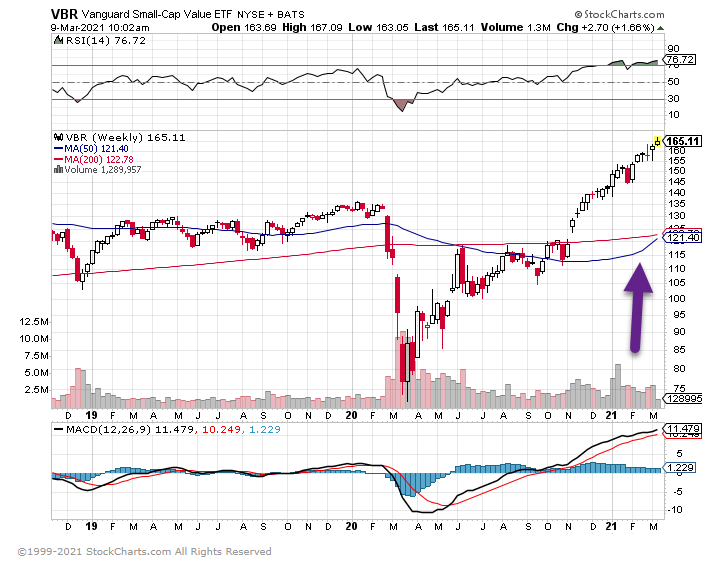

1. Small Cap Value Chart

Follow up from yesterday…Small cap value 50 day about to cross thru 200 day to upside.

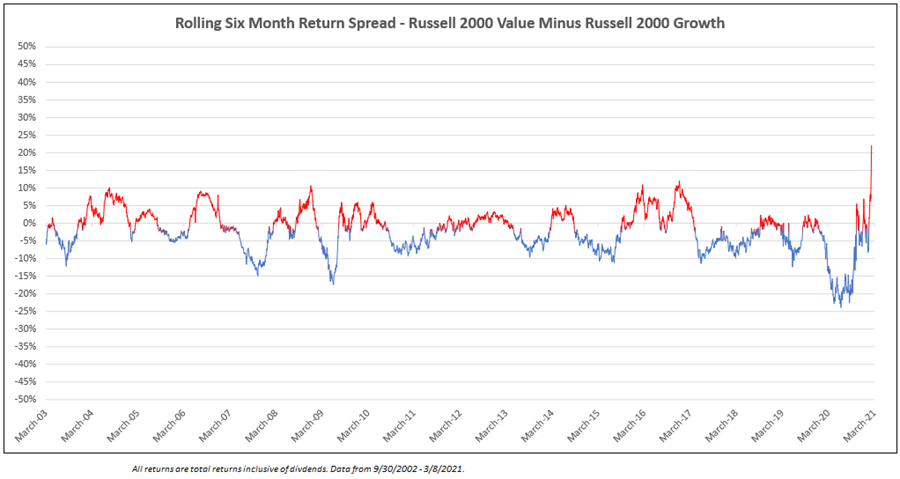

2. The Relative Performance Spread Between Growth and Value in Small Cap is at an Extreme

Nasdaq Dorsey Wright

Year-to-date (through 3/8) the iShares Russell 2000 Value ETF IWN has gained 21.81% on a price return basis, outperforming the iShares Russell 200 Growth ETF by more than 19%.

In fact, as the image below shows, the rolling six-month performance spread between the Russell 2000 Value Index and the Russell 2000 Growth Index is currently about 22% – the highest it has been since at least 2003. Prior to now, the widest the spread had gotten was just over 10%, a level it reached four times since 2002 before reversing back in favor of growth.

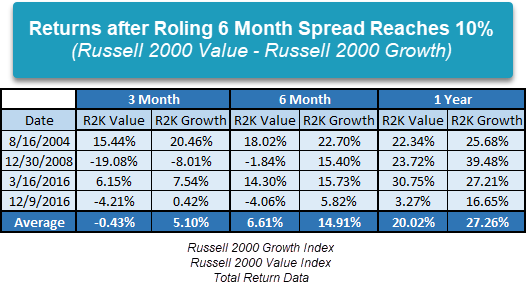

As the first time it has gotten above 20%, we don’t have data on what the forward returns look like after the performance spread between growth and value reaches this level. However, we did examine what happened the four prior times the spread got above 10%. The results are shown in the table below; the red portions of the graph with values above zero are periods when the spread favored value while the areas shaded in blue below zero show when the spread was in favor of growth.

