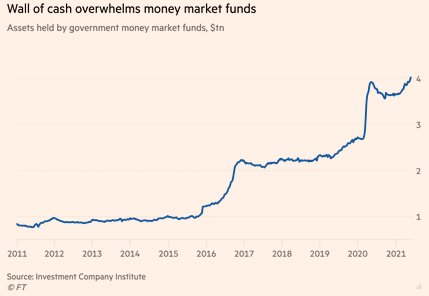

1. Money Market Funds Getting Overwhelmed with Wall of Cash.

Dave Lutz at Jones Trading -If government money market funds have to keep investing at zero per cent, the economics of the industry “breaks down”, said FT – A steady drip has come from the Fed, which is buying $120bn of Treasuries and agency mortgage-backed securities each month. The Treasury department has compounded the situation by doling out funds associated with the Biden administration’s stimulus package passed in March. At the same time, the Treasury has also been shrinking the stock of short-term bills in circulation as part of its efforts to lengthen the maturity of the government’s outstanding debt.

2. Pot Stocks Fell into Background Behind Meme Stocks and Crypto….Seeing Largest Inflows Since Feb.

Another boom for cannabis stocks?

Inflows from individual investors to cannabis stocks have surged in recent days, amid the reintroduction of the Marijuana Opportunity Reinvestment and Expungement Act, which faces steep odds of success with Republicans having filibuster power in the U.S. Senate. Analysts at research firm Vanda point out that the last time meme stocks crashed, in February, individual investors quickly turned to the pot sector, and online retailer Amazon AMZN, 0.00% just announced its support for the legislation and vowed not to punish employees who test positive for marijuana.

This is the power source investors are overlooking in the push to net-zero emissions, Barclays saysBy Steve Goldstein\

