1. Is This The Most Volatile Year Ever?

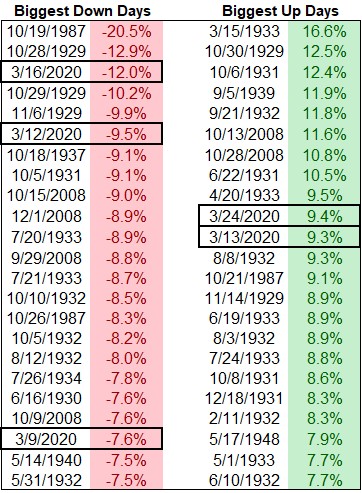

Not yet but it’s getting close. This year has 3 of the worst 25 losses and 2 of the 25 biggest gains for the S&P 500 since 1928:

And the number of large daily moves is massive:

Read Full Story

https://awealthofcommonsense.com/2020/06/is-this-the-most-volatile-year-ever/

Found at Abnormal Returns Blog www.abnormalreturns.com

2. US National Debt Spiked by $1 trillion in 5 weeks to $26 trillion. Fed monetized 65%. Business debts spike to high heaven.

By Wolf Richter for WOLF STREET.

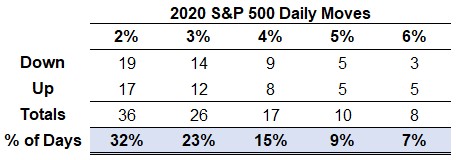

Trillions are now whooshing by at a breath-taking pace. The US gross national debt – the total of all Treasury securities outstanding – jumped by $1 trillion over the past five weeks, from May 4 through June 8, and by $2.5 trillion for the 11 weeks since March 23.

The total US national debt outstanding has reached $26 trillion, according to the Treasury Department. I’ve been fretting about this debt on my site since 2011. In recent years, I innocently added a green upward arrow with “Debt out the wazoo” to my gross-national-debt charts, unaware that this tongue-in-cheek label would turn into a factual, data-based technical term:

Wow, That Was Fast: Debt Out the Wazoo

by Wolf Richter • Jun 12, 2020 • 222 Comments https://wolfstreet.com/2020/06/12/wow-thats-fast-debt-out-the-wazoo/

3. This Always Ends Badly…..Retail Investors Favorite Trading Stocks Outperforming.

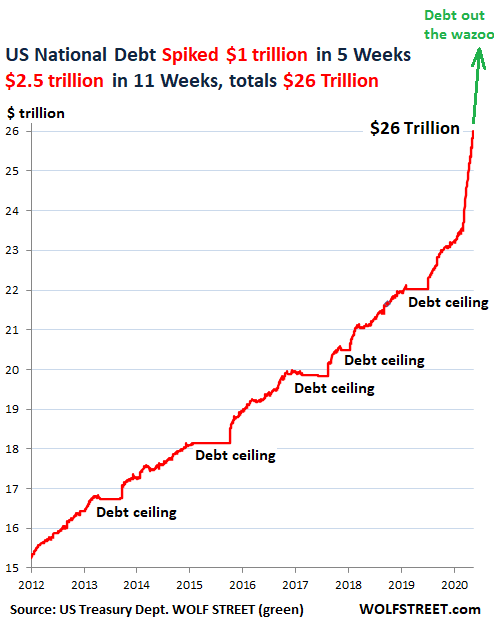

The Goldman analysts report that much of the outperformance by individual investors occurred in the middle of May, as upbeat data on declines in the spread of the deadly pandemic and less-bad economic reports encouraged bargain hunting in cyclicals, including small-capitalization stocks, and shares of companies that are economically sensitive and would therefore benefit from signs of improvement in the business climate.

Such stocks were “quickly embraced by value-seeking retail investors, and now make up a large portion of our retail basket,” Goldman researchers wrote (see attached chart).