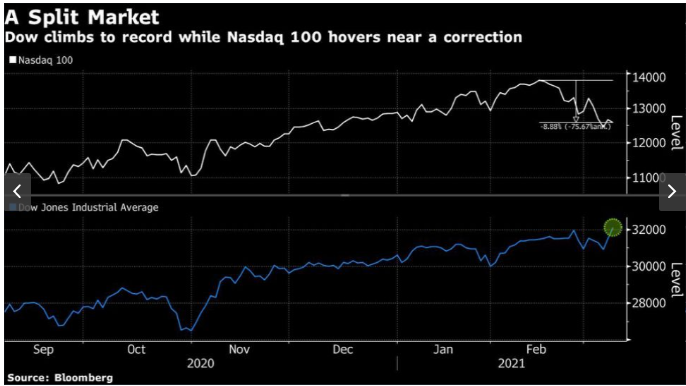

3. Nasdaq 100 Has Not Diverged This Much From the Dow Since 1993

Before Yesterday’s Rally

Vildana Hajric and Lu Wang https://finance.yahoo.com/news/nasdaq-100-not-diverged-much-184824022.html

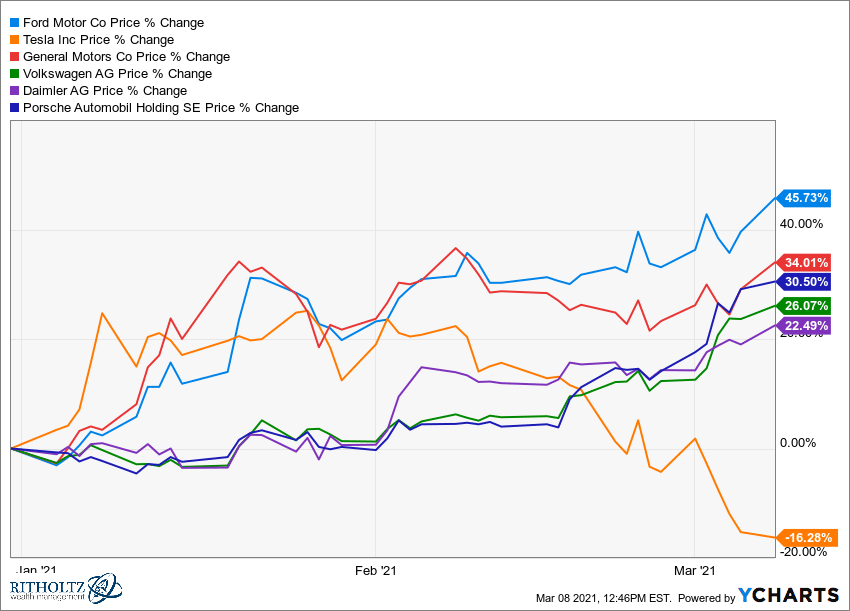

4. Tesla Versus Competition 2021..Before Yesterday’s Rally

Josh Brown Reformed Broker

Thanks, Elon!Posted March 8, 2021 by Joshua M Brown

https://thereformedbroker.com/2021/03/08/thanks-elon/

5. DVY Dividend ETF vs. VUG Vanguard Growth Index.

DVY Outperforming YTD ……But 1 year chart….Growth still up almost double dividend payers.

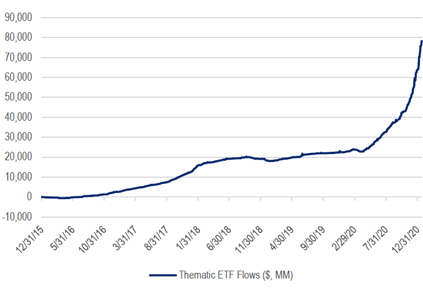

6.Thematic ETF’s have gained nearly $80 billion in net new assets since 2015, with more than half the growth occurring in the last eleven months.1

