1. Great Reminder from Howard Lindzon….1998 Forbes Cover ….Feel Familiar.

Technology Changes But Fear And Greed Never Do….

SOHO was a different place last night.

It was a beautiful evening and wherever there were open restaurants, the streets were packed. It was nice to see.

A lot of silly and weird behavior is driving some stocks right now. Obviously, technology has a hand in this.

This old Forbes cover started circulating that caught my eye as well. Here it is:

I would add…only the technology changes – fear and greed and stupid behavior have been around forever and fun to see this 1998 Forbes cover making the rounds.

Back to the 1998 cover…

My friend Jason Wild saw my link and added this:

Of course, Jason than found him on Twitter of course:

I of course pinged Serge on Twitter because he invests in fintech startups and will chat with him this week.

Now you know why Twitter is a miracle and should be valued much higher.

https://howardlindzon.com/technology-changes-but-fear-and-greed-never-do-and-sunday-reads/

Found at Crossing Wall Street Blog https://www.crossingwallstreet.com/

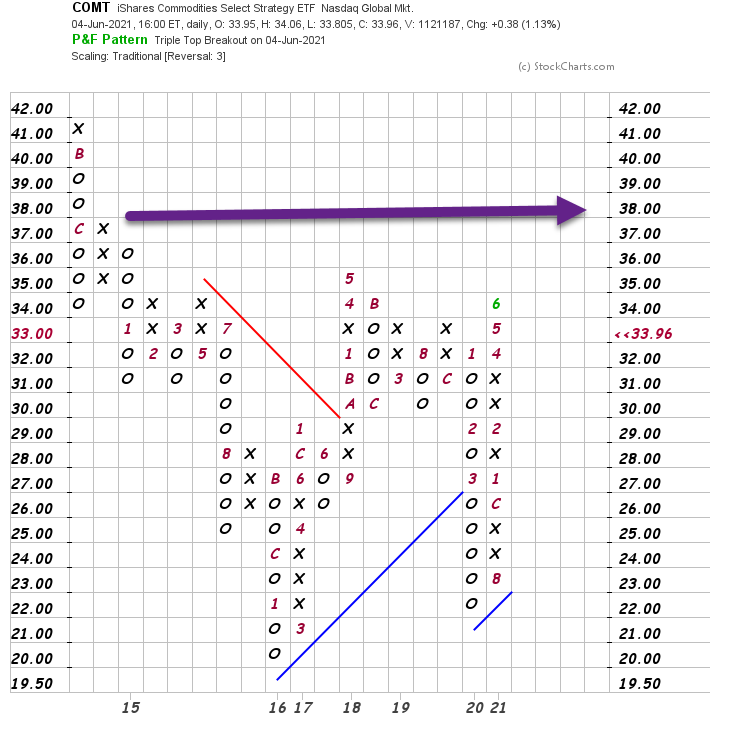

2. COMT-Commodities ETF Approaching Top of 5 Year Range

COMT-IShares Commodity ETF

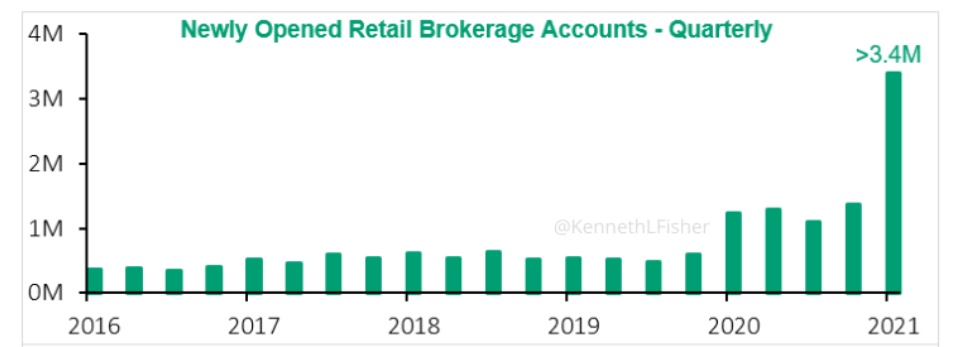

3. Spike in New Retail Brokerage Account Openings.

