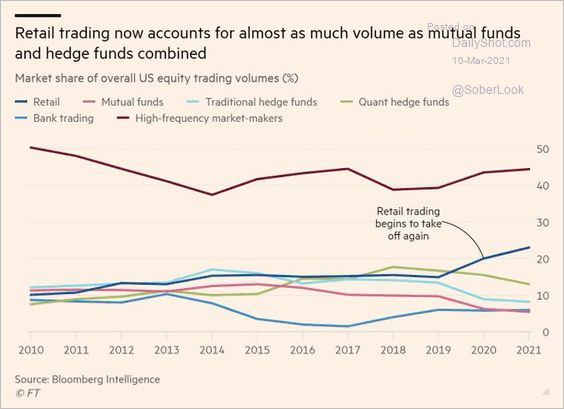

1. Retail Trading Now Accounts for Almost as Much Volume as Mutual Funds and Hedge Funds Combined.

Jonathan Baird CFA

Retail trading now accounts for almost as much volume as hedge and mutual funds combined. The dramatic increase in the influence of retail investors over the past decade is due to the recent sharp increase in their numbers combined with a longer-term decline in trading activity by hedge and mutual funds.

This change in volume composition may be long-term and would restore retail trading to the level of importance it enjoyed prior to the 1970s. Strong retail participation suggests that we can expect increased volatility, and decreased market efficiency, in the years ahead.

Such an environment should present very attractive opportunities for sophisticated active investors.

If you found this post of interest, you’ll find the Global Investment Letter of value. To view free sample issues and to receive our weekly investment comment please visit:

https://lnkd.in/e3BaS3P

2. Most Shorted Stock Index +18% + in One Week

Zerohedge With “Most Shorted” Stocks up over 18% off the Friday lows as the engineered squeeze was unleashed…

Source: Bloomberg

https://www.zerohedge.com/markets/bitcoin-big-caps-reach-record-highs-bonds-dollar-dumped