Cumulative Thematic Equity ETF Flows, 5 Years

Source: Bloomberg, Citi Research

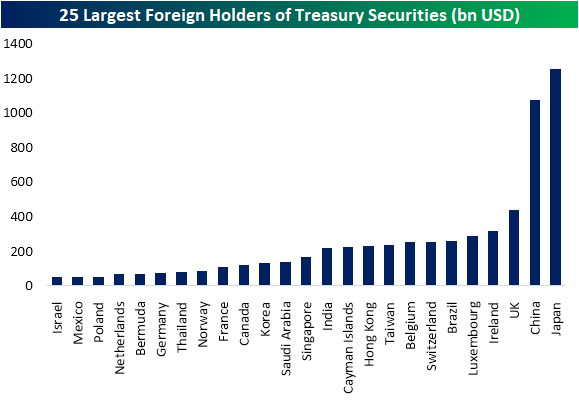

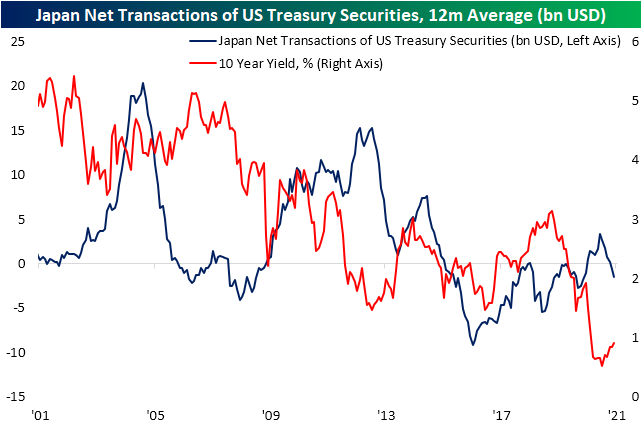

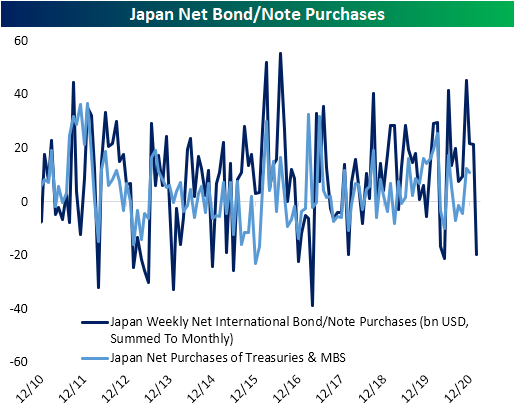

7. Tepper and Treasuries…Japan Buying Fewer Treasuries but Making it up in MBS Market

One catalyst being given credit to the generally positive performance equities today were bullish comments in a CNBC interview with Appaloosa Management’s David Tepper. Tepper stated that in his view “rates have temporarily made the most of the move” and ” “it’s very difficult to be bearish.” Tepper also stated a belief in the possibility of Japan stepping in as a buyer for US Treasuries following the recent rise in yields. As for why exactly Japan doing so would benefit Treasuries, it should be noted that Japan is the largest foreign holder of US Treasuries (per Treasury International Capital TIC data). As of December data (January data is set to be released next Monday, 3/15), Japan held $1.25 trillion in Treasury securities. The only other country that comes even close is China with $1.072 trillion in Treasury holdings. Behind those two, the UK is the next largest holder with not even half that amount: $440.6 billion.

Using the same TIC data, from early 2015 through the end of 2019, Japan was a net seller of US Treasury and Federal Financing Bank securities. For most of 2020, that had changed with Japan becoming a net buyer though that waned towards the end of the year. The recent uptick in yields coincided with Japan returning to being a net seller.

While Japan has purchased fewer Treasuries, they have still been making up the difference as big buyers of MBS. According to the TIC data for December, positive flows of MBS purchases offset the decline in Treasury purchases. As for Japanese data with less of a delay, in the chart below we show weekly net purchases of all foreign bonds and notes in US dollar terms summed by month. As for this more high-frequency data, again, there has yet to be evidence that Japan is buying Treasuries. For the month of February, the country was a net seller of $19.6 billion in foreign bonds and notes. But Click here to view Bespoke’s premium membership options for our best research available.

https://www.bespokepremium.com/interactive/posts/think-big-blog/tepper-and-treasuries

8.BITCOIN’S INTANGIBLE TANGLE…FASB does not have Accounting Guidance for Cryptocurrencies.