MEME stocks may not be over yet

From Ken Fisher on Twitter

https://twitter.com/KennethLFisher

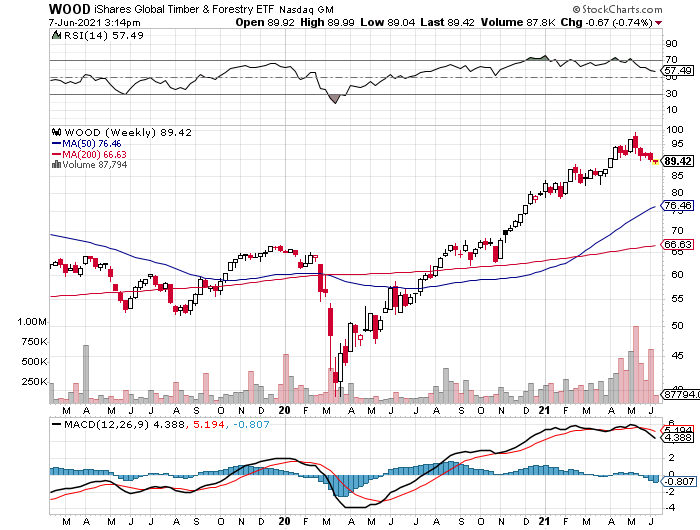

4. Lumber Futures -25% from Highs.

https://twitter.com/TheStalwart

WOOD Lumber ETF -10%

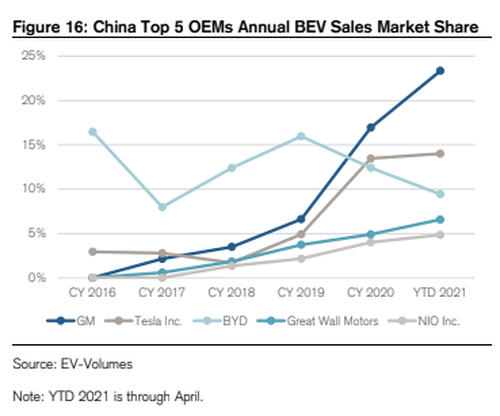

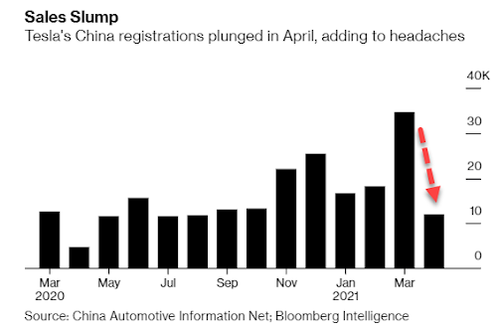

5. Tesla Market Share in China Fell to 8% in April from 19% in March.

The company’s market share in the world’s largest auto market – China – collapsed to 8% in April from 19% in March. That drop should be no surprise given the collapse in sales numbers we reported for Tesla in China last month. “GM remained the share leader in China in April, with a 20% share, driven by continued volume traction of the low cost Wuling HongGuang Mini,” Levy’s note, summarized by Bloomberg, pointed out.

Recall, in mid-May we noted that sales data coming out of China for April looked like it had dropped sharply. At that time, data from April showed that just 11,949 Tesla vehicles were registered in the country, down sharply from the 34,714 registrations in March, according to Bloomberg

Tesla China-Made Deliveries Plunge In April, Musk Cancels Model S Plaid+BY TYLER DURDEN HTTPS://WWW.ZEROHEDGE.COM/MARKETS/TESLA-CHINA-MADE-DELIVERIES-DROP-APRIL-MUSK-CANCELS-MODEL-S-PLAID

