1. FAANGM Market Cap 8% of S&P 2013 to 26% 2021

The Lead Lag Report

If you look at the equity markets since the March 2020 recession low (or even back over the past few years actually), the topic of market leadership has probably come up more than once. While many investors are probably satisfied with the fact that the S&P 500 and the Nasdaq 100 are sitting at or near all-time highs, it’s important to know what’s going on under the surface since it can offer hints as to whether the rally might be sustainable or not.

To be clear, there’s no right or wrong when it comes to whether market leadership is narrow or a rally is broad-based. Investors probably believe that it’s better if more sectors are participating in gains, but there’s also nothing to say that stock prices can’t keep pushing higher if only a few groups are leading the way.

We need to look no further than the tech sector over the past several years for evidence of that. The FAANMG stocks – Facebook, Apple, Amazon, Netflix, Microsoft and Alphabet – have been driving market returns for the past decade.

In 2013, the six-pack accounted for just 8% of the S&P 500. Today, that number has swelled to more than 25%. Market bulls will tell you that this is a great example of how well classic momentum investing can work, letting your winners run until they can’t run any more. Within this specific example, it’s hard to argue with the results.

The flip side of that argument, of course, is that the performance of the entirety of the rest of the equity markets outside of those six stocks has been pretty middling. An 11% annualized return since the beginning of 2013 is nothing to complain about, but it sure seems at least a little disappointing when compared to the 30% average annual return of the FAANGM collective.

2. Europe Back on the New High List

Bespoke Investment Group-It has been a period of sideways trading right near record highs for European equities since mid-June. After a break below its 50-day moving average and an apparent break of its uptrend, European equities were quick to rebound and this morning are trading right at record highs once again.

While European equities are right back at record highs this morning, from the perspective of a US investor, the picture doesn’t look nearly as bright. After a gap lower right after it traded at its last record high in mid-June, the STOXX 600 in dollar adjusted terms was hugging its 50-DMA for more than a month before breaking down earlier this week. And while the STOXX 600 was quick to rebound back above its 50-DMA in local currency terms, on a dollar adjusted basis, it hasn’t gotten there yet.

https://www.bespokepremium.com/interactive/posts/think-big-blog/europe-back-on-the-new-high-list

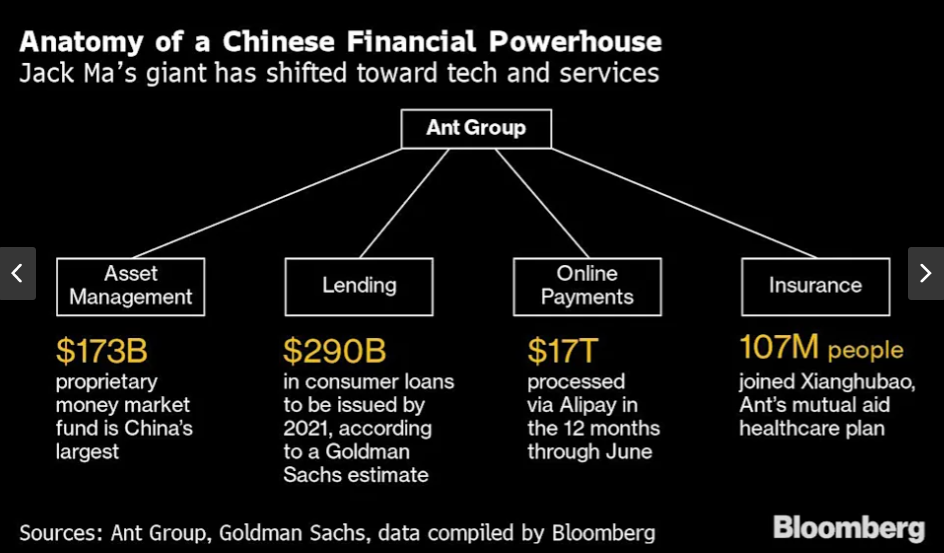

3. Why the Chinese Government is Cracking Down on Ant Group? ½ the Chinese Population in Ant Money Markets….1/2 the Chinese Population Ant Mobile Payments.