One problem could lie in the devil of the accounting detail in a bookkeeping industry that, like many others, is still taking stock of the nature of cryptocurrencies.

The Financial Accounting Standards Board, which sets accounting standards for U.S. corporations, does not have guidance specific to the accounting for cryptocurrencies. However, consistent with discussions among a separate U.S. trade body, companies apply existing FASB guidance on the accounting for “intangible assets”, which usually includes intellectual property, brand recognition or goodwill.

Under these rules, companies other than investment firms or broker-dealers cannot book gains in the value of holdings should the price of bitcoin rise – but must write down their investment as an impairment charge if it falls.

Furthermore, once a company writes down its holdings, it cannot record subsequent gains until it sells.

By contrast, companies periodically reflect the impact of fluctuations in traditional currencies in their financial statements.

The FASB has no immediate plans to review its treatment of bitcoin as the issue affects few of its constituents, according to a source familiar with the matter.

“I don’t think it’s the best accounting so far,” said Robert Herz, a former FASB chairman. “I am hoping that if more mainstream companies get into bitcoin, the accounting standards board may revisit the accounting treatment.”

Outside the United States, cryptocurrencies are usually treated as intangible assets too. But in contrast to guidance under the FASB rules, writedowns can be reversed in future years. In certain cases, companies can record bitcoin at market value. See EXPLAINER:

Rush to bitcoin? Not so fast, say keepers of corporate coffers–Tom Wilson, Anna Irrera and Jessica DiNapoli

