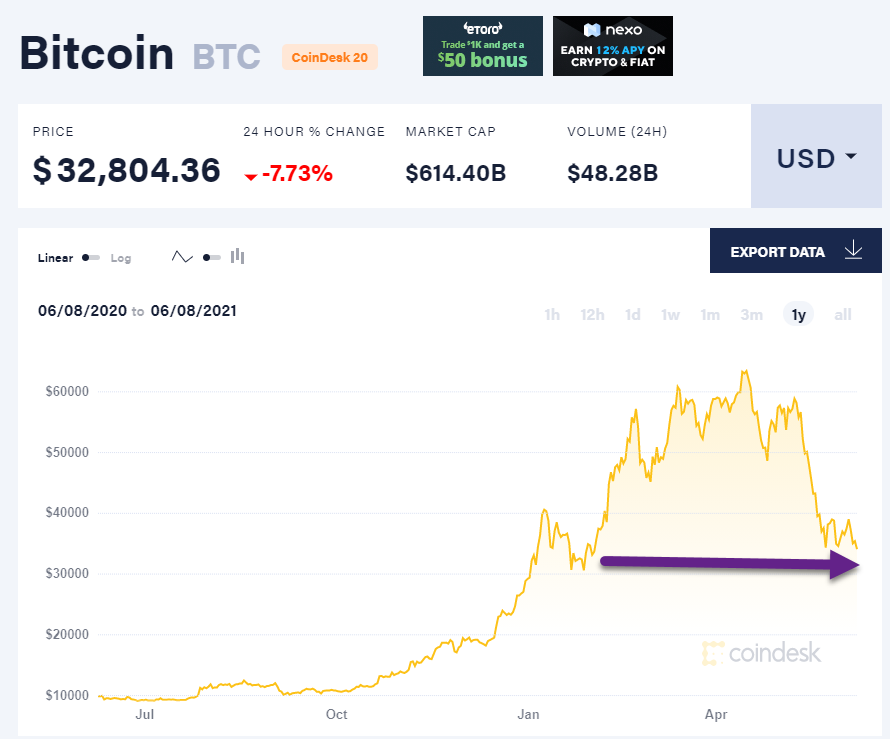

1. Bitcoin Approaching $30,000 Support Level

https://www.coindesk.com/price/bitcoin

Bitcoin tumbles 12% after US authorities claw back most of Colonial Pipeline crypto ransom

- The DOJ’s new Ransomware and Digital Extortion Task Force has recovered most of the Colonial Pipeline ransom.

- The task force recovered 63.7 bitcoin or $2.3 million worth of the $4.3 million ransom.

- The FBI declined to specifically say how it seized the funds from “Darkside” hackers.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

The price of bitcoin tumbled as much as 12% on Tuesday to trade around $31,500 per coin.

The fall may have been a result of security concerns after US authorities clawed back $2.3 million (63.7 bitcoin) of the $4.3 million Colonial Pipeline attack crypto ransom from hackers, according to an affidavit.

The money was recovered by the Department of Justice’s recently launched Ransomware and Digital Extortion Task Force.

At a briefing discussing the ransomware attack, FBI Deputy Director Paul Abbate said agents were able to recover a digital currency wallet that “DarkSide” hackers used to collect payment from Colonial Pipeline.

“Using law enforcement authority, victim funds were seized from that wallet, preventing Dark Side actors from using them,” Abbate said.

The FBI declined to say exactly how it accessed the bitcoin wallet, but experts say it was unlikely they hacked the wallet with brute force tactics.

April Falcon Doss, the executive director of the Institute for Technology Law and Policy at Georgetown Law, told NPR this was “a really big win” for the government, but noted that no one knows “whether or not this is going to pave the way for future similar successes.”

Nine of the 10 biggest cryptocurrencies based on market capitalization were down on Tuesday morning following the news, the exception being a stablecoin pegged to the US dollar. The selloff took roughly $200 billion in market cap from the crypto ecosystem in a day.

In other bearish news, a popular crypto TikTok influencer who goes by Pablo Heman told Insider that bitcoin is at risk of tumbling 30% in the next couple of weeks.

Despite the rough day for bitcoin and cryptocurrency bulls, there were a few bright spots.

First, Coinbase said that institutional investors’ crypto holdings surged 170% in the first quarter on its platform. The data marks a very different tone to what Goldman Sachs had said about very few of its fund managers considering bitcoin as a long-term investment.

Second, President Biden’s top tech antitrust advisor was also revealed to be a bitcoin bull this week. Tim Wu holds between $1 million and $5 million in bitcoin, according to a new financial disclosure recovered by Politico.

