1. Rising Rates? A 3% jump in yields would send the U.S. debt service from $303 billion to $975 billion.

We would spend more on debt service than defense, and would approach the cost of funding Social Security. The Federal Reserve knows how tenuous the situation can become if yields were to surge higher.

Barrons-Scary Debt-Service ScenarioPCM Report June 2021 https://www.barrons.com/articles/keep-an-eye-on-the-money-supply-its-been-shrinking-51622851213?mod=past_editions

10 Year Treasury Yield 1.56% Last

©1999-2021 StockCharts.com All Rights Reserved

2. Historically Zero Correlation Between Changes in Interest Rates and Stock Prices

Charlie Bilello-Should interest rates play a role in timing the market?

Interest rates are low. How low?At 1.63%, the current 10-Year US Treasury yield is lower than 98% of historical readings. In 2020, rates fell below 1% for the first time, hitting an all-time closing low of 0.52%.

That scares a lot of people because of the widespread belief that low interest rates are “propping up” the stock market. When interest rates finally rise, it is said, stocks will come crashing down.

While that’s certainly possible, what does the evidence suggest? Are rising interest rates bad for stocks?

As it turns out, not exactly.

There’s almost a 0% correlation between changes in interest rates and changes in stock prices. In plain English that means even if you could predict the direction of interest rates (no easy task), it would tell you nothing about the direction of stock prices.

Since 1928, the 1-year average returns for the S&P 500 are almost exactly the same (11.4%/11.5% respectively) during periods of rising/falling 10-year Treasury yields.

That’s not to say that higher rates cannot act as an impediment to economic growth or stock market returns at times. They most certainly can. But they are just one variable in a highly complex system that is the stock market.

Still not convinced? Let’s go back in time.

From the start of 1949 to the end of 1968, a 20-year period, the 10-Year Treasury yield rose from 2.32% to 6.03%.

How did stocks fare? They were up over 1,500%, or 14.9% annualized.

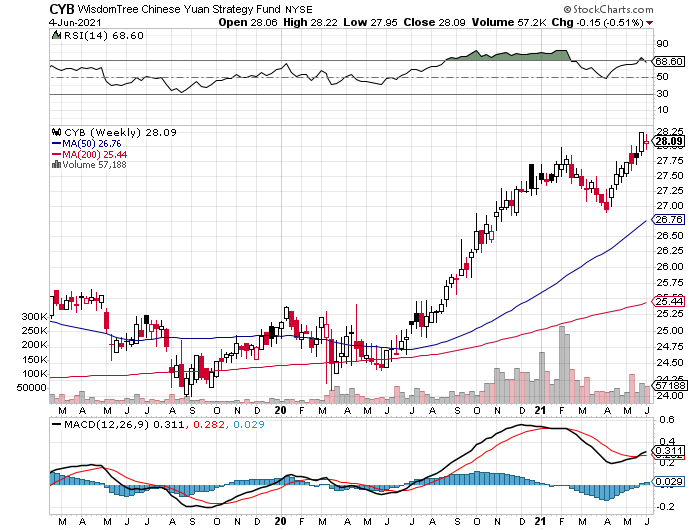

3. Rising Chinese Currency.

China’s yuan hit 6.37 to the buck, the highest level since 2018, and only 5% off its historic peak.

©1999-2021 StockCharts.com All Rights Reserved

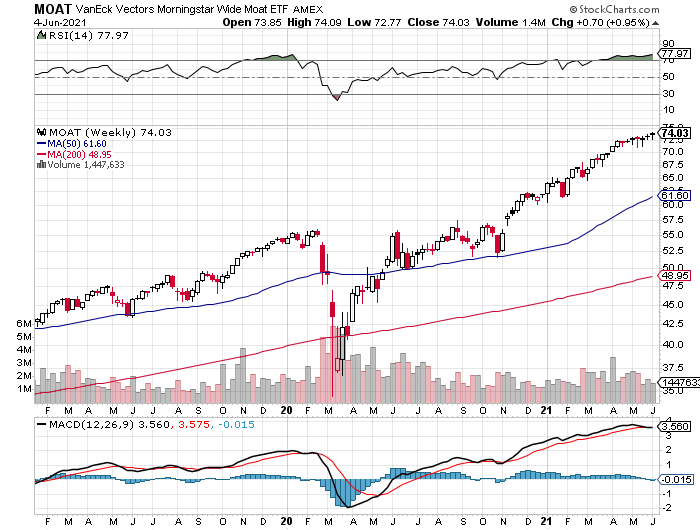

4. MOAT ETF

In Case you want to see who Morningstar and Van Eck consider stocks with wide moats

