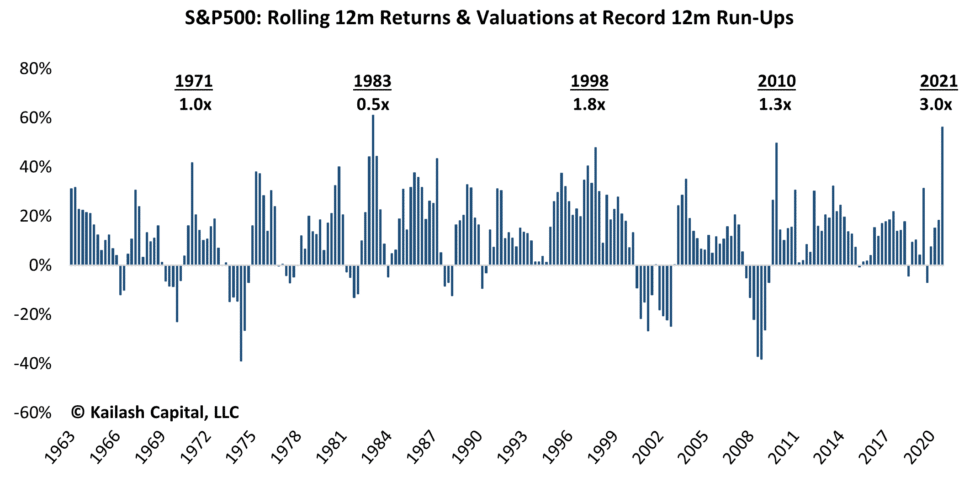

1. The market has never run this far this quickly to a multiple this high.

KCR Concepts-Record Returns & Record Prices:

- The chart shows the rolling annual returns of the S&P 500 since 1963

- We put the Price to Sales ratio above the years that returned over 40% (the 96th percentile)

- In the year ending March 1998 the market rose 48% and was valued at 1.8x sales – a level which was a precursor to the final run higher into the peak of the dot.com bubble

- The 12 months ending in March 2021, the S&P was up 56% – the third highest return in history

- Post this 56% run the market hit 3.0x sales, valuing the market higher than the peak of the speculative bubble in 2000

The market has never run this far this quickly to a multiple this high. Massive stimulus from the federal reserve, record low bond yields and investor enthusiasm have sent equities markets to peak returns and peak valuations.

https://kailashconcepts.com/stock-market-bubble/?twclid=11417965198846144515

2. No 5% Pullbacks Since October 2020

LPL Research

https://lplresearch.com/2021/07/21/is-it-time-for-a-5-pullback/

3. QQQ +15% vs. ARKK -3% YTD….Mega Cap Tech Over Disruptor Tech 2021

4. Firms Raising Prices and Short Labor Above 50%

Blackrock–The graph below shows that about half of firms surveyed this year are planning on raising prices, with 60% having problems hiring – meaning wages may not go down any time soon.

Source: Bloomberg, National Federation of Independent Businesses (NFIB) survey data, as of June 8, 2021.

Why inflation can be good, but why investors need to pay attention | BlackRock

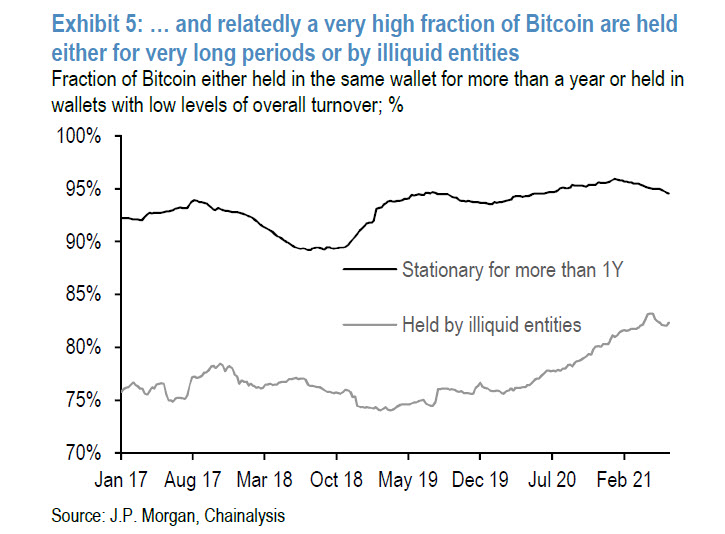

5. Majority of Bitcoin Held in “Illiquid Entities”

Twitter Zerohedge https://twitter.com/zerohedge

6. Bitcoin’s 50% Drop From Peak Hammers Crypto Loans, Derivatives

Bloomberg-Justina Lee

Wed, July 21, 2021, 11:13 AM·3 min read

(Bloomberg) —

The 2021 Bitcoin bubble is deflating and hitting a $1.3 trillion industry built on to-the-moon speculation and rampant leverage.

