1. S&P 500 Value ETF

Run right up to 2022 highs…see if it breaks out

2. Netflix Huge Run Right to Resistance

Netflix approaching 200 week moving average and 2022 highs

3. Jeremy Grantham Still Bearish But Discusses Presidential Cycle.

Still Bearish Grantham But Presidential Cycle in Play

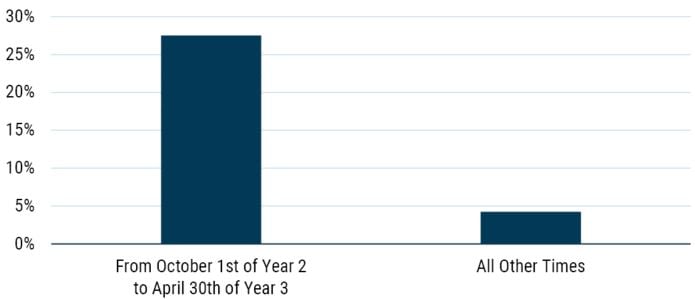

GMO Research-Jeremy Grantham -The important fact here – see Exhibit 1 – is that for 7 months of the Presidential Cycle, from October 1st of the second year (this cycle, 2022) through April 30th of the third year (2023), the returns, since 1932, equal those of the remaining 41 months of the cycle! This has a less than one-in-a-million probability of occurring by chance, pretty remarkably, and it has been about as powerful in the last 45 years as the previous 45 years. We are now in this sweet spot, which once again is up nicely so far. The logic and nuances are spelled out in Appendix 1. Suffice it to say that this positive influence may help to support the market for a few more months.

The Presidential Cycle Politicians have always liked to be re-elected. Decades ago, they worked out what factor moves the vote the most. It is provably the state of the labor market in the 6-month run up to the election. Even brilliant performances before that do not count; they are apparently lost in the mists of time. Administrations aim to achieve precisely this objective, and to do so they must stimulate the economy 12 to 18 months earlier because the economy is large and complicated and has plenty of inertia. So, on or around the 4th quarter of year 2 – this cycle, 2022 – they start some extra stimulus. I say “extra” because there are always other considerations at work. The interesting part for U.S. investors is that the stock market is far more sensitive to this extra stimulus than the economy and employment are (as we saw with the Covid stimulus in 2020 and 2021). Thus, to get a modest, but politically important, twitch in labor numbers, we see for the stock market the remarkable data shown earlier, in which since 1932 the 7-month stimulus window delivers six times the monthly returns of the rest of the cycle. My favorite aspect of this effect though was that the UK market had, from 1932 through 2012 when I last looked, a bigger jump on the U.S. presidential cycle than even the U.S. had! (Europe had half the effect and even Japan had half of that.) The U.S. administration, with 85 years of help from a “completely independent” (ahem) Fed, clearly rules the global waves. There are no prizes for guessing which was the only Fed era where this political market cycle absolutely did not exist – Paul Volcker’s.

