1. Margin Debt 2 Standard Deviations Above Trend.

Jonathan Baird https://www.linkedin.com/in/jonathanbaird88/

2. Broad Commodities Index Makes New Highs.

Inflation Real or Transitory?

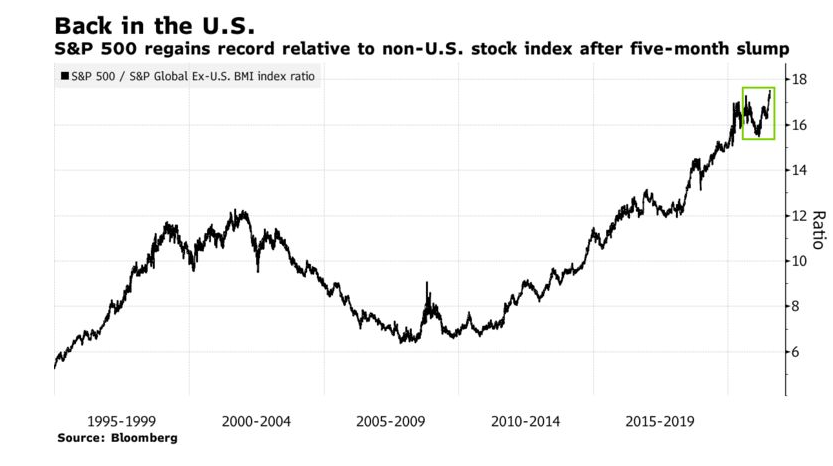

3. U.S. Stocks Regain Record Outperformance Over International.

Tech Stocks Lead S&P 500 Gains; Treasuries Climb: Markets WrapBy Rita Nazarethand Claire Ballentine

https://www.bloomberg.com/news/articles/2021-07-21/asia-stocks-to-rise-after-earnings-led-u-s-climb-markets-wrap?srnd=premium&sref=GGda9y2L

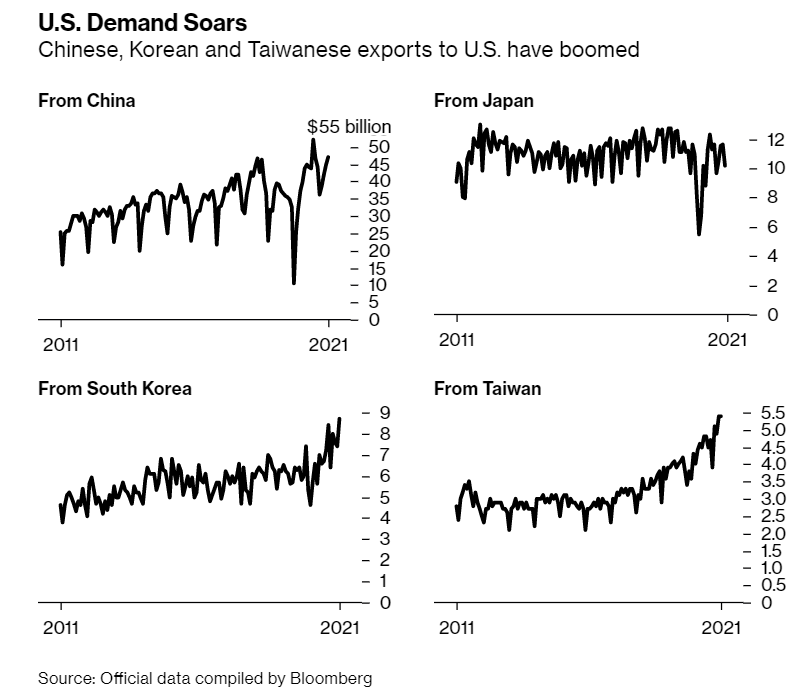

4. So Much for Trade War…Asian Exports to U.S. Boom.

- China buying more farm goods; U.S. consumer demand strong

U.S. imports are ‘through the roof,’ retail federation says

U.S.-China Trade Booms as If Virus, Tariffs Never Happened By Eric Martinand James Mayger https://www.bloomberg.com/news/articles/2021-07-22/u-s-china-goods-trade-booms-as-if-virus-tariffs-never-happened?srnd=premium&sref=GGda9y2L