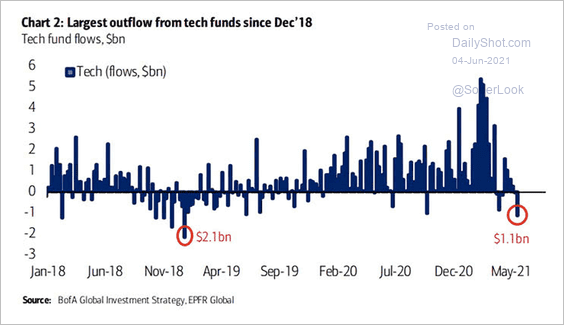

6. Tech Outflows Largest Since Dec. 2018 Correction.

The Daily Shot https://dailyshotbrief.com/the-daily-shot-brief-june-4th-2021-2/

Tech Sector ETF XLK-Barely a blip from highs

7. EFA Developed International ETF 17% Above 5 Year Highs

EFA ETF International Developed

Developed International Making a Run at Pre-2008 Crash Highs Next

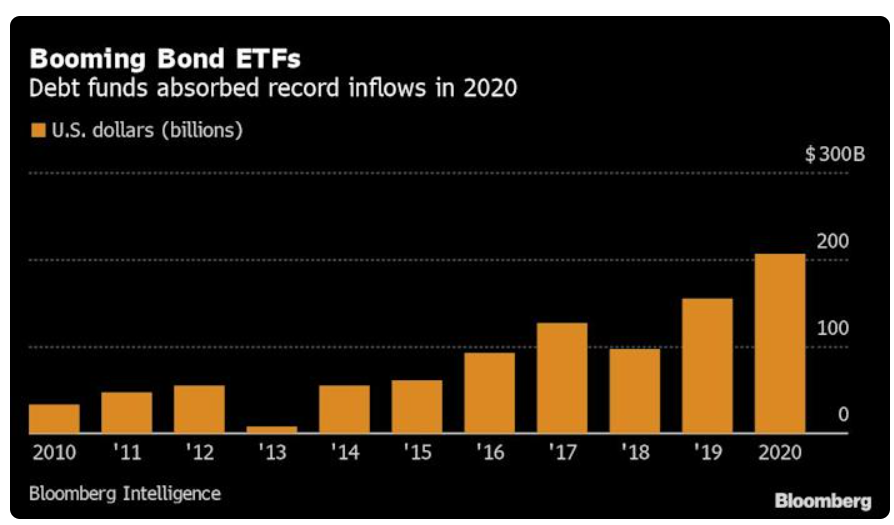

8. The Growth of Bond ETFs and Spike in 2020 After Fed Bailed Out All Debt

$200m Plus into Bond ETFs 2020 Double 2018

Bond ETFs With $1 Trillion Shrug as Fed Starts to Withdraw https://finance.yahoo.com/news/bond-etfs-commanding-1-trillion-141316725.html

9. Philly tech start-up Sporttrade has a new model for sports betting, and it looks a lot like a stock exchange

Philly Inquirer- by Andrew Maykuth

Drexel alum Alex Kane took one look at the traditional sports-betting model and concluded, “This structure stinks.” He set out to revolutionize the market.

Alex Kane, chief executive officer of Sporttrade Inc., a Philadelphia tech company that hopes to revolutionize sports-betting by creating an exchange where bets can be traded like stocks.

Alex Kane traces the origin of his Big Idea to revolutionize sports betting to his junior year at Drexel University, when he and his father placed a wager on an obscure Thai golfer to win the 2016 Masters Tournament.

Kane’s golfer, Kiradech Aphibarnrat, performed surprisingly well through the first half of the four-day tournament and was only a few strokes behind the leader after two rounds. The odds in his favor had risen about 100 times from the start of the tournament.

Kane would have liked to trade his bet at that point, just as he could sell a stock or cryptocurrency on a smartphone app such as Robinhood or Coinbase, the popular tools for a new generation of traders. But there was no similar market platform for trading sports bets.

“That’s when I realized, ‘Oh, my gosh, this structure stinks,’” said Kane, who grew up in Birmingham Township, Chester County. “It should be way more like capital markets trading, where like I’m able to pick up Robinhood or Coinbase and trade based on the changes in the market.”

ADVERTISEMENT

Alas, Kane lost his wager on Aphibarnrat, who finished tied for 15th in the Masters. But the seed of a new business was planted.

Fast forward five years. Sports betting is legal now in Pennsylvania, New Jersey and about a dozen other states. Kane, now 27, has transformed his idea into a real business, Sporttrade Inc., which he envisions will operate more like a stock exchange than a traditional sportsbook. It launched its website last month, www.sporttrade.com, and it’s undergoing licensing review in New Jersey. Pending approval, it could begin taking bets by the end of the summer.

“We fundamentally believe that what we are building is so much closer to options trading or futures trading than traditional sports betting and casinos,” said Kane, who studied business administration at Drexel, where he was also an intercollegiate golfer.

Kane hopes Sporttrade will dramatically change the way in-game sports betting is conducted by increasing the speed and lowering the cost for bettors to wager while an event, such as a golf tournament, is underway.

Bettors using sports-betting apps can now place wagers during an event, and even cash out of a position. But experts say there is often a delay as bookmakers ponder whether to accept or reject an in-game wager as they assess their risk, and the margins the bookmakers earn on such bets makes them unattractive.

“You’ll find that if you’re not betting at the timeouts or between the quarters, you’re going to end up with a situation where you submit the bet and then there is a delay,” said Jack Andrews, a professional sports bettor in New Jersey. “It seems like they’re getting a free roll against you.”

“It doesn’t feel like you as the customer are in control,” Kane said. He believes that electronic platforms adapted to handle split-second trading in stock markets can manage sports-betting action, matching buyers and sellers without delay, because the exchange is acting as a neutral party and is not taking on the risk of a bad bet.