https://finance.yahoo.com/news/china-plans-online-payment-rules-105342219.html

4. Global Working Age Population Shrinking

Jim Reid Deutsche Bank Although there is a short-term issue of labour shortages in Germany, this trend will continue to get worse over the coming decade or so. Today’s CoTD shows the percentage change of the working age population between 2020 and 2035 in six major countries plus selected regions around the world. Germany is one of the worst on this measure. Indeed many major developed economies (plus China) will start to see a lower number of workers going forward. Note that China’s increased 123% between 1980-2020 but drops -7% between 2020-2035. The consensus view is that ageing is disinflation but I side with the argument that one of the biggest disinflationary forces overt the last 40 years has been a huge surge in the global labour force couple with huge growth in globalisation. So as this reverses it’s possible that workers will be able to gain lost bargaining power. This would make bad demographics going forward more inflationary.

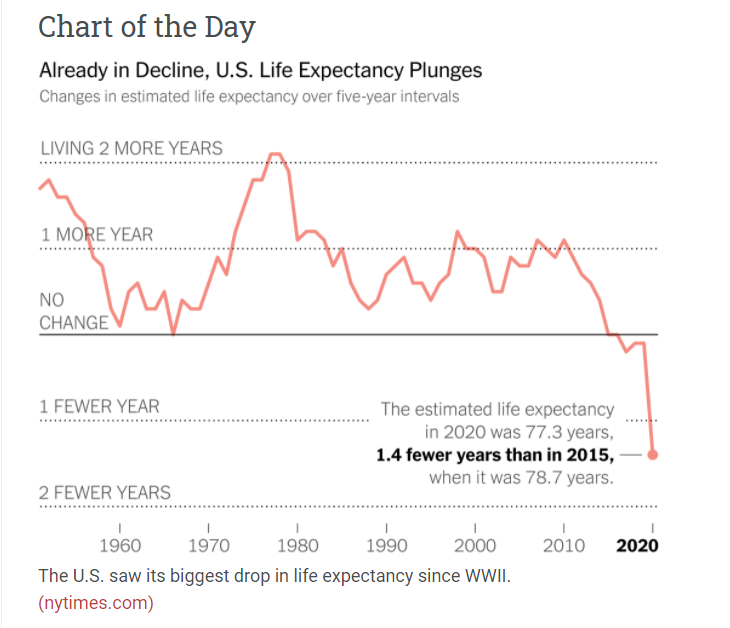

5. Life Expectancy in U.S. was Dropping Pre-Covid

From Abnormal Returns Blog

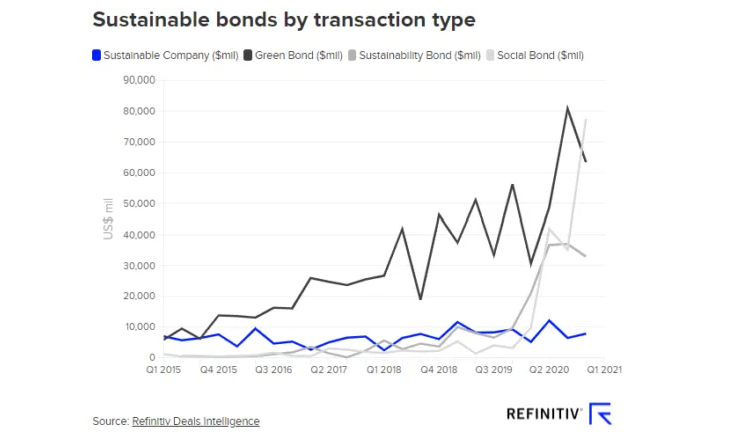

6. Sustainable Bond Industry Increased 8X in 2020….Could Hit $650B in 2021

Sustainability Bonds Surge, Could Hit $650B in 2021 BY HARUN ASAD

Originating from green bonds – now a trillion dollar industry – sustainability bonds have been growing rapidly as a way to fund key issues, including COVID-19 vaccines, climate change, biodiversity, energy efficiency measures, and more.

