The average Robinhood user is 31 years old and has a median $240 account balance. Just 2% are ‘pattern day traders.’ A MagnifyMoney survey polled young investors on where they get their investing information. 41% of the more than 1,500 people polled said they watch YouTube and 24% said they take the cues from people on TikTok. 22% of the polled investors traded stock at least once a week.

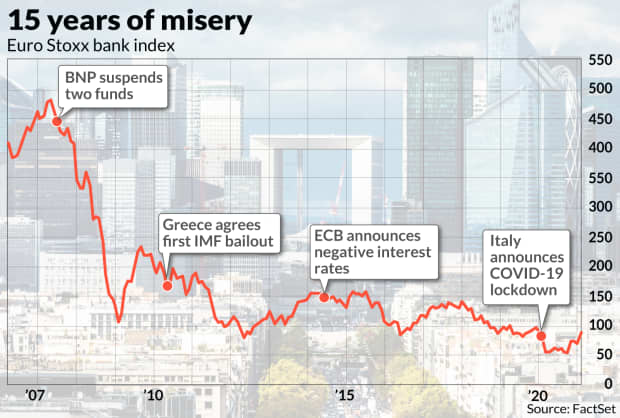

1.From 2007-2020 Euro Stoxx Banks -89%….Since October +71%

It has been a pretty rough 15 years for the eurozone’s leading banks.. From its 2007 high to the 2021 low, the Euro Stoxx banks index SX7E, 0.07% collapsed by 89%.

Since just before the U.S. election, on Oct. 29, the sector has gained 71%.

Eurozone banks are showing life after 15 rough years. Will the ECB snuff out the rally?By Steve Goldstein

2.The Nikkei 225 still needs to gain another 26% to reach its 1989 high.

Nikkei 225 Index – 67 Year Historical Chart

Interactive daily chart of Japan’s Nikkei 225 stock market index back to 1949. Each data point represents the closing value for that trading day and is denominated in japanese yen (JPY). The current price is updated on an hourly basis with today’s latest value. The current price of the Nikkei 225 Index as of March 09, 2021 is 29,027.94.

https://www.macrotrends.net/2593/nikkei-225-index-historical-chart-data

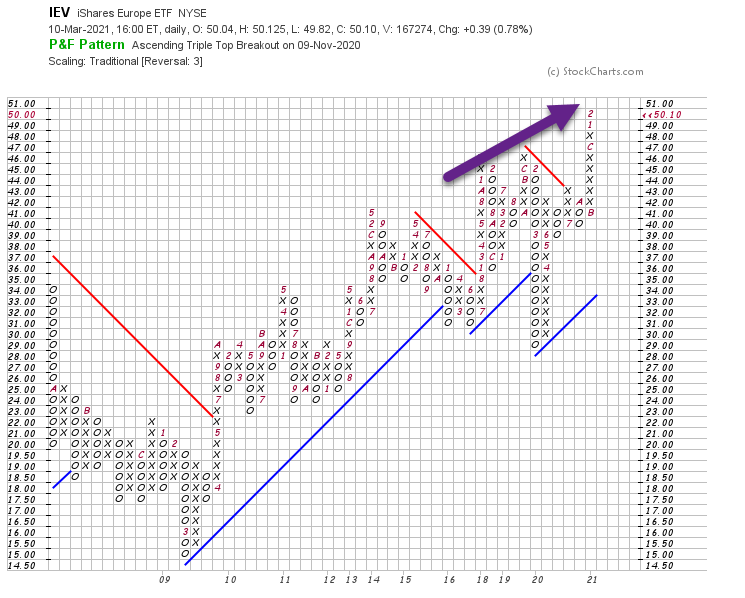

3. IEV Europe ETF New Highs

4. CEO Confidence Hits 50 Year Highs

Liz Ann Sonders -Schwab CEO Confidence: Although not a direct measure of stock market sentiment, rising CEO confidence tends to coincide with sharply rising corporate profits (although it’s a bit of a chicken-or-egg issue); while also typically leading to higher capital spending. However, it has historically been a sign of stock market excess. During spans when CEO confidence was above 65 historically (top yellow dotted line), stocks barely registered a positive return on an annualized basis (table).

Source: Charles Schwab, FactSet, ©Copyright 2021 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/, as of 3/31/2021. Past performance is no guarantee of future results.

Great List of Charts attached from Schwab

5. Everything Outperforming Tech

Ben Carlson-Then something funny happened around September.

