1. S&P 50 Day thru 200 Day to Upside

2. VIX Volatility Index Hits 6-Month Lows

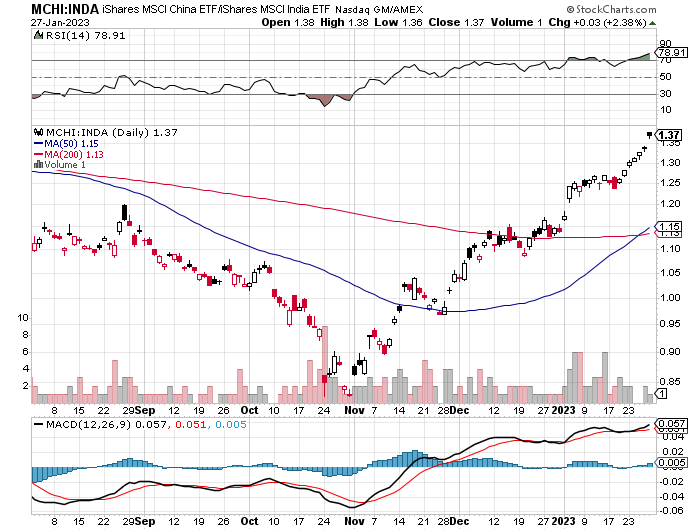

3. China vs. India 2023

After 2022 India outperformance….China taking lead 2023….this chart shows MCHI (China) vs. INDA (India)…50 day thru 200 day to upside.