Sporttrade is no shoestring venture. Kane’s company last year partnered with Twin River Worldwide Holdings Inc., which was then in the process of acquiring Bally’s Atlantic City Hotel & Casino, to obtain one of Bally’s three New Jersey sports-betting brands or “skins.” Kane has also enlisted investors, software designers and experts, including influencers in the sports-betting world and veterans from Wall Street investment banks and stock exchanges.

Kane’s journey to this point — “we’re at the very bottom of the mountain,” he said — got a huge boost when he pitched and sold his idea in 2019 to the Comcast NBCUniversal LIFT Labs Accelerator powered by Techstars, a three-month program to introduce promising entrepreneurs to a network of corporate partners, investors, and mentors.

One lesson that Kane took away from his Techstars experience was to think big. He realized that the Sporttrade platform he envisioned would depend upon sophisticated financial software that needed to pass regulatory scrutiny, and the venture would require more resources than the $3 million budget he set as his initial target.

Similar to those on a stock market, prices on the Sporttrade exchange will be set by market makers, who quote “bid” prices for sellers and “ask” prices for buyers. Sporttrade would take a small commission on each trade, which would be reflected in the difference between the buying and selling price. Kane anticipates that such a system will yield narrower margins than the “vig” (or fee) that sportsbooks now charge to cover their risk. Lower margins mean a lower transaction cost for customers.

The Sporttrade system also seeks to redefine the traditional American way that betting odds are posted, which is now based on a system of minuses and pluses (a favorite is quoted as a minus, such as -110, which shows that a bettor needs to put $110 at risk to win $100).

Alex Kane, 27, talks about his tech company, Sporttrade Inc., along the Schuylkill River Trail in Center City Philadelphia.DAVID MAIALETTI / Staff Photographer

Sporttrade will express the betting cost as a percentage. If the Sixers have an 11% chance of winning the NBA Championship, a bettor would wager $11 to win $100. If the team’s fortunes rise, the price of the contract would increase, and a bettor could cash in the position. After an event is concluded, a contract is worth either $100 or zero.

Sporttrade’s model resonates with people who have spent their lives working in financial markets.

An image of the Sporttrade mobile app, a sports-betting venture that works more like a stock exchange than a traditional sportsbook. The Philadelphia tech start-up, founded by Drexel alum Alex Kane, is aiming its public launch for later this summer in New Jersey.Read moreCourtesy of Sporttrade Inc.

“I think there are really interesting avenues that we’re going to take for customer acquisition and traditional television isn’t initially one,” he said. “The advantage that we have is a differentiated product. We don’t have to spend a ton of money to try to get someone to use our sports betting app.”

Sporttrade now employs about 50 people, and most of them live and work remotely in the Philadelphia area — the leaders meet monthly at a WeWork shared office in Center City. Kane said he plans to open an office in Camden soon, to domicile the company in New Jersey to satisfy regulatory requirements.

If the system passes muster in New Jersey, which has surpassed Nevada in less than three years to become the largest sports-betting state in the nation, then the model can be replicated in other states. Pennsylvania, though it has the nation’s third-largest sports betting volume, presents a high barrier to entry because of its $10 million license fee and high tax rates compared with other states.

Kane thinks it is inevitable that somebody will model a sports-betting business on a market exchange, and the first mover will have a significant advantage.

The Council on Compulsive Gambling of Pennsylvania offers guidance to problem gamblers at 1-800-GAMBLER.

10.The 6 Emerging Tech Trends That You Need to Know About Now

Expect rapid advancements in artificial intelligence and augmented reality, as well as big tech diving further into health care and consumer finance. Don’t get left behind.

Thanks to the Covid-19 pandemic, 2020 saw a decade of digital transformation in the span of a few months. Don’t expect the pace of change to end any time soon, says futurist Amy Webb.

“There were tremendous aftershocks that started to reverberate and change many different segments of the economy,” says Webb, who presented Future Today Institute’s 14th annual Tech Trends Report at SXSW this week. At roughly 500 pages, this year’s edition is the bulkiest yet. Webb says that the length primarily was due to the impact of Covid-19 as barriers to the widespread adoption of remote work, digital payments, and artificial intelligence seemed to disappear nearly overnight. The report highlights nearly 500 new trends, up from 406 last year.

So, what’s on deck for 2021 and beyond? You can expect further advancements in artificial intelligence, including for health care applications like drug discovery and improving patient outcomes, but also in forms of creative expression, like in the visual arts or music. The move toward cryptocurrencies and decentralized finance will continue, and the demand for digital collectibles such as nonfungible tokens (NFTs) will boom this year. As more nations switch to 5G, a wealth of new technologies such as robots, drones, holograms, and augmented reality displays will show up in our everyday environment, from shopping malls to sports arenas.

