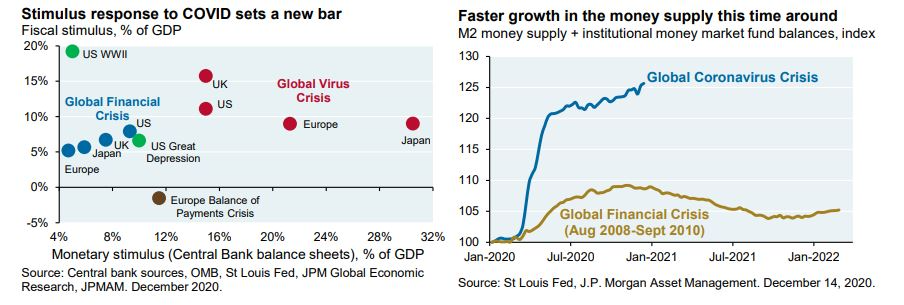

1. GFC vs. Covid-19 Stock Market Returns

Great financial crisis 2008-2010 vs. Coronavirus rally

Irrelevant Investor Blog https://theirrelevantinvestor.com/2021/01/02/the-year-of-stimulus-and-other-great-charts/

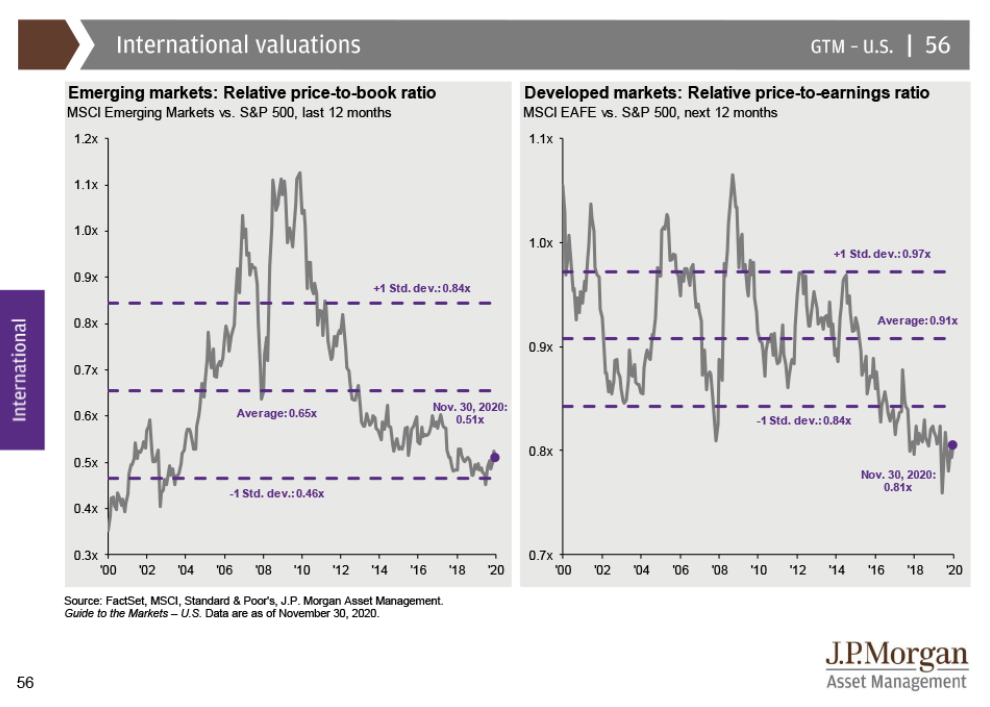

2. International vs. U.S. Valuations.

JP Morgan Asset Management

https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

3. Russell 1000 Growth Outperformed Russell 1000 Value by 38% 2020.

IWF (growth) vs. IWD (value)

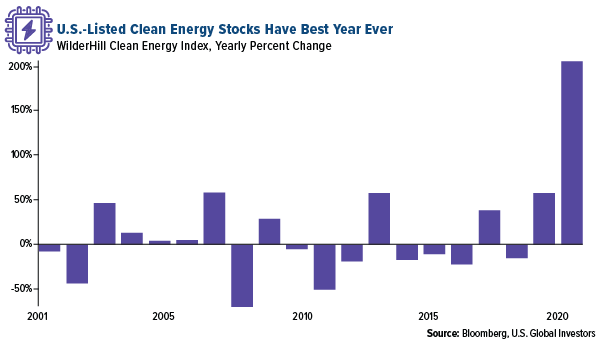

4. Clean Energy Index +200% 2020….$760B Market Cap Without TSLA

U.S.-listed clean energy stocks had their best year ever, as measured by the WilderHill Clean Energy Index, which was up 206% in 2020. The sector has skyrocketed as investors weigh the prospects of an aggressive green push with Joe Biden’s victory in the U.S. presidential election. Tesla dominates the index, but even if you remove the electric vehicle maker, the industry has a market cap of $760 billion.

