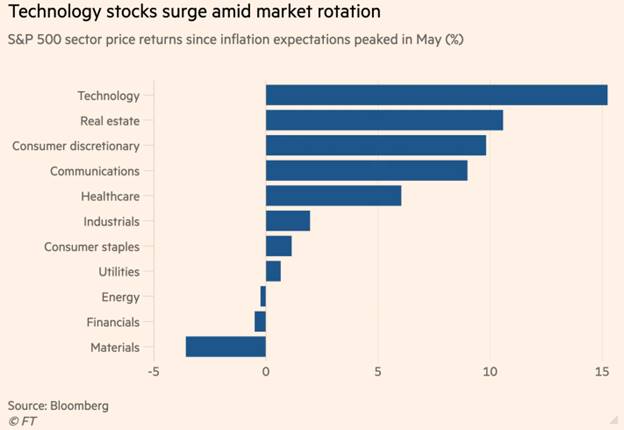

1. Inflation Readings Peaked and Tech Stocks Rallied 15%

Dave Lutz Jones Trading–Falling U.S. bond yields may signal death knell for ‘reflation’ stock trade – Investors piled in to shares of energy producers, banks and other companies expected to benefit from a powerful economic rebound earlier this year while betting that Treasury yields, which move inversely to prices, would rise.

That trade appears to be tottering now, as worries over slowing growth send yields tumbling to their lowest level in more than four months

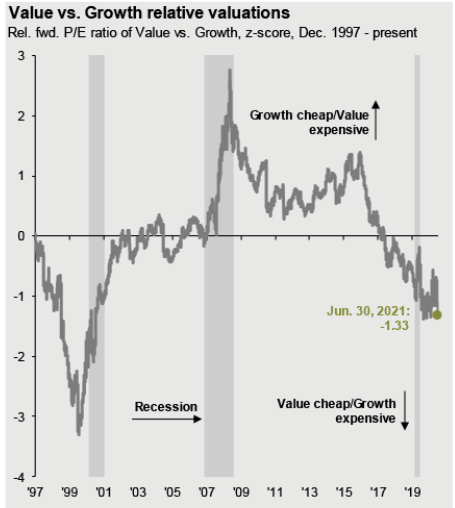

2. Value vs. Growth Valuations-No serious Move for Value.

JP Morgan Asset Management

https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

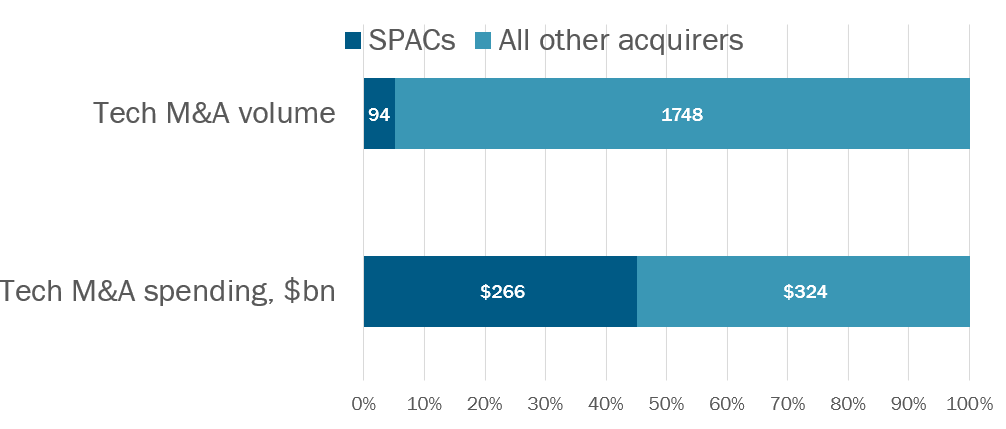

3.A TRILLION-DOLLAR YEAR FOR THE TECH M&A MARKET

Valuewalk blog–Since tech acquirers discovered last summer that they could still do deals during a pandemic, they have spent at a historic rate – ever-larger acquisitions at ever-higher valuations by pretty much every type of buyer. The trillion-dollar shopping spree over the past 12 months has been a run for the ages, and shows no sign of slowing. A little bit of historical data indicates the unprecedented heights of the recent rebound.

According to 451 Research’s latest quarterly tech M&A report, of the roughly $6.8 trillion dollars’ worth of tech deal flow chronicled over the past two decades in 451 Research’s M&A KnowledgeBase, a massively outsized $1.1 trillion of that has come in just the past year. This means that although the past 12 months only account for about 5% of the total time covered in our data, a whopping 16% of overall tech M&A spending has come just since last summer.

Tech M&A Market Shows Record Activity

Key highlights from the report include:

As we noted in our just-published report on Q2 – which, once again, saw spending soar to about twice the level of a typical quarter – the record activity is showing up in virtually all aspects of the tech M&A market.

· SPACs: Throughout the previous decade, blank-check companies acquired an average of a dozen (mostly unknown) tech vendors each year. Already in 2021, the M&A KnowledgeBase has recorded 97 acquisitions. Even more stunning: the combined enterprise value of this year’s ‘de-SPAC’ deals totals $272bn.

· Private equity: Although PE firms took a little longer to get going after the COVID-19 outbreak because of the residual damage in the credit market, they have made up for lost time. Two of the four highest-spending quarters by buyout shops in our database have come in Q4 2020 and the just-completed Q2 2021.

· VC exits: The once-rare ‘unicorn’ transaction has become commonplace. Over the first decade of our data, the average year saw just a single sale of a venture-backed startup for more than $1bn. So far this year, thanks largely to wild SPAC activity, some 74 startups have booked billion-dollar exits.

https://www.valuewalk.com/trillion-dollar-year-tech-ma-market/

4. Job Openings “Hard to Fill” Blowout

Rick Reider Blackrock

5. Central Banks Balance Sheets +800% Since 2008

Bloomberg

A $9 Trillion Binge Turns Central Banks Into the Market’s Biggest WhalesBy Malcolm Scott, Paul Jackson and Jin Wu

https://www.bloomberg.com/graphics/2021-central-banks-binge/?srnd=premium&sref=GGda9y2L

6. VisualCapatlist-Timeline: 150 Years of U.S. National Debt

What Influences U.S. Debt?

It’s worth pointing out that the national debt hasn’t always been this large.

Looking back 150 years, we can see that its size relative to GDP has fluctuated greatly, hitting multiple peaks and troughs. These movements generally correspond with events such as wars and recessions.

| Decade | Gross debt at start of decade (USD billions) | Avg. Debt Held By Public Throughout Decade (% of GDP) | Major Events |

| 1900 | – | 4.8% | – |

| 1910 | – | 10.0% | World War I |

| 1920 | – | 22.9% | The Great Depression |

| 1930 | $16 | 36.4% | President Roosevelt’s New Deal |

| 1940 | $40 | 75.1% | World War II |

| 1950 | $257 | 56.8% | Korean War |

| 1960 | $286 | 37.3% | Vietnam War |

| 1970 | $371 | 26.1% | Stagflation (inflation + high unemployment) |

| 1980 | $908 | 33.7% | President Reagan’s tax cuts |

| 1990 | $3,233 | 44.7% | Gulf War |

| 2000 | $5,674 | 36.6% | 9/11 attacks & Global Financial Crisis |

| 2010 | $13,562 | 72.4% | Debt ceiling is raised by Congress |

| 2020 | $27,748 | 105.6% | COVID-19 pandemic |

| 2030P | – | 121.8% | – |

| 2040P | – | 164.7% | – |

| 2050P | – | 195.2% | – |

Source: CBO, The Balance

To gain further insight into the history of the U.S. national debt, let’s review some key economic events in America’s history.

The National Debt Today

The COVID-19 pandemic damaged many areas of the global economy, forcing governments to drastically increase their spending. At the same time, many central banks once again reduced interest rates to zero.

This has resulted in a growing snowball of government debt that shows little signs of shrinking, even though the worst of the pandemic is already behind us.

In the U.S., federal debt has reached or surpassed WWII levels. When excluding intragovernmental holdings, it now sits at 104% of GDP—and including those holdings, it sits at 128% of GDP. But while the debt is expected to grow even further, the cost of servicing this debt has actually decreased in recent years.

By Marcus Lu https://www.visualcapitalist.com/timeline-150-years-of-u-s-national-debt/

7. How Much Does the Federal Government Spend on Interest?

Even with exceptionally low interest rates, the federal government is projected to spend just over $300 billion on net interest payments in fiscal year 2021. This amount is more than it will spend on food stamps and Social Security Disability Insurance combined. It is nearly twice what the federal government will spend on transportation infrastructure, over four times as much as it will spend on K-12 education, almost four times what it will spend on housing, and over eight times what it will spend on science, space, and technology.

https://www.crfb.org/papers/how-high-are-federal-interest-payments

8. Dealbook-The Dramatic Crash of a Buzzy Cryptocurrency Raises Eyebrows..ICP Token Drops 95%

The ICP token is designed to help operate a decentralized layer of web infrastructure being built by Dfinity that believers say will liberate users from reliance on companies like Amazon and Google. The technically complex network would make it easier for people to build software and publish directly to the internet without going through the tech giants’ platforms.

But by last week, ICP’s value had tanked by about 95 percent.

Even in the famously volatile crypto market, ICP stands out. The stunning climb and crash of this prominent project has market watchers puzzling about what happened — and who may have profited.

Dfinity gave late, complicated instructions for small investors who bought ICP tokens when they were very cheap in a 2017 crowdfunding round, Arkham said. The process was buggy and investors complained about limited customer support, according to the report. Mr. Morel, who co-founded Reserve, a cryptocurrency created for hyperinflationary economies, said that based on his experience with initial coin offerings, the Dfinity approach was unnecessarily complicated.

Dfinity said in a statement that bad actors on social media were undermining its project: “Day traders with alternative agendas and unethical crypto projects have used Reddit and Twitter to confuse the public.” Dfinity said the initial supply of ICP was moved to a custody account at Coinbase, a big crypto exchange, for transfer to various categories of investors, many of whom “immediately transferred tokens” to avoid fees or “safeguard their ICP.” Dfinity said that it was important “not to confuse transferring tokens from Coinbase Custody to other exchange wallets for safekeeping as ‘selling’ tokens.”

Dfinity also denied that the token claim process for early investors was overly technical; the holders who had difficulties trading got the support they needed, the company said. Michael Lee, a Dfinity spokesman, said that the company was taking the “high road” and focusing on developing its Internet Computer project, noting that backers like Andreessen Horowitz remain committed. (A spokeswoman for the venture capital firm declined to comment)

Some industry observers say that the ICP crash was simply bad luck for a hyped project that happened to be listed just as extreme enthusiasm for crypto was waning.

But Mr. Morel said that during the recent downturn, ICP fell more than any of the top 100 cryptocurrencies by market cap, worse even than the decline in Shiba Inu Coin, a joke token based on the meme cryptocurrency Dogecoin, which itself was intended to mock crypto and internet culture. In other words, a postmodern comedy project with no technological proposition backing it experienced less distress than the token underlying Dfinity’s grand goals — and that’s a serious matter.

Ephrat Livni reports from Washington on the intersection of business and policy for DealBook. Previously, she was a senior reporter at Quartz, covering law and politics, and has practiced law in the public and private sectors. @el72champs

Andrew Ross Sorkin is a columnist and the founder and editor-at-large of DealBook. He is a co-anchor of CNBC’s Squawk Box and the author of “Too Big to Fail.” He is also the co-creator of the Showtime drama series Billions. @andrewrsorkin • Facebook

9. 74% of Fortune 500 CEOs expect to reduce office space

JPMorgan Chase CEO Jamie Dimon told shareholders this spring that post-pandemic his company would embrace a mix of in-person and remote work. Doing so, Dimon said, would “significantly reduce our need for real estate.” For every 100 JPMorgan staffers, he estimated, they would need just 60 desks.

Tech companies, like Facebook or Square, adopting remote or hybrid workplaces isn’t surprising. But old guard financial firms like JPMorgan announcing plans to cut back on office space seemed to spell very bad news for commercial real estate. To see just how bad things could get for office buildings, we conducted a poll of Fortune 500 chief executive officers last month.*

https://fortune.com/2021/06/23/companies-reducing-office-space-fortune-500-ceos/

Morningbrew

| If there’s no one to buy a $15 Sweetgreen salad and bring it back to their desk to eat all alone, does downtown even exist? A jump in remote/hybrid work post-Covid could threaten central business districts in places like Boston and San Francisco, where office space makes up 70%–80% of downtown real estate, per a new study from the NYT’s Upshot with CoStar. The threat is real: Even as some large banks push employees back into NYC skyscrapers, 74% of Fortune 500 CEOs around the country are looking to cut office space. In downtown DC, daytime population took a nosedive, dropping 82% from February 2020 to February 2021.The takeaway: Not all US downtowns are equally vulnerable to a tumbleweed-rolling-across-the-street future. Cities like San Diego and Nashville that have a more balanced makeup of residential, retail, and office space in their central districts could be more resilient coming out of the pandemic. But cities that aren’t as balanced will need to get creative in repurposing office space to avoid widespread vacancies and lower property tax revenue. |

https://www.morningbrew.com/daily

10. The Twelve Competencies of Emotional Intelligence

I’m delighted to share with you matters close to my heart, ideas that I find stimulating, and some practical tips and leads that you might find useful. At the core, of course, you’ll find emotional intelligence. But my interests also go far beyond; you’ll get a taste of that range here. PLUS news you can put to use in your life or work – or in both. Please join me each month.

A reminder, for those wanting a deep dive into the inner meaning of a purpose-driven life in business, the Inner MBA program offers just that. A nine-month series of online presentations (I’ll be one of almost 30 presenters) starts September 18th.

For more information and to register, go[http://%20https/lnkd.in/dTgA-mA] here.

Now, let’s dive in…

‘Emotional Intelligence’ By Other Names

The Conference Board lists EI as one of the most common areas coaches are asked to help leaders improve on. But then they list a host of other topics, most of which are alternate names for parts of what I see as EI.

Likewise, the World Economic Forum in its annual report on what executives see as essential skills for work in the future list resilience, stress tolerance, flexibility and influence —all parts of emotional intelligence.

Here’s my model:

| Emotional Self Awareness is the ability to know your own emotions and their effects on your performance. Self-Regulate is the ability to keep your disruptive emotions and impulses in check in order to maintain your effectiveness under stressful or even hostile conditions. Positivity is the ability to see the best in people, situations, and events so you can be persistent in pursuing goals despite setbacks and obstacles. Achieve means that you strive to meet or exceed a standard of excellence by embracing challenges, taking calculated risks and looking for ways to do things better.Adaptability means you can stay focused on your goals, but easily adjust how you get there. You remain flexible in the face of change can juggle multiple demands, and are open to new situations, ideas or innovative approaches. Empathy means you have the ability to sense others’ feelings; have a desire to understand how they see things; and take an active interest in their concerns. Organizational Awareness is the ability to read a group’s emotional currents and power relationships, identifying influencers, networks, and the dynamics that matter in decision-making. Influence refers to the ability to have a positive impact on others and meaningfully engage people in order to get buy-in or gain their support. Coach is the ability to further the learning or development of others by understanding their goals, challenging them, giving them timely feedback, and offering them support. Inspire is the ability to bring your best and motivate others around a shared mission or purpose in order to get the job done.Teamwork is the ability to work with others toward a shared goal; build spirit and positive relationships; encourage active participation; and share responsibility and rewards among members of a group.Conflict Management is the ability to work through tense or highly charged situations by tactfully bringing disagreements into the open, seeking to understand multiple perspectives, and searching for common ground in order to find solutions people can agree to.And now… |

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..