MOAT Factset Analytics Insight

MOAT holds a concentrated portfolio of stocks that are attractively priced and have sustainable competitive advantages (patents, high switching costs, etc.). Morningstar’s equity research team determines the fund’s selection by assigning an economic rating and a fair value estimate to the companies in the Morningstar US Market Index. Despite its safe-sounding name, MOAT makes radical departures from market-like coverage. The fund favors single-name positions and may have significant sector biases. It follows an equal-weighted index with a staggered rebalance—half the portfolio is reconstituted with equal weights every six months, and the other half follows three months later. MOAT also caps turnover and sector exposure. This results in the fund holding more than 40 names at times.

MOAT Top 10 Sectors

- Technology20.99%

- Healthcare20.58%

- Industrials16.91%

- Consumer Non-Cyclicals13.70%

- Financials12.92%

- Consumer Cyclicals7.36%

- Energy2.74%

- Basic Materials2.43%

- Utilities2.39%

MOAT Top 10 Holdings [View All]

- Wells Fargo & Company3.19%

- Cheniere Energy, Inc.2.99%

- Alphabet Inc. Class A2.79%

- Northrop Grumman Corporation2.71%

- Raytheon Technologies Corporation2.66%

- Philip Morris International Inc.2.65%

- General Dynamics Corporation2.65%

- Berkshire Hathaway Inc. Class B2.62%

- Blackbaud, Inc.2.53%

- Yum! Brands, Inc.2.52%

Total Top 10 Weighting27.31%

https://www.etf.com/MOAT#overview

5. Energy Vs. S&P

XLE vs. S&P…Did XOM out of Dow spark new sector leadership in market?

Remember when Exxon was kicked out of the Dow (after 92 years) and it was a ‘sign of the times’? Ryan Detrick asks Wouldn’t it be quite the sign that the removal actually marked a major change in energy performance and was a major buy signal? Here’s energy versus the SPX.

Dave Lutz at Jones Trading

6. Let the crypto price wars begin

Robinhood touts ‘commission free’ trade vs. Coinbase rivals

This article is in your queue.

Is a zero-commission war about to erupt in the crypto arena?

Robinhood Markets on Thursday may have delivered the first shot across the bow in the trading of virtual assets, highlighting that buying and selling assets like bitcoin BTCUSD, -5.18% carries no transaction fees on its venue, pointing to fees that exist at competitors Coinbase Global COIN, -2.84% and Gemini and PayPal’s PYPL, -1.67% Venmo.

ROBINHOOD MARKETS

Coinbase explains its transaction fee structure here, noting that it also varies by region.

Robinhood makes the case that the fees aren’t insignificant in its promotion of its services, saying that “if you invested $100, you’ll pay around $3 in fees on other platforms, and could lose out on unrealized gains”

“With Robinhood Crypto, you get all of what you pay for,” writes the platform run by CEO Vladimir Tenev.

The media campaign centered on its zero-commission offerings in crypto come as Robinhood is on the cusp of becoming a public company as early as this month and views crypto as a major area of growth for the investment app that has marketed itself as a trading platform bent on democratizing investing for average folk.

Meanwhile, Coinbase reported some 56 million verified users and 6.1 million monthly active users, and $223 billion in assets. Coinbase went public in mid April and is expected to face heavy competition in the crypto that could result in fee compression for U.S.’s largest crypto platform.

Coinbase shares are down nearly 28% since its listing on the Nasdaq on April 14.

Calls and emails to the brokerages weren’t immediately returned.