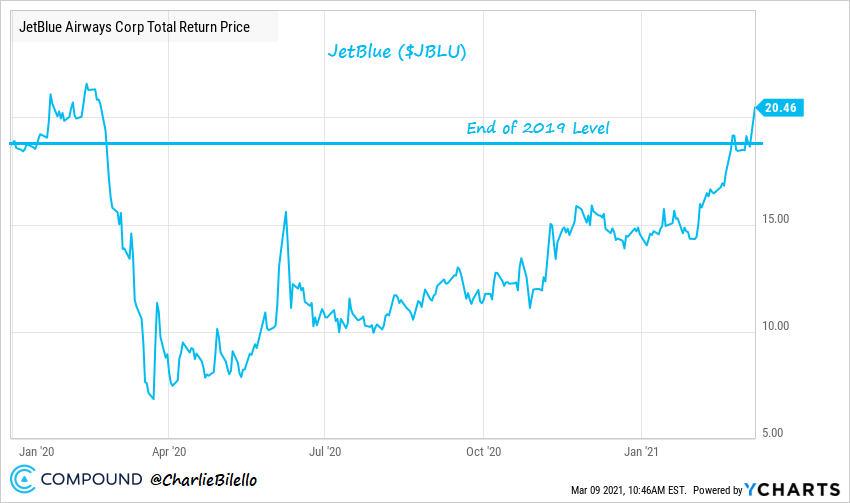

3. What is Priced in? Jet Blue up 3x…Back to Jan 2020 Levels.

Charlie Bilello

https://twitter.com/charliebilello/status/1369314679638659073/photo/1

4. Large Cap Growth Has Won Style Box Best Returns 5 of Last 6 Years…Small Cap Out to Early Lead 2021

https://oxlive.dorseywright.com/research/bigwire/2021/03/10/03-10-2021

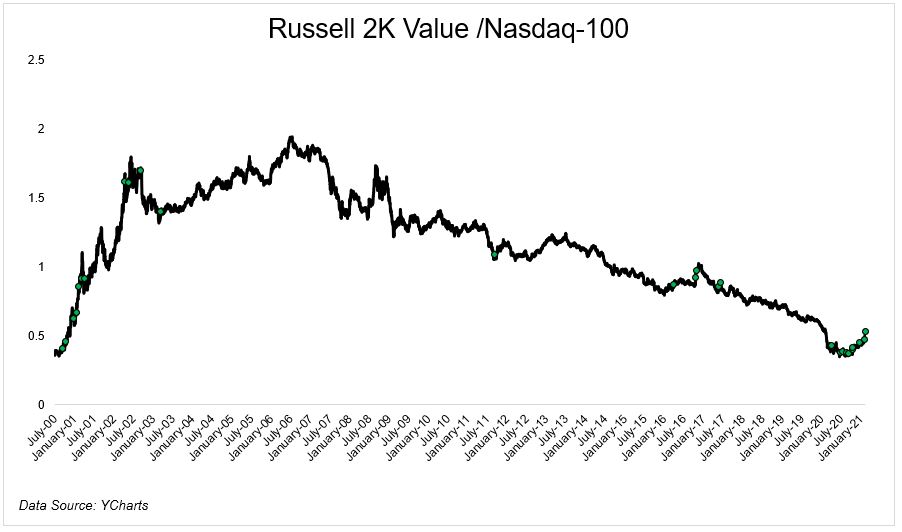

5. Russell 2000 Value (small cap) Showing Action vs. Nasdaq 100 not Witnessed Since 1999

More great work from Michael Batnick

This next chart shows the days where the Russell 2000 Value Index gained at least 1%, and the Nasdaq-100 fell 1%. The last time we saw them cluster like this was in the aftermath of the dot-com bubble. This doesn’t guarantee today will have a similar value renaissance, but I thought it was interesting nonetheless.

A Once-In-A-Career OccurrencePosted March 9, 2021 by Michael Batnick

https://theirrelevantinvestor.com/2021/03/09/a-once-in-a-career-occurence/

6. Another Tech Leader That Saw Major Correction During this Rotation…BIDU -35% from Highs Before this Week.

Baidu $350 down to $220 before this rally

©1999-2021 StockCharts.com All Rights Reserve

7. Nearly Half a Million New Businesses Opened-Yelp

Found at Morning Brew https://www.morningbrew.com/

Though small businsses faced an incredibly challenging year, Yelp data indicates there were nearly half a million new business openings (487,577 total) in the U.S. during the first year of the pandemic, March 11, 2020 through March 1, 2021 – down by only 14% year-over-year (YoY). Of the newly opened businesses, 76,051 were restaurant and food businesses, down by 18% YoY. With people spending more time at home and in their cars (as many people opted for road trips instead of air travel) 286,879 new professional, local, home and auto businesses opened – on par with the year prior, down by only 1% YoY.

In the restaurant and food categories, food delivery services (up 128%), chicken shops (up 23%), desserts (up 17%) and food trucks (up 12%) saw the largest increases in new business openings, compared to the prior year. Notaries (up 52%), landscaping (up 42%), auto detailing (up 37%) and contractors (up 5%) saw the largest increases in the professional, local, home and auto services categories.

https://www.yelpeconomicaverage.com/covid-19-anniversary.html?utm_source=morning_brew

*Read about the methodology here

8. Americans have started leaving home even more than before the pandemic, cellphone data shows

Katherine Shaver, The Washington Post

The sun rises behind the Empire State Building and Hudson Yards in New York City as cars drive on the 14th Street viaduct on March 3, 2021 in Hoboken, New Jersey. (Photo by Gary Hershorn/Getty Images)

Gary Hershorn/Getty Images

Americans have begun leaving home more often than before the coronavirus pandemic took hold, reflecting a pent-up desire to venture out as new cases have declined, according to University of Maryland researchers tracking the movement of cellphones.

The number of daily trips per person – when a cellphone moved more than a mile from home – had hovered around 90 percent of pre-pandemic levels since rebounding over the summer. But by mid-February, after a slight slump amid a surge in new cases, the number regularly started to exceed pre-pandemic travel.

By the first week of March, the number of trips surpassed those taken each day in the same week last year, before stay-at-home orders kicked in, by as much as 13.6 percent.

https://www.chron.com/news/article/Americans-have-started-leaving-home-even-more-16017279.php

9. America’s $5 trillion bet…85% of Households $1400 Stimulus Check ….Total Covid Packages Work Out to $43,000 Per U.S. Household

AXIOS Alayna Treene, Felix Salmon

Illustration: Sarah Grillo/Axios

Democrats’ coronavirus relief bill will dramatically change many low-income families’ lives over the next year. And in the process, it’s setting a new precedent for what Washington can and will do in a crisis.

Why it matters: Once President Biden signs the latest relief bill into law, Washington will have spent more than $5 trillion in less than a year — far more than it has spent in past crises.

By the numbers: In a letter to colleagues Tuesday night, Senate Majority Leader Schumer wrote that the poorest 20% of Americans are estimated to see about a 20% boost in income from Biden’s bill, citing an analysis from the Tax Policy Center.

- 85% of households will get $1,400 in stimulus checks; the unemployed will receive an additional $300 per week through the fall; and families with children under 17 will get $3,000 per child.

- That’s in addition to increased rental assistance, food aid and health insurance subsidies. A recent Washington Post analysis found that 54% of Biden’s package provides direct aid to individuals, compared with 40% or less in previous packages.

State of play: That’s a lot of money to a lot of people — much of it delivered through temporary versions of programs that progressives have been chasing for years.

- The bill is peppered with progressive priorities — like a refundable child tax credit — that some Democrats are hoping will extend beyond the pandemic.

- That will depend on future political calculus, but either way, the bill has already upended the conventional wisdom about what’s possible.

Between the lines: This bill and the series of other COVID packages passed in the last year work out to just over $43,000 per U.S. household — the type of spending that would have been unthinkable as recently as 2009, when Biden last took office.

