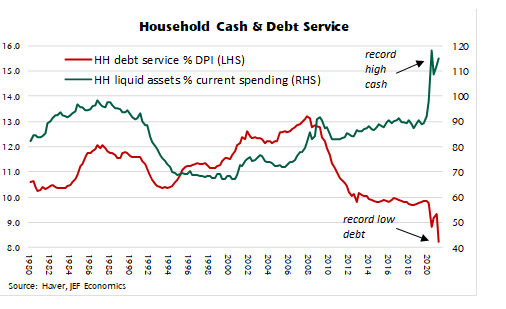

1. Record High Cash and Record Low Debt for U.S. Households.

Jeffries

Dan Stratemeier-Managing Director-Equities, Event Driven Strategies

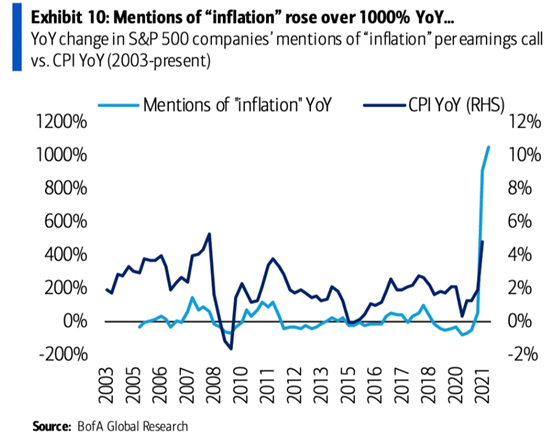

2. Mentions of Inflation Rose 1000% in Earnings Calls.

Yahoo Finance notes Companies can’t stop bringing up inflation on earnings calls

3. Real Fed Funds Rate….Funds Rate – CPI = -5.3%

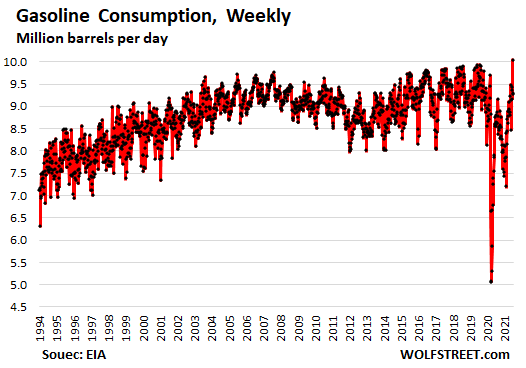

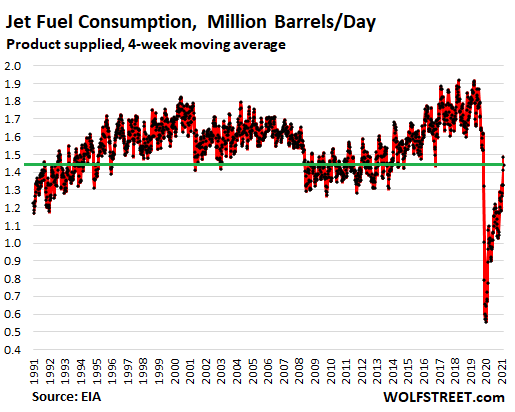

4. Gasoline Consumption New Highs….Jet Fuel Consumption Still Lagging

Wolf Street-People are still not flying as much as they did before, and they’re barely using mass transit, but they’re sure driving a lot, particularly for a holiday week as in early July:

And people are not flying as much. They’re flying a lot for leisure within the US, but they’ve cut business travel such as going to conventions, and they’ve cut international travel for business and leisure, given the travel restrictions. The EIA reported that the four-week moving average consumption of kerosene-type jet fuel, at 1.44 million barrels per day, was still down 22% in the latest reporting week compared to the same period in 2019:

People Sure Are Driving a Lot, Gasoline Consumption Hits Record, But Flying & Mass Transit Lag Way BehindBy Wolf Richter for WOLF STREET.

5. Goldman Sachs Applies for DeFi ETF

The filing joins over a dozen crypto ETF applications sitting before the SEC.

(Jin Lee/Bloomberg via Getty Images)

Jul 26, 2021 at 6:14 p.m. EDTUpdated Jul 27, 2021 at 9:12 a.m. EDT

Investment banking giant Goldman Sachs has filed an application with the U.S. Securities and Exchange Commission (SEC) for an exchange-traded fund (ETF) that would offer exposure to public companies in decentralized finance and blockchain around the globe.

