1. NVDA 2024 vs. CSCO 1999

Barrons Burton G. Malkiel is the author of A Random Walk Down Wall Street, now in its 50th-anniversary edition.

Nvidia makes chips that are in high demand for training AI models. The company’s recent growth has been simply unprecedented. Earnings in 2023 grew by 769%. No large company even came close to that growth during the internet boom (Cisco was growing at 36%), and many stock market favorites such as Amazon had no earnings at all. AI has the promise to make enormous advances in productivity and could be as important as the Industrial Revolution. And if Nvidia grew its earnings at the rate expected by security analysts in 2024, it would be selling at only 33 times forward earnings. No wonder its supporters consider it a cheap stock. Nvidia today doesn’t resemble Cisco in January 2000.

https://www.barrons.com/articles/stock-bubble-tech-valuations-nvidia-b210713f?mod=past_editions

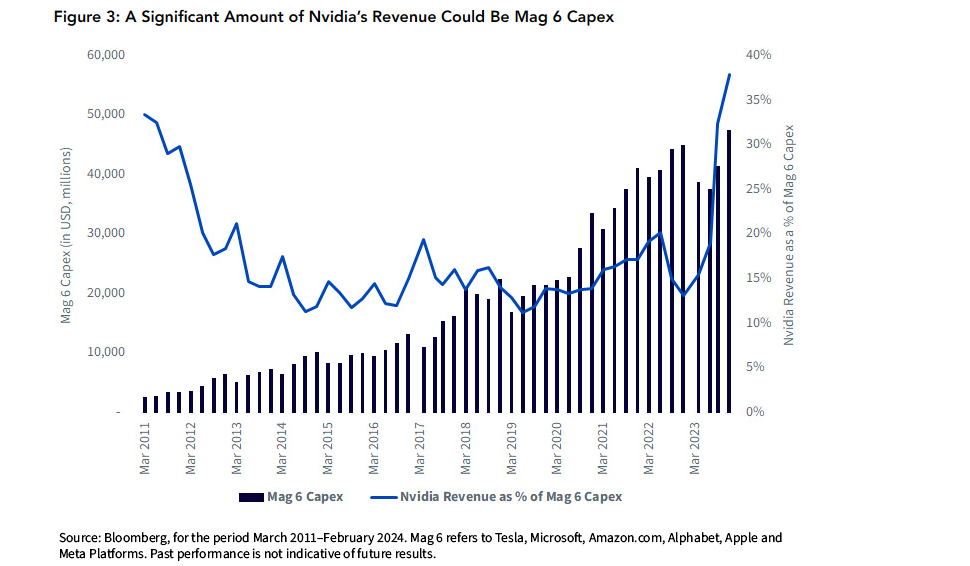

2. NVDA is Selling to Rest of Mag 7

Wisdom Tree Christopher Gannatti, CFA

Nvidia: We Are Watching History | WisdomTree

3. Historical Semiconductor Rally

Bespoke Investment Group The rally in semiconductors is starting to run out of superlatives to describe it. Just when you think it has to take a breather, it turns around and rallies another few percent. Yesterday, the Philadelphia Semiconductor Index (SOX) closed more than 17% above its 50-day moving average and 36% above its 200-DMA. Regarding the 50-DMA, it hasn’t even traded down to within 3% of that level in the last 80 trading days. In fact, the only time it has even traded within 4% of its 50-DMA since mid-November was on 12/6 when it closed 3.99% above that level.

https://www.bespokepremium.com/interactive/posts/think-big-blog/semis-drop-the-mic

