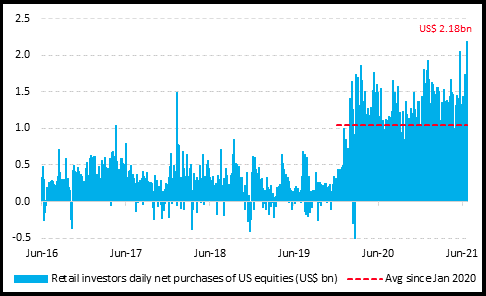

1. Highest Amount on Record Pours into SPY ETF Last Monday

Dave Lutz Jones Trading–This week is lesson to everyone on Wall Street who thought the day-trading army had beaten a retreat: They snapped up stocks at the fastest clip on record, pouring around $2.2 billion into equities on Monday alone, according to Vanda Research. Vanda, which tracks traffic on trading platforms and order flows, estimates they poured $482 million into the SPDR S&P 500 ETF Trust (ticker SPY) on Monday, the highest amount on record

2. Bitcoin Bounce Right at $30,000 on Chart.

https://www.coindesk.com/price/bitcoin

3. S&P Profit Margins as Good as it Gets.

Arouet

https://twitter.com/MichaelaArouet

4. China Stocks in U.S. Suffer Biggest Two-Day Wipeout Since 2008

Bloomberg-By Matt Turner

Nasdaq Golden Dragon China Index has fallen 15% since Thursday

- Index loses $769 billion in value amid rout in Chinese shares

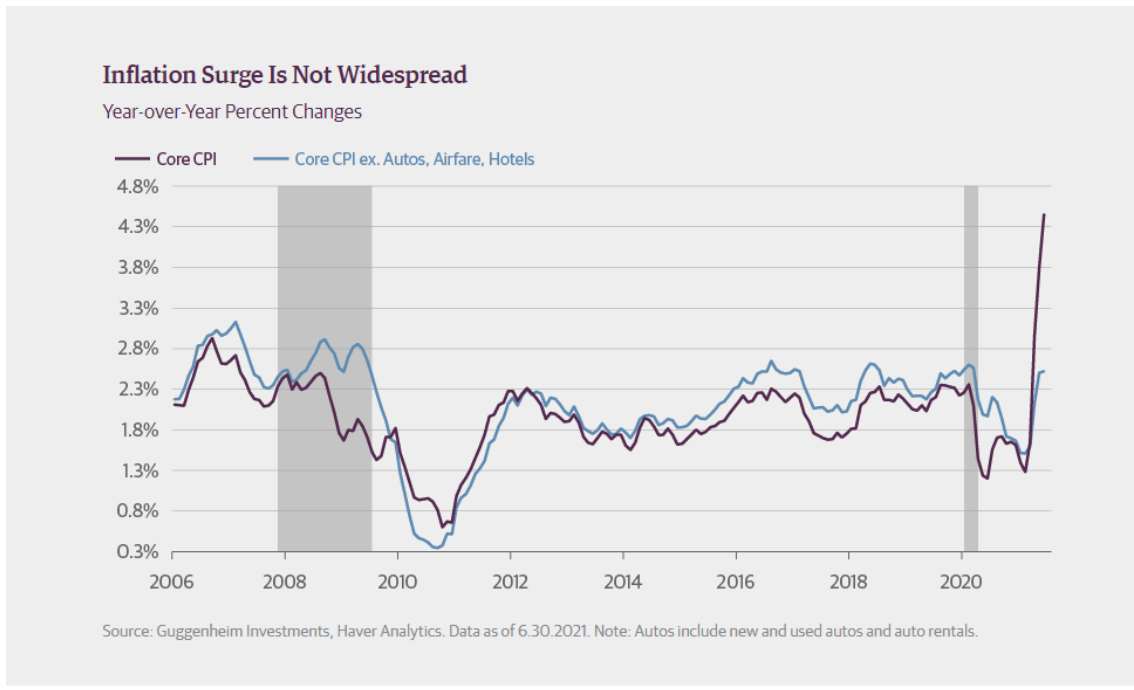

5. Updated Inflation Numbers Less Autos, Airfare, Hotels.

Guggenheim

Still No Reason to Panic About Inflation | Guggenheim Investments

6. Faster Wage Growth Constrained to Several Low Wage Sectors

United States: Faster wage growth has been constrained to several low-wage sectors, according to BCA Research.

Source: BCA Research

The Daily Shot Blog https://dailyshotbrief.com/the-daily-shot-brief-july-26th-2021/

7. Public Pensions 80% Funded for the First Time in Tracking History

Public pension funding topped key threshold on stock-market gains

Marketwatch By Andrea Riquier

80% is a loose guideline for satisfactory pension funding

Public pension-plan funding topped a key benchmark for the first time in tracking history during the second quarter, buoyed by surging financial markets, according to a report released in July.

