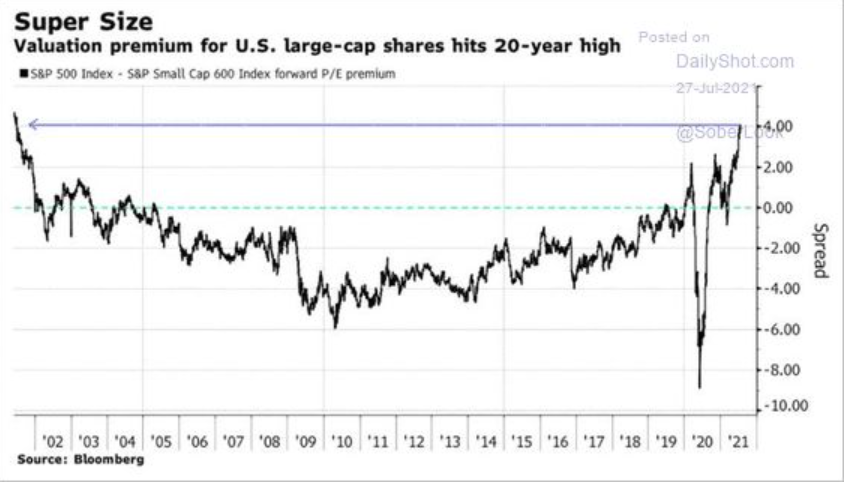

1. Valuation Premium of U.S. Large Cap vs. Small Cap Hits 20 Year High

https://www.linkedin.com/in/jonathanbaird88/

2. YouTube Content Free Same Revenue as Netflix

| YouTube and Netflix are quite similar in many ways. Both provide video content. Both have become global giants in the last 20 years. Both made about $7bn in revenue last quarter. Both have nice red logos. The difference, of course, is that Netflix has to produce or buy their content, at eye-watering expense, while YouTube’s is uploaded completely for free by its users. Social media platforms might be hard to get off the ground, but once that advertising model starts to take off, user generated content is a literal gold mine. |

|

3. November to June 30 Reversal in Beaten Down Sub-Sectors

Capital Group

Darrell Spence EconomistRitchie Tuazon Fixed Income Portfolio Manager Martin Romo Equity Portfolio Mana

https://www.capitalgroup.com/advisor/insights/articles/top-5-investment-worries-answered.html

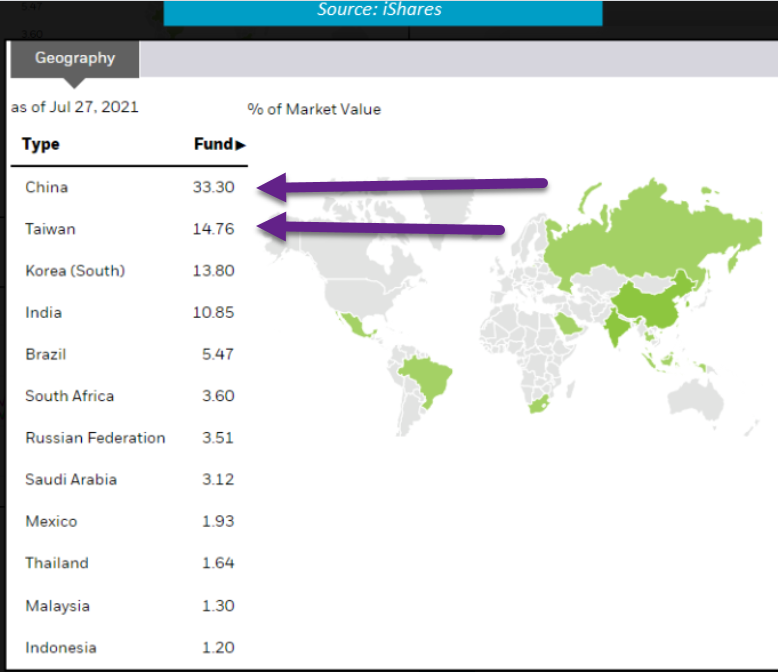

4. Emerging Markets ETF -14%

China Exposure Hits EEM ETF

5. Earnings Growth +70% vs Covid Comps….See Drawdown in Estimates for Q3 and Q4

LPL Research

6. 5 Takeaways From Powell’s Conference

BY TYLER DURDEN

WEDNESDAY, JUL 28, 2021 – 03:47 PM

Courtesy of Curvature Securities’ Scott Skyrm, here are four key takeaways from the Powell presser:

- 1. Inflation – The FOMC statement mentioned the word “inflation” or “price stability” a total of 10 times. It’s clearly on their mind, even though they continue to call it “transitory.”