2020: Gold’s Best Year in a Decade; Ethereum Beat Bitcoin; Inflation Higher Than Reportedby Frank Holmes of U.S. Global Investors, 12/31/20

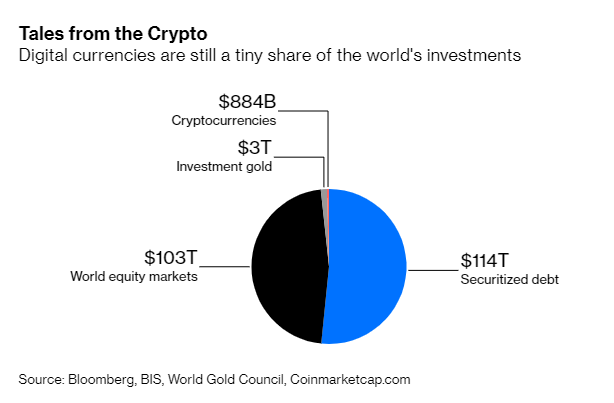

5. Crypto as a Share of World’s Investments

Bloomberg-The problem for digital bulls is that the success of cryptocurrencies tends to eat itself. As the value of the asset class rises, the shifts away from more conventional investments needed to provoke price spikes get larger and larger.Right now, Bitcoin on its own is worth about six times the 56 million ounces of metal represented by all the contracts outstanding on the Comex 100-ounce gold contract. The world’s biggest gold ETF, SPDR Gold Shares, holds about $72 billion of the yellow metal. Add in other forms of private investment gold and you’ve got about $2.87 trillion worth of metal — but much of that is in the form of bars and coins that aren’t easily liquidated when investors want to tweak their portfolios.

That should be enough to concentrate the minds of circumspect investors. Cryptocurrencies are no longer a new arrival on the scene that can attract many more investors on their novelty alone. Turnover of digital coin derivatives in the September quarter came to $2.7 trillion, according to TokenInsight, a research company. That’s not all that far behind the run rate of the world’s biggest equity markets. The value of all shares traded in Japan in 2019 came to just $5.09 trillion, according to the World Federation of Exchanges, enough to make it the third-largest equity market on that basis.

Bitcoin’s Bulls Should Fear Its Other Scarcity Problem

6. 2020-The Year of the Gun

Stocking Up the Gun Safes-Bespoke

While 2020 will be remembered for any number of milestones, one that stands out is the explosion in gun sales. While financial markets may hate uncertainty, gun sales thrive on it. Fueled by the pandemic, civil unrest, and Biden’s victory in the November election, Americans sought out to purchase firearms at record rates in 2020.

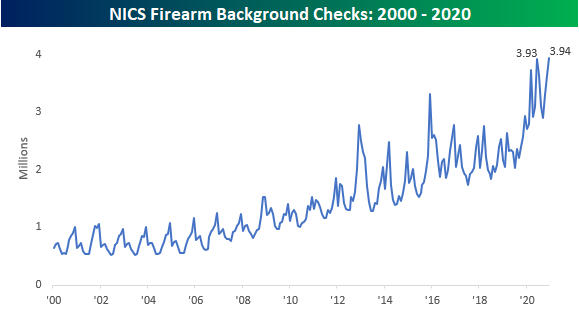

The chart below shows monthly FBI background checks for the purchase of firearms. After surging during the pandemic, background checks initially peaked in June at a rate of 3.93 million. As tensions around the country cooled down and the virus numbers stabilized, the pace of background checks fell sharply over the next three months, but with Biden’s election in November, the pace of background checks quickly reversed course on concerns by gun owners of more restrictive policies with a Democratic administration. In December, those concerns helped to propel the number of background checks to a record 3.94 million.

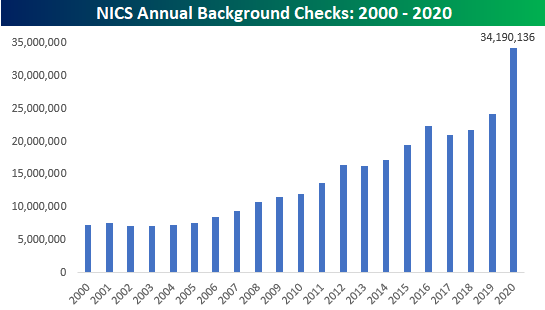

On an annual basis, gun sales have steadily trended higher over the years, but the step-up in background checks in 2020 was unlike anything we’ve seen in at least 20 years.