Sparse on details, the filing noted that the fund would invest at least 80% of its assets into companies that advance blockchain technology and the digitization of finance.

“The Goldman Sachs Innovate DeFi and Blockchain Equity ETF (the ‘Fund’) seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Solactive Decentralized Finance and Blockchain Index (the ‘Index’),” the filing said.

By signing up, you will receive emails about CoinDesk products and you agree to our terms & conditions and privacy policy.

The markets that Goldman would be picking from would include Australia, Canada, France, Germany, Hong Kong, Japan, South Korea, Switzerland, the Netherlands, the United Kingdom and the United States.

The SEC is currently reviewing over a dozen bitcoin (BTC, +3.37%) ETF applications and has delayed decisions on several of them. Both VanEck and WisdomTree have filed for Ethereum ETFs, but Goldman’s filing seems to be the first DeFi-related ETF application.

CoinDesk revealed last week that Goldman is reportedly clearing and settling cryptocurrency exchange-traded products for some hedge fund clients in Europe.

https://www.coindesk.com/goldman-sachs-applies-for-defi-etf

6. US Home Prices Have Never Risen This Fast

BY TYLER DURDEN ZEROHEDGE-US home prices rose an astonishing 16.61% YoY in May (the latest available data from Case-Shiller). That is the great YoY surge in prices in the 33 year history of the index…

Source: Bloomberg

https://www.zerohedge.com/personal-finance/us-home-prices-have-never-risen-fast

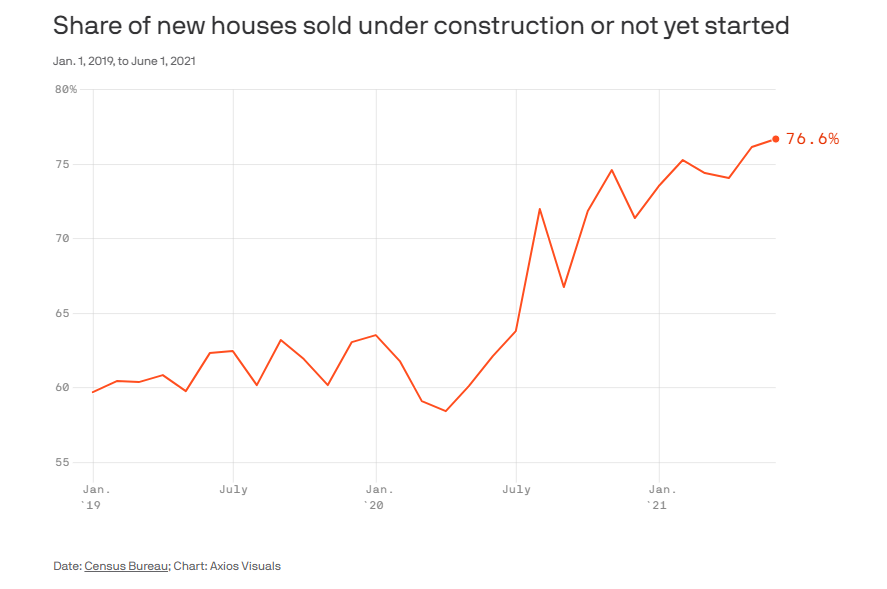

7. Housing demand drastically outpaces supply

Sam Ro AXIOS

Prospective homeowners are so eager to buy that many are closing on new homes that aren’t even close to move-in ready.

Why it matters: Low mortgage rates and the desire for more space have fueled a housing boom where demand has far outstripped supply.

- In turn, prices surged, making homes more unaffordable to increasingly frustrated consumers.

- However, many of the buyers who remain in the market seem to be getting more aggressive as an increasing share of new home buyers aren’t waiting for construction to be completed before they sign.

By the numbers: In June, 76.6% of the new homes sold were either still under construction or not yet started. This is considerably higher than the 65% level where the metric trended before the pandemic.

- For impatient buyers, this may continue to be the best option in the near term based on the inventory.

- While the supply of new homes for sale actually increased to 6.3 months’ worth in June — the highest level since April 2020 — completed homes represented a record low 10.2% of this supply.

What they’re saying: “In recent months, many homebuilders have resorted to intentionally slowing the pace of new sales to allow production to catch up,” Ivy Zelman, CEO of housing research firm Zelman & Associates, tells Axios.