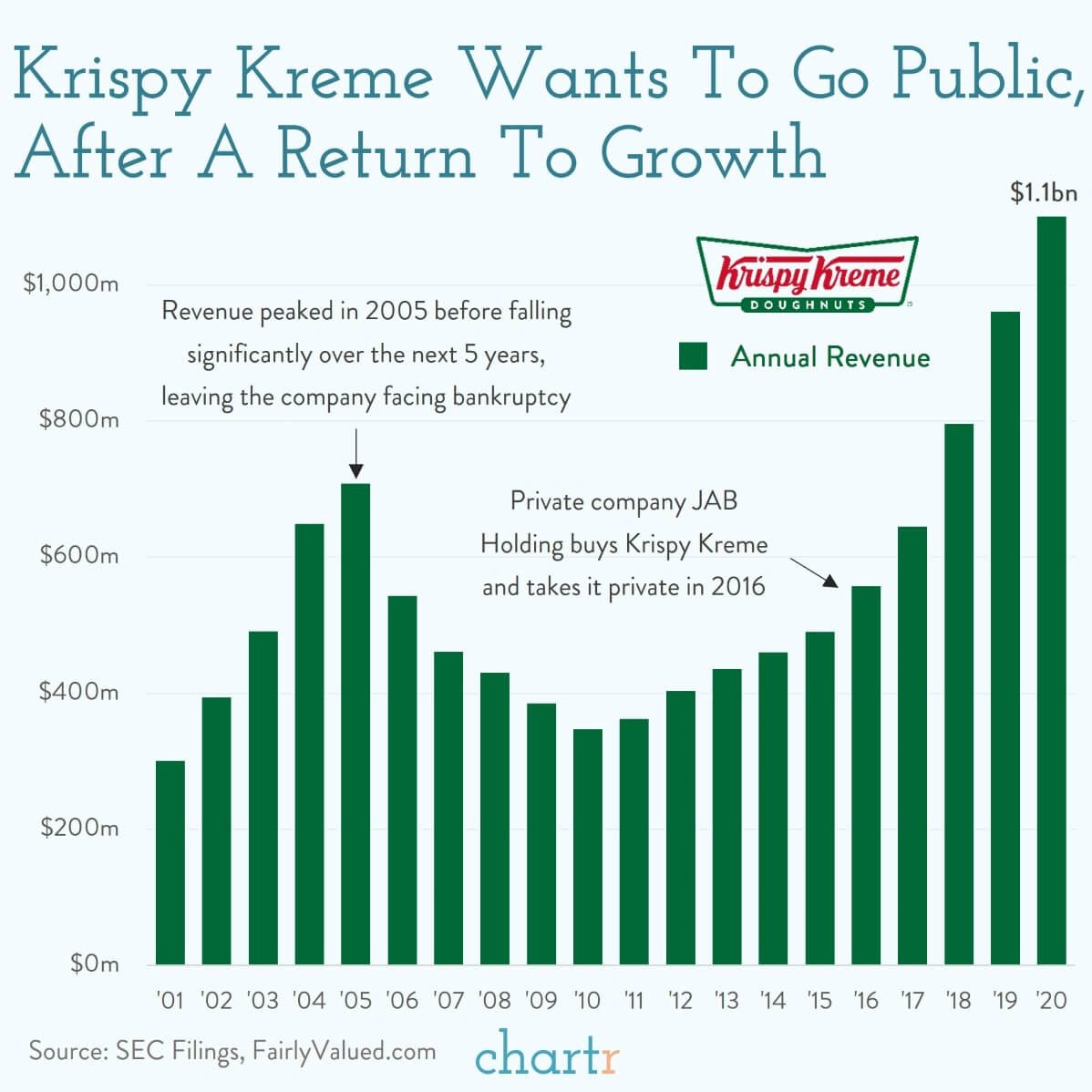

3. Loads of Cash and Weed Around….So Add Some Doughnuts.

| Krispy Kreme are the latest company looking to cash in on the still-hot stock market, filing plans for an IPO earlier this week. Completely stuffed We’ve all experienced that feeling of eating one too many doughnuts, but Krispy Kreme management didn’t get that memo back in the early noughties, in the company’s first stint as a public company. After its IPO in 2000, Krispy Kreme expanded aggressively, with both franchises and company-owned stores — until a big hole was found in the company’s accounting. Krispy Kreme franchisees were accusing management of overloading areas with Krispy Kreme stores. That gave the company a short term boost in revenues, but longer term it meant franchisees were competing with each other, and the growth was completely unsustainable. More seriously, some franchisees accused Krispy HQ of “channel stuffing” — claiming that twice the number of doughnuts they actually needed would turn up at their franchise in the final few weeks of a quarter, in order for the company to meet its sales targets. Things started to really unravel in 2004, with the company’s first ever quarterly loss. The CEO blamed the rise of the Atkins diet and a new trend of low-carb eating. From there things went from bad to worse. Reports of channel stuffing were combined with some unusual financing choices and lucrative buyouts for some franchisees, some of which had ties (like being the ex-wife of the CEO) to insiders at the company. After restating its profits (down, by a lot) the Krispy Kreme share price cratered and sales stalled for a number of years. After a few solid years a private company bought the entire business and took it private in 2016. It looks like they’ve been busy since then, growing revenue almost 20% a year for the last 4 years. Krispy Kreme is ready for its second chapter as a public company. |

4. Commodities vs. Dow 100 Year Chart

Exhibit 5: GSCI commodities index relative to DJIA

Source: MacroStrategy Partnership LLP

Supercycle or not?by Niels Clemen Jensen of Absolute Return Partners, 6/1/21

https://www.advisorperspectives.com/commentaries/2021/06/01/supercycle-or-not

5. When Stocks are up More than 10% on Day 100, Rest of Year Higher 84% of Time.

As shown in the LPL Chart of the Day, when stocks are up more than 10% on day 100, the rest of the year has been higher 84.2% of the time and up 8.6% on average, both well above what the average year does. We continue to recommend an overweight to equities and underweight to fixed-income position relative to investors’ targets, as appropriate.

https://lplresearch.com/2021/06/02/june-swoon/

6. BBBY Meme Stock….Social Media Chatting +2000% in Stock vs. +264% AMC

While AMC stock soared, retail investors went nuts talking about Bed, Bath & Beyond, with social media volume popping by more than 2,000% compared to the previous 30 days. Chatter around AMC was up a mere 264% making it actually the third most popular stock with BlackBerry BB, +31.92% mentions popping more than 1,500%.

Wednesday’s hottest meme stock? Well, it’s not AMC. https://www.marketwatch.com/story/wednesdays-hottest-meme-stock-well-its-not-amc-11622665060?mod=home-page

BBBY-$4 Low During Covid….$44 Close yesterday

©1999-2021 StockCharts.com All Rights Reserved

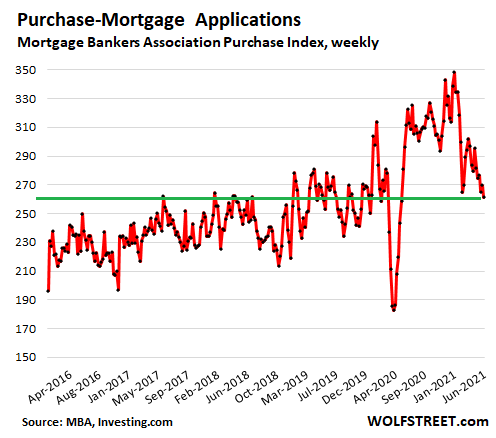

7. Mortgage Apps Drop to 2019 Levels

Buyers’ Strike? Mortgage Applications Drop Deep into

By Wolf Richter for WOLF STREET.