A portfolio of stocks being bought by mom-and-pop investors is trouncing Wall Street pros — here’s what they’re buying-Mark DeCambre

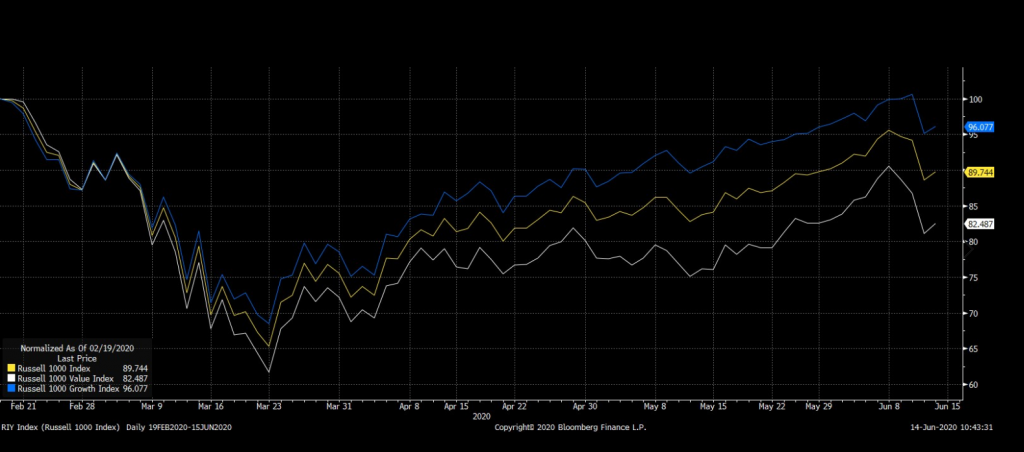

4. Value Outperformance Lasted One Week

Stone’s Weekly Market Guide – Week of June 15, 2020 Bill Stone

Chart of the Week: After a few weeks of outperformance, value went back to underperforming growth last week. For simplicity of explanation, this analysis uses the Russell indexes but other methodologies would have directionally the same results. Short-term, this poor performance is understandable since value stocks generally have more leverage to economic outcomes and more debt. The underperformance of value also holds since the February market peak with value fairing worse on the downside along with growth recently exceeding its February peak (see chart). Despite value being a factor that has led to long-term outperformance, the value has historically been subject to long periods of underperformance as the price of admittance to superior gains. Aside from some brief respites, value (+14.2% annualized) has underperformed growth (+19.2% annualized) by a wide margin since the global financial crisis bottom in March 2009.This differential means $100 became about $632 in growth versus $345 in value. Despite the grim performance comparison, the valuation differential between the two styles argues for at least a more balanced allocation between the two currently rather than focusing only on growth stocks. For those interested in more details, AQR recently wrote some excellent pieces about value underperformance linked here.

https://www.stoneinvestmentpartners.com/post/stone-s-weekly-market-guide-week-of-june-15-2020

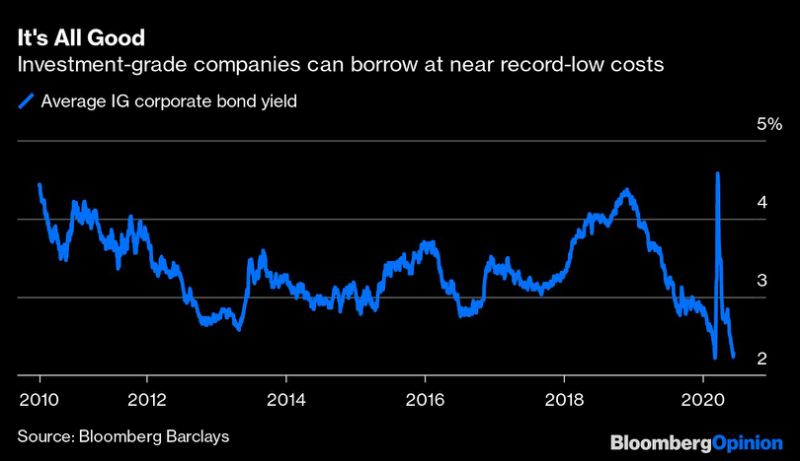

5. Fed Doesn’t Really Need to Buy Corporate Bonds

—Brian Chappatta

Fed Doesn’t Really Need to Buy Corporate Bonds

(Bloomberg Opinion) — The Federal Reserve realizes that it doesn’t have to buy U.S. corporate bonds, right?