Back in 2019, shares of discount brokerages plunged after Charles Schwab Corp. dropped commissions on U.S. stocks, exchange-traded funds and options, effectively launching a price war among retail investing arena.

Robinhood’s focus on pricing may similarly place pressures on its competitors.

However, Robinhood has received some push back from industry participants at times for taking payments for its order flow, in order to maintain its zero-commission structure.

“We receive uniform volume-based rebates from trading venues, but never consider rebates when deciding where to route your order,” Robinhood said in its blog on Thursday about its no-fee crypto trading

7. COIN Stock Chart Since IPO

https://www.tradingview.com/symbols/NASDAQ-COIN/

8. Half of All Homes are now Selling in Less than a Week

A new report from Zillow shows nearly half of all homes are now selling in less than a week:

Has There Ever Been a Worse Time to Be a Homebuyer?by Ben Carlson

https://awealthofcommonsense.com/2021/05/has-there-ever-been-a-worse-time-to-be-a-homebuyer/

Found at Abnormal Returns Blog www.abnormalreturns.com

9. United Airlines agrees to purchase 15 Boom supersonic airliners

Darrell Etherington@etherington / 7:52 AM EDT•June 3, 2021

Image Credits: Boom Supersonic

United Airlines is the first official U.S. customer for Boom Supersonic, a company focused on making supersonic commercial flight a reality once again. Boom unveiled its supersonic sub-scale testing aircraft last year, and intends to start producing its Overture full-scale commercial supersonic passenger jet beginning in 2025, with a planned 2029 date for the beginning of commercial service after a few years of flight testing, design refinement and qualification.

United agreed to purchase 15 of the Overture aircraft, provided they meet United’s “safety, operating and sustainability requirements,” and the agreement also includes an option for the airline to purchase an additional 35 after that. United is obviously interested in the benefits of supersonic flight, which aims to reduce travel times by half, but it’s also looking to boost its sustainability profile with this deal with Boom.

Boom’s goal is to be the first commercial aircraft that runs on net-zero carbon footprint fuel right from day one. The company is focused on sourcing and using 100% sustainable aviation fuel, and part of the arrangement between the two companies includes United working in collaboration with the startup to develop and improve production sources for that sustainable fuel.

U.S. airlines committed jointly to a goal of achieving net-zero carbon emissions by 2050, and as part of that they agreed to partner with government and other stakeholders to accelerate the development and commercialization of sustainable aviation fuel, so this team-up with Boom could be a key driver of those aims for United long-term.

United Airlines agrees to purchase 15 Boom supersonic airliners | TechCrunch

10. The 6 Initial Scientific Discoveries About Happiness

Much of what we know about happiness stems from one study in 1969.

It is worthwhile to detail his discoveries for two reasons. First, to understand the lasting legacy of a single scientific contribution. Second, to consolidate his discoveries in hopes of adding to them. Here are six discoveries by Bradburn that predated positive psychology by three decades:

1. A lot of people are very happy.

Among a sample of men who lost their job because of a plant shutdown, 22 percent reported being “very happy” and 44 percent reported being “pretty happy.” This is not far off from residents in a wealthy Washington, D.C. suburb where 33 percent reported being “very happy” and 61 percent reported being “pretty happy.” As for the all-Black inner-city sample, 20 percent reported being “very happy” in the first two months of 1963, and 31 percent reported being “very happy” in the last two months. Each of these groups is in the vicinity of the 33 percent of adults sampled from ten metropolitan cities who said they are “very happy.”

Thanks to these data, we know that a sizeable minority of adults are satisfied with their lives. Happiness is commonplace. Happiness levels are highly uniform across the United States. Separating real from illusory happiness is important. To clarify the psychological and social underpinnings of happiness, we had to begin with a careful examination of the landscape. Bradburn offered a starting point.

