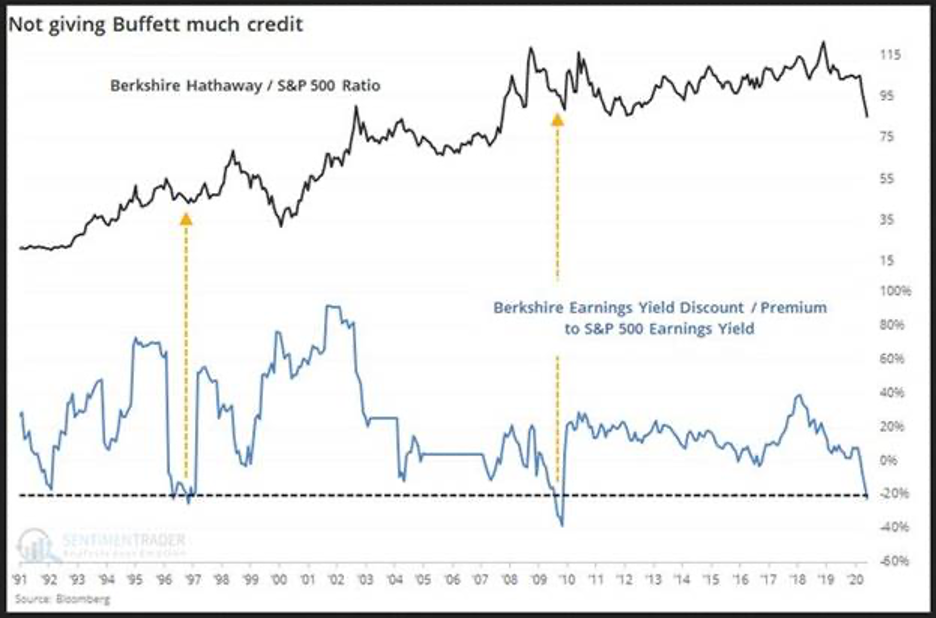

1. Berkshire Hathaway Trades at Lowest Price to Book in 30 Years

Buffett puts some cash to work with buy of Dominion.

There are continued headlines that Buffett has lost his touch – SentimentTrader notes that consensus opinion is why Berkshire is trading at a 23% earnings yield discount to the S&P 500, and setting up a hellofa BRK buying opportunity.

2. S&P 500 50 Day About to Cross 200 Day to the Upside

See heavy bars at lower end of chart…heavy volume on March lows…should happen today.

3. House Passes $1.5 Trillion Infrastructure Bill

Democratic plan to rebuild roads and rails doesn’t have Republican support, and bipartisan efforts have faltered for years

The Democratic bill pours more than $300 billion into repairing bridges and roads.

PHOTO: JOHN RAOUX/ASSOCIATED PRESS

by: Andrew Duehren

WASHINGTON—The House passed a broad, $1.5 trillion effort to rebuild the nation’s roads, railways and schools, as Democrats pursued their own infrastructure legislation without the bipartisan deal discussed for years during the Trump administration.

Almost 40 House Democrats joined with House Republicans to approve a last-minute amendment to the legislation on the floor. The change aims to bar the government from using funds in the bill to enter into contracts with Chinese state-owned companies or Chinese companies that construct facilities for interning Uighurs in western China.

The bill pours more than $300 billion into repairing bridges and roads, $130 billion into schools that educate low-income children, more than $100 billion into building or preserving affordable housing and $100 billion into expanding broadband internet access. Republicans oppose the legislation, which also includes a host of measures aimed at fighting climate change, and the White House has said President Trump would veto it if it came to his desk.

Mr. Trump has called for Congress to pass a major infrastructure package since he won the White House in 2016, but the extensive bipartisan negotiations necessary to pass such a bill have repeatedly faltered.

The president has recently sought $2 trillion in infrastructure spending to help the economy recover from the recession induced by the coronavirus pandemic. Senate Republicans, averse to such a major spending effort, haven’t embraced the administration’s push, and Democrats said they had lost patience hoping for a bipartisan deal that could become law to materialize.