The funded ratio — a metric that describes the amount of assets on hand to pay all expected liabilities for the coming 30 years — rose to 82.6% at the end of June for the 100 largest plans in the country, according to the Public Pension Funding Index from actuarial group Milliman. That’s the highest since Milliman began tracking in 2016, and suggests that the largest public pensions, in aggregate, are in better shape than in the past.

An 80% funded ratio is often loosely considered a satisfactory level for pensions sponsored by state and local governments and other municipal entities, even as most employers formally aim for full funding — that is, enough money on hand to cover all existing workers and retirees for the next 30 years.

It’s worth noting that more recent scholarship suggests that full funding for public pensions isn’t necessary, and that they would do fine with a pay-as-you-go approach, as Social Security does. Still, there are plenty of larger pension plans that remain dangerously underfunded.

It’s worth noting that more recent scholarship suggests that full funding for public pensions isn’t necessary, and that they would do fine with a pay-as-you-go approach, as Social Security does. Still, there are plenty of larger pension plans that remain dangerously underfunded.

Milliman estimates aggregate returns for the plans tracked to be 4.26% for the quarter, while the overall annualized return for the year ending June 30 was 19.95%. As the group points out, that kind of return “significantly exceeds the expected long-term earnings assumptions” for plans it covers.

The S&P 500 SPX, +0.24% is up over 17% in the year to date and up more than 36% in the past year. The S&P 500 on Friday rose 2% to finish at its 40th record close of 2021.

As previously reported, many public pension plan administrators have been reducing their assumptions for returns, believing that lower, more conservative assumptions are safer. Among state pensions, the median assumed return in 2021 is 7.20%, down about 1 percentage point since 2000.

Market returns account for roughly two-thirds of a pension’s asset growth (or decline), so when they fall short, governments, school districts and other plan sponsors must kick in more money.

As Milliman’s release notes, “In the coming months, plan sponsors will start seeing the results of actuarial valuations that will reveal the extent to which the [COVID-19] pandemic has impacted plan liabilities, including higher death rates and the impact of furloughs on benefit accruals, pay levels and contributions from active members.”

That’s already evident, according to an earlier report from the Center for Retirement Research at Boston College, which found that layoffs during the COVID recession meant fewer workers paying into the system.

Read: Public pensions don’t have to be fully funded to be sustainable, paper finds

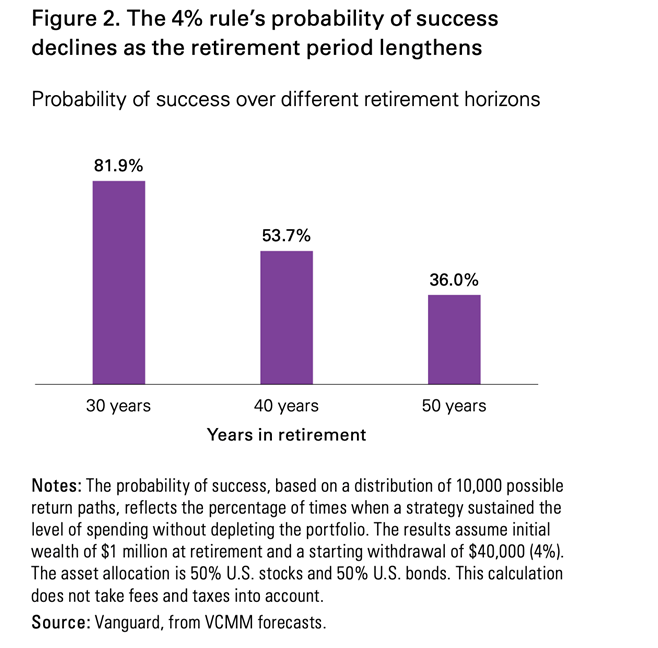

8. Longevity and the 4% Rule for Retirement

Fuel for the F.I.R.E.: Updating the 4% rule for early retirees (vanguard.com)

Found at Abnormal Returns www.abnormalreturns.com

9. Even with China Crackdown on Tech and Trade War Threats Between U.S./China…Blackrock Geopolitical Risk Indicator New Lows.

BlackRock Geopolitical Risk Indicator

The global BlackRock Geopolitical Risk Indicator (BGRI) aims to capture the market attention to our geopolitical risks. The indicator has been trending down in the past year because of fading market attention to risks such as U.S.-China strategic competition, COVID-19 resurgence and Gulf tensions. Overall, our global BGRI shows a significant reduction in concern about geopolitical risk since the change in U.S. administration. The gauge has been hovering in negative territory this year, as the chart shows, meaning investor attention to geopolitical risks is below the average of the past four years. See our methodology section for details. As a result, geopolitical shocks could catch investors more off guard than usual.