I ask this question only somewhat in jest. In a surprise move, the central bank announced Monday that it would start to buy individual company bonds under its $250 billion Secondary Market Corporate Credit Facility, specifically by following a diversified index of U.S. corporate bonds created expressly for its program. “This index is made up of all the bonds in the secondary market that have been issued by U.S. companies that satisfy the facility’s minimum rating, maximum maturity and other criteria,” the Fed said in a statement. Notably, issuers of bonds acquired through this program don’t need to provide certifications, unlike the stipulations for individual debt purchases.

It’s not immediately clear why this is necessary, nor how this will impact markets any differently than the facility’s current purchases of exchange-traded funds. So far, the secondary-market vehicle has bought about $5.5 billion of ETFs. As my Bloomberg Opinion colleague Tim Duy quipped on Twitter, it’s as if policy makers said “we want to expand beyond ETFs, so we will purchase individual bonds such that we mimic an ETF.”

Predictably, the largest investment-grade bond ETF, ticker LQD, surged in the wake of the announcement to its biggest intraday gain since April 9. That was the day the Fed changed the parameters of its credit facilities to allow for purchases of high-yield ETFs and debt from fallen angels that were investment grade as of March 22.

The most surprising part of this is there is virtually no evidence that the corporate-bond market needs this kind of intervention — it has been working nearly flawlessly for months. Sure, the credit ratings of several brand-name companies have been lowered since Covid-19 started to spread across America in March. Some even fell into junk, like Ford Motor Corp., Kraft Heinz Co. and Macy’s Inc. For countless others, their business model has radically changed for at least the next several months, if not years.

And yet the average yield demanded by investors for investment grade debt fell last week to just 2.23%

https://finance.yahoo.com/news/fed-doesn-t-really-buy-194612619.html

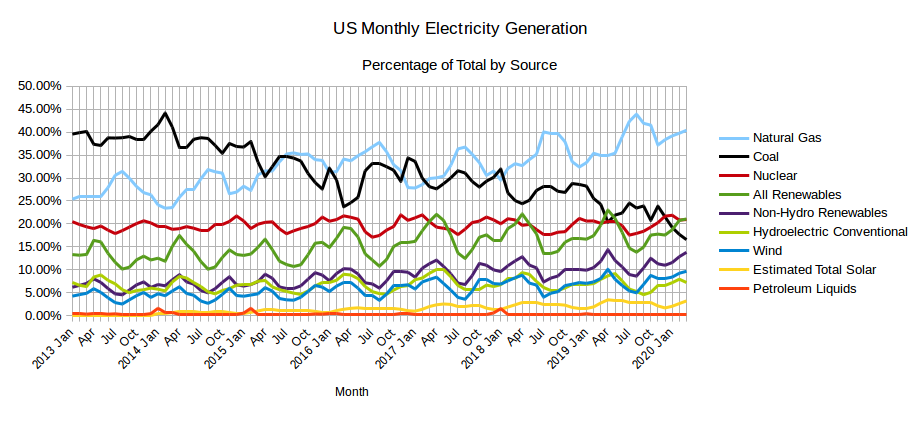

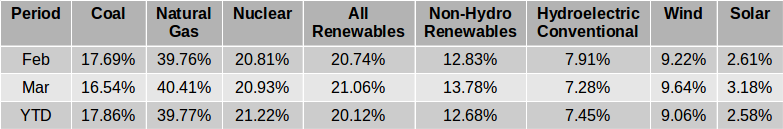

6. Where is Electricity Generated?

EIA’s Electric Power Monthly – May 2020 Edition with data for March

by ISLANDBOY posted on 06/02/2020

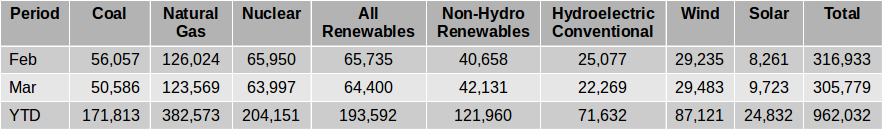

The EIA released the latest edition of their Electric Power Monthly on May 26th, with data for March 2020. The table above shows the percentage contribution of the main fuel sources to two decimal places for the last two months and the year 2020 to date.