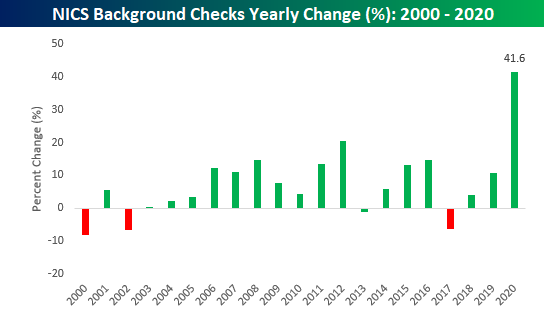

For the year, total background checks surged over 40%. Since 2000, that’s more than twice the percentage increase of the next closest year (20.6% in 2012)!

https://www.bespokepremium.com/interactive/posts/think-big-blog/stocking-up-the-gun-safes

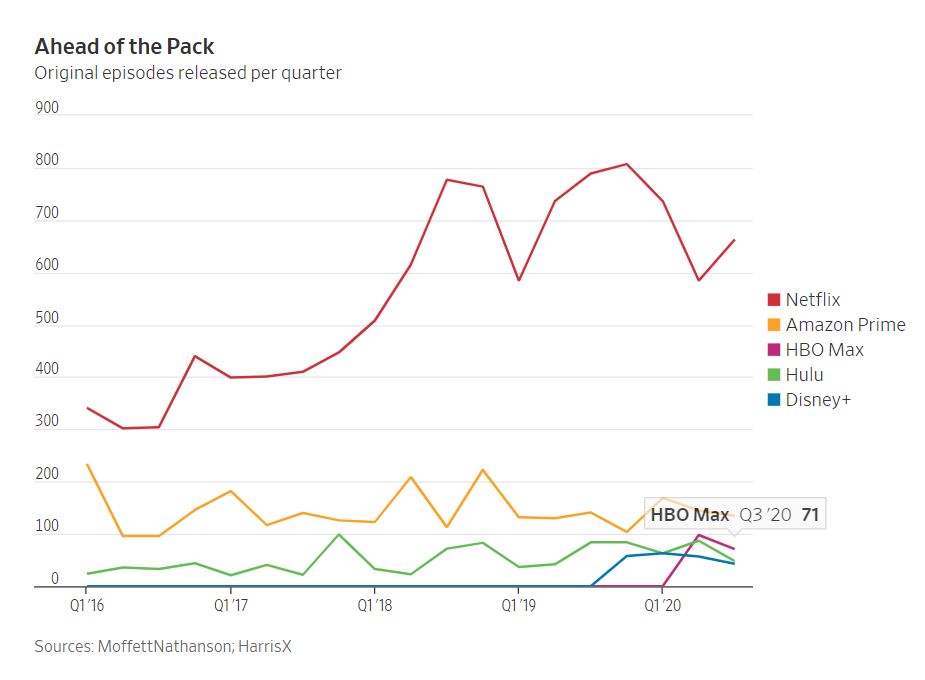

7. Streaming-Original Episodes Per Quarter NFLX Dominates.

Forget the Streaming Wars—Pandemic-Stricken 2020 Lifted Netflix and Others– By Lillian Rizzo-and Drew FitzGerald

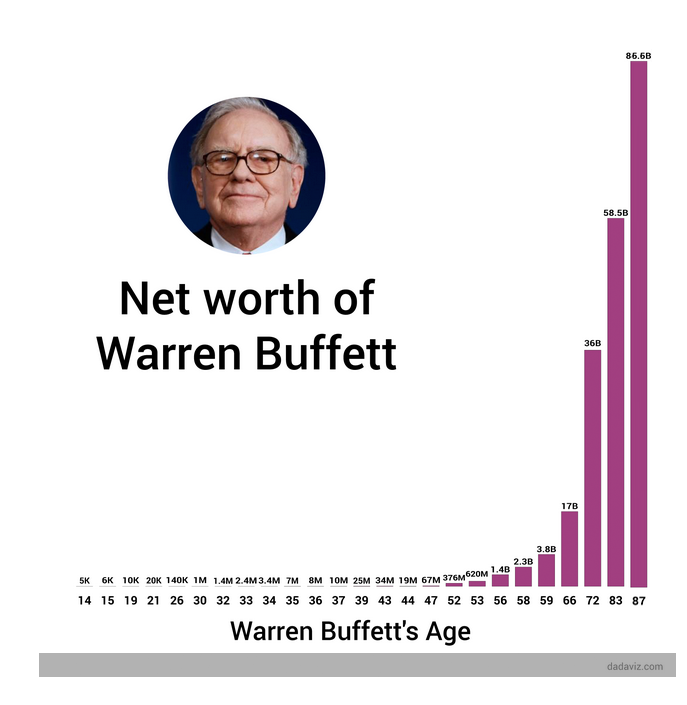

8. Warren Buffett has made 99.7% of his money after the age of 52

9. Divided U.S., Not Covid, Is the Biggest Risk to World in 2021, Survey Finds

Alexandra Veroude 23 hrs ago

Divided U.S., Not Covid, Is the Biggest Risk to World in 2021, Survey Find

(Bloomberg) — With the global economy still in the teeth of the Covid-19 crisis, the Eurasia group sees a divided U.S. as a key risk this year for a world lacking leadership.