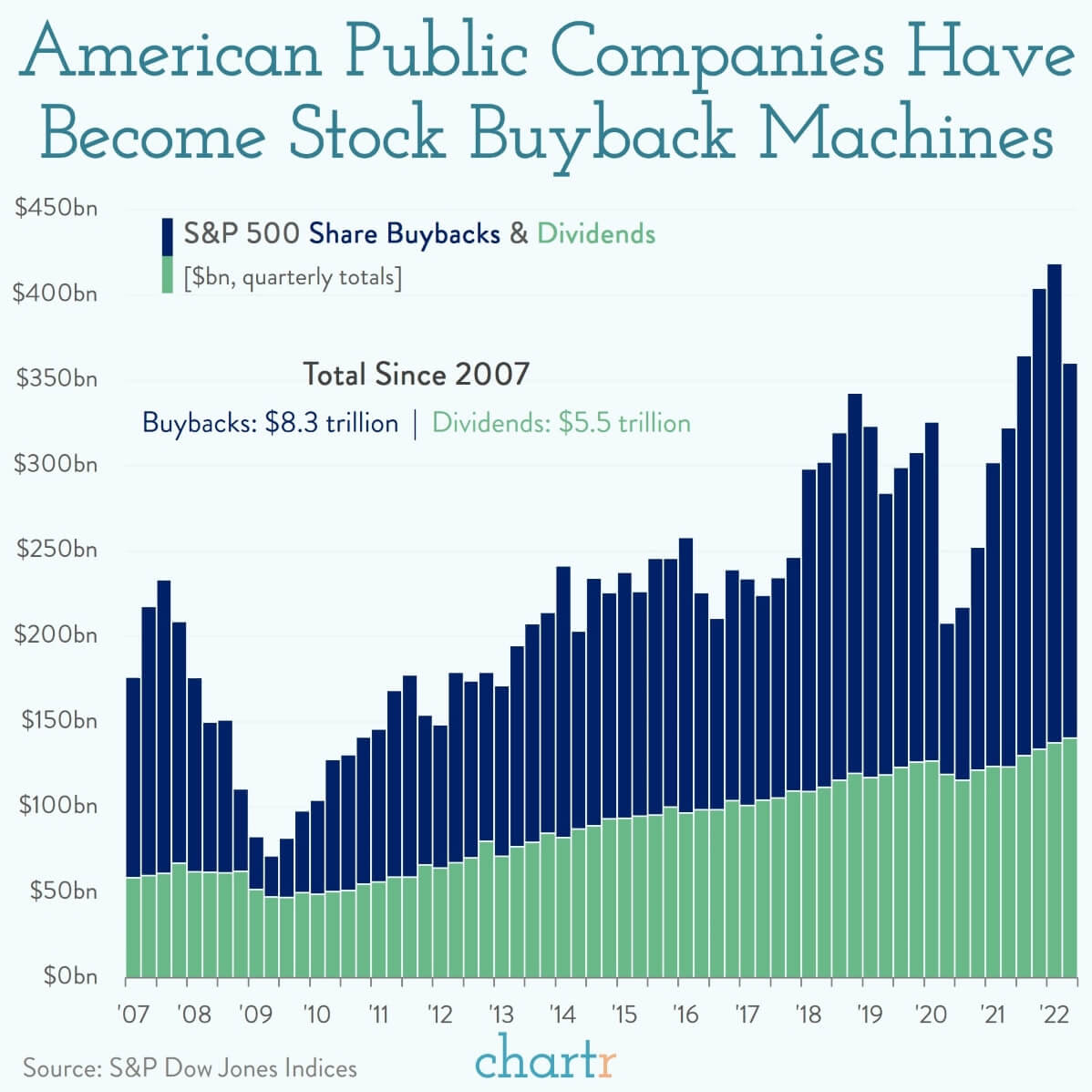

4. S&P 500 Buyback Machines

|

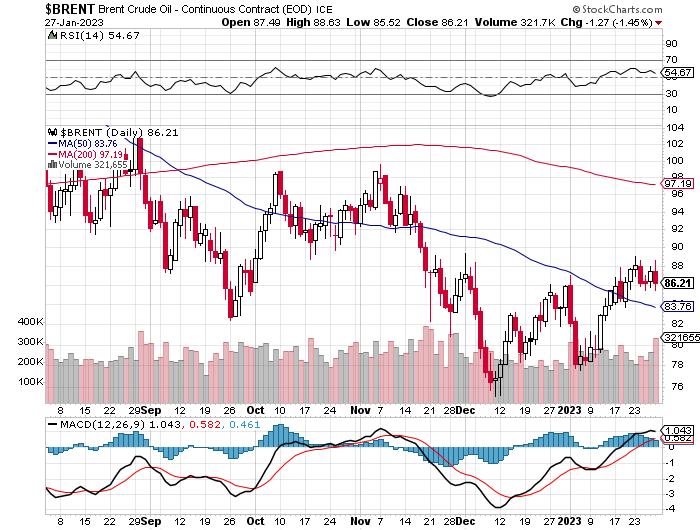

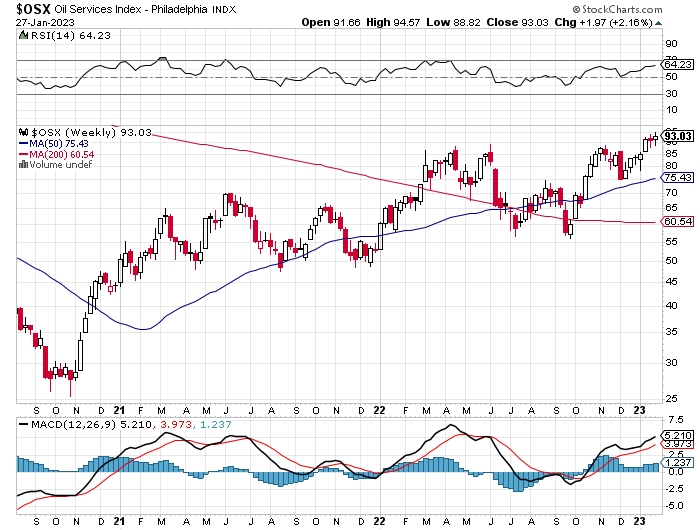

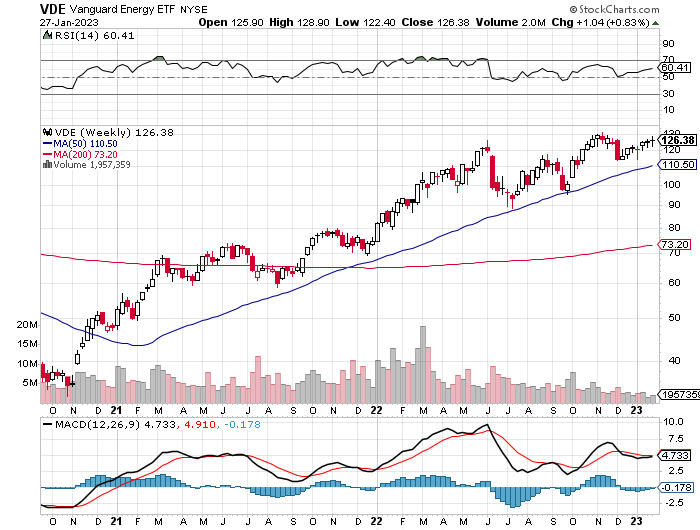

5. Energy Charts

$Brent Crude Oil 50day thru 200day back in September….multiple lower highs