- 2. Tapering – “Last December, the Committee indicated that it would continue to increase its holdings … until substantial further progress has been made … since then, the economy has made progress … and the Committee will continue to assess progress in coming meetings.” I read that as ‘we will announce tapering at a meeting in the near future.’

- 3. Standing RP Facility – The FOMC discussed the details of this facility at the last meeting and pulled the trigger today. The facility will be the mirror image of the RRP facility. The Fed will provide cash to approved Primary Dealers at a rate of .25% (upper end of the fed funds target range) with a program limit of $500 billion. Though .25% is currently well above market rates, there will be in time in the future when this facility will be used regularly. But that’s a few years away. Between now and then, the Fed officially created a corridor system for Repo rates with the RP facility as the ceiling rate at .25% and the RRP facility rate as the floor at .05%.

- 4. Goodbye IOER. The terms IORR and IOER will be replaced with IORB (Interest On Reserve Balances).

- 5. Powell defined “substantial further progress” as maximum employment with little/no regard for inflation. This means that while tapering is coming – eventually – it will be a function of improvements in the labor market not in response to soaring inflation. And should the Delta variant lead to another round of stimmies and more unemployment benefits, we may not see normalization in the labor market – and lower unemployment rates – for a long, long time.

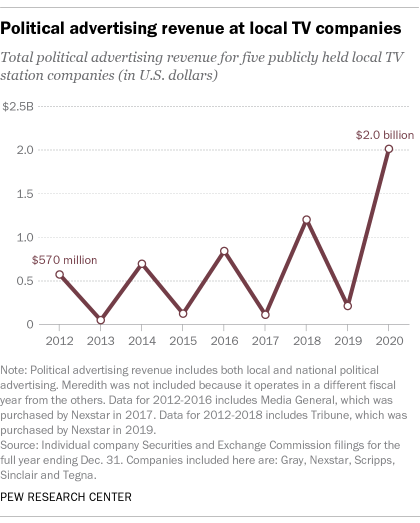

7. The Massive Jump in Political Advertising 2020 Election

Pew Research

8. Here’s a map of the Covid hot spots subject to the CDC’s new guidance

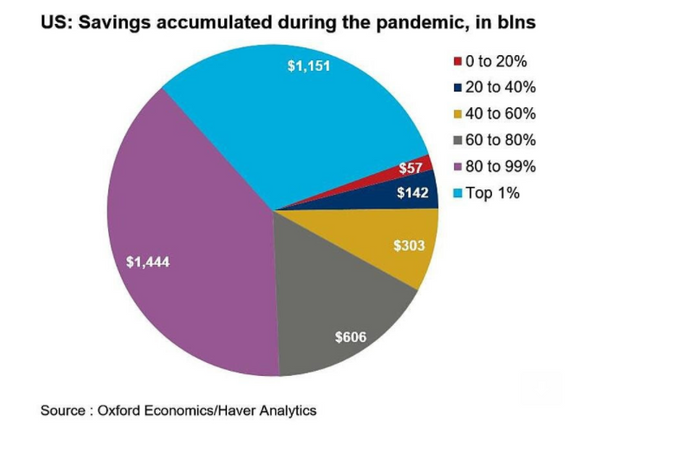

9. U.S. wealth grew by $19 trillion during the pandemic

Marketwatch By Joy Wiltermuth

Rising stocks and financial assets helped U.S. household wealth grow by $19 trillion during the pandemic to $137 trillion, but wealth inequality has gotten worse, according to a new report.

That means American household net worth increased 16% from the end of the fourth quarter of 2019 through the first quarter of 2021, marking the largest 15-month stretch of gains since 2004, according to Oxford Economics.

But more than 90% of the gains in households’ holdings of real estate, equities and mutual funds in that stretch “reflect price appreciation, with the small remaining balance coming from new investments,” economists Nancy Vanden Houten and Gregory Daco at Oxford Economics wrote, in a Tuesday note.

In other words, those who owned assets going into the crisis benefited the most.

“Those in the top 1% of the income distribution saw their wealth increase 23%, while those in the bottom income quintile experienced only a 2.5% gain in net worth,” the team wrote.

A similar pattern in U.S. savings has occurred, with more than 80% of the $2.6 trillion in excess savings residing with those in the nation’s top two income brackets.

Those who already had, have a lot more.

OXFORD ECONOMICS, HAVER ANALYTICS

10. What Pirates Can Teach Us About Leadership

27 JUL 2021|by Francesca Gino

Despite his reputation for ruthlessness, Blackbeard ran a surprisingly progressive and equitable ship. Francesca Gino highlights three lessons for today’s leaders from the golden age of piracy.