Everything else began to outperform tech: Small caps, value, mid caps, emerging markets, foreign developed stocks and even commodities have all outperformed the previous untouchable Nasdaq 100.

https://awealthofcommonsense.com/2021/03/is-diversification-finally-working/

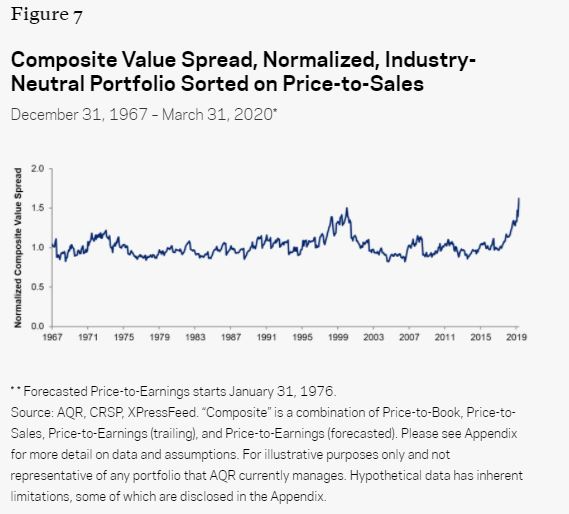

6. Value Rally…2020 Witnesses Spread Between Value and Growth Price to Sales Hit Record Levels

Buying cheap stocks is great in theory, but holding cheap stocks as they get cheaper is excruciating. 2020 was the worst year ever for value, capping off a challenging decade. This pushed the valuation spread between growth and value stocks to their widest level ever.

The Most Powerful CatalystPosted March 9, 2021 by Michael Batnick

https://theirrelevantinvestor.com/2021/03/09/the-most-powerful-catalyst/

Found at Crossing Wall Street Blog https://www.crossingwallstreet.com

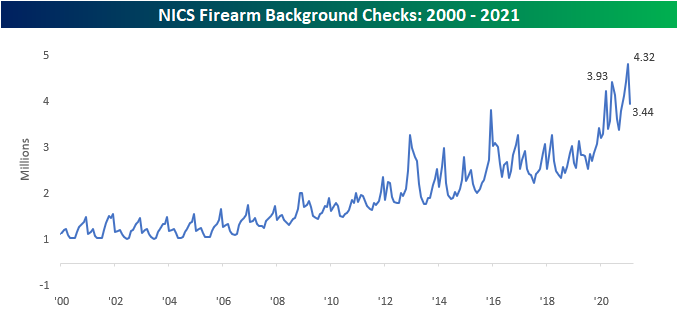

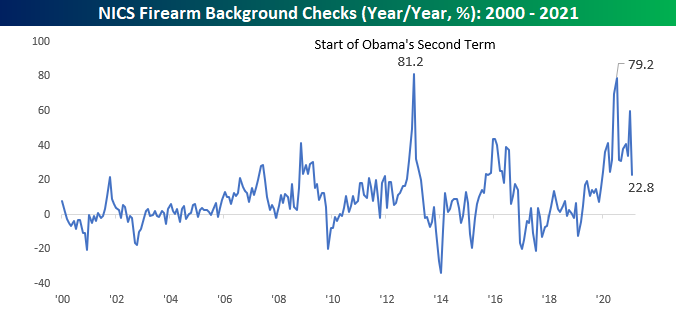

7. Guns Still Flying Off the Shelves

Wed, Mar 3, 2021

The latest data on firearm checks from the FBI for the month of February showed that while gun sales eased off from January’s record pace, by all accounts, the pace of gun sales is unlike anything seen prior to 2020. With a total of 3.44 million background checks during the month, February’s pace was down 20% versus January’s record pace. Even with the decline, though, February saw more background checks than all but six other months since 2000, and all of those six months were in the last twelve. For the month of February alone, background checks this year were higher than any other February on record by a margin of over 600K.

On a y/y basis, background checks were up over 22%, and while that’s a significant increase, it actually represents the lowest y/y increase since December 2019. Again, 2020 was a year unlike any other in the last twenty years in terms of Americans looking to buy guns.