5. Dominos Pizza Another 100 Point Spike.

Tech Company Domino’s Pizza

6. Natural Gas is the Largest Source of Electricity in U.S.

UNG natural gas chart just getting back to pre-covid levels

©1999-2021 StockCharts.com All Rights Reserved

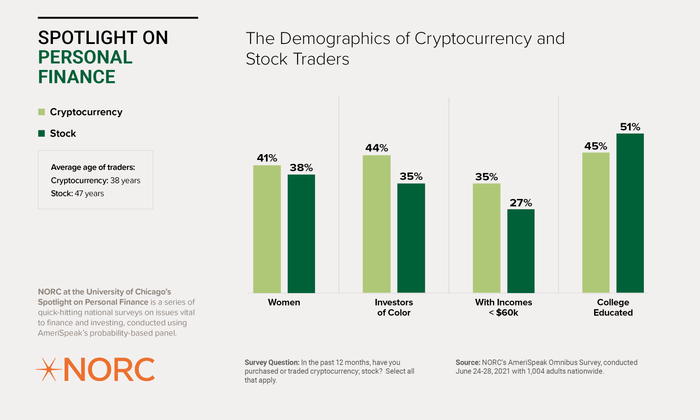

7. 13% of Americans Bought Crypto Last Year

Some 13% of Americans have bought or sold a cryptocurrency such as bitcoin, ether, or dogecoin in the past year, according to a report based on a survey of more than 1,000 people published Thursday by researchers at the University of Chicago.

Of these investors, some 41% are women, 44% are people of color, 35% earn less than $60,000 a year, and 45% are college educated, according to the survey that was conducted between June 24 and June 28.

Meanwhile, some 24% of Americans bought or sold stocks during the same one-year period. Of these investors, 38% are women, 35% are people of color, 27% earn less than $60,000 a year, and 51% are college educated.

More than 1 in 10 Americans invested in crypto this year — here’s how they differ from stock market investorsBy Elisabeth Buchwald