The damage from the latest selloff is spreading across the world of crypto loans, options and futures — wiping out money-spinning strategies from the famous basis trade to yield farming.

Even with Wednesday’s rebound, Bitcoin at around $31,700 is still trading near the lower end of its range over the past two months, and down about 50% from the April peak.

This means bulls are getting schooled on the need for restraint, with hedging costs rising and trading activity across the much-hyped decentralized finance community on the wane.

“The hype has toned down,” said George Zarya, chief executive officer at crypto prime brokerage Bequant. “It’s a 24/7 market, so for the entire industry it’s an exhausting process. When summer comes, it’s very timely. You need a little bit of rest.”

Here are all the signs crypto speculators have yet to regain their gumption after the May rout.

Spot and derivatives turnover totals $2.6 trillion this month, on track to reach the lowest since December, CryptoCompare data show. The number of active and new Bitcoin addresses has also fallen. On Deribit, the largest options exchange, Bitcoin’s implied volatility is rising again this week to 88% from a recent low.

Another window into how bullish sentiment is vanishing is the reversal of the basis trade, the once-lucrative quant strategy that arbitrages the spread between the futures market and the spot price.

When a $100,000 Bitcoin price target was in vogue in April, a roughly 50% annualized premium in futures was par for the course. That effectively meant some traders were so gung-ho on the underlying asset, they were willing to pay big time for their bet.

But since the May crash, the interest rate bulls pay to roll over their futures has collapsed to zero or even become negative.

“The overall sentiment among professional crypto quantitative traders is that we are still in the super bull cycle,” Reisman at YRD Capital said.

https://www.yahoo.com/now/bitcoin-50-drop-peak-hammers-151328225.html

7. High Prices Driving Sellers to List in Home Market.

Have Home Prices Peaked?by Michael Batnick https://theirrelevantinvestor.com/2021/07/21/have-home-prices-peaked/

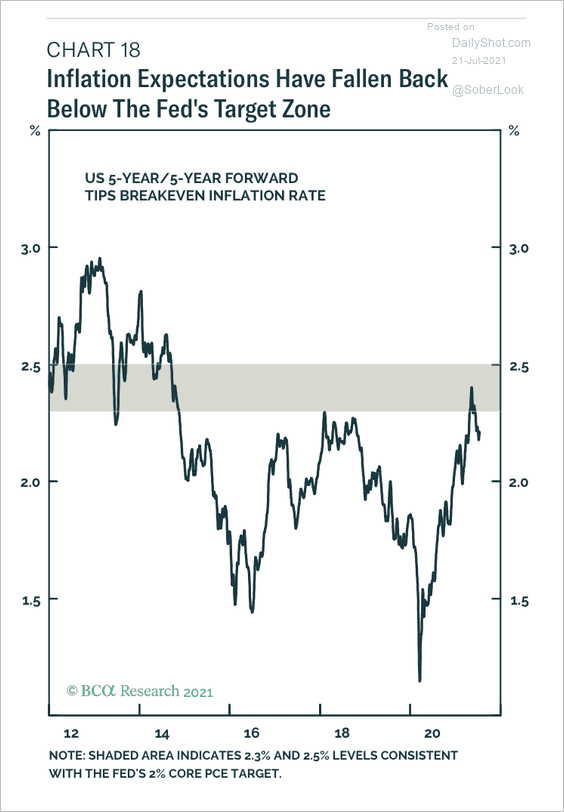

8. Inflation Expectations Back Below 2.5%

Source: BCA Research

The Daily Shot Blog https://dailyshotbrief.com/the-daily-shot-brief-july-21st-2021/

United States: Longer-dated market-based inflation expectations have been moderating, …

