sunset.

8. Overspending. Emotionally healthy people consume less than emotionally insecure and unhealthy people. Never buy anything to make yourself feel good. Overspending is a disease. If you get sick with the disease, get help immediately. Don’t wait until it takes over your life, destroys your relationships, and make you physically sick. If you are not free to say no, you are not free to say yes.

9. Future Income. Don’t just work for money, make your money work for you. Save and invest to ensure that you have income in the future. Contribute to your retirement plan as soon as you start working, buy a rental property, invest in a business. Ensure a future income for yourself and your family.

10. Generosity. Decide to be a generous person. No matter how little you have, always look for ways to be generous with others. The joy of giving elevates the soul.

Get your child three jars and help them make labels: SAVE, SPEND, GIVE. Encourage him/her to put ten percent of any money they receive in the save jar, ten percent in the give jar, and eighty percent in the spend jar. Teach them to enjoy earning, saving, giving, and spending.

Teaching your child about money is a gift that will pay dividends every day for the rest of their lives. It doesn’t matter how much money a person makes, if he/she doesn’t not know how to manage it wisely he/she will never have enough. Make the wisdom of money part of your life and your child’s life.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.