2. Race and education matter for happiness.

By diving into the demographics, Bradburn found that 31 percent of men reported being “very happy” compared to 33 percent of women. Nearly identical. Of adults with an eighth-grade education, 26 percent reported being very happy compared with 37 percent of high school graduates and 39 percent of college graduates. A much smaller difference than might be expected in light of the opportunities afforded by education.

article continues after advertisement

In general, demographic findings showed remarkable similarity across the samples with one exception: race. For Black adults, 18 percent were very happy, 57 percent were pretty happy, and 25 percent were unhappy—whereas for White adults, 35 percent were very happy, 56 percent were pretty happy, and 9 percent were unhappy. By examining racial differences within educational levels, Bradburn found that “for both races, unhappiness declines with higher education.” A full 28 percent of Black adults with an eighth-grade education or less reported being unhappy whereas only 13 percent of White adults with the same education felt unhappy. Thanks to these data, we learned to test assumptions about the combination of variables that are relevant (and irrelevant) to happiness and human suffering.

3. Positive and negative experiences are independent.

Bradburn discovered that the frequency of positive experiences in life provided little to no information on negative experiences faced by the same person. For instance, feeling pleased about accomplishing something had a -.01 correlation with feeling restless and only a -.10 correlation with being depressed. Being upset because someone criticized you had a .06 correlation with the belief that things are going your way.

This is probably the most memorable contribution of Bradburn, and for what he cited for the most frequently. Thanks to these data, we learned that any attempt to treat positive and negative emotions as endpoints on a single continuum is a mistake. We must study them separately and explore the interactive influence of positive and negative experiences. We learned that people often experience a large number of life stressors and still flourish with a wide range of positive emotions, thoughts, and events. Distress is not a proxy for functional impairment or positivity deficits. The clinical implications are profound: you do not have to wait to feel good in order to live a fulfilling life; you do not have to feel good in order to do good.

4. Well-being shows a high level of stability.

Upon interviewing people three days apart, the percentage of people who endorsed high levels of positive experiences (feeling pleased, proud, excited, on top of the world, and having things go your way) only had a slight uptick from 43 percent to 47 percent. When interviewed about negative experiences (feeling restless, bored, depressed, lonely, or upset), those endorsing high levels also had nothing more than a slight uptick from 54 percent to 62 percent. Thanks to these data, we started to build conceptual models on stable individual differences and hedonic adaptation.

article continues after advertisement

5. Socializing and novelty-seeking are strong correlates of well-being.

The strongest predictors of positive experiences were making new friends, meeting new people, traveling far distances, and getting together with friends. In contrast, none of the indicators of socializing or novelty-seeking correlated with negative experiences (correlations ranged from -.04 to .06). Thanks to these data, we discovered that what best distinguishes very happy people from the rest of humanity is the quality of their social life. We also discovered that if you want to understand whether someone has a good day, check to see if they felt curious and learned something new.

6. Income is not that important to well-being.

Bradburn believed that if income was a significant determinant of well-being, the two should change together over the course of time. To his surprise, income had only a small effect. If you expected to make less money over the course of the next year, or make more money, or stay the same, the change in well-being was nearly identical. If you expected to pay off debts over a year’s time, increase your debts, or stay the same, the change in well-being was nearly identical.

He did find that “those who combine low incomes with heavy family responsibilities, are likely to have a low sense of well-being.” But outside of severe financial difficulties, income at best had only a small to moderate impact on well-being. Thanks to these data, we began to tackle the complex relationship between money and happiness. Anticipating the difficulties that lie ahead, Bradburn confessed,

the data so far have been unable to answer the question of whether the important variable at the higher income levels is the income itself, in the sense that it enables greater discretion over the kinds of goods and services that one purchases, whether it is a certain position in society and the way in which one is treated by other people, or whether it is the symbolic effect of income that allows a person to judge his worth in society.

To build on existing knowledge, we must pay heed to prior discoveries. Often, we pay more attention to recent work as opposed to the best work. The legacy of Norman Bradford is his appreciation of happiness as an essential area of study, and that it cannot be studied outside of the environments in which people live. We must remember to study the full spectrum of humanity, not just convenient pockets of people online or who share the same socioeconomic status. Let his work be a reminder to continue the difficult journey of understanding people in context, in hopes of learning how to best increase the well-being of individuals, communities, and larger societies.

The author’s latest book is The Art of Insubordination: How to Dissent and Defy Effectively.

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.