With sales still near historically high levels but clearly slowing from the torrid pace of growth in 2020, the stocks of gun manufacturers (SWBI and RGR) have been in a bit of a holding pattern. Both stocks peaked in the middle of last year as protests and riots exploded around the country. They started to rally again after the election right up through early January. Interestingly, the closing high of the post-election rally in both stocks ended on the same day as the Capitol riots on 1/6, and since then both stocks have been drifting back into the ranges they traded in during the second half of 2020. For full access to our research and market commentary, start a two-week trial to our Bespoke Premium service.

https://www.bespokepremium.com/interactive/posts/think-big-blog/guns-still-flying-off-the-shelves

8. 65% of podcast listeners began listening in the past three years

Spotify Calls Him Daddy-Packy McCormick

The numbers back up my experience. According to a16z, 65% of podcast listeners began listening in the past three years. Just over half of the country (51%) has ever listened to a podcast. The entire podcast industry generated $679 million in advertising revenue last year. For comparison, YouTube brought in $15 billion, or 22 entire podcast industries, from ads in 2019.

https://www.packym.com/blog/spotify-calls-him-daddy

9. COVID’s curse: 42% of Americans now consider themselves germaphobes because of pandemic-

New survey shows average adult washes their hands 9 times daily — though nearly one in five admit to scrubbing their digits 15 times a day!

NEW YORK — Nearly half of Americans feel that no matter how often they wash their hands, it’s never enough during COVID-19, according to a new survey. Despite the results however, researchers find constantly stressing over safety is getting old fast as the world enters year two of the pandemic.

The poll asked 2,000 Americans to reflect on the past 12 months to analyze their hygiene habits. Even though 90 percent of respondents say they are aware of the CDC’s guidance on washing hands for 20 seconds, 41 percent admit it’s starting to get tiresome.

Conducted by OnePoll on behalf of American Water, the survey analyzed how respondents are practicing hygiene as quarantines, lockdowns, and social distancing drags in to 2021.

Conducted by OnePoll on behalf of American Water, the survey analyzed how respondents are practicing hygiene as quarantines, lockdowns, and social distancing drags in to 2021.

2020 turned Americans into germaphobes

It may come as no surprise that the pandemic is a frustrating subject for three-quarters of respondents. More specifically, 65 percent have had it with people not taking the crisis seriously enough so it can end. Forty-two percent of the survey now describe themselves as a germaphobe because of the pandemic. Of these respondents, 79 percent agree that this change isn’t necessarily a bad thing.

The top habits respondents are doing to stay safe include carrying hand sanitizer at all times, immediately washing their hands for a full 20 seconds after being outside, and avoiding contact with public surfaces at all costs. With frequent hand washing being a key part of fighting COVID-19, the survey also looked at how frequently people are doing this. Researchers discovered the average American washes their hands nine times a day. Nearly one in five (18%) wash upwards of 15 times a day.

Although 65 percent of respondents said their hygiene habits have improved over the past year, 42 percent admit to letting things slide over the past few months. The top habit respondents are less inclined to do today, compared to March 2020, are immediately changing out of their clothes and washing them after being outside. Respondents are also less likely to sanitize all groceries and mail now.

Additionally, one in five respondents admitted that they don’t wash their hands an average of five times a day anymore, even though they know they probably should.

https://www.studyfinds.org/covid-curse-many-americans-consider-themselves-germaphobes-over-pandemic/

10. Money is stored energy

by THE INVESTOR on MARCH 4, 2021

Money is power, as anyone who has watched The Godfather or read an expose of the shadowy interaction between oligarchs and the establishment knows. But I think of money as stored energy.

You work, beg, borrow, steal, or otherwise obtain money.

You put it aside – store it.

Later you discharge the power and make something happen.

A plane moves, with you on it. Food appears on a plate, a partner smiles at a gift, an Amazon delivery arrives. Your run the tap and hot water comes out.

I’ve thought about money so long this way I assumed everybody did. But then I had a conversation with a friend who evidently didn’t.

“Of course you must be right – I’ve just never seen it that way,” he genuinely said in unfashionable agreement.

We kicked the analogy around for a while.

Voila – a blog post!

The electrifying power of a pension

My friend always saw money more like a slightly advanced barter system.

He works and he gets things or experiences. Money is like a handshake between these things happening.

Given roughly half of people live paycheck to paycheck, he’s not alone.

My friend is not good with money, but he’s not terrible. He won’t be gunning for The Accumulator’s mantle anytime soon, but he’s not in debt, for instance. And he pays into a pension.

Actually, I noticed the words he used: “I pay the pension every month.”

Intellectually he knows he’s putting cash aside for the future. But through his money lens, his pension is another monthly bill to be paid.