The Table immediately above shows the absolute amounts of electricity generated in gigawatt-hours by the main sources for the last two months and the year to date. In March the absolute amount of electricity generated decreased slightly, joining the years 2015 and 2016 as the only years since 2013 that did not see a slight increase in electricity production between February and March. Coal and Natural Gas between them, fueled 56.95% of US electricity generation in March. The contribution of zero carbon and carbon neutral sources increased from 41.55% in February to 41.99% in March. The percentage contribution from Natural Gas in March edged back above 40% at 40.41%, increasing from 39.76% in February.

PEAK OIL BARREL http://peakoilbarrel.com/eias-electric-power-monthly-may-2020-edition-with-data-for-march/#more-27081

7. Student Loans are 44.8% of the FED’s Total Assets

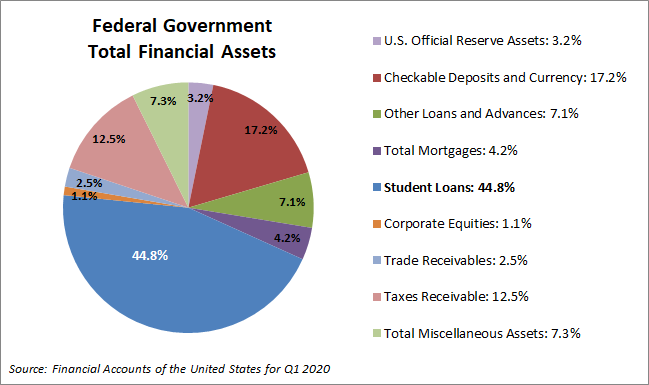

But back to our quiz. Student loans may be a liability on the consumer balance sheet, but they constitute an asset for Uncle Sam. Just how big? It’s about 44.8 percent of the total Federal assets. This is 10.8 times larger than the 4.2 percent for the Total Mortgages outstanding and 3.6 times the size of Taxes Receivable at 12.5 percent.

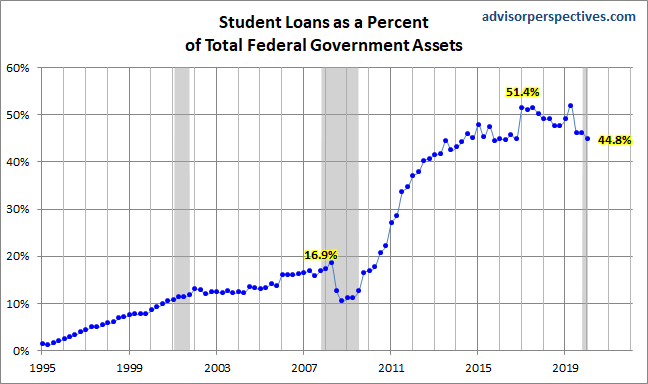

The 44.8 percent referenced is below its peak. Here is a look at how this metric has changed since 1995.

The Fed’s Financial Accounts: What Is Uncle Sam’s Largest Asset?-by Jill Mislinski, 6/12/20