Whatever demand there may be from investors, demand from buyers needing a regular mortgage in order to buy a home continues to decline, and in the week ended May 28 fell 4.0% from the prior week, to the lowest level since May 2020 (when mortgage applications were coming out of the collapse of the prior weeks), according to the Mortgage Bankers Association today.

This put applications for mortgages to purchase a home roughly in the middle of the range of 2019, having worked off the entire Pandemic boom (the big drop and bounce-back in February was the result of snowmageddon; data via Investing.com):

8. Coach K-Only if he was a Stock

Tough To Beat

Naismith Hall of Famer Mike Krzyzewski ranks at or near the top of most career lists among Division I men’s college basketball coaches:

| COACH K | RANK | |

| Wins | 1,170 | 1st |

| NCAA tourney app. | 35 | T-1st |

| 30-win seasons | 15 | 1st |

| Final Four app. | 12 | T-1st |

| Final Four wins | 14 | 2nd |

| National titles | 5 | 2nd << |

| NBA draft 1st-rounders | 41 | 1st |

| >> Trails John Wooden (10) | ||

| https://www.espn.com/mens-college-basketball/story/_/id/31553654/duke-blue-devils-coach-mike-krzyzewski-plans-leave-season-leave-next-season-sources-say |

9. These are the top 10 beaches in America

Dr. Stephen Leatherman, aka “Dr. Beach,” who has been rating the top beaches in America since 1991, shared his top 10 rankings for 2021.

Here is the full list:

10. Coast Guard Beach, Cape Cod, Massachusetts

9. Beachwalker Park, Kiawah Island, South Carolina

8. Coronado Beach, San Diego, California

7. Caladesi Island State Park, Dunedin, Florida

6. Duke Kahanamoku Beach, Oahu, Hawaii

5. Lighthouse Beach, Buxton, Outer Banks of North Carolina

4. St. George Island State Park, Florida Panhandle

3. Ocracoke Lifeguarded Beach, Outer Banks of North Carolina

2. Cooper’s Beach, Southampton, New York

1. Hapuna Beach, Hawaii Island, Hawaii

10. Remote Work Revolution: Succeeding from Anywhere

Tsedal Neeley is a professor at the Harvard Business School, an award-winning scholar, and an expert on the intersection of work, technology, and organizations. She specializes in how to scale organizations by developing global and digital strategies, regularly advising top leaders who are looking to have more productive, satisfied, and agile teams. Her work has been featured on BBC, CNN, Forbes, Financial Times, MarketWatch, the New York Times, NPR, the Wall Street Journal, The Economist, and many other outlets.

Below, Tsedal shares 5 key insights from her new book, Remote Work Revolution: Succeeding from Anywhere(available now from Amazon). Download the Next Big Idea Appto listen to the audio version—read by Tsedal herself—and enjoy Ideas of the Day, ad-free podcast episodes, and more.

1. Autonomy drives productivity.

Productivity goes up, not down, with remote work—provided some conditions (such as autonomy) are met. Autonomy alters the degree of control leaders have over virtual employees’ working conditions and processes. Through remote work, people have a greater ability to shape the two factors of space and time. They have the flexibility to control where, when, and how one gets the job done. This is one of remote work’s most appealing benefits.

Keep in mind that autonomy doesn’t mean giving employees free rein to do whatever they want. Even if they’re out of sight, remote workers are still accountable to their teammates, goals, and productivity agreement. Nor is autonomy equivalent to isolation. Employees still need connection, leadership, guidance, and feedback, but by leaning into the inherent flexibility of the remote format, people gain confidence, agency, and efficiency. What this means is leaders, when assessing productivity, should focus on outcome, not process.

2. Trust is not one-size-fits-all.

Trust is one of the most explored topics in remote work. In fact, social scientists have been preoccupied with the science of trust and remote teams since the 1990s. Understanding trust’s role in remote work is key because trust is the glue that binds remote teams together, yet it’s hard to establish and maintain when people are physically apart.

The first thing to recognize is that trust is not binary, nor is it one-size-fits-all. Instead, we have a nuanced palette of trust available to us. The two basic types of trust are cognitive trust and emotional trust. Cognitive trust is grounded in the belief that your coworkers are reliable and dependable because you’ve considered their qualifications and deem them capable to do the tasks at hand. This type of trust is usually confirmed or disproven over numerous experiences and interactions.

