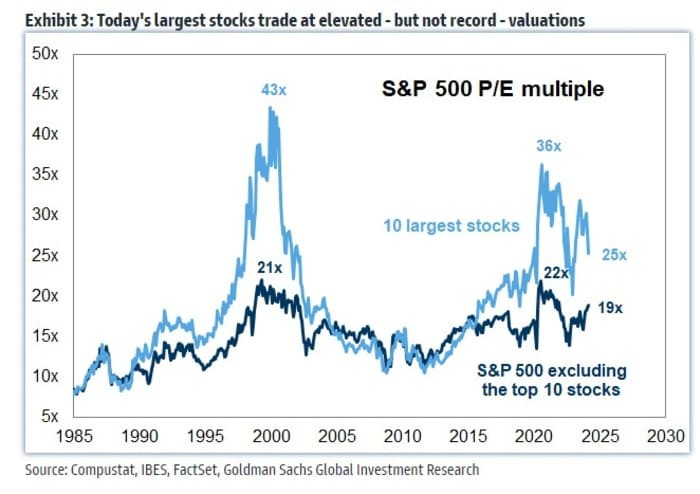

1. S&P Ex-Top 10 Largest Stocks Trades at 19x P/E

2. Jeff DeGraff Similar Thoughts as Yesterday’s Ned Davis Chart

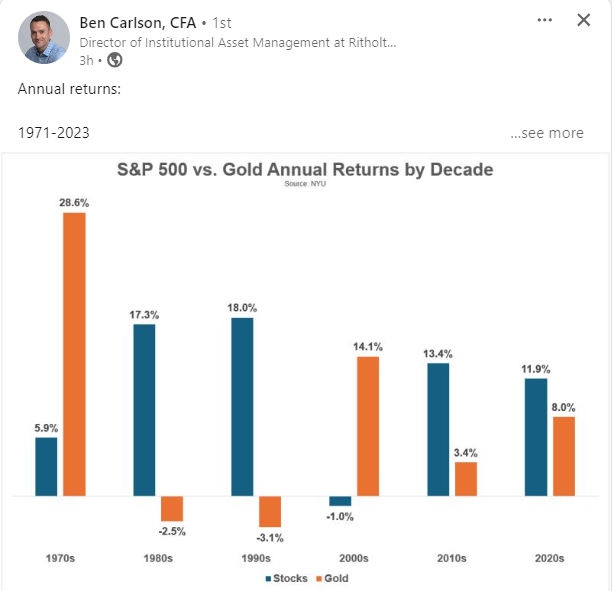

3. Follow Up to Gold (GLD) New Highs…Gold Performance History by Decade

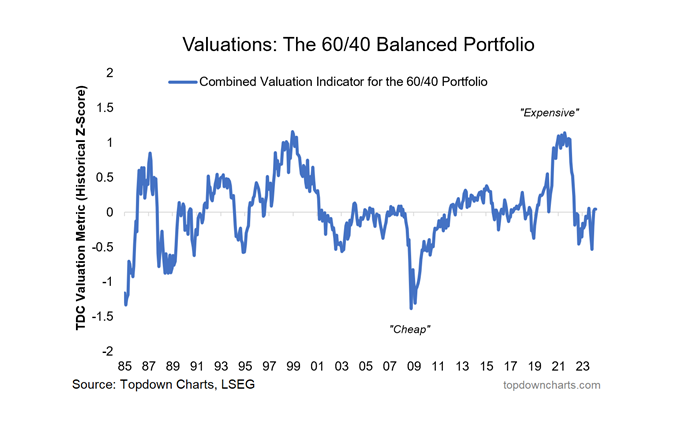

4. Classic 60/40 Portfolio Valuation at 40-Year Median Valuation Levels

From Callum Thomas

5. ETFs that Use Options are Becoming Popular

The Daily Shot Brief Equities: ETFs that use options strategies have become very popular.