In 2020, the sustainability bond market increased eightfold, according to data provider Refinitiv. In the first quarter of 2021, sustainability bonds reached a new high of $287 billion, more than doubling the previous year’s record-breaking figures, and Moody’s projects sustainability bonds could hit more than $650 billion by the end of the year, a 32% increase over 2020. Social and sustainability bond categories each surpassed $100 billion for the first time, as sovereigns, multi-laterals and banks financed relief efforts related to COVID-19’s economic disruption.

The pandemic has accelerated the trend towards sustainability bonds and responsible investing. Increasingly, investors want to know where their money is going and ensure it is being used for responsible projects.

Earlier this year, Environment & Energy Leader reported that Kellogg, Amazon, Whirlpool, Pacific Life, Aflac, MasterCard, Georgia Power, and others issued sustainability bonds, some of which were first-time issuances.

Last year, the World Bank made an $8 billion, five-year sustainable development bond, the largest ever U.S. dollar bond issued by a supranational. Funds go towards financing the World Bank’s pledge of $160 billion aimed at helping countries with their pandemic recovery, $12 billion of which will be used specifically for vaccination efforts in developing countries. The aim is to reach 50 countries with these vaccination projects by the middle of this year.

7. China Launches Carbon Trading Market as Urgency to Cut Emissions Grows

July 26, 2021Posted byChina BriefingWritten byAlexander Chipman KotyReading Time:4 minutes

China recently launched the world’s largest carbon trading market, a potential landmark in the country’s efforts to go green.

The market was finally launched in Shanghai on July 16, 2021, after first being announced years ago. Regional trials began over 10 years ago, but the national market experienced several delays in launching, including missing its most recent target of opening on June 30, 2021.

Carbon neutral before 2060

As the world’s largest polluter, the carbon trading market may grow to become instrumental for China’s efforts to become carbon neutral before 2060. Measured by total emissions of companies listed on the market – responsible for over 4 billion tons of CO2 – it is easily the world’s largest.

How does the carbon trading market work?

The carbon trading market gives companies financial incentives to reduce their emissions by allotting credits to those who pollute below their allowances, while requiring those who go beyond their limit to purchase additional credits. Carbon markets aim to decrease emissions by offering financial rewards and punishments in the form of credits, allowances, or quotas that can be purchased and sold in a marketplace.

Although the market’s scope is currently limited to energy companies, its arrival adds urgency for businesses in China to integrate carbon pricing into their business and risk strategies.

China’s carbon trading market is overseen by the Ministry of Ecology and Environment, while trading is run by the Shanghai Environment and Energy Exchange.

At launch, the carbon market covers over 2,225 companies that operate coal and gas plants to produce power and heat, most of which are state-owned enterprises (SOEs). Together, these companies are responsible for about half of China’s energy-related emissions, and 10-14 percent of the world’s total.

Policymakers plan on expanding the scope of the carbon market to include other polluting industries, including steel, cement, chemicals, and aviation.

Under the carbon trading scheme, each company is allowed by the government to emit a certain amount of CO2 emissions each year. If the company ends the year beneath its allotted limit, they can sell the difference on the market as a credit. Conversely, if the company exceeds its limit, it is required to buy additional credits to compensate.

After launching, the market’s first transaction was a company purchasing 160,000 metric tons of emissions for US$1.2 million. Overall, on the first day of trading, 4.1 million tons of CO2 quotas worth RMB 210 million (US$32 million) switched hands.

This put the price on carbon at RMB 51.23 (US$7.92) per ton, a 6.7 percent increase from the opening price of RMB 48 (US$7.41).

What are the implications for China’s green economy?