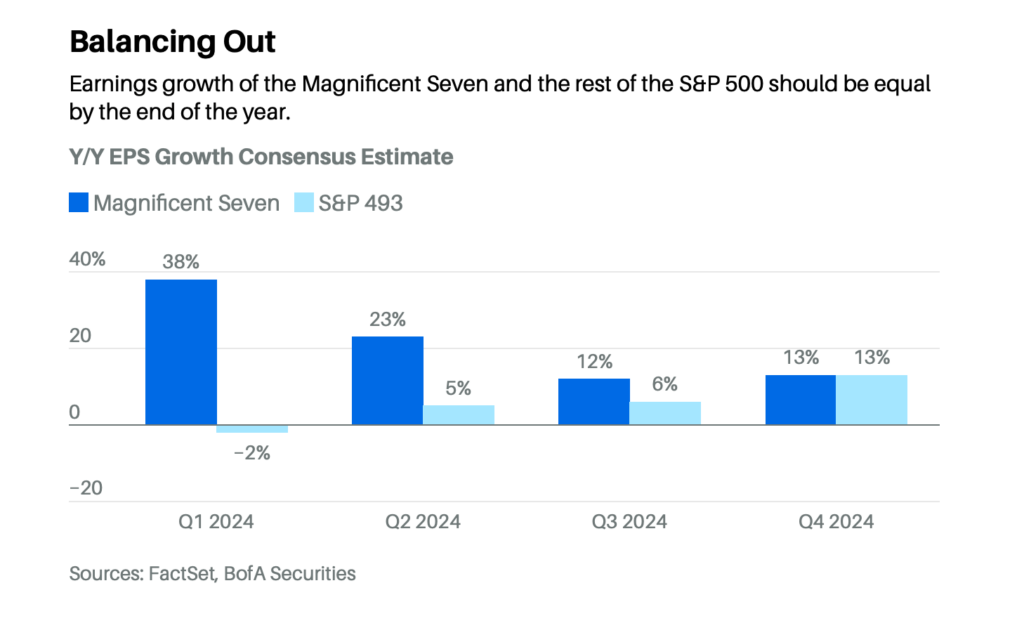

4. Mag 7 Earnings vs. 493 Set to Balance Out Next Year

Barrons

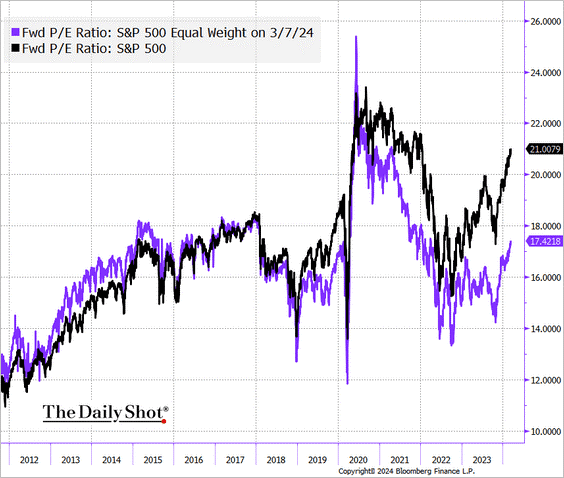

5. Equal Weight vs. Cap Weight Forward P/E

Equities: The S&P 500 12-month forward P/E ratio is back above 21x

Source: The Daily Shot

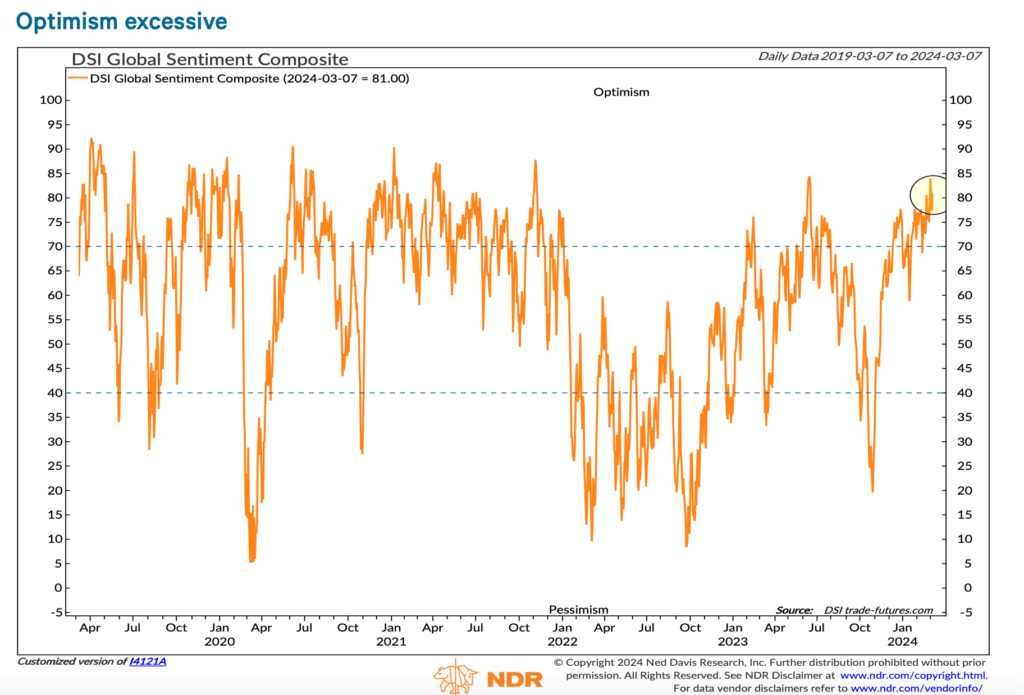

6. Ned Davis Global Stock Optimism Getting Excessive

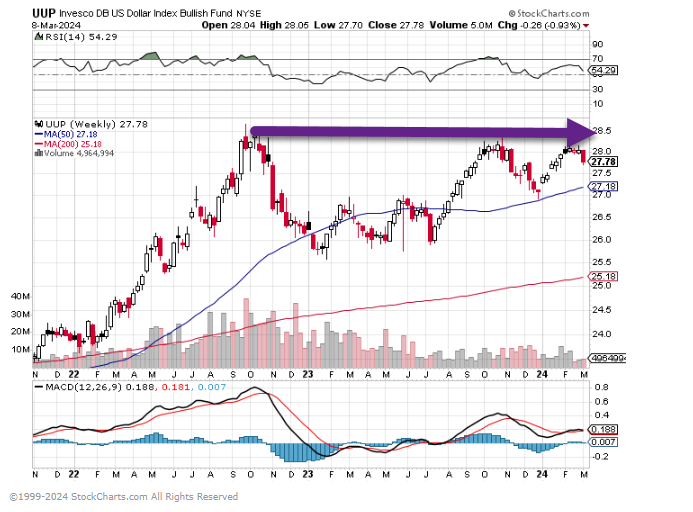

7. U.S. Dollar Fails Again to Make New Highs

8. Best Performing Sector Last Week was Utilities. +3.5%

XLU Still Below Highs.

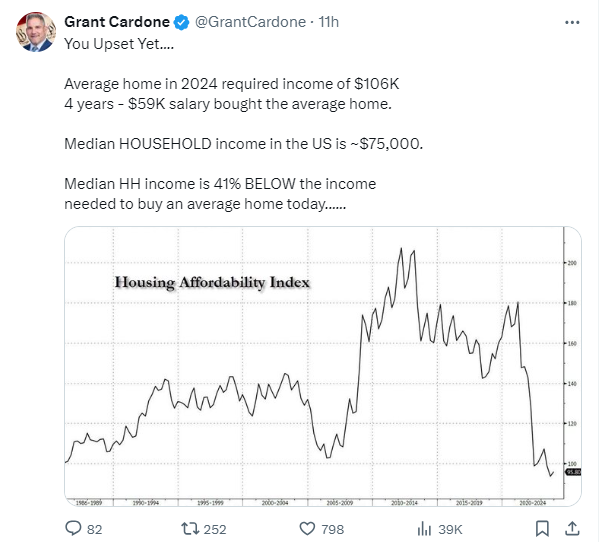

9. Median Household Income is 41% Below Income Needed to Buy Home

10. Problems

Farnam Street Blog

Tiny Thought(s)* https://fs.blog/

“We need to redefine “problems” into opportunities.

Problems are an opportunity to create value.

Problems are an opportunity to strengthen relationships.

Problems are an opportunity to differentiate yourself from others.

Every problem is an opportunity in disguise.”

**

“Talent and potential mean nothing if you can’t consistently do things when you don’t feel like doing them.”

***

“If you’re not willing to look like an idiot in the short term, you will never look like a genius in the long term.”

—

(Share Tiny Thought one, two, or three, on X).