EXHIBIT 1: PRESIDENTIAL CYCLE

S&P 500 Annualized Real Total Return, 1932-2022

Source: Global Financial Data, GMO

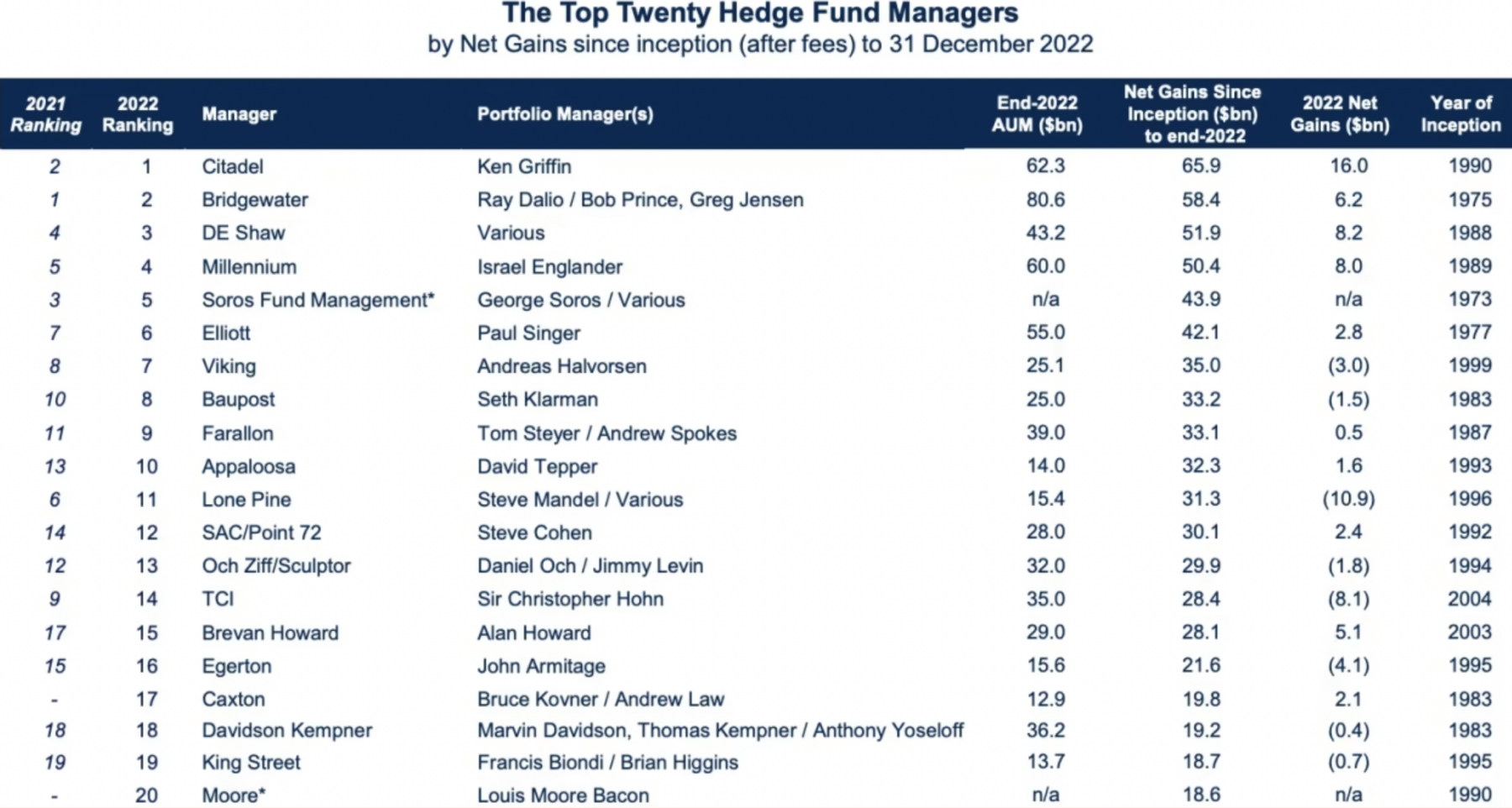

4. Top Twenty Hedge Funds of All-Time

Barry Ritholtz Blog

LCH Investments list of the best-performing hedge fund managers of all time

Source: Financial Times

https://ritholtz.com/2023/01/

5. Recent IPO Stocks No Rally

6. Biggest Losing Sector of 2022 …Rallies 12% YTD

XLC-rally to start year but still a blip on long-term chart

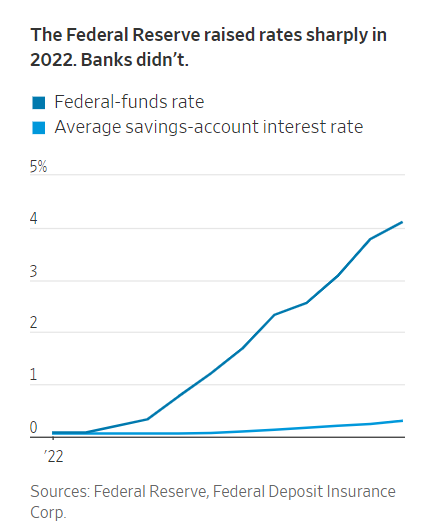

7. Wealthy Savers Move Out of Bank Accounts.

WSJBy Rachel Louise Ensign-Wealthy savers are starting to take their cash out of bank accounts in search of higher yields.