“Leaders, when assessing productivity, should focus on outcome, not process.”

On the other hand, emotional trust is grounded in coworkers’ care and concern for one another. Relationships built on emotional trust crop up most easily when team members have values, mindsets, or experiences in common. Cognitive trust has a lower threshold than emotional trust, which requires a strong emotional bond to form over time. As a result, cognitive trust can be conferred quickly among team members so that it’s possible for teams to rapidly pull together around goals. Most remote teams can meet their goals with high levels of cognitive trust, regardless of the level of emotional trust.

Remote colleagues, even if they begin without having met face to face, can work well together within a team with a fairly shallow level of emotional trust, but a fairly intense and quickly gained cognitive trust.

3. Don’t choose digital tools randomly.

Digital tools in remote environments are conduits for working—they’re not just communication tools. Today, there are so many from which to choose, but what we find is that people have certain preferences that they go for over and over again.

It’s really important to pause and consider two important purposes for the use of digital tools. The first one is called conveyance. Meaning, what’s your top choice for the transmission of new information? The second one is called convergence. Convergence describes communication in which people must discuss and interpret in order to come to a collective agreement. Both conveyance and convergence are crucial to advance work goals.

If we know whether we’re conveying or converging, it helps us narrow down which digital tool we need in that moment. It forces us to think intentionally, understanding that we need to match conveyance or convergence goals to the digital tools available to us. This also means we need to weigh whether we need synchronous, asynchronous, rich, or lean media for work goals. And there are so many other features to consider in regards to communication capture and information storage. For instance, delays that we need in order to give people time to process content. Whether you need conveyance or convergence should drive the digital tools you use.

“Trust is the glue that binds remote teams together.”

4. We need mature self-disclosure in remote work.

I went to get my car fixed yesterday. I’m looking forward to resting during my vacation next week. I’m worried about my sister, who’s recovering from a serious illness. These statements are examples of what social scientists call self-disclosure, which is the process of revealing your experiences, preferences, concerns, and aspirations to other people. The act of opening up changes colleagues’ perception of you, and they will actually find you more likable and approachable.

It’s incredibly important for remote workers who don’t have regular interactions in a common space, where informal information exchange occurs more naturally, to open up in a virtual context. Opportunity occurs, particularly, in the more casual conversations that often ensue at the beginning or end of group meetings. Sometimes you have to structure unstructured time at the top of a meeting, literally asking people how they are or create a prompt so that self-disclosure can occur. These moments can also take place asynchronously through emails or chats or video posts.

It’s key, however, that all self-disclosure remains mature. While people get to choose when and how they want to self-disclose, it’s important not to tread into the “too much information zone” which can make others uncomfortable or offended. You need to be thoughtful about the self-disclosure that you do. Leaders have important roles in modeling self-disclosure to teams in ways that are explicit, intentional, and voluntary.

5. Leaders have to motivate while invisible.

Leaders have to create and maintain conditions that realize their virtual teams’ own capacity and power. There are many ways to accomplish this.

“Leaders have important roles in modeling self-disclosure to teams in ways that are explicit, intentional, and voluntary.”

First, leaders need to build and stress a singular group-level identity that binds the remote team together and reminds members that they represent the team. This is necessary because a natural, but detrimental, aspect of remote work is that people will fragment, and you will end up with subgroups. The group-level identity narrative that you continually message is the thing that will pull people back together.

Then there is predictability. Remote workers crave predictability, and leaders can support this by connecting people to the big picture. Keep the team updated on what’s going on at the organization, the industry, and even their ecosystem. If you don’t have any updates to share, it’s okay to say so, but you can be transparent about certain organizational circumstances. It’s really important to connect the remote workers around such pillars, because it gives them the sense of predictability that they need from a leader.

Furthermore, development research shows that remote workers are no less likely to perform well and advance in their careers than co-located workers. However, high-performance and advancement requires that leaders provide appropriate and constructive feedback to support individual goals. This idea of developing people has to be dialed up in a remote environment so that you create parity among your group.

A related issue is inclusion. Geographically distributed teams are especially likely to have diverse members across many dimensions, including nationality, age, gender, race, religion, education, experience, and culture. These differences are both a strength and a challenge, so practicing inclusive leadership is crucial. At every turn, highlight individual strengths. Ensure that people communicate in a way where every member can contribute to common discourse, which may mean helping dial dominant members down.

These bits of advice are just a sampler platter of what it takes to lead a team to its maximum capacity and power.

https://nextbigideaclub.com/magazine/remote-work-revolution-succeeding-anywhere-bookbite/27619/

Found at Abnormal Returns Blog www.abnormalreturns.com

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.