“We have been on the cusp of producing a trillion-dollar bill, now it’s a $2 trillion bill, where is it? Where is it, where’s their alternative?” said Rep. Peter DeFazio (D., Ore.), the chairman of the House Infrastructure and Transportation Committee.

In a statement advising the president to veto the bill, the Trump administration criticized the bill for not finding money to pay for the new investments and not including measures accelerating the permitting process for new infrastructure projects.

The House Democratic bill puts roughly $100 billion into new transit funding, investing in putting more buses that don’t release carbon emissions on the road. It would also provide roughly $65 billion in funding for water infrastructure and $29 billion to Amtrak over five years.

While the House Democratic bill is unlikely to become law in the near future, lawmakers face a Sept. 30 deadline to act before the current five-year highway bill expires. Both the House bill and a separate highway bill in the Senate would provide for five more years of spending on highways and safety programs.

The House bill would spend $411 billion from the Highway Trust Fund, which is fed by taxes on fuel purchases and has faced shortfalls in recent years, while the Senate bill authorizes $287 billion over five years. The Senate bill passed unanimously out of committee last year, but, like the House bill, it lacks a plan for providing new revenue.

The federal government hasn’t raised the tax on gasoline and diesel since 1993, and revenue to the Highway Trust Fund has dropped as vehicles have become more fuel-efficient. Republicans have opposed raising the gas tax.

Sen. John Barrasso (R., Wyo.), the chairman of the Senate Environment and Public Works Committee, said funding transportation projects with money from the gas tax has become more challenging as the pandemic has cut back on travel and fuel purchases. He said reauthorizing highway funding could occur in the next economic relief bill.

“If there is another recovery bill, it would be important to include in that bill the things that we were able to do in a bipartisan way in the Senate rather than what they did in a partisan way in the House,” he said.

Congress has approved roughly $3 trillion in relief funding over the course of four bills this spring, and House Democrats passed a $3.5 trillion relief bill in May. Senate Republicans haven’t yet committed to approving another relief bill, which they say will consider in earnest beginning in mid-July.

Write to Andrew Duehren at andrew.duehren@wsj.com

https://www.wsj.com/articles/house-passes-1-5-trillion-infrastructure-bill-11593638962