Big banks are still paying paltry interest on checking and savings accounts despite the Federal Reserve’s steepest rate increases in decades. Their wealth-management customers are done waiting: They are moving the extra savings they accumulated during the pandemic into products whose rates have more closely tracked the Fed.

The typical savings account is paying a 0.33% interest rate, according to the Federal Deposit Insurance Corp. Treasury notes, money-market funds and brokered certificates of deposit, meanwhile, are all paying between 4% and 5%.

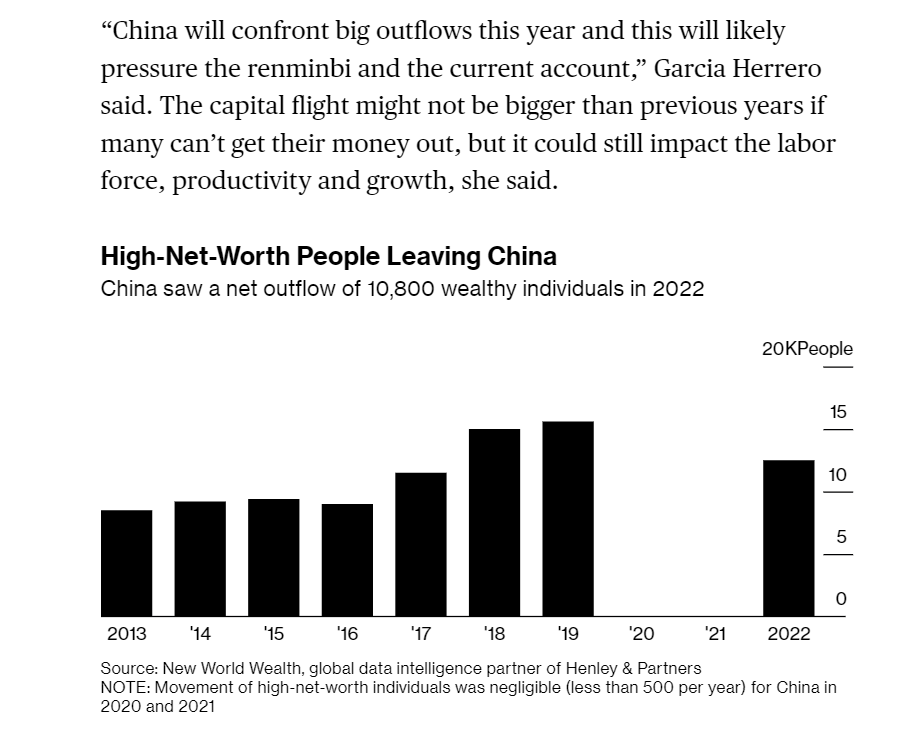

8. Exodus of Wealthy Chinese Accelerates With End of Covid Zero

-China could face at least $150 billion capital flight: Natixis

-Resumption of travel opens gates for China’s wealthy to leave

ByBloomberg News

https://www.bloomberg.com/news/articles/2023-01-25/rich-chinese-plan-to-leave-with-money-with-covid-zero-s-end?srnd=premium&sref=GGda9y2L