- Flashback: Barack Obama’s stimulus package, the American Recovery and Reinvestment Act, cost $840 billion.

Americans don’t seem to mind the spending, and Democrats are betting the popularity of this legislation will propel them through the midterms.

- Public opinion over the past year has shown that Americans in both parties support immense government aid during a crisis.

- A Quinnipiac survey taken last month showed more than two-thirds of the country support Biden’s rescue package.

The big picture: Economists predict the economy will grow at a pace of well over 6% in both the second and third quarters of 2021 as Biden’s stimulus plan kicks in, according to FactSet.

- This time last year, the Wall Street consensus was that a coronavirus-addled economy would grow by only 2% in 2021.

- Congressional aides say that the expected economic boon, in conjunction with scientists promising a light at the end of the pandemic tunnel, mean this $2 trillion bill is likely the last mammoth COVID-related package we’ll see.

Yes, but: There are also some foreseeable problems that could come back to haunt Democrats. Almost all the relief for families is expiring over the coming year, which could create economic pain down the line.

- The package is also so big that some experts worry the economy might grow too fast, resulting in inflation.

With $1,400 checks and child care credits, Biden’s coronavirus stimulus bill changes America – Axios

10. The 7 Reasons We Fail

By Harvey Mackay | June 21, 2017 | 4

As any successful person will honestly admit, failure happens, and we’ve all had our fair share of it. But from each failure, we learn two equally valuable lessons. One, that there was at least one reason we failed; and two, that we can rebound from that failure.

So, why do we fail? And how do we fix it?

Related: Why Some People Fail and Others Succeed

According to Shiv Khera, author of You Can Win, failures most often occur for one of seven reasons. And Harvey Mackay, best-selling author and business speaker, says each one can teach us something valuable, can show us how to avoid falling back into the same hole.

Here are the most common failure-causing problems and their solutions:

1. Lack of Persistence

More people fail not because they lack knowledge or talent but because they just quit. It’s important to remember two words: persistence and resistance. Persist in what must be done and resist what ought not to be done.

Try new approaches. Persistence is important, but repeating the same actions over and over again, hoping that this time you’ll succeed, probably won’t get you any closer to your objective. Look at your previous unsuccessful efforts and decide what to change. Keep making adjustments and midcourse corrections, using your experience as a guide.

2. Lack of Conviction

People who lack conviction take the middle of the road. But what happens in the middle of the road? You get run over. People without conviction go along to get along because they lack confidence and courage. They conform in order to get accepted, even when they know that what they are doing is wrong.

Decide what is important to you. If something is worth doing, it’s worth doing right and doing well. Let your passion show even in mundane tasks. It’s OK to collaborate and cooperate for success, but it’s not OK to compromise your values—ever.

3. Rationalization

Winners might analyze, but they never rationalize. Losers rationalize and have a book full of excuses to tell you why they couldn’t succeed.

Change your perspective. Don’t think of every unsuccessful attempt as a failure. Few people succeed at everything the first time. Most of us attain our goals only through repeated effort. Do your best to learn everything you can about what happened and why.

4. Dismissal of Past Mistakes

Some people live and learn, and some only live. Failure is a teacher if we have the right attitude. Wise people learn from their mistakes—experience is the name they give to slipups.

Define the problem better. Analyze the situation—what you want to achieve, what your strategy is, why it didn’t work. Are you really viewing the problem correctly? If you need money, you have more options than increasing revenue. You could also cut expenses. Think about what you’re really trying to do.

5. Lack of Discipline

Anyone who has accomplished anything worthwhile has never done it without discipline. Discipline takes self-control, sacrifice and avoiding distractions and temptations. It means staying focused.

Don’t be a perfectionist. You might have an idealized vision of what success will look and feel like. Although that can be motivational, it might not be realistic. Succeeding at one goal won’t eliminate all your problems. Be clear on what will satisfy your objectives and don’t obsess about superficial details.

6. Poor Self-Esteem

Poor self-esteem is a lack of self-respect and self-worth. People with low self-confidence are constantly trying to find themselves rather than creating the person they want to be.

Don’t label yourself. You might have failed, but you’re not a failure until you stop trying. Think of yourself as someone still striving toward a goal, and you’ll be better able to maintain your patience and perseverance for the long haul.

7. Fatalistic Attitude

A fatalistic attitude prevents people from accepting responsibility for their position in life. They attribute success and failure to luck. They resign themselves to their fate, regardless of their efforts, that whatever has to happen will happen anyway.

Look in the mirror every day and say, I am in charge. You might not have control over every phase of your life, but you have more control than you realize, and you are responsible for your own happiness and success. Your attitude determines your altitude, and you can turn “down and out” into “up and at ’em.”

Related: How to Bounce Back From Failure

Editor’s note: This post was originally published in February 2015 and has been updated for freshness, accuracy and comprehensiveness.

https://www.success.com/the-7-reasons-we-fail/

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.