What’s more, algorithms will continue to score and rank areas of our life, from our sleep to our fitness to our “social credit score,” which measures your online activity. In other words, the videos, the pictures, the links, nearly everything you post online will continue to be measured by big tech.

“Everyone alive today is being scored,” wrote the authors of the report.

Here is a look at some of the most notable predictions for 2021.

1. Smartphones will be a thing of the past.

The pandemic hit the smartphone industry especially hard, with global smartphone shipments declining in 2020 as both demand and supply took a nosedive. While smartphone sales will likely rebound in 2021, they will also have to compete with a new breed of smart eyewear and wearables that are entering the market. These include Apple’s yet-to-be-released smartglasses, virtual reality headsets such as Facebook’s Oculus Quest 2 and Microsoft’s HoloLens, and a growing industry of wearables and “hearables” like the Apple AirPods.

Webb notes that people are holding on to their old smartphones for longer, and are less excited by new features.

“There are just not a lot of compelling new features or functionality that are coming and are all in one smartphone device. So we’re transitioning away from that. It’s a different paradigm, from a single phone to a new constellation of devices that we will either wear or embed,” says Webb, who is a former Inc. columnist.

2. The tech exodus and newly remote workforces aren’t temporary.

While Silicon Valley isn’t going anywhere, there will be an impact as companies like Facebook, Shopify, Twitter, Square, and Slack promise to let their workers continue to work from home past the pandemic’s end. Startups and smaller companies will likely follow suit. This will result in a high-skilled tech workforce now being more equally distributed across the United States, instead of just the Bay Area and New York City.

3. Health care is the next battleground for big tech.

The tech giants will make further advances in health care, including through wearables such as smart glasses and wristbands, and the growing smart fitness industry. There’s already been ample evidence of this in recent months, including Apple unveiling its Fitness+ service, Amazon launching a Halo band fitness tracking wearable, and Google’s acquisition of Fitbit. Webb predicts that big tech is influential enough to force established pharmaceutical companies and the health insurance industry to evolve. These changes are already in the making; for example, major insurers are already offering to reimburse wearables like the Apple Watch.

Covid-19 accelerated the adoption of telehealth and smart fitness, so expect more advancements in this space from both big tech and startups. Also in the pipeline are further growth of at-home lab testing and remote patient monitoring tools.

4. The “home of things” industry is expanding.

The rising popularity of smart home devices and home surveillance systems such as Amazon Ring and Google Nest has created a new “home of things,” or HoT, industry. Google, Amazon, and Apple will be the major players in this space. But also forthcoming are a growing number of connected smart home appliances and devices, from vacuums to drink makers to a trash can that can detect an empty milk carton or box of cereal and automatically order a replacement.

5. Antitrust action may fail to keep up with big tech’s moves.

The Biden administration is expected to ramp up antitrust enforcement of big tech. But the report notes the ever-changing business landscape may be too fast for regulators to keep up with. Also, it’s unclear whether some of big tech’s most consequential actions (such as Facebook’s acquisition of Instagram, or Amazon’s acquisition of Whole Foods or its moves to build out a digital payments, logistics, and delivery infrastructure) are illegal from an antitrust standpoint.

“No U.S. laws prohibit being really, really smart,” write the report’s authors.

6. Cryptocurrency and social payments will gain mainstream acceptance.

The blockchain and digital currency made significant headway in 2020. Just this month, J.P. Morgan released a report warning that Wall Street is at risk of falling behind in digital finance, and also released a new debt instrument geared toward cryptocurrency companies. For 2021 and beyond, the report predicts that more governments and central banks will seriously explore cryptocurrency. Countries such as Ecuador, China, Singapore, and Senegal have already issued their own digital coins, and a number of other countries, including Japan and Sweden, are actively exploring the adoption of a centralized bank e-currency.

The pandemic encouraged more people to use Venmo, Apple Pay, Google Pay, and other contactless peer-to-peer payment services. The growing popularity of online shopping has prompted a rise in “buy now, pay later,” or BNPL, platforms like Affirm. Not only are people now more likely to shop or pay for things with their phones, they’re also more likely to trust big tech with their finances. Big tech has already stepped up to the plate. Google last year partnered with Citi to launch mobile bank accounts and plans to add more partner institutions next year. Expect big tech to dive further into consumer finance, from offering loans to cryptocurrency.

https://www.inc.com/amrita-khalid/tech-trends-forecast-future-amy-webb.html

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.