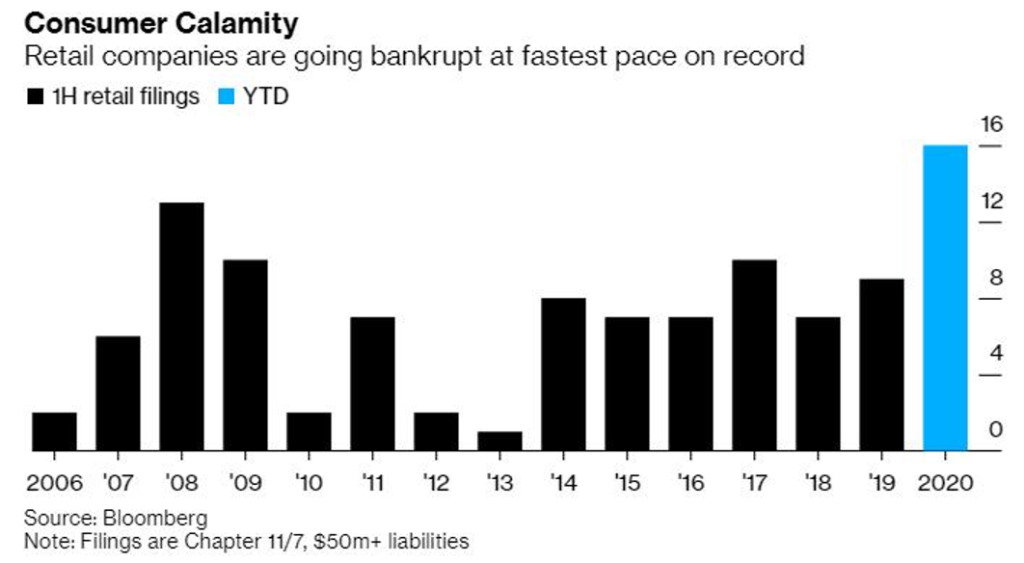

4. Retail Companies Going Bankrupt at Record Pace

Dan Crosby

https://www.linkedin.com/in/danielcrosby/

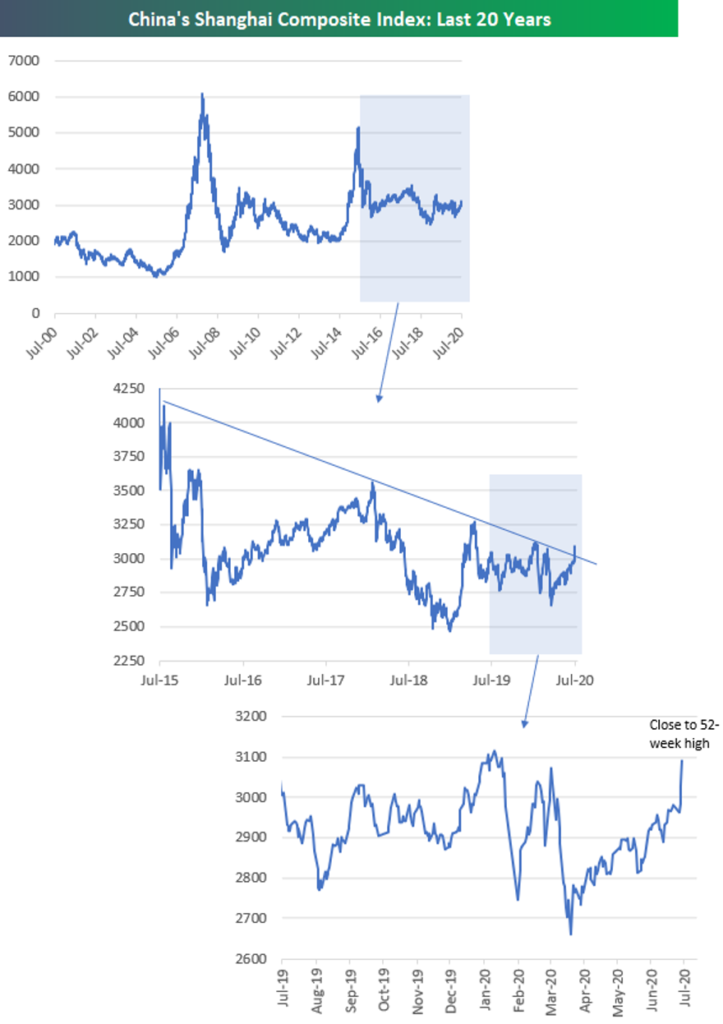

5. China Up Big Overnight…..Taking Out It’s Covid Peak

China’s Shanghai Composite Approaching 52-Week Highs Chinese equities surged to close out the trading week today with the Shanghai Composite gaining 2.1%. At current levels, the Shanghai Composite is just 0.80% from taking out its pre-COVID peak made in early January.

Below is a 20-year chart of the Shanghai with a 5-year and 1-year chart included as well. While the index is still well off its highs made during bubble runs in 2007 and 2015, its recent run higher over the last few weeks has pushed it above the top of its 5-year downtrend channel (see second chart below). Click here to view Bespoke’s premium membership options for our best research available.