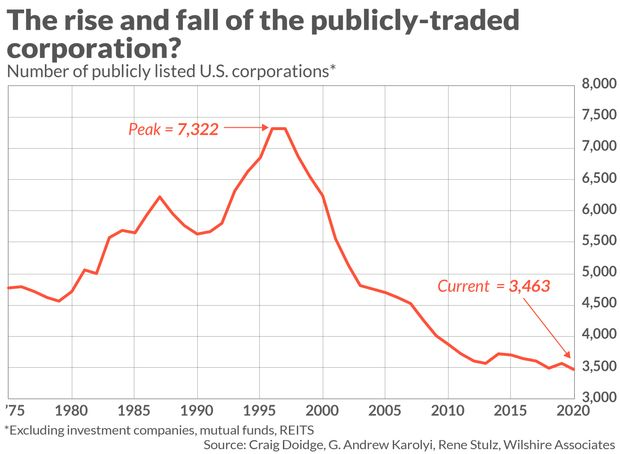

2. MEME Stocks, SPACS, IPO Boom…Still Falling Number of Publicly Traded Firms.

Mark HulbertThe S&P 500 would be below 1,600 without these 3 pillars and those supports are now weakening

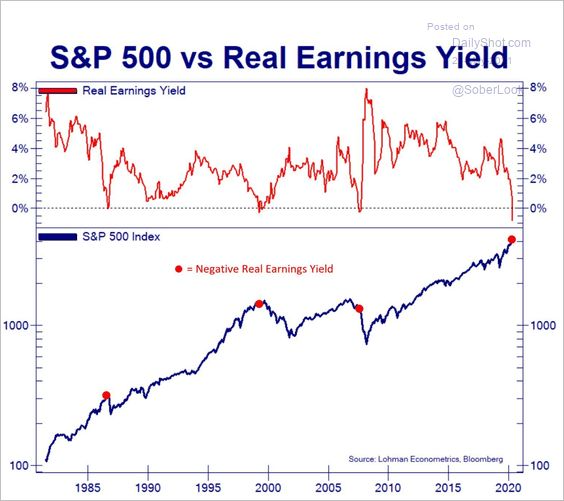

3. The S&P 500 real earnings yield (the inverse of the p/e ratio minus inflation) is at its lowest level in over 40 years and is now solidly negative.

Jonathan Baird

https://www.linkedin.com/in/jonathanbaird88/

EARNINGS YIELD DEFINITON KEY TAKEAWAYS

- Earnings yield is the 12-month earnings divided by the share price.

- Earnings yield is the inverse of the P/E ratio.

- Earnings yield is one indication of value; a low ratio may indicate an overvalued stock, or a high value may indicate an undervalued stock.

- The growth prospects for a company are a critical consideration when using earnings yield. Stocks with high growth potential are typically valued higher and may have a low earnings yield even as their stock price rises.