- “Speculative homes are being started and will not be released for sale until later on in the construction process given the inflated cost risk, or in some cases upon completion. This should change the supply-demand landscape, as more inventory gets released for sale.”

What to watch: In addition to the new home sales reports, monthly updates on homebuilder confidence from the NAHB and new residential construction from the Census Bureau will provide the earliest signals on if and when new home supplies improve materially.

- “There are signs that this low inventory/tight housing market could be ending or softening soon,” UBS senior U.S. economist Pablo Villanueva tells Axios. “Inventory of new homes for sale is rising, demand is softening, labor market is loosening, and supply chain disruptions probably peaked in Q2.”

The bottom line: While new home sales are well off of their highs, the underlying details suggest there is nevertheless a sense of urgency among those who have the capacity to buy.

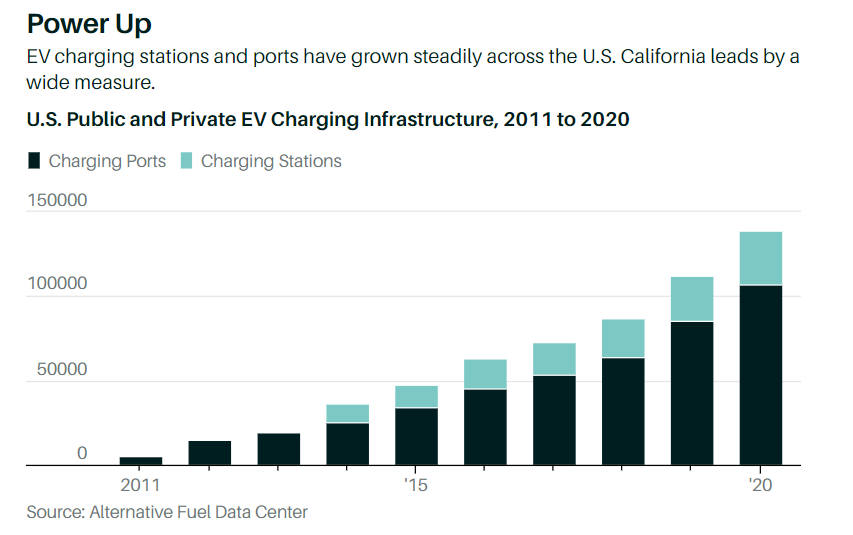

8. Growth of EV Power Stations and Ports.

BARRONS

Musk Tweets That Tesla Will Share Its Charging Network. Why That’s a Savvy Move.-By Al Root

https://www.barrons.com/articles/elon-musk-tesla-charging-network-51627090559?mod=past_editions

9. Divine Laws That Govern Stock Market Over Long Time Periods

Divine Law

To us at Smead Capital Management, there are some divine laws which govern the stock market over long time periods.

- Interest rates are like gravity to P/E ratios (Warren Buffett)

- Euphoric episodes end badly (Galbraith)

- Cheap stocks outperform expensive stocks over long time periods (Benjamin Graham)

- Performance is enhanced by buying extreme pessimism (John Templeton)

- Every stock which goes up 10-fold had to double and quadruple first (Smead)

- Young people who buy stocks on borrowed money lose (Edwin Lefevre-Reminisces of a Stock Market Operator)

- Most investors suffer stock market failure (Dalbar)

The goal of our work is to avoid getting stuck as fashion disappears. We have no urge for getting beat up by our companies suffering from civil law moving against them. We enjoy using these divine laws to run our portfolios. Thanks to John Locke, we hope to avoid stock market failure.

Warm regards, William Smead

The Law of Fashionby William Smead of Smead Capital Management, 7/27/21 https://www.advisorperspectives.com/commentaries/2021/07/27/the-law-of-fashion

10. Our Brains Make Us Way Too Optimistic About Meeting Deadlines. Here’s How to Work Around That

Why Are We So Bad at Meeting Deadlines?BY CHRISTOPHER COXJULY 15, 2021 7:00 AM EDT

Cox is the author of The Deadline Effect: How to Work Like It’s the Last Minute Before the Last Minute

Not long ago, I visited a peculiar farm in southwestern Oregon. Year after year, Hastings Inc. produces a single crop: the Easter lily. Every Easter weekend, hundreds of thousands of lilies from this farm appear in supermarkets, big-box stores, and garden centers throughout North America. Each one has to look the same—a single stem, a dark green nest of leaves, and five or more flared white trumpet blossoms—and each one has to bloom at exactly the same time. They can’t miss their target by even a few days. As one of the farmers told me, “The day after Easter, an Easter lily is worthless.”