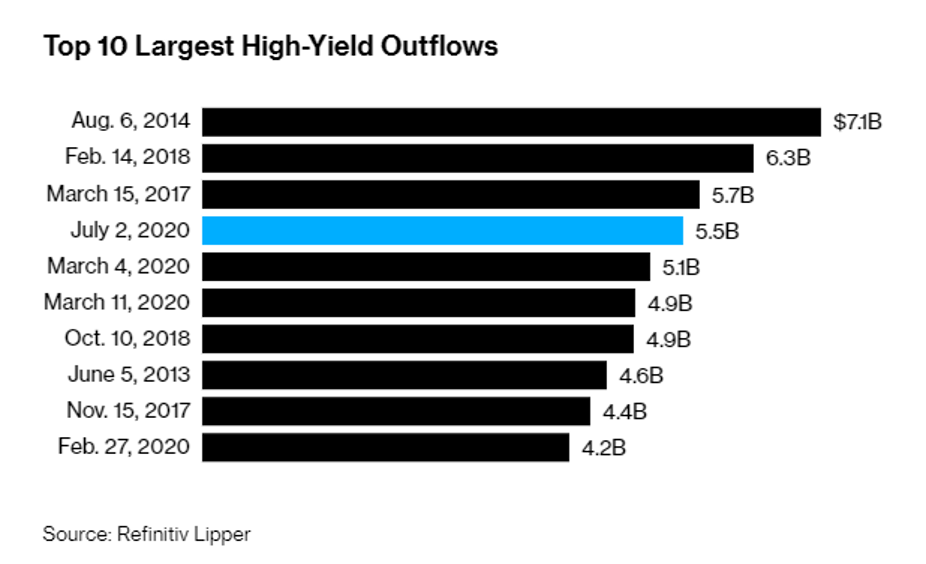

6. Investors Yank Most Cash From U.S. Junk Bonds Since 2018

After Top 10 last week talking record junk issuance….We get outflows

By Gowri Gurumurthyand Jack Pitcher

Buyers pulled $5.55 billion from funds, fourth-most on record

Outflows follow virus resurgence, uncertain outlook on economy

U.S. high-yield bond funds suffered the biggest outflows in more than two years as investors reassess risk after the best returns in a decade and an uncertain outlook due to the pandemic.

High-yield investors pulled $5.55 billion during the week ended July 1, according to data compiled by Refinitiv Lipper. It’s the fourth-biggest withdrawal on record and compares with an outflow of just $87.6 million the prior week.

“You’ve seen high yield recover so much during the quarter that it has coaxed some money out of the asset class,” said Scott Kimball, a portfolio manager at BMO Global Asset Management.

About $5.1 billion was pulled for the week ended March 4 when the spreading coronavirus was battering markets globally, but that was soon followed by about three months of inflows after the Federal Reserve unleashed unprecedented support in the wake of the outbreak.

Top 10 Largest High-Yield Outflows

Source: Refinitiv Lipper

Investors are cutting back on risk after high-yield debt returned 10.2% in the second quarter, the most since 2009, according to Bloomberg Barclays index data. Average yields have fallen to just 6.77% as of Wednesday from a peak of 11.69% on March 23, the data show.

The rally has also spurred a surge in corporate borrowing with high-yield issuance reaching a record monthly high of more than $58 billion in June. But much of the outlook depends on how the pandemic impacts the economy in the second half, with some analysts warning that U.S. credit could be susceptible to weakening.

John McClain, a portfolio manager at Diamond Hill Investment Group, expects investors to continue reaching for yield and for returns to remain attractive.

“Given the strong flow into the asset class in the quarter, combined with strong returns, investors are taking some chips off the table. We see this as short-sighted,” said McClain.

Many riskier high-yield companies are currently exceeding the modest expectations that they had set for investors when the pandemic started to spread earlier this year, said Ken Monaghan, co-head of high yield at Amundi Pioneer Asset Management.

If virus cases drop and there’s no second wave, then big parts of the economy can reopen, and junk bonds can surge. But if cases continue to jump or an accessible vaccine or treatment takes longer than expected, the virus will keep harming the economy and have an impact on riskier credit.

Read more: Buying corporate bonds is almost easy money, strategists say

This is the second consecutive week of outflows from high-yield funds. Investors pulled $427 million from leveraged loan funds, the third straight outflow.

— With assistance by Lara Wiecze

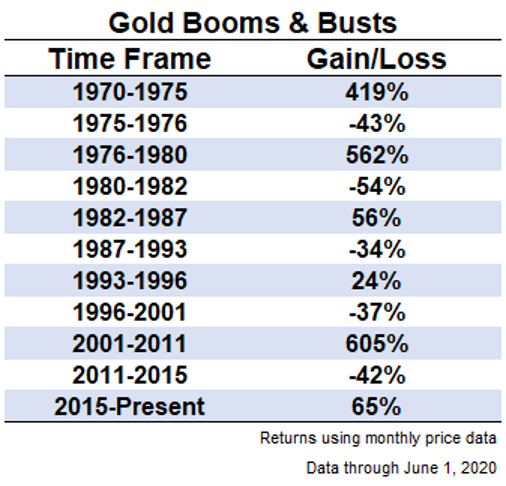

7. Gold Booms and Busts Always

The Gold Breakout Posted July 1, 2020 by Joshua M Brown https://thereformedbroker.com/2020/07/01/the-gold-breakout/