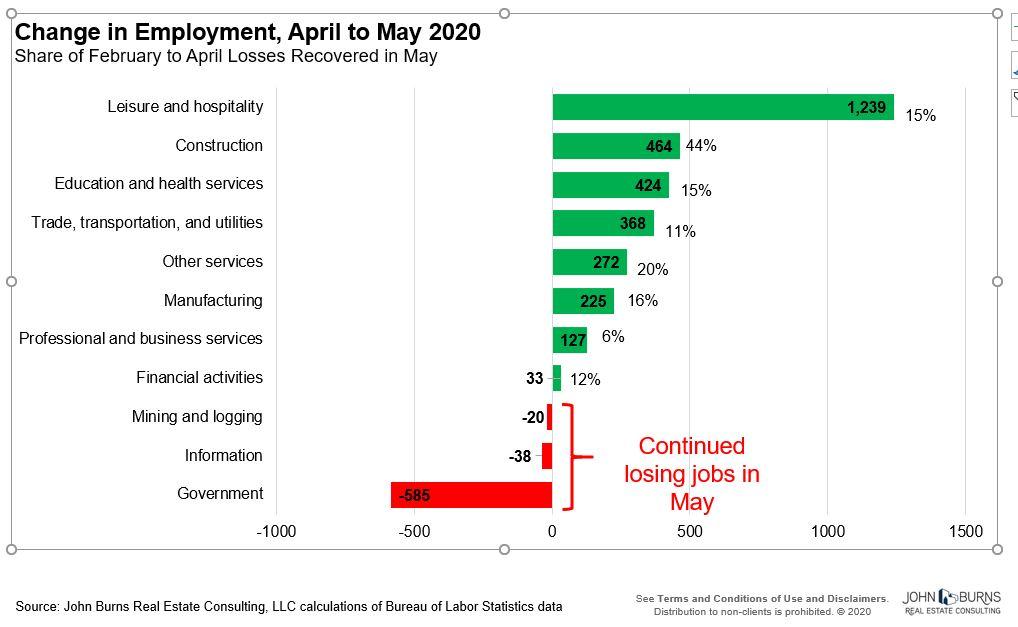

8. Change in Employment April to May 2020

John Burns Real Estate

https://www.linkedin.com/in/johnburns7/

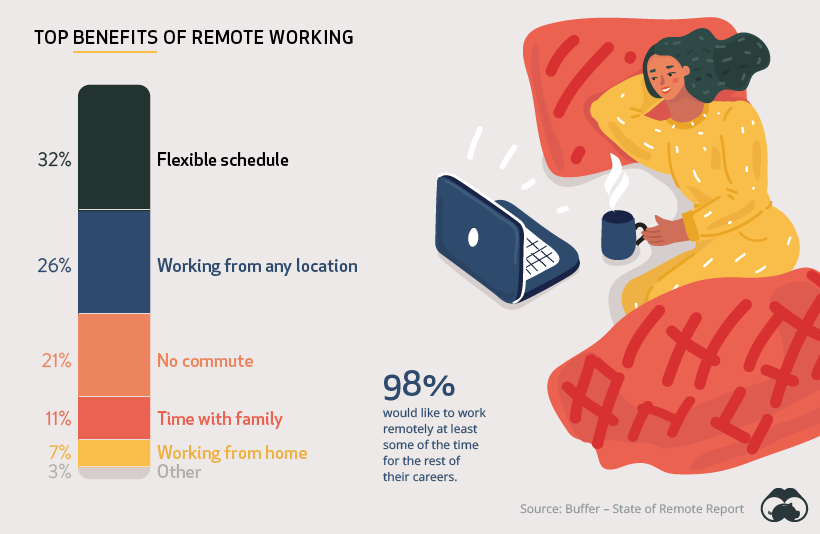

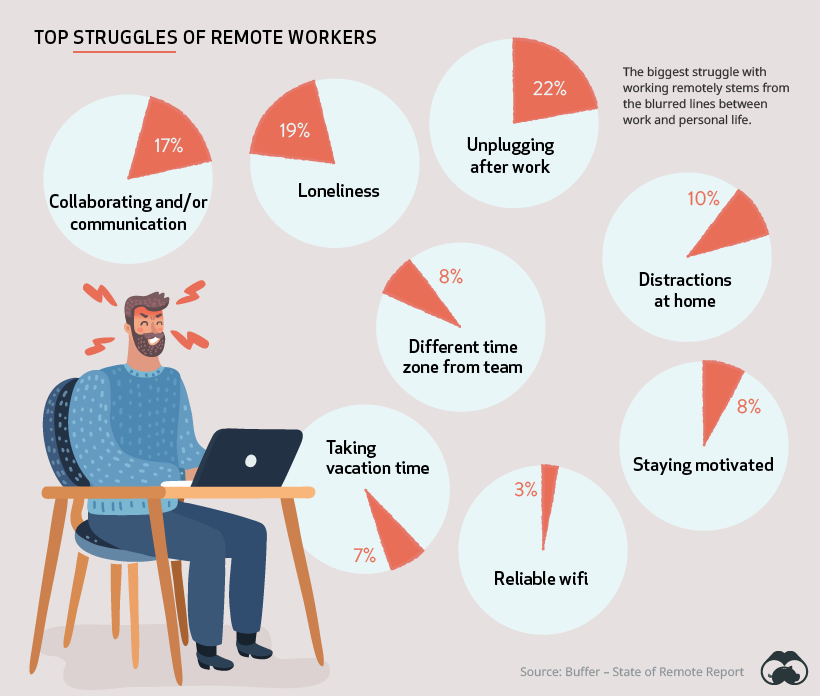

9. Remote Work is Here to Stay

How People and Companies Feel About Working Remotely–Nick Routley

10. 4 Signs That Will Instantly Identify Someone with Remarkable Leadership Skills

The way to create effective working teams starts here.

BY MARCEL SCHWANTES, FOUNDER AND CHIEF HUMAN OFFICER, LEADERSHIP FROM THE CORE@MARCELSCHWANTES

Getty Images

Now more than ever, companies need to create cultures centered on employees. Strong cultures create effective working teams that attract top talent, while weak cultures can quickly lead to burnout or employees heading for the exit.

Companies facing these high stakes are eager to create a place where employees want to go to work. But they can struggle to find the right person to own culture. Who will invest in leading their organization’s unique blend of people and purpose?

Latane Conant, CMO of 6sense, an account engagement platform, sees the tie between a company delivering great customer experiences and having great employee experiences. She has made it her mission to develop an employee-centered community unified by a common purpose.

Conant shared with me four key perspectives on how leaders can build meaningful company cultures:

1. Build trust through transparency

Companies need trust to create a productive community and culture, which derives from honesty and openness. While leaders may be forthcoming with each other, Conant says that transparency should be extended throughout the organization.

Conant advises executives to create a clear and transparent vision and detailed plans, and then revisit the company strategy regularly.

Conant also says marketing teams and its senior leaders must embrace and champion strategic transformation. “Marketing has to evangelize new strategies and set the tone for everybody else,” she said. “They have to wear it proudly, nail the pitch to their coworkers and be the cheerleaders your company needs to make the transformation work.”

2. Prioritize connection