10. More Proof That Vigorous Workouts Boost Fluid Intelligence

Psychology Today Christopher Bergland

Another new study reports that exercise regimens can improve fluid intelligence.

Last month, researchers from Colorado State University and the University of Illinois at Urbana-Champaign published a study (Burzynska et al. 2020) showing moderate-to-vigorous physical activity (MVPA) is positively correlated with improved fluid intelligence abilities. In contrast, sedentariness appears to facilitate better cognitive abilities relating to crystallized knowledge. Arthur Kramer, formerly of UIUC’s Beckman Institute for Advanced Science and Technology, was this study’s senior author. (See “Moderate-to-Vigorous Exercise May Benefit Fluid Intelligence.”)

Today, another new study (Zwilling et al., 2020) was published in Scientific Reports that corroborates the link between vigorous workouts and better fluid intelligence abilities. Aron Barbey, a psychology professor at the University of Illinois at Urbana-Champaign and director of Beckman’s Decision Neuroscience Laboratory, led the research team along with postdoctoral researcher and first author Christopher Zwilling.

For this 12-week, double-blind controlled clinical trial, the researchers recruited 148 active-duty Air Force airmen who were randomly assigned to two different groups in an experiment designed to see how effectively a multimodal physical fitness regimen alone—or in conjunction with a nutritional intervention—enhanced physical and cognitive performance.

All of the Air Force airmen (N = 148) participated in a 12-week exercise program that combined strength training gym workouts and high-intensity interval training (HIIT) cardio workouts. Notably, after just three months, the researchers found that, on average, fluid intelligence scores increased by 19.5 percent after kick-starting this exercise regimen.

Twice a day during this period, one group (n = 70) of airmen also drank a specially designed nutritional beverage that has been shown to boost cognitive functions in previous studies. This nutrient-enriched beverage contained vitamin B12, an omega-3 fatty acid (DHA), lutein, phospholipids, hydroxymethyl butyrate (HMB), and selected micronutrients, including folic acid.

The other cohort of airmen (n = 78), who represented a placebo control group, consumed a twice-daily beverage that was not enriched with nutrients. Neither the study participants nor the field researchers knew which group received the nutrient-enriched drink or a placebo beverage.

Chris Zwilling and colleagues also administered a battery of cognitive tests before and after the 12-week intervention to assess how the exercise regimen affected cognition by itself and in conjunction with the novel nutritional supplement. Six cognitive function domains were measured:

1. episodic memory

3. working memory

5. fluid intelligence

6. processing efficiency/reaction time

“Both groups improved in physical and cognitive function, with added gains among those who regularly consumed the nutritional beverage,” the researchers stated in an October 19 news release.

article continues after advertisement

As expected, the 12-week exercise regimen of strength training and HIIT workouts increased physical power and lean muscle mass, reduced participants’ body fat percentages, and boosted their VO2 max. As mentioned, the most notable exercise-related gains in cognitive function were on tests designed to measure fluid intelligence.

After 12 weeks of HIIT and strength training exercise regimen, these are the “enhanced physical and cognitive performance in active duty airmen” results from the latest (2020) Zwilling et al. study:

“The exercise intervention alone improved several dimensions of physical fitness [strength and endurance (+ 8.3 percent) power (+ 0.85 percent) mobility and stability (+ 22 percent) heart rate (− 1.1 percent) and lean muscle mass (+ 1.4 percent)] and cognitive function [(episodic memory (+ 9.5 percent) processing efficiency (+ 7.5 percent) executive function reaction time (− 4.8 percent) and fluid intelligence accuracy (+ 19.5 percent)].”

Interestingly, the researchers found that participants who consumed the nutrient-enriched beverage twice a day in addition to performing the exercise regimen “saw greater improvements in their ability to retain and process information. And their reaction time on tests of fluid intelligence improved more than their peers who took the placebo.”

“The exercise intervention alone improved strength and endurance, mobility and stability, and participants also saw increases in several measures of cognitive function,” Barbey explains in the news release. “They had better episodic memory and processed information more efficiently at the end of the 12 weeks. And they did better on tests that required them to solve problems they had never encountered before; an aptitude called fluid intelligence.”

“Our work motivates the design of novel multimodal interventions that incorporate both aerobic fitness training and nutritional supplementation, and illustrates that their benefits extend beyond improvements in physical fitness to enhance multiple measures of cognitive function,” Barbey concluded.

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.