https://www.investopedia.com/terms/e/earningsyield.asp

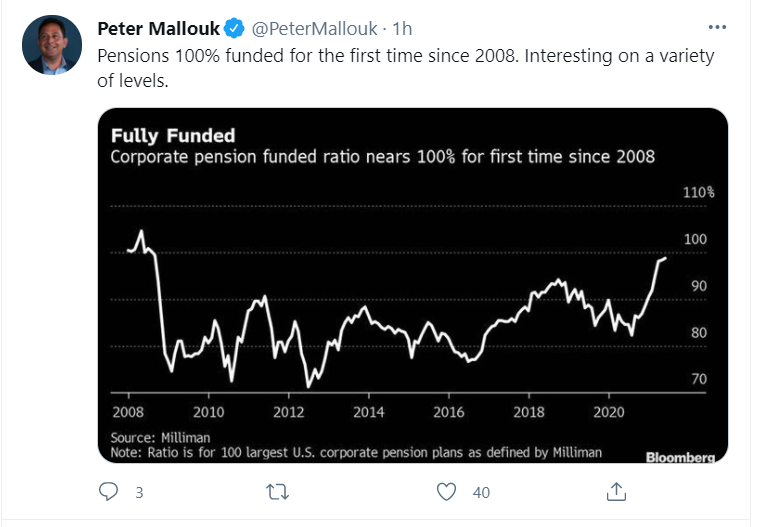

4. Corporate Pension Funds Fully Funded for First Time Since 2008

https://twitter.com/PeterMallouk

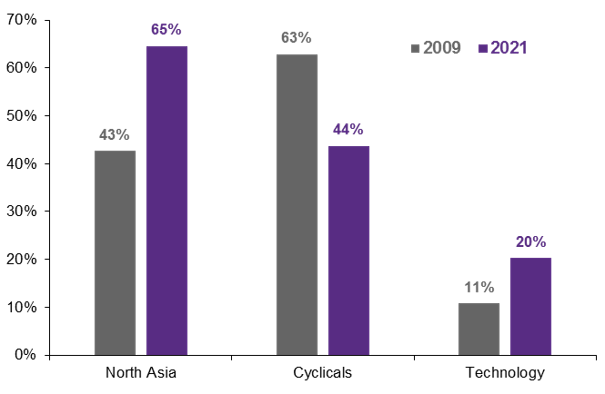

5. Emerging Markets Index Exposure to Cyclicals 2009 63% 2020 44%…..

While regional pandemic trends explain part of EM’s underperformance, a more important explanation is the EM market’s dramatic regional and sectoral change over the past decade. EM equities are now a growth market, not a cyclical one. The more cyclical EM regions have shrunk in size, while North Asia (China, Korea, and Taiwan) have moved up from 43% of the index in 2009 to 65% today. These are regions where “growth-y” sectors, like technology, dominate the market. As a result, the sectoral representation of the overall EM index has changed. Cyclical sectors have moved down from 63% of the index in 2009 to only 44% today, while technology has doubled in size from 11% to 20%. In a year when growth is out of favor and cyclicality is in favor, EM should now be expected to underperform.

For EM, this is a different beginning to a new cycle. For investors looking to add cyclicality in the year of the global recovery, Europe now offers one of the best cyclical bangs for the buck. Meanwhile, EM offers investors access to powerful structural growth stories of the expansion: technological innovation and the rise of the EM Asia middle class, themes that will come back into favor once investors look past the early cycle economic growth surge.

Very different beginning to a new cycle for EM equities

Percentage of MSCI Emerging Markets Index

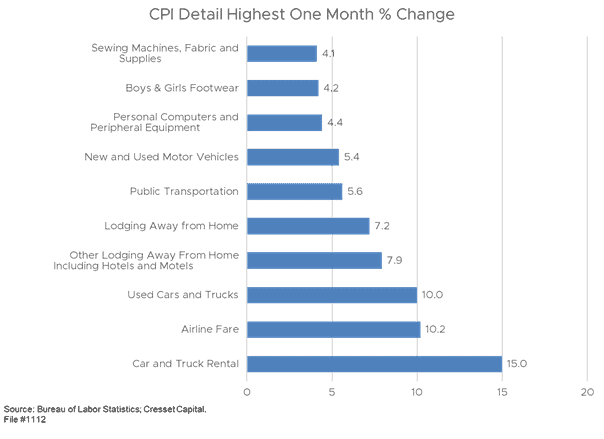

6. CPI Details and One-Month Wage Increases Details

IS THE FED WRONG ON INFLATION? MARKET COMMENTARY JACK ABLIN https://cressetcapital.com/post/is-the-fed-wrong-on-inflation/

7. Is $1 Million Still Worth $1 Million?

Posted June 1, 2021 by Nick Maggiulli

This change is mostly due to inflation since $1 million in 2001 would be worth about $1.5 million in 2019.

https://ofdollarsanddata.com/is-1-million-still-worth-1-million/

8. Affluent Americans Rush to Retire in New ‘Life-Is-Short’ Mindset

Jump in Business Owners Looking to Exit

A November study from Pew Research Center found a surge in the number of baby boomers, those born between 1946 and 1964, who reported being retired compared to previous years — 1.2 million more than the historical annual average.

Other datapoints back up the findings. The number of people expecting to work beyond age 67 fell to a record low of 32.9% last month, according to a New York Federal Reserve survey. And about 2.7 million workers age 55 and older plan to apply early for Social Security benefits — almost twice as many as the 1.4 million people in the same age group who anticipate working longer, according to a recent U.S. Census Bureau survey.

The unprecedented surge in shares and home values during an economic crisis is easing the retirement path for those who have investments. Assets for Americans ages 55 to 69 rose by $4.2 trillion in 2020, including a $2.2 trillion increase in corporate equities and mutual fund shares and a $250 billion gain in the value of private businesses, according to data from the Federal Reserve. Real estate assets soared by almost $750 billion for this group.

9. Massive Global Organized Crime Bust

Hundreds arrested in ‘staggering’ global crime sting

ANOM: Hundreds arrested in ‘staggering’ global crime sting

Trojan Shield

Danny KEMP with Andrew BEATTY in Sydney and Paul HANDLEY in Washington

Mon, June 7, 2021, 7:40 PM·4 min read

Police arrested more than 800 people worldwide in a huge global sting involving encrypted phones that were secretly planted by the FBI, law enforcement agencies said Tuesday.