I see a pension as surplus energy stored for the future. A long-term battery backup, or perhaps given the timescales involved something akin to the US strategic petroleum reserves. Power to be discharged when my everyday supply has dwindled or been switched off.

Money is stored energy: a grid

We can flesh this analogy out. Look at our personal finances like an energy grid.

I can see the blog now:The Money Power Grid – Light up your finances.

(Apologies if it exists. I dare not Google when I’m on a roll!)

Here’s a first schematic of my money energy grid.

Immediate power generation

You work and get paid for it. An energy transfer takes place from the buyer of your car to your bank account. In these and various other ways you fire-up energy on-demand, like an oil-fueled power plant can send electricity flowing into the grid. Stop burning fuel though, and the power goes out.

Trickle generation

Other revenue streams can top-up your energy supply in the background. Like the power generated by domestic solar panels, the money that comes in from small passive streams or a buy-to-let property won’t be enough to live on, but it all adds up. Especially if we can put it away for future use.

Short-term energy storage

In a world without bank accounts, everyone would have to spend most or all their money right away. But so long as inflation isn’t rapidly diminishing the power of our money, we can allow it to accumulate in the equivalent of batteries, to be discharged as needed. This short-term storage should ideally at least maintain our spending power. Impossible in today’s low interest environment, but that’s normally how we’d look to wire the grid.

Long duration energy storage

A drawback of renewable energy systems such as solar, wind, and tidal power is we’re not good at storing the intermittent power they generate. They’re like a freelancer who finds it hard to put money aside for their future taxes. Battery technology is improving, but for now the best longer-term energy storage solutions are quite cumbersome. For example a hydroelectric dam will use an energy surplus to pump water back up to a header lake. That way it has a renewed capacity to provide the juice when required.

Our long-term money energy storage comes with catches, too. You have to lock money into a pension. Shares best protect you against inflation over the long-term, but are volatile short-term. A rental property takes more maintenance than a savings account. Even with cash accounts, you expect to get higher interest rates the longer you lock your money away.

Transmission lines

We need to get our money energy from A to B. From our employer to our bank account. From our current account to our ISA. Unfortunately energy is lost in transmission.

In the real world, jostling electrons over tens of miles of power lines creates wasteful heat. In our money grid we can maintain all our power on the short hop between a current and savings account. But elsewhere we lose energy to fees, fines, and ongoing expenses as we charge our longer-term storage. Taxes can cause a mini brownout. Maybe the drain of the notorious latte factor fits in here, too. A smart financial grid is engineered to reduce these leakages.

Energy spikes

Sometimes our money grids must handle huge inflows of energy. It’s a good problem to have, but it can be tricky. One physicists’ controlled nuclear explosion is another one’s nuclear power plant, after all. Similarly a sudden windfall – a lottery win, or an inheritance – can bolster the long-term resilience and strength of our money grid if we’re ready to capture and store the energy. But the fact so many lottery winners wind up back where they started shows many people’s grids aren’t really fit for that purpose.

Fuel tankers, coal lorries, and power sharing agreements

I’m reaching for an equivalent to debt. Perhaps it’s in the sunk cost of the raw materials of power generation? Fossil fuels we ship in for energy here and now, regardless of the long-term consequences? That’s not quite right. A better analogy might be when one grid sends surplus energy to an adjacent grid that’s not generating enough power to keep the lights on. The inflow solves things for now, but all that energy will have to be repaid…

Electric shocks

Don’t stick a screwdriver in a socket. Don’t day trade Gamestop shares.

Feel the energy

I’ve slightly tortured the money as stored energy metaphor, but I do think it’s an interesting framework.

The consulting work I’ll do this afternoon sounds to me now like the roar of a gas-fired plant powering up. Meanwhile the adverts on this website and the shares in my ISA will be ticking away, sending pulses of energy into my grid.

Overloaded from a recent asset sale, my current account looks ready to blow – I need to get that energy flowing somewhere productive. Like up in Snowdonia, where metaphorically my monthly payment to my SIPP is pumping water thousands of feet high into the mountains, where it will wait until I open the floodgates and the energy comes flowing back out.

We could also have fun turning various laws of energy into financial rules of thumb. (I did this yonks ago with the first law of thermodynamics.)

Here’s one:

E= MC2

Stored energy = Money(Compounded)

Well, it’s a start.

May your finances never blow a fuse!

https://monevator.com/money-is-stored-energy/

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.