“In decades past, the world would look to the U.S. to restore predictability in times of crisis. But the world’s preeminent superpower faces big challenges of its own,” said Eurasia Group President Ian Bremmer and Chairman Cliff Kupchan in a report on the top risks for 2021.

Starting with the difficulties facing the Biden Administration in a divided U.S, the report flags 10 geopolitical, climate and individual country risks that could derail the global economic recovery. An extended Covid-19 impact and K-shaped recoveries in both developed and emerging economies is the second biggest risk factor cited in the report.

Biden will have difficulty gaining new confidence in U.S. global leadership as he struggles to manage domestic crises, the report said. With a large segment of the U.S. casting doubt over his legitimacy, the political effectiveness and longevity of his “asterisk presidency,” the future of the Republican Party, and the very legitimacy of the U.S. political model are all in question, it added.

“A superpower torn down the middle cannot return to business as usual. And when the most powerful country is so divided, everybody has a problem,” said Bremmer and Kupchan.

The report lists the following as top risks in 2021:

The report warns that the pandemic and its broad impact will not vanish once vaccination becomes widespread. Uneven recoveries, variance in vaccine access and stimulus plans that fall short will push up debt levels, leave workers displaced and fuel opposition toward incumbent leaders.

For the U.S., this will increase the polarization that fed support for Donald Trump. For emerging economies, the debt crunch could lead to financial troubles, the report said.

Some concerns are more likely to be “red herring” risks that have been overplayed, the report adds. These include relations between Biden and “Trump’s fellow travelers” such as Turkey’s Recep Tayyip Erdogan, Brazil’s Jair Bolsonaro, the U.K.’s Boris Johnson and Israel’s Binyamin Netanyahu. The Biden administration will engage on shared interests and leaders will adapt to the new status quo, the report says.

Fears over a global backlash against U.S. big tech and an Iran-U.S. confrontation are also seen as lower risks.

For more articles like this, please visit us at bloomberg.com

10. Scientists Discover That Your Brain Stays Half Awake When You Sleep in a New Place

By Madeleine Muzdakis on December 26, 2020

Have you ever woken up after sleeping in a new place and felt as if you hardly slept at all? This phenomenon is called the First-Night Effect (FNE), referring to the sub-par quality of human sleep during the first night in a new environment. Sleep researchers have been seeking the physiological root of FNE in humans. In a recent paperpublished in Current Biology, a team of scientists at Brown University announced that they have discovered one source of FNE: the human brain does not fully sleep during that first night. Led by Masako Tamaki, the study discovered that one of the hemispheres of the brain remains alert and vigilant for strange stimuli.

The researchers studied 35 sleeping subjects using advanced neuroimaging techniques and polysomnography (a technique which monitors brain waves, eye movements, and other sleep metrics). On the first night in a new environment, the researchers found the subjects’ brains showed “regional interhemispheric asymmetry of sleep depth” in their first sleep cycle. This means that one hemisphere of the brain (usually the left) showed more activity that was mostly focused in the default mode network (DMN). The DMN includes sections of the brain responsible for daydreaming and other ambient thought patterns during wakeful rest. These active areas in one hemisphere mean that half the brain has significantly less sleep depth. As a result, researchers called the alert DMN the “night watch.”

The researchers also tested the reaction times of both the slumbering and alert hemispheres. They found that the less-sleeping hemisphere responded to stimuli—such as a dog barking or door slamming—more quickly than the half of the brain in deeper sleep. For this reason, the researchers not only postulate that the semi-alert hemisphere is the reason for FNE, but that FNE itself is a manifestation of the human brain keeping a “night watch” in a new environment. Other animals such as dolphins use partial sleep as a way to remain alert for predators or other threats. Tamaki and the team of researchers suspect that their discovery of asymmetrical sleep depth in humans likely has a similar function. On the first night in a new environment, it only makes sense that our brains remain more alert to help guard us.

If you would like to read the paper, you can find it on Current Biology‘s website.

A team of researchers at Brown University have discovered the reason you do not sleep well in strange places: half of your brain remains alert and vigilant as a protective mechanism.

The researchers believe this brain activity explains the First-Night Effect many experience sleeping in new places.

Disclosure

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.