Source: @financialtimes

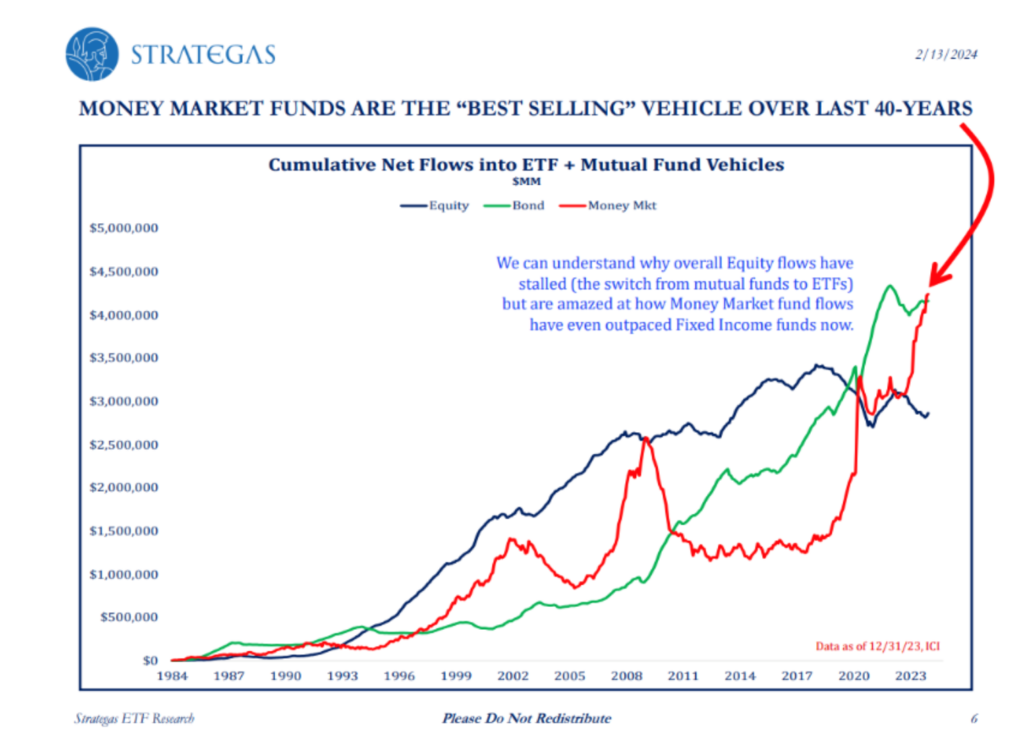

6. The Best Selling Investment Vehicle of 40 Years is Money Market Fund

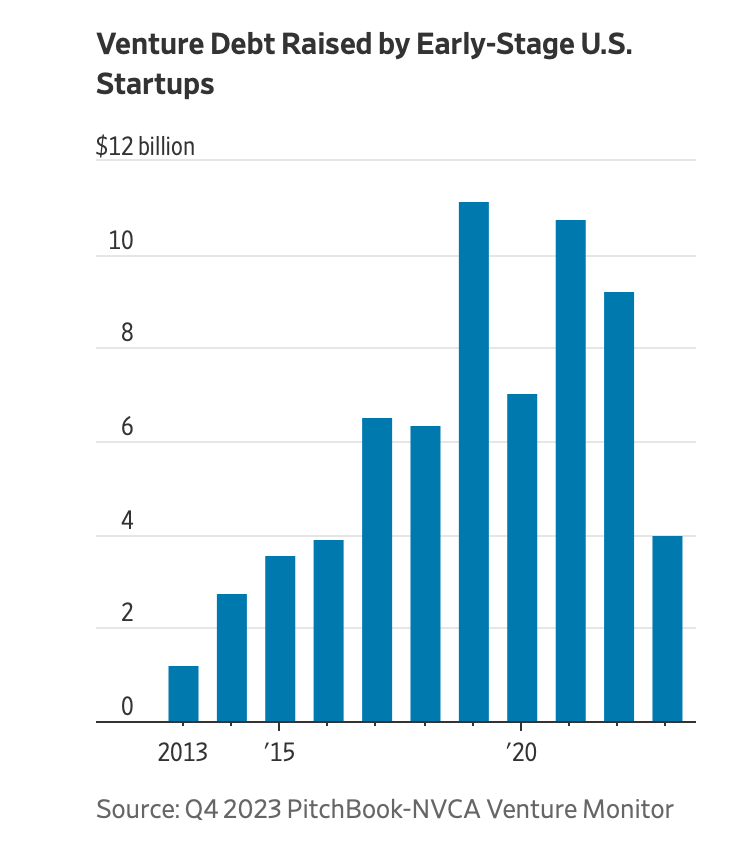

7. Venture Funding Down -50-60%

Pitchbook-Debt funding to early-stage startups, referring to companies at the Series A and B stages, plunged almost 57% to about $4 billion in 2023, while funding to seed and pre-seed startups shrank about 59% to just $610,000, according to PitchBook-NVCA.

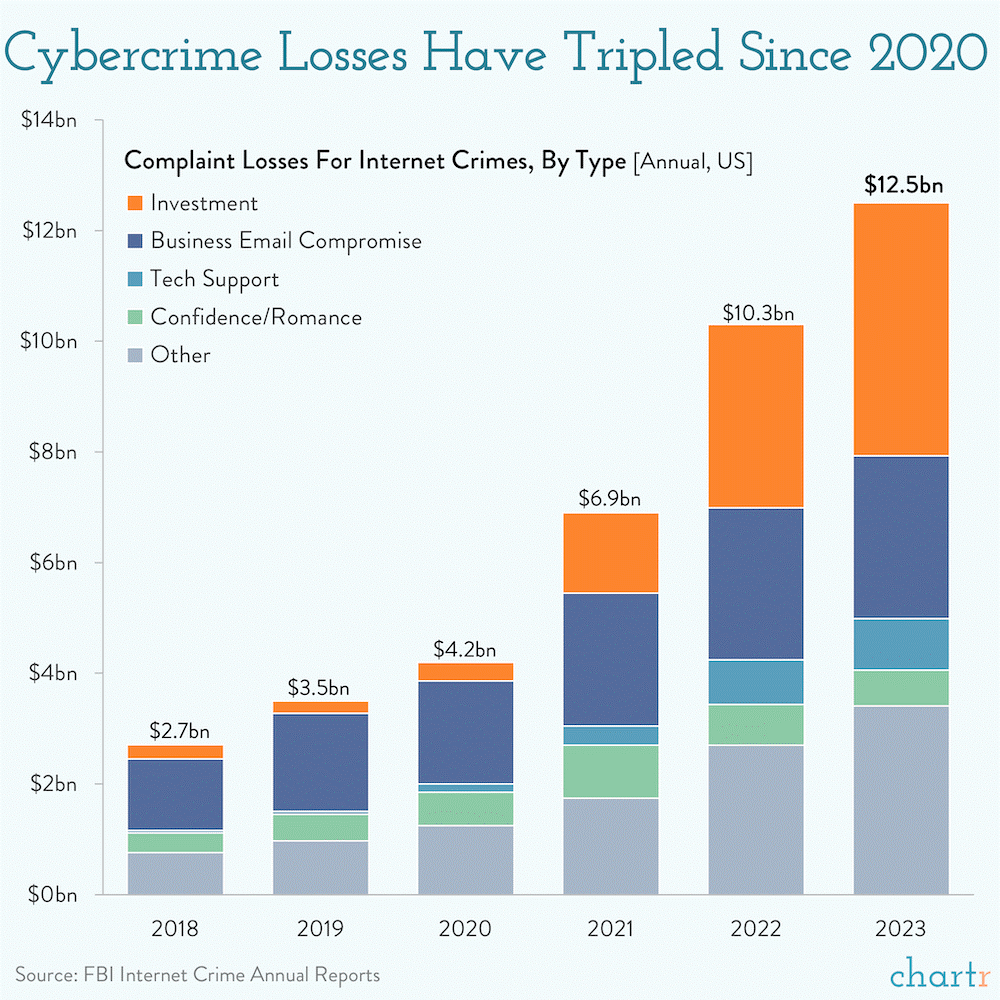

8. Cybercrime Triples in 3 Years

9. Boomers Are Expected To Pass $90 Trillion In Assets Onto Millennials — Leaving Them To Become The ‘Richest Generation In History’