Why was this lily farm so good at meeting its deadline while the rest of us struggle endlessly? I found a clue on the wall of the main office at Hastings, near a window that overlooked the Pacific Ocean: a laminated calendar that showed the date of Easter for every year from 1996 to 2045. That calendar, I discovered, held the secret for how the farmers avoided an all-too-human problem known as the planning fallacy.

The term was coined in 1977, when Amos Tversky and Daniel Kahneman wrote a paper about predictions for DARPA, the Defense Advanced Research Projects Agency. Kahneman, who won a Nobel Prize in economics for the work he did with Tversky, later said the paper was inspired in part by an experience he’d had writing a textbook with a group of academics. At the beginning of that project, he had asked the participants to estimate how long it would take. The average guess was two years. It took nine.

Most of us are optimists, which might make us better company at the dinner table, but it means we are lousy at predicting the future. We underestimate the amount of time a project will require. If it’s a project that has a budget, we underestimate the expense as well. The most famous example of this failing probably the Sydney Opera House, which was commissioned in 1957 with an expected completion date of 1963 and a budget of $7 million Australian dollars. The building wasn’t finished until 1973, and only after the most ambitious versions of the plan had been scaled back, for a final cost of $102 million.

The planning fallacy is the tendency to seize upon the most optimistic timetable for completing a project and ignore inconvenient information that might make you revise that prediction. According to Roger Buehler, a professor of psychology at Wilfrid Laurier University, people are pretty stubborn about these conclusions even when presented with evidence of how they’ve been wrong in the past. Although people are aware that “most of their previous predictions were overly optimistic, they believe that their current forecasts are realistic.

Buehler and some colleagues at the University of Waterloo in Ontario ran a test on their students to see how bad they were at estimating when they would finish their work. They asked thirty-seven seniors to make three predictions: the date they would submit their honors thesis “if everything went as well as it possibly could,” the date “if everything went as poorly as it possibly could,” and their best guess for what their actual submission date would be.

Fewer than 30 percent submitted their work by the date they thought was the best estimate of when they would be done. The optimistic predictions were even worse—they were off by an average of 28 days, and barely 10 percent of the students were done by that date. The most striking result, however, might be the one for the pessimistic scenario. Even when asked to predict what would happen “if everything went as poorly as it possibly could,” the students were still too optimistic. Fewer than half had finished by the worst-case-scenario date.

The problem with our predictions is that we treat each task like it’s a novel problem. We construct a story about how we will complete our work but ignore evidence from similar projects we or other people have done in the past. That was true with Kahneman’s textbook: One of the academics later admitted that earlier projects he’d worked on took a minimum of seven years. But when it was time to estimate how long this one would take, he guessed two years like everyone else.

It’s not all hopeless, though. There is a way to overcome, or at least mitigate, the planning fallacy. In a follow-up experiment, Buehler and his colleagues had a different group of students complete a one-hour computer tutorial at some point before a one- or two-week deadline. They also asked them to predict when they would finish the assignment, but here the researchers inserted a variable. Some of the students were prompted to think about past assignments they had completed that were similar to this one, and to apply that knowledge to their prediction. The control group was given no such instructions.

The results were remarkable: although the control group exhibited the same optimistic bias as the students in the first experiment, that bias almost disappeared among the students who were prompted to forge a connection between their past experiences and the current assignment. They predicted it would take them an average of seven days to complete the tutorial. The actual average: seven days.

In that office on the lily farm, there was a reason that a calendar dating back to 1996 was up on the wall. It was a cure for optimism. The farmers were bound by the Easter deadline—they couldn’t afford to let the planning fallacy have its way with them. So they did what those students did, only without the prodding of a group of professors. They took their past experience and used it to build a schedule, counting back from Easter. They knew down to the day how long the lilies had to be in greenhouses, how long in storage, and how long it took to get them out of the ground and into boxes. The calendar was there to remind them to think about how it was done in 1996, or 2006, or 2016.

When it comes time for you to build your own Sydney opera house, even if you don’t have a deadline as clear-cut as Easter Sunday, take a cue from those lily farmers. Ignore what you wish were true. Use the past to build your schedule. Keep your eye on the calendar—and then watch those flowers bloom.

This article is adapted from Cox’s new book, The Deadline Effect

https://time.com/6080389/brains-optimistic-making-deadlines/

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.