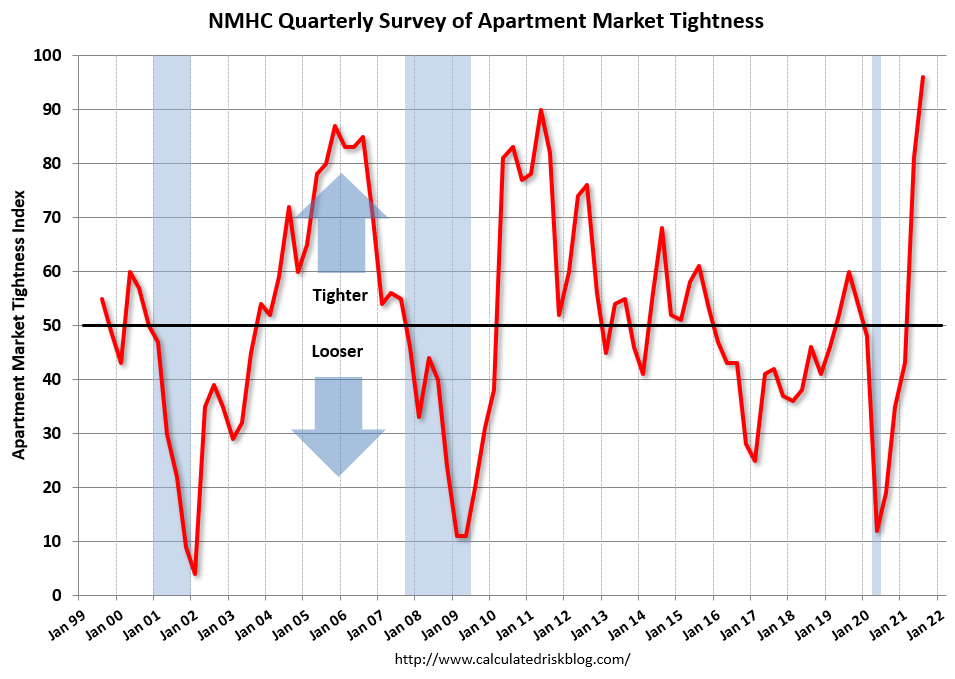

8. Apartment Market Tightness Hits a Record.

Chart of the Day

The Market Tightness Index increased from 81 to 96 – the highest index number on record – indicating widespread agreement among respondents that market conditions have become tighter. Nearly all (92 percent) respondents reported tighter market conditions than three months prior, compared to only 1 percent who reported looser conditions. Seven percent of respondents felt that conditions were no different from last quarter.

emphasis added

The apartment market is rapidly tightening.

Found at Abnormal Returns Blog www.abnormalreturns.com

9. Start-Up Claims Breakthrough in Long Duration Batteries.

WSJBy

Russell Gold

-A four-year-old startup says it has built an inexpensive battery that can discharge power for days using one of the most common elements on Earth: iron.

Form Energy Inc.’s batteries are far too heavy for electric cars. But it says they will be capable of solving one of the most elusive problems facing renewable energy: cheaply storing large amounts of electricity to power grids when the sun isn’t shining and wind isn’t blowing.

The work of the Somerville, Mass., company has long been shrouded in secrecy and nondisclosure agreements. It recently shared its progress with The Wall Street Journal, saying it wants to make regulators and utilities aware that if all continues to go according to plan, its iron-air batteries will be capable of affordable, long-duration power storage by 2025.

Its backers include Breakthrough Energy Ventures, a climate investment fund whose investors include Microsoft Corp. co-founder Bill Gates and Amazon.com Inc. founder Jeff Bezos. Form recently initiated a $200 million funding round, led by a strategic investment from steelmaking giant ArcelorMittal SA, MT 0.95% one of the world’s leading iron-ore producers.

Form is preparing to soon be in production of the “kind of battery you need to fully retire thermal assets like coal and natural gas” power plants, said the company’s chief executive, Mateo Jaramillo, who developed Tesla Inc.’s Powerwall battery and worked on some of its earliest automotive powertrains.

On a recent tour of Form’s windowless laboratory, Mr. Jaramillo gestured to barrels filled with low-cost iron pellets as its key advantage in the rapidly evolving battery space. Its prototype battery, nicknamed Big Jim, is filled with 18,000 pebble-size gray pieces of iron, an abundant, nontoxic and nonflammable mineral.

Iron pellets that fill the battery are abundant and inexpensive and could hold electricity for days or weeks.

The battery cathode acquired from NantEnergy was a break for Form Energy.

For a lithium-ion battery cell, the workhorse of electric vehicles and today’s grid-scale batteries, the nickel, cobalt, lithium and manganese minerals used currently cost between $50 and $80 per kilowatt-hour of storage, according to analysts.

Using iron, Form believes it will spend less than $6 per kilowatt-hour of storage on materials for each cell. Packaging the cells together into a full battery system will raise the price to less than $20 per kilowatt-hour, a level at which academics have said renewables plus storage could fully replace traditional fossil-fuel-burning power plants.

A battery capable of cheaply discharging power for days has been a holy grail in the energy industry, due to the problem that it solves and the potential market it creates.

Regulators and power companies are under growing pressure to deliver affordable, reliable and carbon-free electricity, as countries world-wide seek to reduce the greenhouse-gas emissions linked to climate change. Most electricity generation delivers two out of three. A long-duration battery could enable renewable energy—wind and solar—to deliver all three.

10. 5 Negative Traits of Insecure Leaders

By Lisa M. Aldisert | February 27, 2017 | 1

Most of us have had horrible bosses at some point in our careers. And if we’re being honest, we might even admit to having been a horrible boss at some point.