Cops in 16 countries were able to read the messages of underworld figures as they plotted drug deals, arms transfers and gangland hits on the compromised ANOM devices.

Mafia groups, Asian crime syndicates, motorcycle gangs and other criminal networks were all monitored using the spiked phones as part of “Operation Trojan Shield.”

– ADVERTISEMENT –

The sting, jointly conceived by Australia and the US Federal Bureau of Investigation, prevented around 150 murders, foiled several large-scale narcotics shipments and led to seizures of 250 weapons and $48 million in currency, they added.

“The results are staggering,” FBI Assistant Director Calvin Shivers told reporters at the headquarters of the EU’s police agency Europol in The Netherlands.

Using a network of unaware distributors, the FBI placed thousands of the ANOM devices into the hands of over 300 criminal syndicates in over 100 countries, who believed their messages could never be seen by law enforcement.

Traffickers used them to haggle over prices, fashion ways to secretly ship their drugs, and launder their money.

One cocaine trafficker texted another photographs to prove he could ship the drug from Bogota using the French embassy’s protected diplomatic pouch, two kilograms at a time.

In all, officials said, they raked in some 27 million messages on phones which were used “exclusively” by criminals.

Australian Prime Minister Scott Morrison said Tuesday that the operation had “struck a heavy blow against organised crime — not just in this country, but one that will echo around organised crime around the world”.

– ‘Heavy blow’ –

The operation took off in the past two years as police disrupted other encrypted phone networks used by criminals, Phantom Secure, EncroChat and SkyGlobal.

That created a void that ANOM filled.

An affadavit filed in San Diego, California court described how the FBI forced a person involved in Phantom Secure to produce a “next generation” encrypted messaging device that gave the FBI a master key into the encryption technology.

The devices also secretly copied any message to an FBI-controlled server after they were sent.

This enabled them to turn the tables on criminals whose use of encryption apps and devices have increasingly stymied criminal investigations.

“We were actually able to see photographs of hundreds of tonnes of cocaine that were concealed in shipments of fruit, we were able to see hundreds of kilos of cocaine that were concealed in canned goods,” Shivers said.

The messages also exposed official corruption and other crimes.

While present across the globe, the heaviest use of the ANOM phones was in Germany, Netherlands, Spain, Australia and Serbia, according to the FBI.

Australia said more than 200 people had been charged already. Sweden arrested 155 people, including five in Spain.

Neighbouring Finland announced around 100 arrests, including a major seizure of machine guns and a 3D printing workshop turning out parts for firearms.

Germany detained 70 suspects, the Netherlands 49, and New Zealand 35 in the operation.

“Criminals assumed that the service was safe and touted it among themselves as the platform you should use… Nothing could have been further from the truth,” Dutch police said in a statement.

US authorities indicted 17 foreign nationals, some known drug traffickers, who played key roles in distributing and popularizing the ANOM handsets to others who trusted their expertise.

Asked if any Americans would face charges related to Operation Trojan Shield, the US Justice Department said there were “ongoing and international investigations” and would not comment further.

– ‘People came to us’ –

According to unsealed court documents, the FBI launched Trojan Shield with a “beta test” of 50 ANOM devices distributed in Australia.

The devices were marketed as “designed by criminals for criminals” and sold for about $2,000 each, with a $1,300-$2,100 user fee every six months.

They had no email, call or GPS services and could only send text or photo messages to other ANOM phones.

Criminal “influencers” were recruited to push them, including an Australian fugitive drug boss on the run in Turkey.

“We didn’t hand them out, people actually came to us seeking those devices,” Shivers said.

But they gave police a huge amount of information on users: their identities, links to financial accounts, and their networks.

US officials said the ruse was revealed Tuesday because it was time to begin taking action against the criminals.

But the cover appeared to be blown in March 2021 when a blogger detailed ANOM security flaws and claimed it was a scam linked to Australia, the United States and other members of the Five Eyes intelligence sharing network. The post was later deleted.

ANOM’s website was unavailable Tuesday, with a message that the “domain has been seized.”

burs-dk/pbr/ach/pmh/bgs

https://news.yahoo.com/raids-worldwide-police-reveal-vast-234028107.html

10. Shaq Still Banging Out Degrees.

https://www.linkedin.com/in/designated-dr-belinda-kendall-68894313/

https://www.linkedin.com/in/designated-dr-belinda-kendall-68894313/

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.