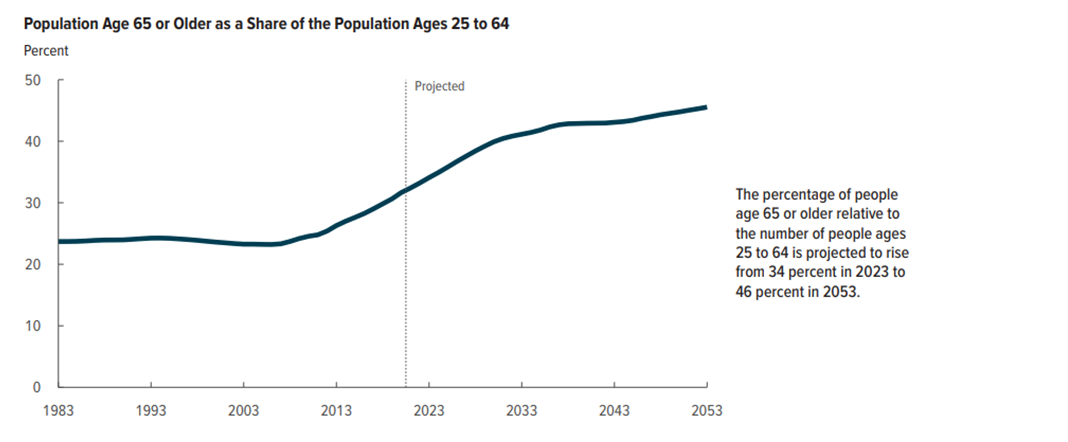

9. Population Over 65 Projected to Rise from 34% to 46%

Torsten Slok Apollo

10. 4 Reasons Teamwork Is Hard to Build at Work

The question of teamwork is not going away in the workplace. Bruce Tulgan, JD

KEY POINTS

- Most of today’s workers realize they are less likely than those of prior generations to have long-term careers with one organization.

- Today’s employees are less likely to trust the “system” or any organization to take care of them, and thus show less loyalty.

- Because workers today usually do not stay with one company for very long, they make fewer efforts to adapt within their current workplace.

It is too easy to explain away why today’s workforce seemingly disregards the value of joining something larger and making personal sacrifices for the greater good. After all, “Question Authority!” has been a hackneyed cliché for longer than it has been a true slogan.

But the question of teamwork is not going away in the workplace. There are four reasons why it is so difficult to build.

1. People today think more like customers than players.

Yes. They know that their employer is the one paying them. But still, they look at their relationship with any established institution, no matter how small or how large, and they think, “What do you have for me? And what currency do I need to use to get what I want or need from you?”

Most workers are grateful to have a source of income and maybe some benefits. They are grateful to be accepted, validated, and wanted. They are grateful to have access to a hub of resources from which to acquire experience, training, and networking, a place to be that has computers, phones, and bathrooms, and maybe a kitchen, gym, and some office supplies. They are grateful for the future doors that might be opened by this current job. But let’s not get carried away. It’s not like they are likely to be here for a long time, anyway.

Most people today realize they are much less likely than those of prior generations to have long-term uninterrupted careers with one organization. They are less likely to be exclusively employed by one organization at any given time, work full-time, or work on-site. They are also less likely to trust the “system” or organization to take care of them and thus less likely to show what looks like loyalty—a desire to belong, deference to authority, willingness to make short-term sacrifices for the good of the whole, and an eagerness to contribute regardless of credit or rewards.

2. How workers think about their relationships with lateral coworkers is changing.

These relationships involve a high degree of interdependency in pursuit of concrete goals every step of the way, and the stakes are high. Adults are in the workplace to earn their livelihoods. There are lots of opportunities to disappoint and/or be disappointed.

3. How people look at individuals in positions of authority is changing.

Once again, they think like customers—in this case, specifically, your customer. Workers do not typically look at other people in the workplace trying to figure out “their proper place” in the context—i.e., how they can adapt in order to “fit in” with others who clearly have longstanding relationships and a well-established course of dealing. Instead, they look at you—and everyone else in the room—and think, “I wonder what role you might play in this chapter of my life story?”

4. Nobody is expecting to follow the old-fashioned career path anymore.

Why should workers take the trouble to adapt to one company’s approach to how they should manage themselves when they won’t even be there that long? They think, “Seriously, what am I supposed to do? Adapt my schedule, work habits, style, and attitude for every new job?” Even if they could be convinced to adapt for an employer eventually, they are very unlikely to be ready to do it from the get-go; certainly not early in their first or second real job.