https://finance.yahoo.com/news/insight-rush-bitcoin-not-fast-112557350.html

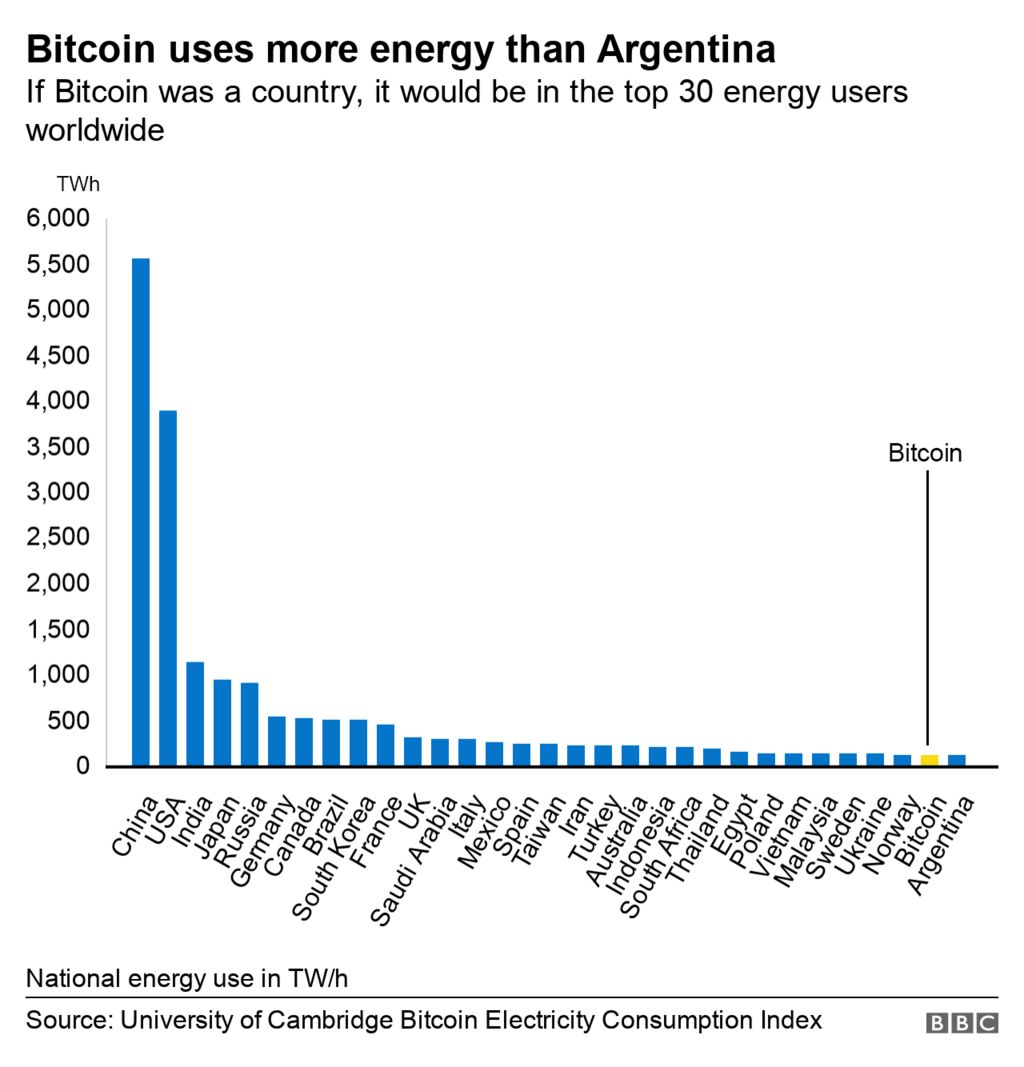

Bitcoin consumes ‘more electricity than Argentina’By Cristina Criddle

https://www.bbc.com/news/technology-56012952

9. Tesla Is Plugging a Secret Mega-Battery Into the Texas Grid

The utility-scale battery located outside of Houston will connect to the same grid that faltered in February’s freeze

By Dana Hull and Naureen S Malik

Elon Musk is getting into the Texas power market, with previously unrevealed construction of a gigantic battery connected to an ailing electric grid that nearly collapsed last month. The move marks Tesla Inc.’s first major foray into the epicenter of the U.S. energy economy.

A Tesla subsidiary registered as Gambit Energy Storage LLC is quietly building a more than 100 megawatt energy storage project in Angleton, Texas, a town roughly 40 miles south of Houston. A battery that size could power about 20,000 homes on a hot summer day. Workers at the site kept equipment under cover and discouraged onlookers, but a Tesla logo could be seen on a worker’s hard hat and public documents helped confirm the company’s role.

Tesla hasn’t announced the Gambit battery project but the site is visible in Angleton, located about 40 miles outside of Houston.

Photographer: Mark Felix/Bloomberg

Property records on file with Brazoria County show Gambit shares the same address as a Tesla facility near the company’s auto plant in Fremont, California. A filing with the U.S. Securities and Exchange Commission lists Gambit as a Tesla subsidiary. Executives from Tesla did not respond to multiple requests for comment.

Shares of Tesla gave up early gains Monday, falling 6% to $562.31 as of 3:17 p.m. in New York. The stock has fallen for the past four days and is down about 20% so far this year.

As winter storms pummeled Texas in February and left millions without power for days, Musk took to Twitter to mock the Electric Reliability Council of Texas, or Ercot, the nonprofit group that manages the flow of electric power to more than 26 million customers. “Not earning that R,” he wrote. Musk, 49, recently moved to Texas and his various companies are expanding operations in the state.

Explore dynamic updates of the earth’s key data points

The battery-storage system being built by Tesla’s Gambit subsidiary is registered with Ercot and sits adjacent to a Texas-New Mexico Power substation. Warren Lasher, senior director of system planning at Ercot, said the project has a proposed commercial operation date of June 1. The battery’s duration remains unclear, and Ercot couldn’t comment on the project’s capability.

While Tesla is known for its sleek, battery-powered electric vehicles, it’s always been more than a car company: its official mission is to “accelerate the world’s transition to sustainable energy.” Utility-scale batteries are needed to store the electricity produced by wind and solar, but they can also become lucrative opportunities. By storing excess electricity when prices and demand are low, battery owners can sell it back to the grid when prices are high.

Read More: How America’s Rich Can Escape From an Unreliable Power Grid

10. 7 Ways to Retain More of Every Book You Read

written by JAMES CLEAR

There are many benefits to reading more books, but perhaps my favorite is this: A good book can give you a new way to interpret your past experiences.

Whenever you learn a new mental model or idea, it’s like the “software” in your brain gets updated. Suddenly, you can run all of your old data points through a new program. You can learn new lessons from old moments. As Patrick O’Shaughnessy says, “Reading changes the past.”