Oil Service stocks hit new highs

VDE Vanguard Energy ETF no new high yet

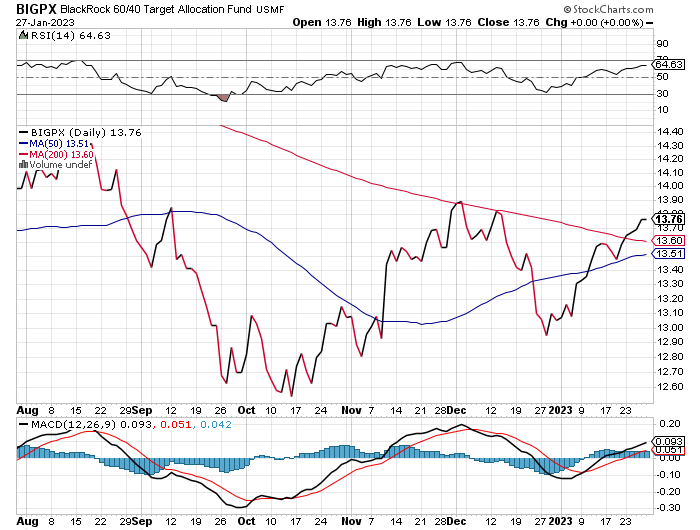

6. Blackrock 60/40 Portfolio

60/40 closes above 200 day after failing twice in Nov/Dec 2022…however 50day still below 200day….200day still sloping downward