China has ambitious plans to decarbonize its economy and become a leader in green technology. Most notably, Chinese President Xi Jinping committed to hitting peak emissions before 2030 and becoming carbon neutral before 2060.

The carbon market could become a key piece of the puzzle for China to hit these goals, which will require an economy- and society-wide transformation. Currently, China is the world’s largest polluter – responsible for 27 percent of global emissions in 2019 – though its emissions per capita are about half of major polluters like the US.

At a press conference, Zhao Yingmin, the vice minister for the environment, said that the market “can place responsibility for containing greenhouse gas emissions on businesses, and can also provide an economic incentive mechanism for carbon mitigation.”

Despite China’s ambitious climate goals, the carbon market has drawn mixed reviews from experts.

TransitionZero, a financial analytics group, found that the government is allotting power companies so many credits that the number of additional credits that they will need to buy will be minimal. To start, authorities are giving companies free credits so they can familiarize themselves with the system and adapt their practices accordingly.

Further, the market sets a carbon limit per unit of power generated instead of a hard ceiling on carbon emissions, making the system more relaxed than others.

Authorities will also likely encounter challenges in accurately measuring companies’ emissions, as well as preventing companies from falsifying their own. One reason that the initial market is limited to energy companies is because their emissions are more easily measurable than companies in most other sectors.

In contrast, experts view Europe’s carbon market as more effective, because its higher prices give companies greater incentive to reduce emissions.

Added urgency to integrate carbon risks and pricing

While the immediate impacts of China’s carbon market may be somewhat limited, it offers a system that can be expanded in the future to become more comprehensive.

Eventually, China’s carbon market may cover a much broader set of companies, while the emergence of a global trading system also remains a possibility. Further, the price on carbon will likely be closer to RMB 180-200 (US$27.77-30.86) per ton by the end of the decade.

Considering the trend to put a price on carbon, companies are increasingly incorporating climate risks in their business planning. Along with factors like operational and labor costs, CO2 emissions are becoming mainstream considerations for business planning. In some industries and jurisdictions, they are expected to do so from investors and other stakeholders.

One way that companies can prepare for carbon trading requirements is to put an internal price on carbon. This can either be an internal tax to encourage emissions reductions within the company to fund green initiatives, or a shadow price that allows the company to track its emissions.

As China steps up its efforts to decrease emissions, companies operating in the country will be under greater pressure to reduce their carbon footprints across their value chains.

8. Dubai Creates Fake Rain Using Drones to Battle 122 Degree Heat

BY ANABELLE DOLINER ON 7/21/21 AT 11:34 AM EDT

Scientists in the United Arab Emirates are working towards new methods of weather manipulation in an attempt to bring increased rainfall to the desert country—and so far, it appears the efforts have been successful.

The cloud seeding operation, which uses electrical charges to prompt rainfall, speaks to the growing interest globally in rainmaking technologies as an avenue for potentially mitigating drought.

According to The Independent, the cloud seeding method employed in Dubai relies on drone technology. The drones release an electrical charge into clouds, prompting them to coalesce and create rain. The technology is reportedly favored compared to other forms of cloud seeding because it uses electricity to generate rain rather than chemicals.

The Middle Eastern country receives an average of four inches of rain per year and summer temperatures that routinely surpass 120 degrees, reported the news outlet. Additionally, its sinking water table—an essential source of fresh water—poses a serious threat. As a result, in 2017, the UAE invested a total of $15 million across nine projects hoping to increase rainfall.

So far, the investment appears to be paying off: according to reports from the country’s National Center of Meteorology (NCM), cloud seeding contributed to the heavy rainfall seen across the country earlier this month. According to Gulf Today, both the NCM and Abu Dhabi Police issued warnings to the public, urging caution in the wake of poor visibility and driving conditions.

Gulf Today also reported that, since the beginning of 2021, the NCM has conducted 126 instances of cloud seeding.