9. Highest Paid Musicians.

|

| Taylor Swift has topped Billboard’s list of the highest paid music artists, raking in more than $23m last year in the US according to their estimates. It turns out that dropping 2 new albums and a re-release of an older album in one year is a good way to please your fanbase. Billboard estimates that roughly half of Swift’s music income came from streaming payouts — with another $10m from sales and $3.2m from publishing rights. Swift didn’t make a dime from touring thanks to COVID restrictions, but that wasn’t the case for everyone. Queen of touring Celine Dion may have only made an estimated $300k from streaming last year, but she more than made up for it with an enormous haul from touring. Dion squeezed in 23 shows before the corona curtain came down, equating to almost $50m in gross ticket sales — of which she took home $17m according to Billboard estimates. The Eagles also managed to squeeze in some shows, netting the classic group more than $11m for their efforts. Check out the full list of music money makers at Billboard. |

10. Corporate Psychopathy- How Do Destructive Leaders Attain (and Sustain) Power?

Psychology Today-Corporate psychopathy refers to individuals who function inside an organizational setting, and exhibit dominating behaviors in pursuit of positions of power and influence, as well as personal gain and affluence (Boddy, 22 2013; Spencer & Byrne, 2016; Walker & Jackson, 2016).

Psychopathy in the workplace is distinguished from the psychopathology studied in the psychiatric community in that the former is associated with leaders in organizations who have lower levels of organizational commitment and lower social responsibility tendencies (Boddy, 2013), while the latter is associated with neurological irregularities and criminality. Corporate psychopathy exists on a continuum, and can include any or all of the following traits:

· Reduced guilt/reduced regret/lack of remorse/low on shame/low embarrassment, with individuals begging for forgiveness not out of guilt but to reduce potential consequences.

· Faking morals and emotions

· Taking without reciprocity

· High levels of anger, rage, and indignation

· Corporate crime

It’s difficult to evaluate just how prevalent corporate psychopathy is across the business world, because by definition, these leaders have traits that mask their behavior. They’ve become adept at making it difficult to measure the depth of the harm they’ve caused.

How Do People Gain This Power?

The present moment is showing us just how common corporate psychopathic behavior is, and while the first step is to hold these leaders accountable for their actions, the next reckoning will be examining just how we allow it to continue.

Culture is a key factor, as so much of our language around business is tied to success at all costs and a winner-take-all attitude. Once again looking at Scott Rudin, his abusive behavior was often written off as a sign of his eccentricities. He was successful, so he was allowed to remain abusive.

That level of success also comes with freedom from consequences, for both the perpetrator and those who go along with the behavior. Compliance is rewarded, so behavior perpetuates. This is an example of the Toxic Triangle, the combination of a destructive leader, susceptible followers, and a conducive environment. This perfect storm is responsible for so much of the pain and destruction that happens in corporate environments today, and it’s a big reason leaders rise to the top and maintain their grip on power.

So what can you do if you are a leader in an organization that has allowed a corporate psychopath to prosper, or if you work for someone who fits the description?

Working for or alongside a corporate psychopath is never easy. If you find yourself working for a psychopathic leader, know that your voice matters now more than ever, and actively seek avenues for help. For yourself, certainly, but also for the sake of others who may be experiencing this leader, and the organizations that they may negatively impact.

We’ve reached an inflection point where there is more opportunity to speak up and voice concerns than ever before. However, the opportunity isn’t always equally applied, and one effect of larger-than-life personalities is that those who cast aspersions their way are often viewed with skepticism. It took years for the open secret of Rudin’s behavior to be taken seriously by the press, and not everyone has access to media contacts who can break the dam.

It’s imperative that organizations take steps now to ensure that there are clear channels for those suffering under psychopathic leadership to pursue help, gain internal support, and make a career change if they so desire.

A huge part of this process is for boards and the senior decision-makers who are putting these leaders into power to understand that they may be producing unsustainable short-term business outcomes, due to the human cost surrounding them.

Human resources professionals and other leaders can get educated on the signs/indicators of corporate psychopathy that are outlined here. Be prepared to act, regardless of whether or not you currently see any signs of corporate psychopathy. After all, so many of the examples I’ve provided have remained hidden, and that may be the case right now.

LinkedIn image: Thomas Andre Fure/Shutterstock

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..