Of course, this is only true if you internalize and remember insights from the books you read. Knowledge will only compound if it is retained. In other words, what matters is not simply reading more books, but getting more out of each book you read.

Gaining knowledge is not the only reason to read, of course. Reading for pleasure or entertainment can be a wonderful use of time, but this article is about reading to learn. With that in mind, I’d like to share some of the best reading comprehension strategies I’ve found.

1. Quit More Books

It doesn’t take long to figure out if something is worth reading. Skilled writing and high-quality ideas stick out.

As a result, most people should probably start more books than they do. This doesn’t mean you need to read each book page-by-page. You can skim the table of contents, chapter titles, and subheadings. Pick an interesting section and dive in for a few pages. Maybe flip through the book and glance at any bolded points or tables. In ten minutes, you’ll have a reasonable idea of how good it is.

Then comes the crucial step: Quit books quickly and without guilt or shame.

Life is too short to waste it on average books. The opportunity cost is too high. There are so many amazing things to read. I think Patrick Collison, the founder of Stripe, put it nicely when he said, “Life is too short to not read the very best book you know of right now.”

Here’s my recommendation:

Start more books. Quit most of them. Read the great ones twice.

2. Choose Books You Can Use Instantly

One way to improve reading comprehension is to choose books you can immediately apply. Putting the ideas you read into action is one of the best ways to secure them in your mind. Practice is a very effective form of learning.

Choosing a book that you can use also provides a strong incentive to pay attention and remember the material. That’s particularly true when something important hangs in the balance. If you’re starting a business, for example, then you have a lot of motivation to get everything you can out of the sales book you’re reading. Similarly, someone who works in biology might read The Origin of Species more carefully than a random reader because it connects directly to their daily work.

Of course, not every book is a practical, how-to guide that you can apply immediately, and that’s fine. You can find wisdom in many different books. But I do find that I’m more likely to remember books that are relevant to my daily life.

3. Create Searchable Notes

Keep notes on what you read. You can do this however you like. It doesn’t need to be a big production or a complicated system. Just do something to emphasize the important points and passages.

I do this in different ways depending on the format I’m consuming. I highlight passages when reading on Kindle. I type out interesting quotes as I listen to audiobooks. I dog-ear pages and transcribe notes when reading a print book.

But here’s the real key: store your notes in a searchable format.

There is no need to leave the task of reading comprehension solely up to your memory. I keep my notes in Evernote. I prefer Evernote over other options because 1) it is instantly searchable, 2) it is easy to use across multiple devices, and 3) you can create and save notes even when you’re not connected to the internet.

I get my notes into Evernote in three ways:

I. Audiobook: I create a new Evernote file for each book and then type my notes directly into that file as I listen.

II. Ebook: I highlight passages on my Kindle Paperwhite and use a program called Clippings to export all of my Kindle highlights directly into Evernote. Then, I add a summary of the book and any additional thoughts before posting it to my book summaries page.

III. Print: Similar to my audiobook strategy, I type my notes as I read. If I come across a longer passage I want to transcribe, I place the book on a book stand as I type. (Typing notes while reading a print book can be annoying because you are always putting the book down and picking it back up, but this is the best solution I’ve found.)

Of course, your notes don’t have to be digital to be “searchable.” For example, you can use Post-It Notes to tag certain pages for future reference. As another option, Ryan Holiday suggests storing each note on an index card and categorizing them by the topic or book.

The core idea is the same: Keeping searchable notes is essential for returning to ideas easily. An idea is only useful if you can find it when you need it.

4. Combine Knowledge Trees

One way to imagine a book is like a knowledge tree with a few fundamental concepts forming the trunk and the details forming the branches. You can learn more and improve reading comprehension by “linking branches” and integrating your current book with other knowledge trees.

For example:

- While reading The Tell-Tale Brain by neuroscientist V.S. Ramachandran, I discovered that one of his key points connected to a previous idea I learned from social work researcher Brené Brown.

- In my notes for The Subtle Art of Not Giving a F*ck, I noted how Mark Manson’s idea of “killing yourself” overlaps with Paul Graham’s essay on keeping your identity small.

- As I read Mastery by George Leonard, I realized that while this book was about the process of improvement, it also shed some light on the connection between genetics and performance.

I added each insight to my notes for that particular book.

Connections like these help you remember what you read by “hooking” new information onto concepts and ideas you already understand. As Charlie Munger says, “If you get into the mental habit of relating what you’re reading to the basic structure of the underlying ideas being demonstrated, you gradually accumulate some wisdom.”

When you read something that reminds you of another topic or immediately sparks a connection or idea, don’t allow that thought to come and go without notice. Write about what you’ve learned and how it connects to other ideas.

5. Write a Short Summary

As soon as I finish a book, I challenge myself to summarize the entire text in just three sentences. This constraint is just a game, of course, but it forces me to consider what was really important about the book.

Some questions I consider when summarizing a book include:

- What are the main ideas?

- If I implemented one idea from this book right now, which one would it be?

- How would I describe the book to a friend?

In many cases, I find that I can usually get just as much useful information from reading my one-paragraph summary and reviewing my notes as I would if I read the entire book again.

If you feel like you can’t squeeze the whole book into three sentences, consider using the Feynman Technique.

The Feynman Technique is a note-taking strategy named after the Nobel Prize-winning physicist Richard Feynman. It’s pretty simple: Write the name of the book at the top of a blank sheet of paper, then write down how you’d explain the book to someone who had never heard of it.

If you find yourself stuck or if you see that there are holes in your understanding, review your notes or go back to the text and try again. Keep writing it out until you have a good handle on the main ideas and feel confident in your explanation.

I’ve found that almost nothing reveals gaps in my thinking better than writing about an idea as if I am explaining it to a beginner. Ben Carlson, a financial analyst, says something similar, “I find the best way to figure out what I’ve learned from a book is to write something about it.”

6. Surround the Topic

I often think of the quote by Thomas Aquinas, “Beware the man of a single book.”

If you only read one book on a topic and use that as the basis for your beliefs for an entire category of life, well, how sound are those beliefs? How accurate and complete is your knowledge?

Reading a book takes effort, but too often, people use one book or one article as the basis for an entire belief system. This is even more true (and more difficult to overcome) when it comes to using our one, individual experience as the basis for our beliefs. As Morgan Housel noted, “Your personal experiences make up maybe 0.00000001% of what’s happened in the world but maybe 80% of how you think the world works. We’re all biased to our own personal history.”

One way to attack this problem is to read a variety of books on the same topic. Dig in from different angles, look at the same problem through the eyes of various authors, and try to transcend the boundary of your own experience.

7. Read It Twice

I’d like to finish by returning to an idea I mentioned near the beginning of this article: read the great books twice. The philosopher Karl Popper explained the benefits nicely, “Anything worth reading is not only worth reading twice, but worth reading again and again. If a book is worthwhile, then you will always be able to make new discoveries in it and find things in it that you didn’t notice before, even though you have read it many times.”

Additionally, revisiting great books is helpful because the problems you deal with change over time. Sure, when you read a book twice maybe you’ll catch some stuff you missed the first time around, but it’s more likely that new passages and ideas will be relevant to you. It’s only natural for different sentences to leap out at you depending on the point you are at in life.

You read the same book, but you never read it the same way. As Charles Chu noted, “I always return home to the same few authors. And, no matter how many times I return, I always find they have something new to say.”

Of course, even if you didn’t get something new out of each reading, it would still be worthwhile to revisit great books because ideas need to be repeated to be remembered. The writer David Cain says, “When we only learn something once, we don’t really learn it—at least not well enough for it to change us much. It may inspire momentarily, but then becomes quickly overrun by the decades of habits and conditioning that preceded it.” Returning to great ideas cements them in your mind.

Nassim Taleb sums things up with a rule for all readers: “A good book gets better at the second reading. A great book at the third. Any book not worth rereading isn’t worth reading.”

Where to Go From Here

Knowledge compounds over time.

In Chapter 1 of Atomic Habits, I wrote: “Learning one new idea won’t make you a genius, but a commitment to lifelong learning can be transformative.”

One book will rarely change your life, even if it does deliver a lightbulb moment of insight. The key is to get a little wiser each day.

Now that you know how to get more out of each book you read, you might be looking for some reading recommendations. Feel free to check out my book summaries or my public reading list.

FOOTNOTES

https://jamesclear.com/reading-comprehension-strategies

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.