These types of weather-manipulation attempts are not limited to the UAE: according to a March report, published by The Guardian, several U.S. states are looking into cloud seeding as a way to combat severe drought conditions.

https://www.newsweek.com/dubai-creates-fake-rain-using-drones-battle-122-degree-heat-1611887

9. 45% of All Undergrads at Community College.

https://www.chronicle.com/article/community-colleges-at-a-glance/

10. While many are looking for work, some older workers are jumping at the chance for a new start

By Chris Farrell

Job change, entrepreneurship, or retirement—workers over 50 are reimagining their lives

This article is reprinted by permission from NextAvenue.org.

You probably heard: Meghan McCain is leaving ABC’s “The View” after nearly four years. Among her reasons for quitting is that COVID-19 “has changed the world for all of us,” she told the Guardian. “It’s changed the way I’m looking at my life, the way I’m living my life, the way I want my life to look like.”

Few of us have the net worth or name recognition of Meghan McCain, who’s 36. Yet her sentiment resonates among many who’ve worked throughout the pandemic, often tethered to their computers at home.

Record numbers of workers are part of what’s been dubbed “The Big Quit” or “The Great Resignation,” as economies emerge from the pandemic. If a recent Microsoft MSFT, +1.23% survey is even close to the mark, 41% of the global workforce plan on saying goodbye to their employer and colleagues this year.

Many of the quitters are, and will be, people 50+. Some for greener pastures at other employers or ventures they’re starting; others for retirement.

The flurry of emailed farewells and virtual goodbye gatherings around the U.S. lately reflect worker confidence that the U.S. economy’s rebound is strong enough that they’re willing to take a risk and leave their jobs.

Demand for workers means options for some

Their timing is savvy considering how strong the demand is for workers.

Companies are fighting for talent, and that’s the definition of a good market for anyone looking to voluntarily change jobs. Generally speaking, household finances seem unusually supportive for funding a job search, too. Economists estimate Americans accumulated an excess of $2 trillion in savings during the pandemic, though they are quick to add that many are struggling.

Seasoned workers with retirement savings plans have done well lately since the markets have been strong and 401(k) contributions have remained relatively steady. Home values also rose sharply during the pandemic in many places, and older Americans tend to be homeowners.

“In a world where workers don’t have a lot of power, quitting is the one bargaining chip they have,” says Geoffrey Sanzenbacher, research economist at the Center for Retirement Research at Boston College. And, he added, many older workers “have something they’ve wanted to do for a while” — which could be starting a business, following a passion or retiring.

Something else is at work, though.

For the past two decades, the combination of stagnant wages and job insecurity deterred many people from quitting while older workers had the added concern of age discrimination.

See: These workers would quit their jobs, but worry about losing health care

The ‘life is short’ phenomenon at work

But the social isolation endured by so many during the pandemic and the trauma following the murder of George Floyd by a former Minneapolis police officer pushed many to rethink and reimagine what they were doing with their lives and at work.

“With so much change upending people over the past year, employees are re-evaluating priorities, home bases and their entire lives,” according to the Microsoft report. “So, whether it’s due to fewer networking or career advancement opportunities, a new calling, pent-up demand or a host of pandemic-related struggles, more people are considering their next move.”

Among those considering their next move are Nancy Collamer’s clients. A retirement coach based in Pennsylvania and a popular Next Avenue contributor, Collamer has been hearing from people looking for help figuring out their next chapter.

One motivated longtime volunteer lost her husband (not from COVID-19) during the pandemic. The combination of his death and the coronavirus cloud have convinced the woman that life is fleeting and things can change on a dime. She’s now driven to find a more purposeful path with her volunteer work.

A client of Collamer’s in the financial services industry realized during the pandemic how much he enjoyed being with his family. He now dreads traveling for work and is looking to make a job change, possibly a career change.

“A common thread is that the pandemic gave them the time to pause and think about what they wanted to do with their lives,” says Collamer.