Jeannine Mancini-Yahoo Finance

In an unprecedented financial shift, millennials are on the cusp of becoming the richest generation in history, with $90 trillion expected to be passed down to them over the next two decades. This transfer of wealth, highlighted in Knight Frank’s 2024 Wealth Report, promises to reshape the economic landscape and alter the current power dynamics heavily influenced by the baby boomer generation.

The report, drawing on recent findings, forecasts a seismic change in the distribution of wealth, with millennials positioned to inherit assets that will significantly elevate their financial standing. This generational wealth transfer is not merely a redistribution of existing wealth but signals a broader transformation in the avenues for wealth creation.

As highlighted by Mike Pickett, a director at Cazenove Capital, the diversity of opportunities for generating wealth has expanded, encompassing everything from digital platforms to entrepreneurial ventures, marking a shift towards first-generation wealth creation.

Don’t Miss:

- Investing in real estate just got a whole lot simpler. This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

- Miami is expected to take New York’s place as the U.S. Financial Capital. Here’s how you can invest in the city with as little as $500 before that happens.

Despite this optimistic outlook, the journey to financial prosperity has been fraught with challenges for millennials. Many have grappled with an increasingly unattainable housing market, a competitive job landscape reshaped by the global pandemic and the burden of student debt. Additionally, the anticipation of inheritance reveals a gap in expectations, with a significant portion of millennials expecting a larger inheritance than their boomer parents plan to leave.

The focus on housing remains a critical concern for millennials struggling to secure a foothold in the property market. This challenge extends to ultra-high-net-worth individuals within the generation, underscoring the importance of real estate as a key area of investment. The report indicates a keen interest among affluent millennials, both male and female, in expanding their property portfolios in the coming year, mirroring a similar sentiment among wealthy Gen Zers.

The Knight Frank report also sheds light on the increasing number of ultra-high-net-worth individuals globally, projecting a significant rise in their numbers, particularly in India and mainland China. This growth underscores the expanding landscape of wealth and the critical role of the financial sector in catering to the needs of an increasingly affluent millennial cohort.

As millennials stand on the brink of a historic wealth influx, the report calls on the financial sector to adapt its services to meet the unique needs and preferences of this generation. This adaptation is crucial for managing the wealth accumulated during the pandemic and for supporting the diverse and innovative paths millennials are taking toward financial independence and wealth creation.

Boomers Are Expected To Pass $90 Trillion In Assets Onto Millennials — Leaving Them To Become The ‘Richest Generation In History’ (yahoo.com)

10. U.S. Spy Agencies Know Your Secrets

WSJ By Byron Tau

Last November, Michael Morell, a former deputy director of the Central Intelligence Agency, hinted at a big change in how the agency now operates. “The information that is available commercially would kind of knock your socks off,” Morell said in an appearance on the NatSecTech podcast. “If we collected it using traditional intelligence methods, it would be top secret-sensitive. And you wouldn’t put it in a database, you’d keep it in a safe.”

In recent years, U.S. intelligence agencies, the military and even local police departments have gained access to enormous amounts of data through shadowy arrangements with brokers and aggregators. Everything from basic biographical information to consumer preferences to precise hour-by-hour movements can be obtained by government agencies without a warrant.

Most of this data is first collected by commercial entities as part of doing business. Companies acquire consumer names and addresses to ship goods and sell services. They acquire consumer preference data from loyalty programs, purchase history or online search queries. They get geolocation data when they build mobile apps or install roadside safety systems in cars.

But once consumers agree to share information with a corporation, they have no way to monitor what happens to it after it is collected. Many corporations have relationships with data brokers and sell or trade information about their customers. And governments have come to realize that such corporate data not only offers a rich trove of valuable information but is available for sale in bulk.