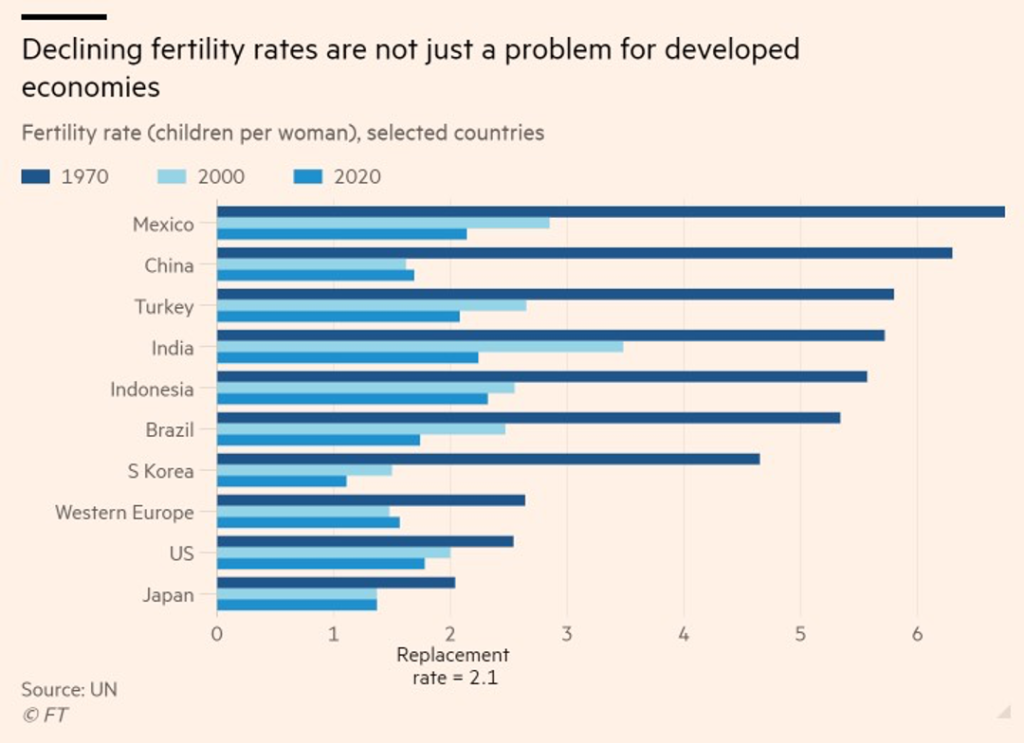

8. Declining Fertility Rates are a Global Problem

Record Low Child Births in U.S…..See Similar Drops Below Globally

9. 60,000 Users of Gangster Chat Room Worldwide…Cops Break it Up

Published: July 3, 2020 at 5:00 a.m. ET By Rupert Steiner

Police hacked into a WhatsApp-style chat for gangsters and spied on drug dealers, weapons traffickers, and crime lords plotting to execute rivals.

A general view of The National Crime Agency. Dubbed “the British FBI”, the NCA will be tasked with tackling the most serious of crimes in the U.K. and replaces a number of existing bodies.

Police have hacked into a WhatsApp-style instant messaging service set up exclusively for gangsters to deal drugs and execute rivals, smashing hundreds of organized crime rings in Europe.

More than 746 “Mr. Bigs” of the criminal underworld have been arrested as part of Operation Venetic as officers broke the encryption of a “secure” mobile phone instant messaging service called EncroChat that was used exclusively by criminals.

Britain’s FBI, also known as the National Crime Agency (NCA), said on Thursday that it, along with partners in France and the Netherlands had been trying to infiltrate the platform since 2016 and had a breakthrough two months ago.

A specialist NCA team, working closely with policing partners, has prevented rival gangs carrying out kidnappings and executions . . . by successfully mitigating over 200 threats to life.”