Job changes and longer work lives

To be sure, money isn’t an obstacle with her clients. Nevertheless, for anyone able to take the leap there’s intriguing evidence that voluntary job changes among late-career workers lengthen their work lives.

Take research by Sanzenbacher, Steven Sass and Christopher Gillis at the Center for Retirement Research. They looked into voluntary job changes by workers ages 51 to 61 from 1992 to 2012 and followed them to age 65. They discovered that a voluntary job change was associated with a 9.1% increase in the likelihood of remaining in the labor force until 65.

The effect held for different socioeconomic groups. For those with at least some college, the increase was 10.9% and for those with high school or less, 7.5%.

“If you’re leaving an employer for more pay or because you like it better, both are good,” says Sanzenbacher.

The rise in risk-taking reflected in what’s known as the “quit rate” has also been showing up in new business creation numbers.

University of Maryland economist John Haltiwanger noted in a recent paper that the pace of new business applications since mid-2020 was the highest on record (although the series only goes back to 2004).

He adds that things are much different from the economic trauma so many felt a dozen years ago when entrepreneurship declined during the 2007-09 recession.

The Kauffman Foundation, which studies entrepreneurship, also has seen a sharp increase in startup activity in 2020. A majority of new entrepreneurs, Kauffman says, were 45 and older.

To be sure, the pandemic has meant the number of new entrepreneurs finding it necessary to start a business just to pay their bills reached its highest level over the past 25 years at least.

New businesses: for passions and to pay the bills

“Individuals starting a business as an opportunity, rather than a necessity, went down for everyone,” says Robert Fairlie, an economist at University of California, Santa Cruz.

Nevertheless, you don’t take the risk of launching a business unless you believe there’s an opportunity to make a go of it — a reasonable bet these days for midlife entrepreneurs.

“The data shows that older entrepreneurs have assets and the knowledge base to succeed,” says Susan Weinstock, vice president of financial resilience programming at AARP. “I think we will be seeing many more small businesses being founded by older workers.”

Despite several challenges, the U.S. economic rebound is on track to be among the strongest and quickest in history. If that’s the case, the time to think about making a late-career shift or starting your own business is now.

As former Treasury Secretary Larry Summers once wrote, a good economy is when “firms are chasing workers rather than workers chasing jobs.” That’s certainly the case today.

Collamer says when deciding on your next avenue, it helps to think through two key questions: “Who or what energizes you? And who or what drains you?”

Now is a good point in this column to pause and reflect on what’s going on with America’s job market and what experienced workers are facing.

Coming out of the pandemic, the rise in voluntary quits and the embrace of second-life entrepreneurship is mostly positive. Other parts of the job market, however, are disturbing.

Over half of job seekers 55 and older were long-term unemployed in June, meaning they’d been looking for work for at least six months. The longer someone is unemployed, the harder it is to get another job — and that’s before taking age discrimination into effect.

Uncertainly also swirls around the sharp increase in retirees last year.

Also on MarketWatch: This is the ‘best place’ to live in America — and it isn’t on the coast

According to Pew Research Center, 3.2 million more boomers retired in the third quarter of 2020 compared with 2019, and many of them not by choice. The COVID-19 economy hit older workers living on low and unstable incomes much harder than their high-earning peers.

“There are a lot of confounding factors in what is going on here now that the economy is opening up and people are going back to work,” says Weinstock.

Many questions about the state of older workers won’t be known for at least another year, if not more. But for those who are able to reimagine their lives, the economic recovery is an opportune time to seek the purpose they discovered in isolation.

Chris Farrell is senior economics contributor for American Public Media’s Marketplace. An award-winning journalist, he is author

of “Purpose and a Paycheck: Finding Meaning, Money and Happiness in the Second Half of Life” and “Unretirement: How Baby Boomers Are Changing the Way We Think About Work, Community, and The Good Life. ”

This article is reprinted by permission from NextAvenue.org, © 2021 Twin Cities Public Television, Inc. All rights reserved.

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania.