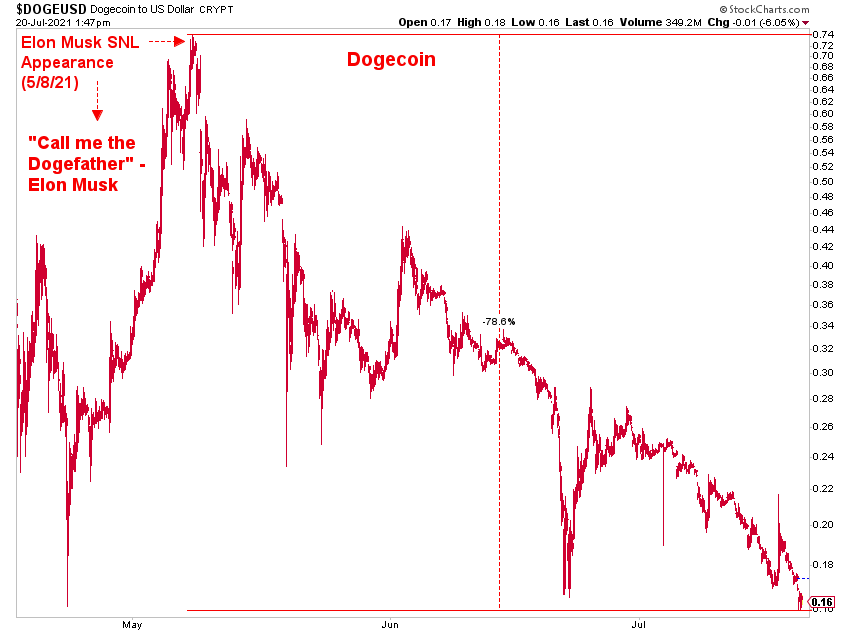

1. I golfed the Saturday Morning Before Musk SNL Appearance and Both Caddies were Long Dogecoin.

Charlie Bilello https://twitter.com/charliebilello

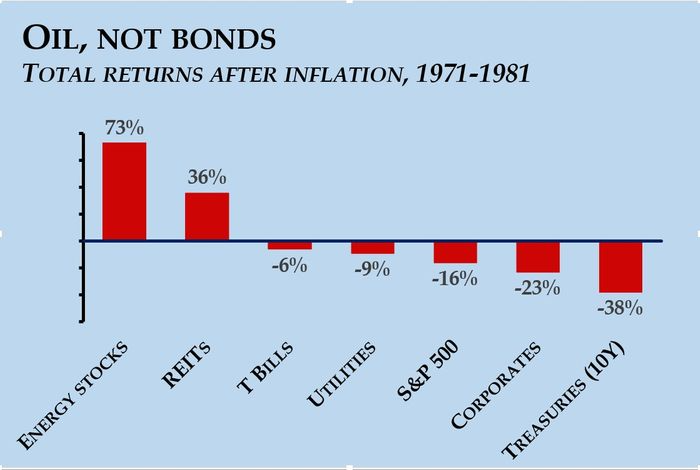

2. Total Returns After Inflation 1971-1981

Nonetheless the chart above shows the total returns, after adjusting for inflation, of various asset classes from December 1971 to December 1981. (I used those dates because the National Association of Real Estate Investment Trusts, or NAREIT, starts their data series then.) The data on energy stocks came from data compiled by professor Ken French at Dartmouth College’s Tuck School of Business.

This is what happened to your purchasing power if you invested in these assets and hung on for 10 years. (I’ve excluded gold, which is a different story.)

The key standout is that you really didn’t want to own Treasury bonds. The near 40% loss of purchasing power over 10 years is somewhat notional—it is derived from the compound annual returns on 10 Year Treasurys compiled by New York University’s Stern School of Business, divided by the consumer-price index—but tells a story nonetheless. (In Great Britain, where inflation was even worse, government bonds during the 1970s became known as “certificates of confiscation.” Ouch.)

Holding them cost you money. Lots of it.

You could argue that the danger today is even greater, simply because the yields on long-term Treasury bonds are so low. Federal Reserve quantitative easing, bond buying, and zero interest-rate policies have left Treasury yields at their lowest on record—which means the turns would be a disaster if inflation reared its head.

Brett Arends’s ROIOpinion: Worried about inflation? Here’s how investments did in the 1970sBy Brett Arends

3. Margin Debt Hits $900B

FINRA has released new data for margin debt, now available through June. The latest debt level is up 2.4% month-over-month and is at a record high.

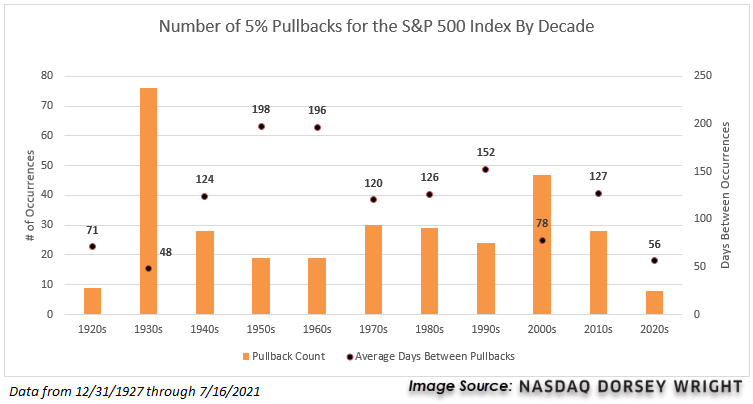

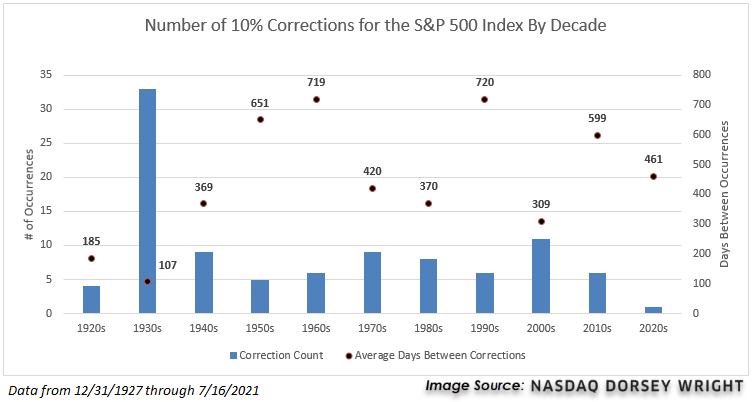

4. History of 5% and 10% Corrections by Decade.

5. Used Car Index -24% from Highs

Continuing to see significant cooling in

used vehicle value index … now at 24.6% y/y; not low but continuing to fall from peak of 54.2% in April (reminder: used car prices significantly boosted CPI #inflation over past few months)

Liz Ann Sonders Schwab https://twitter.com/LizAnnSonders

6. Negative Yielding Debt Ticks Back Up

https://twitter.com/Schuldensuehner

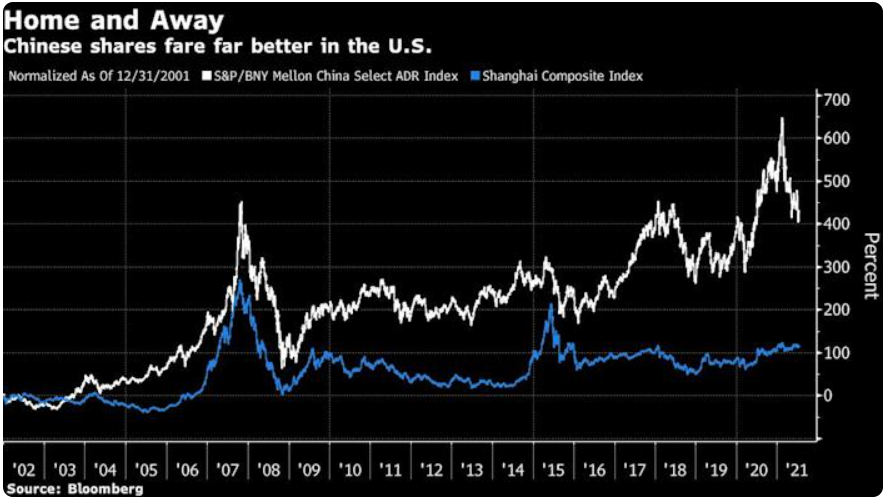

7. China Signals End to $2 Trillion U.S. Listings Juggernaut

China Signals End to $2 Trillion U.S. Listings Juggernaut

(Bloomberg) — For two decades Chinese tech firms have flocked to the U.S. stock market, drawn by a friendly regulatory environment and a vast pool of capital eager to invest in one of the world’s fastest-growing economies.

Now, the juggernaut behind hundreds of companies worth $2 trillion appears stopped in its tracks.

Beijing’s July 10 announcement that almost all businesses trying to go public in another country will require approval from a newly empowered cybersecurity regulator amounts to a death knell for Chinese initial public offerings in the U.S., according to long-time industry watchers.

“It’s unlikely there will be any U.S.-listed Chinese companies in five to 10 years, other than perhaps a few big ones with secondary listings,” said Paul Gillis, a professor at Peking University’s Guanghua School of Management in Beijing.

https://finance.yahoo.com/news/china-signals-end-2-trillion-200000164.html

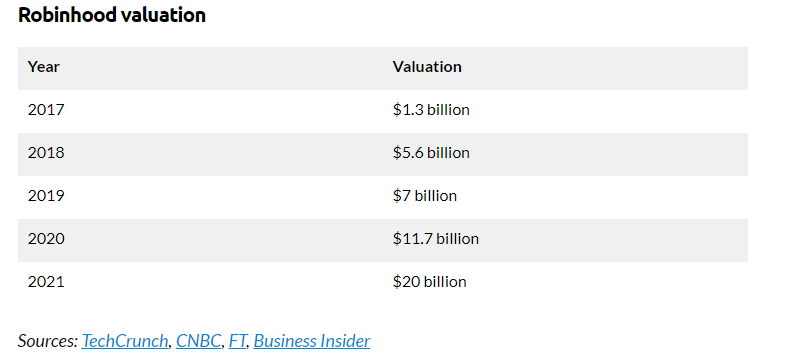

8. Robinhood is seeking a market valuation as high as $35 billion in upcoming IPO

CNBC Maggie Fitzgerald@MKMFITZGERALD

KEY POINTS

· Robinhood is seeking a market valuation of as much as $35 billion in its upcoming initial public offering, according to its amended prospectus released Monday.

· The stock trading app will attempt to sell its share at a range of $38 to $42 per share.

· Robinhood is looking to sell 55 million shares at that range to raise as much as $2.3 billion.

Robinhood is seeking a market valuation of as much as $35 billion in its upcoming initial public offering, according to an amended SEC filing released Monday.

The stock trading app will attempt to sell its share at a range of $38 to $42 per share, according to the updated prospectus. Robinhood is looking to sell 55 million shares at that range to raise as much as $2.3 billion.

Robinhood’s last private market valuation was $11.7 billion as of September.

Goldman Sachs, Citigroup and JPMorgan are the lead underwriters on the deal.

Robinhood — which plans to trade on the Nasdaq under the symbol HOOD — also updated several of its financial and user metrics in the filing. The company estimates it has 22.5 million funded accounts — those tied to a bank account — as of the second quarter, up from 18 million in the first quarter of 2021.

The Menlo Park, California-based free-trading pioneer estimates second quarter 2021 revenue between $546 million and $574 million. This would be an 129% increase from the $244 million in the second quarter of 2020. The company generated $522 million in revenue in the first quarter of 2021.

However, Robinhood estimates a net income loss of $537 million to $487 million in the second quarter of 2021, compared with a profitable second quarter in 2020.

Robinhood’, whose longstanding mission is to “democratize” investing, is seen as the main gateway to the markets for young investors. The app experienced record levels of new, younger traders entering the stock market during the pandemic and during the GameStop trading mania.

Competitors of Robinhood include Fidelity, Charles Schwab, Interactive Brokers and start-ups like Webull and Sofi. Charles Schwab has a market capitalization of $130 billion and Interactive Brokers has a market valuation of $26 billion.

Robinhood — which offers equity, cryptocurrency and options trading, as well as cash management accounts — is expected to make its public debut by the end of next week.

Robinhood is a five-time CNBC Disruptor 50 company that topped this year’s list.

RobinHood Valuation History

https://www.businessofapps.com/data/robinhood-statistics/

9. Software bots could be the future of business automation

Bryan Walsh, author of Future

Illustration: Annelise Capossela/Axios

Businesses are building a new kind of assembly line — and this one is digital, staffed by software bots.

Why it matters: For all the hopes and fears around industrial robots, more progress is being made in the realm of digital workers: Bots that can perform a growing number of often tedious and time-consuming tasks in an increasingly online business world.

- The shift holds out the promise of enhanced productivity and reduced costs for companies, even as some human employees may end up automated out of a job.

How it works: Intelligent automation takes the logic of a physical assembly line — where the work of making something is broken into discrete, individual tasks that can be done more efficiently in sequence — and moves it into the digital world.

- What intelligent automation allows companies to do is “rethink the process lines of how business is done,” says Jason Kingdon, the CEO of Blue Prism, a leading intelligent automation company. “Why not have digital assistants that can work throughout your entire company?”

Details: Kingdon uses the example of how Blue Prism works with banks on reducing credit card fraud.

- Banks “used to have a dedicated team that would go through (questionable) transactions and fill in the various forms that a credit card company would require,” he says. “Now they train robots to do that task, and have it fully automated in a way that a robot will be able to carry out all of that activity.”

- “It’s now a process that no longer needs any human interaction.”

By the numbers: Gartner projects that business spending on robotic process automation — a part of intelligent automation — will grow by nearly $1.5 billion in 2021.

- It is estimated it will be worth over $23 billion globally by the end of 2026.

- That growth is being fueled by trends that emerged out of the pandemic, when companies were forced to digitize as fast as possible.

- In a December 2020 McKinsey survey of global executives, 51% of respondents in North America and Europe reported they had increased investment in new technologies — excluding remote work — in 2020, while companies were able to digitize many business activities 20 to 25 times faster than they had previously thought.

The big picture: Just as Henry Ford and his peers were able to revolutionize manufacturing in part by breaking tasks down into an assembly line, intelligent automation works best when knowledge work can be broken down into discrete micro-tasks that can be handled by bots.

- Intelligent automation “is not one monolithic capability,” says Kingdon. Instead, the question is “How do you break up that task into tiny, very-well-understood steps? And then the digital workers can synthesize and bring all those steps together.”

The catch: Like any other form of automation, intelligent automation can make human workers more productive individually — but it also carries with it the longer-term specter of job loss as the bots get more capable and companies look to cut payroll.

The bottom line: Most companies are “still very, very early in the journey” of intelligent automation, says Kingdon.

- “But once you start, you see that anything you want codified, it can do better.”

10. 4 Non-Financial Factors to Measure Success as an Entrepreneur

Steve Mastroianni Addicted to Success Blog

If you ask most online entrepreneurs what they want to get out of their business, they’ll instinctively mention something financial: “I want to make $1 million by my 30th birthday.” Fair enough. Most of us have grown up hearing stories about self-made millionaires, so money is often where our minds naturally go when asked about definitions of success. But there is so much more to life.

When a business owner talks about money as a goal, they rarely consider the toll achieving it could take on their life. If getting to a financial endgame costs the relationships of those you love because you don’t have enough time to spend with them, was it really worth it?

The fact is, there is more to life than just money. A lot of business owners lose sight of the fact that there are four other areas of need that define success in life, not just business. Once you understand these four areas, you can set goals that stretch beyond the myopic aim of pure financial gain. After all, this is your life we’re talking about. Money is just one part of that.

When Is Enough… Enough?

We might as well get this one out of the way first: Yes, making money matters. Your business needs to generate enough revenue so that money doesn’t dictate your choices in life. Ask yourself what will become possible once your business succeeds to the point where money doesn’t restrict your life choices as much as it might today.

The trick here is to strike the right balance between financial independence and having a healthy relationship with the other aspects of your life. Find a way to make this yin and yang work for you, so that you know when working hard enough is… enough. Making $1 million might be great, but so is $100,000 if you feel great mentally, physically, spiritually, and emotionally,

Non-Financial Factor #1: Mental Health

You’re nothing without your mental health; pure and simple. Sure, in today’s go-go society, stress, anxiety, and depression run rampant from sea to shining sea, especially in the minds of business owners. The decisions we make on a daily basis carry tremendous weight. The very livelihood of our families could be at-stake.

If your business becomes or already is successful, think about how it can satisfy your mental health. Are you able to unwind after a long, hard day? Can you detox from the stress of your business around the family dinner table at night?

Deeper questions might arise if you become so successful that you don’t need to be as present in your business. For example, how do you continue to acquire knowledge? What sort of daily rituals and behaviours do you participate in?

Maintain mental health now, give your business an optimal chance to succeed, and later on, permit yourself the freedom of mental space from achieving your goals.

Non-Financial Factor #2: Physical Health

If you aren’t slothing it on the couch all day, covered in cookie crumbs, having to survive on ramen noodles for the fifth night in a row, what becomes possible for your physical health? Another amazing factor of life to enjoy when your business becomes successful is the fact that cookie crumbs might become creme brulee and ramen noodles might become pasta primavera at a five-star restaurant instead of your cramped and filthy living room.

Running a successful business should also mean that you have the time to eat right, exercise, and sleep well. That may not seem possible in the early days of a business when you’re still figuring out how to balance your time while growing a customer base, but it’s crucial to get there as soon as you can. After all, running a business from your home is hard enough, try running it from a hospital bed.

“Success is not just money in the bank but a contented heart and peace of mind.” – Sarah Breathnach

Non-Financial Factor #3: Spirituality

Many online entrepreneurs are abstract thinkers, meaning we think in terms of the big picture, which translates easily into a spiritual nature. Most of us feel a need or at least a desire to be connected to something bigger than ourselves.

Once your online business is successful, how does it affect your spirituality? Do you have more time to look within yourself and think deeper about your purpose in life? Are you able to meditate and/or pray as often as you’d like? Are you able to temporarily shut off the outside world and tap into your creativity?

A healthy spiritual side can be a wonderful byproduct of a successful business. Once it’s up and running and you have an established customer base, make sure to dedicate even just fifteen minutes per day to address your spiritual needs, and you’ll find a deep level of fulfillment in life that no financial status can satisfy.

Non-Financial Factor #4: Emotional Needs

A large part of running a successful online business is having emotional resilience and being able to roll with the punches. What becomes possible for you emotionally when your business is creating the life you desire?

If finding a significant other to share your life with is important to you, make sure you dedicate the proper amount of time to finding and nurturing that relationship. Put in the necessary hours to your business to satisfy its financial needs, but always keep enough energy in the tank to enjoy life with that special someone. This becomes even more important if you have children.

More Than Money

The next time someone asks you what you hope to achieve from your online business, think a little more deeply. You might have a dollar number set aside as a goal. That’s fine, but go beyond that. There are other factors to consider. Think about how you want to feel mentally and physically, how satisfied your soul can be, and if you want enough energy for a family or another emotionally satisfying aspect of your life.

Instead of simply saying, “I want to make $1 million by the time I’m 30 years old,” maybe say something like “I want to make enough money to not have financial stressors. I also want enough time to work out four days a week, while living a life of constant learning. Some day, I want a family to share my success with, and I hope to find a lot of the answers I’m looking for in my connectedness to others and the world around me.”

Sure, that answer is a little longer and more in-depth, but once you get it, write it down, keep it in a safe place, and refer to it anytime you need guidance in your online business.

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..