In companies, connection happens constantly, and Conant says good cultures prioritize communication and connection. To foster healthy connections, she recommends shoutouts and public feedback recognizing employees working the strategic plan. She is also a firm believer in the all-hands meeting.

“Do not skip your all-hands meeting! It should be treated as a sacred space, where your employees gather to talk about what matters most,” Conant said. “Once you start blowing off the meeting or rescheduling it constantly, you lose your chance to keep everyone focused on the company’s strategic plan and vision.”

3. Lead by example

While leaders work to agree on company direction, Conant says they should also gather feedback on how teams perceive their leadership. Like the all-hands meeting, she encourages leaders to conduct at least biweekly one-on-one meetings with employees to have two-way conversations and help employees achieve their own career goals.

Conant also believes leaders show trust by providing examples of their own experiences — both successes and failures — when they talk with employees. While it’s scary to start, she says leaders who model the openness they preach will find it happening organically within their teams.

4. Have more fun

Conant encourages leaders to ask their employees what they enjoy doing, then incorporate fun into the day job. Make work a place people want to be — beyond perks like a snack-filled fridge.

Conant is also using data to evaluate her office’s “Fun Factor.” Her team deploys a biweekly survey asking how much fun employees had. She reviews the results and determines what changes to make to bring more fun into the job.

Most importantly, she says, leaders have to model fun. “If leaders want their employees to take part in trivia nights or karaoke, then they have to get up and sing along, too.”

Whether it’s championing the strategic plan, creating open and collaborative spaces or having fun, intentional planning and commitments to community help companies create a place employees want to be.

MAR 13, 2020

Like this column? Sign up to subscribe to email alerts and you’ll never miss a post.

The opinions expressed here by Inc.com columnists are their own, not those of Inc.com.

https://www.inc.com/mbvans/contest.html?cid=sf01003

Disclaimer

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publically available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only