In the deep heat of an 18th-century summer, a crew of pirates was sailing off the Virginia coast when a lookout spotted a merchant ship to the south. Springing into action, the pirates launched an attack, rocking the merchant ship with a cascade of musket balls and grenades. The helmsman of the merchant ship abandoned the wheel, and the vessel swung around, allowing the pirates to board, brandishing their axes and cutlasses. Behind them, through the smoky haze, came the captain. Sashes holding daggers and pistols crisscrossed his large chest. Black ribbons flapped in his braided beard. The most feared pirate of his era, notorious English raider Blackbeard, had taken another ship.

We usually associate pirates with violence, theft, and mayhem—all indisputably true. What we may not think about, however, is how someone like Blackbeard was so effective at inspiring and commanding his crews. Pirates, it turns out, were forward-thinking in a number of surprising—and instructive—ways. Here are the three that stand out to me as raising interesting implications for our leadership.

Everyone has an equal voice. For many sailors on the open sea, merchant ships were a floating dictatorship. With the blessing of the vessel’s owner, the captain treated crewmen as he saw fit, often harshly. Sailors were beaten, overworked, underpaid, and sometimes starved. Morale was low. Dissent was punished as mutiny.

Pirates, by contrast, practiced a revolutionary form of democracy. To keep the ship running smoothly for months on end and discourage revolt, pirates voted on who should be captain, set limits on his power, and guaranteed crew members a say in the ship’s affairs. They also elected a quartermaster, who in addition to his primary duties—settling minor disputes and distributing supplies and money—served as a check against the captain’s authority.

“BLACKBEARD’S SHIP WAS ARGUABLY MORE PROGRESSIVE AND EQUITABLE THAN AMERICAN OR ENGLISH SOCIETY AT THE TIME.”

Except in the heat of battle, when the captain took full command, no single man ruled the others. Captain and crew took a vote on everything: where to go, from whom to steal, how best to steal, what to do with prisoners. And when rules were disputed, it was a jury of crewmen who decided the matter, not the captain. With enough votes, the crew could not only demote or dismiss the captain but even maroon him on an island or dump him into the sea.

A sense of ownership is powerful. Any pirate could lodge complaints or concerns without fear of reprisal, as crew members were protected by “articles”—essentially, a constitution drafted for each ship. The articles were formulated democratically and required unanimous agreement before an expedition launched. They set the rights and duties of the crew, the rules for the handling of disputes, and incentives and insurance payments to ensure bravery in battle and compensate injured crewmen. The articles gave all crew members a sense of personal investment: They felt their actions mattered.

What matters is skills and commitment, not background. As they sailed the high seas, pirates picked up mariners from different races, religions, and ethnicities, which made for a cosmopolitan lot. Though slavery was common on the land, for example, at sea, Black pirates had the right to vote, were entitled to an equal share of the booty, could bear arms, and were even elected captains of crews. Individual pirates were valued for their competence and hard work; their background and skin color were irrelevant. In fact, pirates knew that when they raided slave ships, they came away with better crews. Blackbeard’s ship was arguably more progressive and equitable than American or English society at the time.

Would they choose you to lead?

No matter our industry or role, we all face a choice of how to lead at work: in our relationships, on our teams, and in our companies. We can brandish our job title, focus on our own accomplishments, or command attention with a booming voice. Or we can choose to think like a pirate, ensuring that every person on our team “shall have an equal vote in affairs of the moment”—as stated in the first article that governed the ship of Welsh pirate Black Bart, known for capturing the greatest number of vessels during the golden age of piracy. We can seek to give each person a sense of personal investment in the team’s success. We can look beyond gender and ethnicity to elevate skills and work ethic.

“AM I THE CAPTAIN THAT MY CREW WOULD CHOOSE AS ITS LEADER TODAY?”

According to one study of more than 800 employees, those with a strong sense of ownership in their organizations—when they felt they had an equal voice, and equal stakes in team outcomes—were more committed, satisfied, and productive. When ownership of both ideas and problems becomes shared, rather than concentrated in the hands of a few, workers and their organizations thrive.

Pirate captains served at the pleasure of their crew, which meant they understood they had to earn the trust of their crewmates. Our work lives would be markedly different if we embraced the same way of thinking, asking ourselves on a day-to-day basis the same question Blackbeard would: Am I the captain that my crew would choose as its leader today? This powerful question can center our attention and energy on the very conditions that will help everyone on our crew thrive—and make the conquests that matter.

This article originally appeared on LinkedIn. Follow Francesca Gino on LinkedIn to read more of her posts.

About the Author

Francesca Gino is the Tandon Family Professor of Business Administration at Harvard Business School. She’s the author of Rebel Talent: Why It Pays to Break the Rules in Work and Life.

[Image: iStockphoto/IPGGutenbergUKLtd]

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.