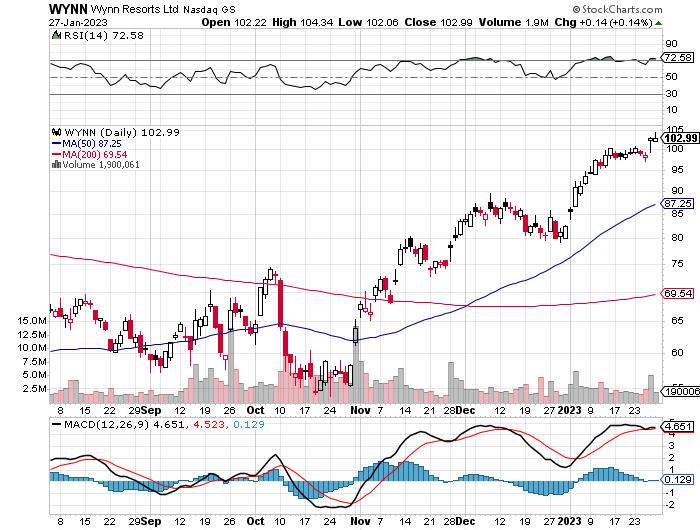

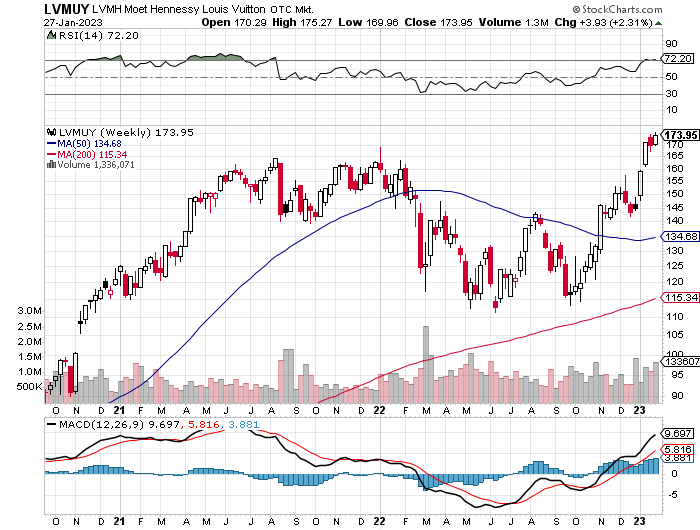

7. China $2 Trillion in Savings Pent Up from Covid Lockdown

WYNN Resorts Doubles Since November

Louis Vuitton Luxury Goods Breaks Out to New Highs

8. Which Are the Best States for Raising a Family?

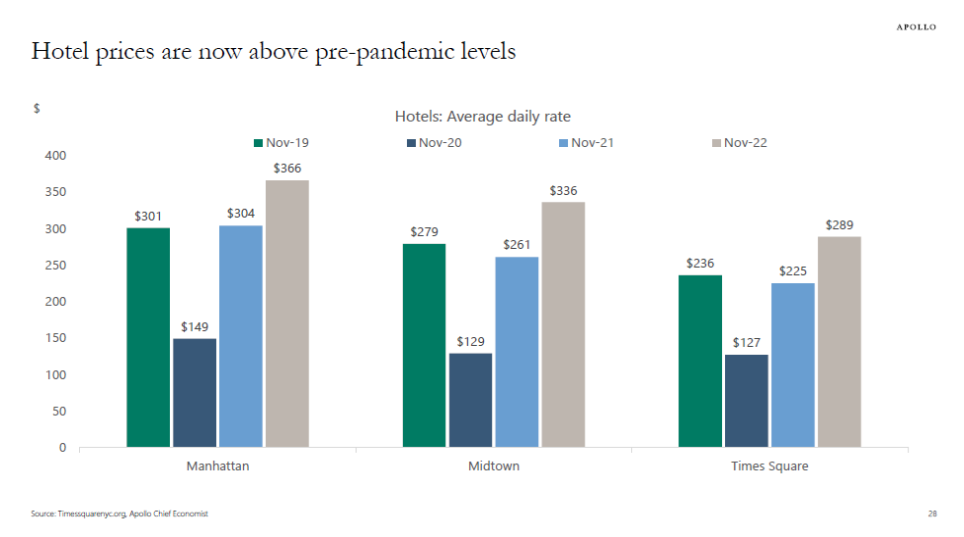

9. NYC Hotel Prices Above Pre-Pandemic Levels

Torsten Slok The chart below shows the price of staying at a hotel in Manhattan, Midtown, and Times Square, and the average daily rate is now above its pre-pandemic level. Looking across a broad range of daily and weekly indictors the consumer is still doing fine. The interest rate-sensitive components of GDP are softer, but the overall picture continues to look like a soft landing, see also our attached chart book.

Torsten Slok, Ph.D.Chief Economist, PartnerApollo Global Management

10. Determination vs. Talent

FS-Farnam Street

The difference between open and closed-minded people:

Over time, the person who approaches life with an openness to being wrong and a willingness to learn outperforms the person who doesn’t.

— Source

Insight

“One sign that determination matters more than talent: there are lots of talented people who never achieve anything, but not that many determined people who don’t.”

— Paul Graham

TKP

The Three Types of Listening:

“Listening to win is, ‘Let me make the problem go away by telling you, you don’t have a problem.’ Listening to learn is getting underneath what’s being said and reflecting back to the person. And listening to fix is, ‘Let me take your problem and solve it for you, or help you solve it.'”

A new episode of The Knowledge Project Podcast is now available, featuring a conversation with Carolyn Coughlin. This episode is filled with practical insights on improving your relationships by becoming a better listener. Listen or read the transcript.