Related: 15 Traits of a Terrible Leader

The truth is that poor management behavior is all too common and is typically driven by one factor: insecurity. All leaders have insecurities whether or not they admit it. Good leaders want to do well for their people and the organization (What if I’m not making the right decision for my employees? What if this idea doesn’t work?). But for poor leaders, insecurities often come from a personal level.

Managers with low self-awareness frequently take the impact of personal challenges and project those issues onto employees, which is the ultimate outcome of not taking ownership of insecurities. It’s the equivalent of packing your insecurities into a briefcase each day and bringing them with you to work.

Here are five negative leadership behaviors that are driven by insecurity:

1. Bullying

This behavior usually manifests in the form of inappropriately harsh words and actions toward employees. Bullies also thrive on escalating employee mistakes into public hangings—Cc’ing colleagues and managers on condemning emails or calling out employees in meetings.

The justification for this type of bad behavior is usually “this is what it takes to get the job done.” Some managers believe that making an example of an employee will encourage the rest of the team to do better, when in fact it has the opposite effect. Watching your colleagues suffer public shame only serves to lower morale and create fear.

There is also often a power trip at play here. The leader does not feel like he or she is in control of the situation or of the people involved, and must take the employee down a notch to prove dominance.

2. Know-It-All

The attitude here is one of superiority. This manager has all the answers and wants everyone to know it—even to the point of taking decision-making and autonomy out of the hands of his employees.

Part of a leader’s role is to help employees grow and develop. The know-it-all will never accomplish this task. Employees whose opinions, ideas and decisions are habitually squashed will eventually check out, become complacent or start looking for new jobs.

The leader feels threatened in his or her position—maybe he is trying to prove himself as a new manager or trying to prevent his authority from being taken away. Let me let you in on a little secret: Managers who have to continually fight for their authority don’t have any authority to begin with.

3. Lack of Response

This is when the leader doesn’t reply to requests or completely ignores the situation in an attempt to avoid revealing inexperience. The insecurity at play here is the fear of being exposed as ignorant.

This type of insecurity can bubble to the surface in the face of new technology, projects that require additional skills, or when dealing with employees who are incredibly smart and capable. Leaders who don’t feel comfortable with their expertise (and their limitations) will be threatened by employees who know more than they do and by situations where their lack of expertise is evident.

Managing is a completely different skill than knowing. You don’t have to be the expert at everything to be a great leader. You just have to know how to get results out of people.

This leader makes reviews on minutia, takes projects out of people’s hands and simply makes her employees feel useless at every turn. Whether it’s driven by inflated ego (nobody can do it as well as she can) or lack of faith in employee abilities, the leader who micromanages is simply afraid to let go.

The leader cannot achieve success on a project without stepping in to shepherd or even do the work. This often happens when a star employee has been promoted to a leadership position because of her technical expertise, but lacks the management expertise to truly lead. Instead, she defaults to using her knowledge as a crutch, when the real work she should be doing is managing her people to success.

The harsh truth is that if you are not competent at getting results through the skills of other people, you should not be a manager.

5. Avoidance

This behavior centers on fear of the unknown. Whether it’s the new leader who feels like he is in over his head or the senior leader who can’t seem to make difficult decisions, avoidance is a common expression. It is played out in endless procrastination, reluctance to commit to bold goals, circumventing performance reviews and avoiding letting horrible employees go because of their institutional knowledge.

Leaders who operate from a place of fear will almost never make the best decisions for the team or the organization. Many times avoidance comes from insecurities about making course corrections along the way. But in today’s work environment, you’ll only stay competitive if you are nimble enough to embrace change when there’s a better way.

Many leaders don’t realize how deeply their personal insecurities play into their managerial styles, and how habitual these behaviors can become if left unchecked. Not only can insecurities manifest themselves as undesirable behavior toward employees, but they are often embarrassingly obvious to the rest of team—and somehow not apparent to the leader exhibiting the behavior.

Leaders who are honest with themselves and develop stronger self-awareness can make better decisions about what they need to change in order to improve. Everyone has insecurities. It’s just a matter of leaving them at home.

Related: 11 Types of Ineffective Leaders

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..