— Said an NCA spokesman

Over that period information was harvested and shared via Europol with authorities monitoring criminal conversations and unraveling gangster networks to foil executions.

Police say there were 60,000 users of the gangster chat world-wide and around 10,000 users in the U.K. The EncroChat servers have now been shut down destroying the killer app.

An NCA spokesman said: “The sole use was for coordinating and planning the distribution of illicit commodities, money laundering and plotting to kill rival criminals.

“A specialist NCA team, working closely with policing partners, has prevented rival gangs carrying out kidnappings and executions . . . by successfully mitigating over 200 threats to life.”

Police seized:

- Over £54 million ($67.31 million) in criminal cash

- 77 firearms, including an AK-47 assault rifle, sub machine guns, handguns, four grenades, and over 1,800 rounds of ammunition

- More than two metric tons of Class A and B drugs

- Over 28 million Etizolam pills (street Valium) from an illicit laboratory

- 55 high value cars, and 73 luxury watches

NCA director of investigations Nikki Holland, said: “The infiltration of this command and control communication platform for the UK’s criminal marketplace is like having an inside person in every top organized crime group in the country.

“Together we’ve protected the public by arresting middle-tier criminals and the kingpins, the so-called iconic untouchables who have evaded law enforcement for years, and now we have the evidence to prosecute them.”

Police raid the homes of alleged gangsters:

The NCA said organized crime groups had been using EncroChat, communicating freely believing the technology made them secure.

On 13 June EncroChat realized the platform had been penetrated and sent a message to its users urging them to throw away their handsets.

The phones – which had pre-loaded apps for instant messaging, the ability to make VOIP calls and a kill code which wipes them remotely – had no other conventional smartphone functionality and cost around £1,500 for a six-month contract.

The NCA says it created technology and specialist data capabilities to process the EncroChat data, and help identify and locate offenders by analyzing millions of messages and hundreds of thousands of images.https://www.marketwatch.com/story/an-instant-chat-app-promising-criminals-worry-free-secure-communication-was-hacked-by-uk-police-heres-how-746-gangsters-were-arrested-2020-07-02?mod=home-page

10. WHY WE MAKE BAD DECISIONS

Humans make bad decisions because we are inherently terrible at objectively assessing risks and rewards. And as much as I’d love to tell you that we can overcome these psychological flaws with a really cute gimmick or three-step technique, the fact is that these flaws seem to be permanent features of how our minds work. We can’t escape them. The best we can do is gain an awareness of them and manage them appropriately.

I could write dozens of articles about all of the heuristics and biases that cause us to view our decisions inaccurately, but for the sake of brevity (and my sanity), I’ll lump our psychological failures into three categories and then summarize them.1

Those categories are:

- The influence of our emotions

- Our poor perception of time

- The seduction of social status

Let’s take them one by one.

1. HOW OUR EMOTIONS DERAIL OUR DECISION-MAKING

Think back to some of the stupidest decisions you’ve ever made. Chances are, most of those decisions were motivated by you being an emotional wreck. Maybe you were angry and in a fit of rage, smashed your keyboard against your desk, causing you to get fired. Maybe you were so sad from your break up that you drank yourself into a stupor, blacked out, drove home and woke up in a jail cell. Maybe you were so anxious that you passed up on a huge career opportunity that you’ve always wanted.

A pretty epic way to get fired.

Whatever it is, we’ve all been there. Our emotions hijack our sense of reality and suddenly something that is clearly a good decision, feels like a horribly scary, icky bad decision. Or, what is obviously a terrible idea, draws us in with an irresistible force, until we wake up in a pool of our own vomit wondering what happened.

The problem is that our emotions operate separately from our thoughts. One way to think about it is that we all possess two brains, a Thinking Brain and a Feeling Brain. Our Thinking Brain is our higher-level human brain — it’s the intelligent, thoughtful, patient part of ourselves. But our Feeling Brain is our animalistic side — it’s our cravings, our urges, and our desires.

Sadly, the Feeling Brain is much stronger than the Thinking Brain. In fact, our Feeling Brains tend to bully our Thinking Brains around in our heads. Our Thinking Brains are like, “Oh hey, there’s that person we’re attracted to, it’s a great opportunity, we should go talk to them.”

And our Feeling Brain starts screaming things like, “FEAR! SHAME! LOSER! YOU’RE A PIECE OF SHIT! THEY WILL NEVER LOVE YOU! NOBODY WILL EVER LOVE YOU!” until our Thinking Brain is cowering in a corner, shaking, and capitulates, “Okay, okay, okay, you’re right, they probably wouldn’t like us anyway.”

What is, on paper, a proposition to risk $1 to make $50 — talking to them takes all of 10 seconds and you literally lose nothing by trying — starts to feel like an incredibly risky and terrifying proposition. So, we sit there, sipping our warm beer, watching the love of our lives quietly walk out of the room, wondering for the next week what could have been.

But how do we overcome this? How do we develop an ability to manage our emotions? How do we gain a little bit of separation between what we feel and how we act?

Well, it’s hard. And I don’t know if you ever completely master it. The first step is to develop greater self-awareness — to see your emotions as they happen. Many people don’t even realize they’re sad or mad until long after the fact, thus causing them to make poor decisions without knowing.

Once you’ve developed a bit of self-awareness, the next step is to develop a habit of reasoning by working through important decisions, either out loud or on paper, before saying or doing something drastic. I’ll talk a bit more about these ideas in a section below, but this can mean journaling, talking to someone you trust, or even running your decisions by a coach or therapist before committing to them.

2. HOW OUR POOR PERCEPTION OF TIME DERAILS OUR DECISION-MAKING

There’s an interesting economics experiment where if you offer people $100 today or $150 a year from now, most people will take the $100 today.2

In economics, this is known as “temporal discounting” — we “discount” the value of having something far off in the future compared to having something now.

In psychology, it’s often referred to as the “present bias” and you see it crop up in all sorts of other areas in life.3 We’d rather eat that double pepperoni pizza every Saturday night than think about the weight we’ll gain a year from now. We’d rather be right in an argument than think about how we might be affecting a friendship a week, a month, or a year into the future. We’d rather have fun tonight than think about how we’re going to feel at work tomorrow.

We tend to overestimate the value of something now and underestimate the value of something later. This is why people are terrible at saving money. This is why we procrastinate important tasks. This is why we put off having necessary but difficult conversations.

Time messes us up in other ways too. Think about this: take a penny and put it on the first square of a chess board. Now put two pennies on the next. Now put four on the next. Continue doubling the pennies for all 64 squares on the board. How much money is on the last square?

If you said $92.2 QUADRILLION dollars, you were right.

But let’s be honest, you didn’t say that. You probably said some generic, large number, like $5 million or something, thinking you were being clever and guessing really high. Meanwhile, you were only off by about nine zeroes.

Our minds are poor at compounding things over time. We overestimate the pain of doing something for 30 minutes today, without realizing the compounding effects it can have if we fail to do it every day for months and months on end.

For example, let’s pretend there’s some imaginary skill that if you practiced for 30 minutes a day, that you’d get 1% better each day for the next year. Now, let’s say you actually did practice for 30 minutes per day — how much better would you be at the end of the year?

Instinctively, you probably think, “Well, 365 days in a year, so I don’t know, like 400%?” If you’re somewhat familiar with compounding functions, you might know to guess extra high, so you say something like 1,000% better.

But the real answer? You’d be 3,778% — or almost 38 times — better than you were at the start of the year.

Do I wake up early each day to write that novel I’ve always dreamed about? Or do I snort some more bath salts?

Again, our mind doesn’t think like that. Instead, we think, “Oh, what’s the big deal if I miss one workout? Not going to kill me.” Then we proceed to say that once or twice a week for years and years and years on end. And because we don’t think exponentially — our intuition thinks linearly — we vastly underestimate how much we’re actually giving up.

Because here’s how much you improve if you only practice that skill every other day, for a year: 611%.

3,778% improvement vs 611% improvement. That’s 6x the difference in results, for only 2x the effort. That’s the difference between being an expert at something and being merely “good” at it. Run that out over a few years and that’s the difference between being a professional and an amateur. Not a sprint of 12-hour days, but a slow, steady marathon of 30-minutes per day, year after year.

None of us think about this shit when we’re going about our lives. That’s because it’s really, really hard. Our brains don’t think exponentially. It strikes us as counterintuitive.

We tend to vastly overestimate the short-term benefits of taking a day off, or skipping practice or bailing on one of our commitments. Missing one workout isn’t a big deal!

And you’re right, it really isn’t that big of a deal. But we don’t consider the fact that, “just one workout isn’t a big deal,” when repeated every week or even every other week for a couple years, can have a drastic effect on our results.

3. HOW OUR PERCEPTIONS ARE EASILY INFLUENCED BY STATUS

You may be wondering why our brains function like this. It’s almost as though we’re handicapped in some way — being at the mercy of our emotions; struggling to properly value things in the future. But the truth is that for most of human evolution, these were not the handicaps but the benefits of our minds.

Fifty thousand years ago, out on the savannah, you couldn’t consider whether something would be more valuable a year from now or not. No, you had to kill a big fucking animal or be killed by that big fucking animal. That’s all that mattered. You needed to be overly concerned with the present.

Similarly, we inherit a retinue of biases and prejudices around social status as well. Why? Because we’re a bunch of fucking monkeys with fancy colorful screens in front of us. That’s why.

Despite thousands of years of our best efforts, humans self-organize into status hierarchies with the few reaping the most resources and opportunities at the top… and everyone else scrounging for the leftovers.

Now, I know what you’re saying, “I don’t give a fuck about no status hierarchies. I am my own man/woman. I do what I want. I will not be swayed by silly social markers of prestige and class.”

Well, that’s nice… but you’re wrong.

The fact is that we are all subconsciously affected by what we perceive as valuable and socially desirable in others. It’s automatic. It colors our perceptions. It skews our emotions. When in the presence of extreme beauty, wealth or power, we all become a little bit dumber, a little bit more passive, and a lot more insecure.

I noticed this the first couple times I met Will Smith. I realized that, without even meaning to, I laughed harder at his jokes, paid more attention to his stories, watched if he got up and moved around the room. It was totally involuntary. And I wasn’t the only one. When he’s in a room, it’s like a vacuum sucking up all of the attention in it. Knowing that I was going to work with him on a book, I had to start consciously checking myself to make sure I wasn’t agreeing to something stupid just because he was famous. I had to question myself around him.

We tend to give way too much credit to people we perceive to have social status. In psychology, this is known as “The Halo Effect.”4 It’s our tendency to assume that physically attractive people are smarter or nicer than they actually are. That successful people are more interesting than they actually are. That powerful people are funnier or more charismatic than they actually are.

As with most of our cognitive biases, marketers take advantage of this to make money. Think about all of the celebrities doing car commercials and shilling worthless supplements and beauty products. Think about how former presidents and heads of state can get paid half a million dollars to simply be in a room. Think about how you’ve convinced yourself that you like different clothes, different food, different music, because somebody you really respect or admire likes them. We all do it. It’s impossible not to.

Like I said, we’re fucking monkeys with screens.

The best we can do is simply be aware of how we are influenced by our perceptions of status and modify our reasoning accordingly.5 Notice how you react around people you deem as particularly successful and admirable. Notice how much more agreeable you become. Notice how you tend to make positive assumptions about them, even though you don’t necessarily know whether they are true or not.

Then, question these things. Ask yourself, “If some random person I know said this, would I react the same way?” And if you’re honest with yourself, you’ll find that sometimes the answer is “no.”

It sucks to admit it. But welcome to being human.

Our biases around people of status and prestige are important because we’re likely to overvalue things related to them and undervalue things not related to them. As someone who spent much of high school and college getting drunk and high in desperate hopes of impressing the people around me, I can tell you: poor decisions were made.

READ FULL STORY

3 REASONS WHY YOU MAKE TERRIBLE DECISIONS (AND HOW TO STOP)

Decisions in life come down to trade-offs. And it just so happens we’re really bad at evaluating trade-offs.

22 minute readby Mark Manson

Disclaimer

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publically available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only